Table of Contents

- 1. Starbucks (SBUX) — Earnings Review

- 2. Thoughts on DeepSeek Implications

- 3. Meta Platforms (META) – Earnings Review

- 4. Tesla (TSLA) — Earnings Review

1. Starbucks (SBUX) — Earnings Review

a. Key Points

- Awful results as expected and still no guidance.

- Signs of changes working under the new team are clear with some early statistical wins.

- Niccol is increasingly confident in righting this ship, but more time is needed.

- The USA total addressable market (TAM) is larger than expected in CEO Brian Niccol’s mind.

“If you take one thing from today's call, let it be this: Despite near-term challenges, we have significant strengths and a clear plan… We are where we want to be one quarter in, but much of our work is just beginning. While we’re only one quarter into our turnaround, we’re moving quickly to act on the 'Back to Starbucks' efforts and we’ve seen a positive response.”

CEO Brian Niccol

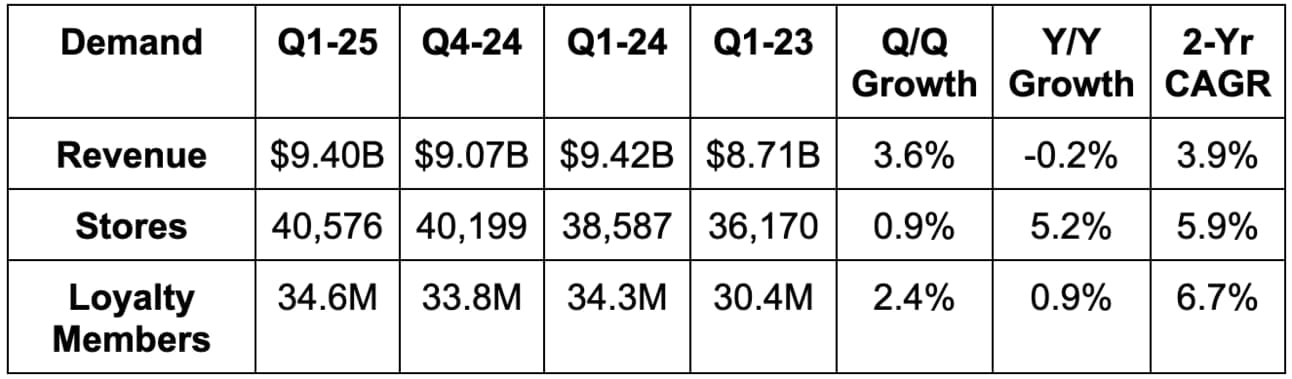

b. Demand

- Beat revenue estimate by 1%.

- North America was 1% ahead; International was 2.5% ahead; channel development revenue was a 4% miss.

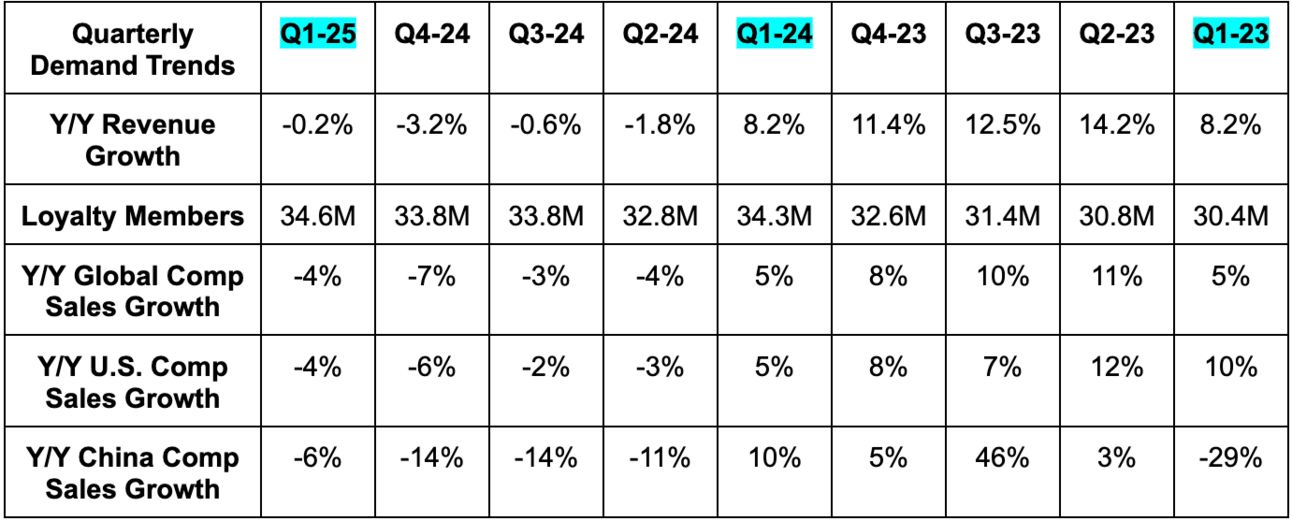

- -4% Y/Y comparable store sales growth beat -5.5% estimates.

- 3% Y/Y ticket growth beat 2% Y/Y estimates. This was based on strength in the USA offsetting international weakness.

- Slightly missed store count estimates.

North America revenue fell 1% Y/Y and beat estimates by 1%. This was driven by -4% comparable store sales (CSS) growth, which beat -5% Y/Y estimates. Within that CSS growth, transactions declined by 8% Y/Y and ticket size rose by 4% Y/Y. Things like cutting some up-charges and a mix-shift to cheaper drinks were more than offset by price hikes last year and lower discounting. Much more on all of this later. While revenue growth continues to be lackluster, this does mark an improvement in the trend and Starbucks thinks it has a “clear path forward.”

Outside of the USA, revenue rose by 1% Y/Y and beat estimates by 2.5%. This was thanks to -4% international CSS growth, which beat -6% Y/Y estimates. China CSS growth was -6% Y/Y vs. -9% Y/Y expected. 9% store growth for this segment helped offset 2% declines in traffic and ticket size, while more revenue from purchasing its U.K. franchise partner helped here too.

The channel development segment saw -3% Y/Y revenue growth due to lower revenue from the Global Coffee Alliance (Nestlé partnership) and category weakness.

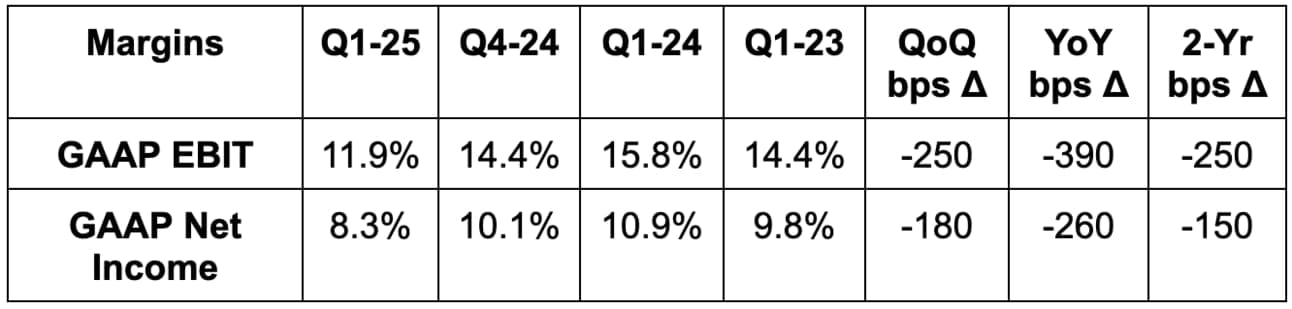

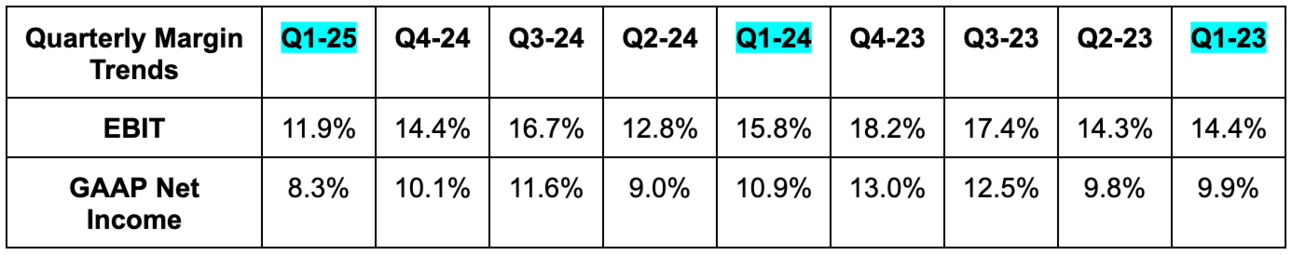

c. Profits & Margins

- Beat EBIT estimate by 5.4%.

- North American and International EBIT both beat; channel EBIT missed by 6%.

- Beat $0.67 EPS estimate by $0.02. EPS fell by 23% Y/Y. This reflects “heightened investments as part of Niccol’s Back to Starbucks strategy.”

- Nearly doubled free cash flow (FCF) estimates. Slower store growth likely led to this large beat for the volatile metric on a quarterly basis.

North American EBIT margin sharply contracted from 21.4% to 16.7% Y/Y. This was as planned and as a result of its “Back to Starbucks” Investments. As a reminder, this Brian Niccol-inspired campaign aims to fix crippling throughput issues, reduce menu clutter, revamp the food offering (with actual testing), improve in-store customer experience and focus on serving consistently great coffee. This quarter, the main margin headwinds stemming from this were via more marketing activity, wage and benefits investments and eliminating the up-charge for non-dairy milks. It was able to recover a bit of this decline with supply chain and brick-and-mortar efficiency gains.

Internationally, the EBIT margin decline was much more modest. Issues outside of the USA are more to do with macro than terrible execution, so things like more marketing and free premium add-ons aren’t as necessary as they are here. As a result, the margin fell from 13.1% to 12.7%.

d. Balance Sheet

- Nearly $4B in cash & equivalents.

- $700M in long-term investments.

- $15.5B in total debt.

- Diluted share count fell by 0.2% Y/Y.

- Dividends rose 7% Y/Y.

- “Committed to BBB+ credit rating.”

“Although we are in the beginning chapter, and have much more work ahead of us, we will continue to prioritize shareholder value through dividends, providing a predictable return of capital while we turn around our business.”

CFO Rachel Ruggeri

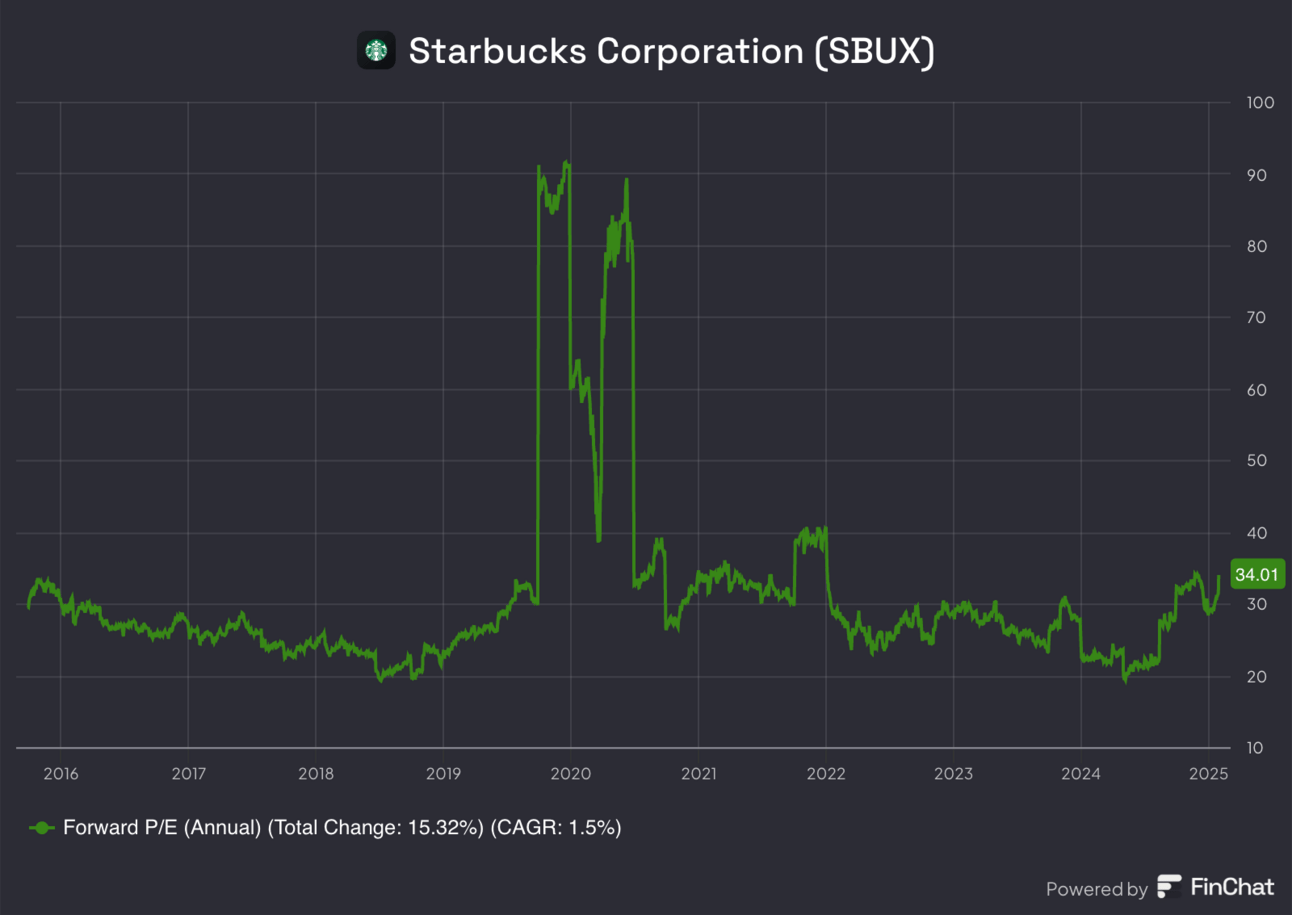

e. Guidance & Valuation

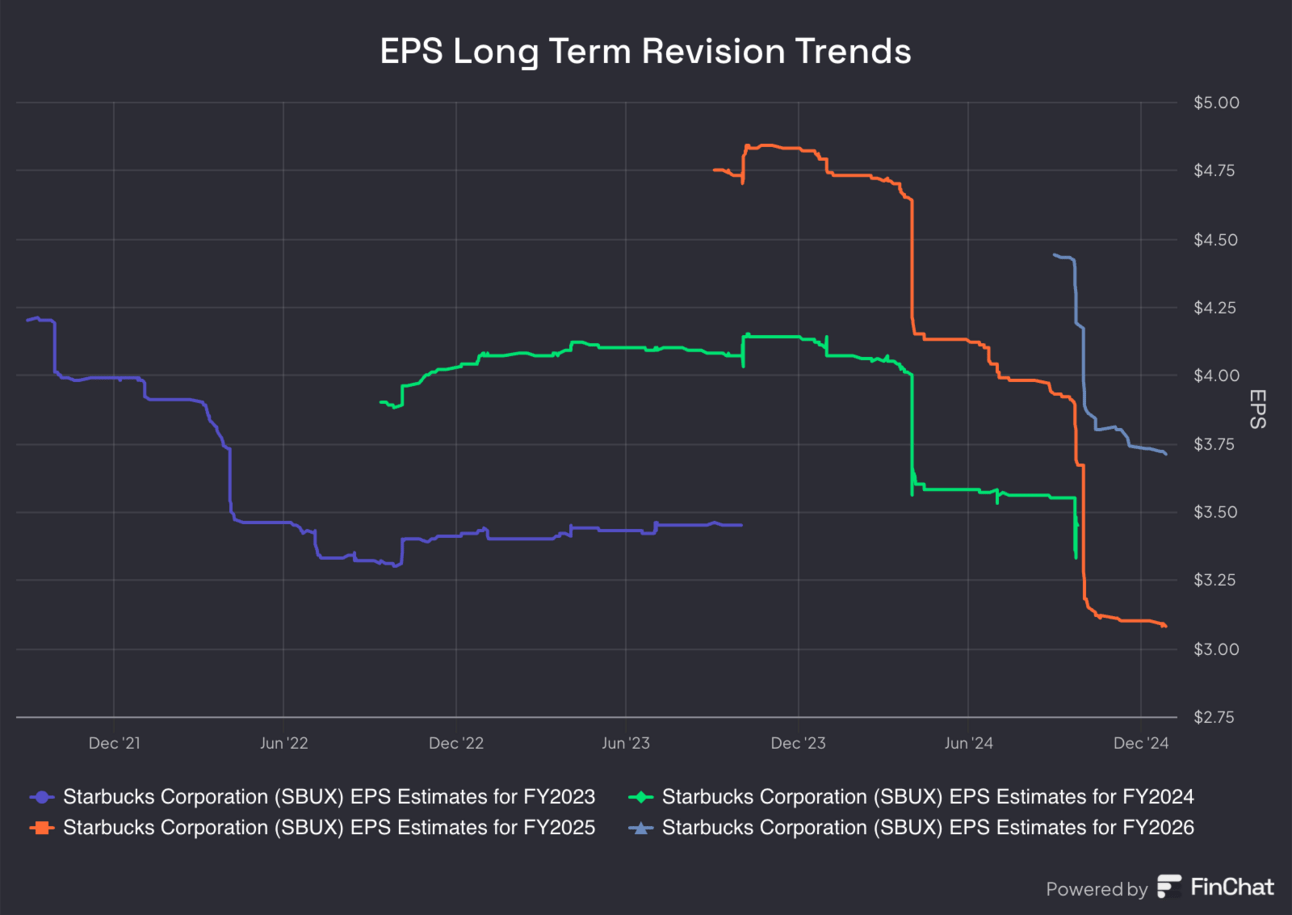

We got very little color on guidance, as expected. Organizational changes discussed below will lead to EPS troughing in Q2 2025, with positive growth resuming in Q3 and Q4. The Q2 weakness is related to restructuring and lapping lower performance-based compensation in the prior year period. Finally, it walked back the old team’s commitment to $4 billion in operating expense (OpEx) savings.

EPS is expected to compound at a 21% clip for the next two years. Estimates should be mostly stable (might move a tick higher) following this report.

f. Call & Release

Back to Starbucks:

As a reminder, like when he led Chipotle, new CEO Brian Niccol has instituted a “Back to Starbucks” plan to turn things around. The key focus areas within this plan include: Reintroducing Starbucks to the world, greatly improving customer experiences, revamping the in-store environment and creating a better work environment for internal career mobility. Candidly, this company was a complete mess before he took over. Old leadership had made inexplicably poor decisions like abandoning food testing and stage-gate processes, while turning menu introductions into trial and error. Gigantic companies that are fundamentally lost cannot be turned around overnight. This will take time, but Niccol’s track record is elite and progress is already beginning to pop up.

“To be the premier purveyor of the finest coffee in the world, inspiring and nurturing the human spirit — one person, one cup and one neighborhood at a time.”

New Starbucks Mission Statement

Reintroduce Starbucks to the World:

Under the old team, broad-based marketing campaigns were largely abandoned. The company fixated on marketing to its most loyal rewards members, but ignored the demand and preferences of everyone else. Under Niccol, frequent discounting has been greatly slashed and a 40% Y/Y decline in discounted transactions is the early result. Starbucks is not letting these added profit dollars flow down the income statement just yet. Instead, it’s re-earmarking this budget to national marketing campaigns to take back control of the Starbucks brand story and perception. I’ve personally started to see a lot more ad placements from them, and they do seem to be well done in my view. Directly following the debut of these campaigns, customers responded positively. Specifically, Starbucks comparable store sales trends improved throughout the quarter, with this being one of the main contributors.

Improve the Customer Experience & In-Store Environment:

There are many facets to this core initiative, with throughput perhaps being the most important piece. Through intricate testing, it has become apparent that mobile order sequencing is the biggest issue as Starbucks works towards its goal of fulfilling all orders in 4 minutes or less. It’s this poor sequencing process that leads to a mountain of cluttered, cold drinks at the end of the ordering line. Capacity is also an issue, which is why the team has invested in more labor in 3,000 U.S. stores (more initiatives coming to support staff in 700 more stores), upgraded scheduling and changed assembly routines, but throughput comes with the most low-hanging fruit to devour.

It’s now testing a new “in-store prioritization algorithm” to better organize workflows and take the guesswork out of which drink to make first. As of now, there is still a lot of that guesswork involved. During hectic peak hours, baristas are expected to know which order to fulfill first – across several channels and with little guidance. This is meant to fix that and take this massive headache out of their day-to-day work.

Other customer experience changes, like eliminating non-dairy up-charges, simplifying customization and ordering processes and reducing menu clutter, have all also been well received so far. This year, Starbucks plans to cut 30% of its overall menu (food and drink) to “free it up to make sure it has the right offerings.” All menu boards will become digital through 2026 to improve flexibility. It’s starting to lean more heavily on its baristas for feedback on what customers actually want to better guide testing. What a concept. This worked extremely well with its lavender drink lineup.

To recapture the “community coffeehouse reputation,” in-store drinks are now served in ceramic mugs, barista sharpies are back to deepen the personal connection and it expanded access to free refills for some drinks. It also debuted a new code of conduct to operationalize in-store standards.

All of these changes help the customer experience, but also the employee experience. It’s items like these and reintroducing its coffee condiment bars that make working for Starbucks more enjoyable and create a compelling win-win-win: happier customers, happier workers and happier shareholders.

Better Place to Work:

As previously discussed, Starbucks doubled paid parental leave and is committed to 90% of retail leadership roles being internally filled over the next 3 years. Based on its commitment to employees, “shift completion, hours per partner, retention and hourly partner engagement” all improved.

More Changes:

Starbucks is reorganizing its support teams to “improve efficiency and accountability.” As part of this, it hired a new Chief Store Officer to “drive store excellence” and a Chief Development Officer to help with real-estate pipelines. This will lead to a spike in Q2 G&A, but some savings beginning in Q4.

“Similar to what we're trying to do for driving store accountability, we want to make sure that we've got the support center also focused on supporting the stores in an efficient manner and an accountable manner to where the business happens.”

CEO Brian Niccol

The Starbucks app is adding an option for customers to schedule mobile orders, while gearing up for another update this year to “improve customization and pricing.” On the scheduling, SBUX has found that making people wait more than 15 minutes leads to high abandoned order rates. This item is meant to improve proportion of mobile orders ready in under 15 minutes.

Starbucks is no longer eager to deploy Siren Craft in all stores. This marks the final strategic priority from the old team that has now been abandoned by Niccol. Siren Craft simply refers to upgraded workflows and tools (like a new blender and food warming systems) that make service more efficient. Niccol thinks these ideas are good, and the implementation has just been too slow and disruptive to operations. The idea here is to improve throughput, but most of its stores don’t need help getting to the sub-4 minute goal. Now, they will exclusively focus this system on the stores that actually do need the help. This should minimize disruption and cost.

Early Signs of Progress:

Starbucks quick service market share stabilized in Q1 after two consecutive negative quarters. It maintained its #2 share position in the gift card space. Non-rewards members delivered positive traffic growth Q/Q and rewards membership resumed positive growth. The decision to eliminate non-dairy up-charges also “brought back lapsed Starbucks Rewards members, while bringing back condiment bars and adding more free refills were the “top drivers of purchase intent.” It’s important to keep in mind that these expenses aren’t all incremental, as again Starbucks is greatly cutting back on discounting to make room for providing value through compelling perks such as these.

“Progress like this shows me that the Starbucks brand is still resilient and strong and that we have significant future potential.”

CEO Brian Niccol

Store Footprint:

Starbucks sees a path to doubling USA store count “while improving portfolio health.” Strong debuts in newer markets across the Southeast build on this confidence, while new stores being 90% incremental to results does too.

The new mobile order sequencing plan is a big piece of its better-than-expected total addressable market (TAM) assumption. Per Niccol, this “frees up another degree that it hasn’t totally comprehended yet.” That made it sound like the doubling estimate may not even be the ceiling here. Large efficiency gains unlock significant potential for once-fringe markets to become more compelling from a unit economics standpoint.

International:

Niccol toured facilities across Italy, Japan and Korea. He sees many of these markets as “setting an example for the experience we aim to deliver in the USA.” He also visited China for the first time, and sees several opportunities to address near-term challenges to “stabilize and strengthen the business.” It’s also exploring more strategic partnerships and borrowing supply chain efficiencies from the Chinese market to implement in other countries. There were rumors of Starbucks selling this business once and for all, but this commentary (in my mind) makes that a bit less likely.

Dissecting Sources of EBIT Margin Contraction:

All of the investments we’ve spoken about thus far are currently weighing on margins. Labor investments hit the EBIT margin by 180 bps; cutting non-dairy upcharges hit it by another 60 bps (while delivering the intended engagement uplift). More marketing actually didn’t impact things all that much, because those dollars came from fewer discounts. On the other hand, supply chain efficiency gains offset these declines by about 150 bps. While coffee commodity prices do continue to zoom, Starbucks does a fantastic job of hedging away this risk. This wasn’t a material source of margin weakness.

Comments on Current Labor Disputes:

“In December, the company shared an update on contract negotiations with Workers United and remains committed to engaging constructively and in good faith to reach collective bargaining agreements for represented stores and partners.”

Press Release

g. Take

The quarter was very bad, but a bit better than feared. What’s more important is that Niccol’s plan of action is actually a good one and his track record clearly points to him being capable of executing a turnaround. The changes implemented will need time to fully take hold, but early progress is palpable and shows the brand is entirely fine. They just need to execute, and I’m confident they will with Niccol running the show. I still think we have a few more bad quarters ahead of us, before double-digit EPS growth resumes and Starbucks reclaims its rightful place as a blue-chip fundamental darling.

2. Thoughts on DeepSeek Implications

Headlines swirled over the last week about a Chinese AI firm called DeepSeek. It’s supposedly able to train high-quality models, like its R1 model, at a fraction of the cost of other leading options. That led to many arriving at a broad range of conclusions about overall market implications.

There are many conflicting notes on how expensive R1 actually was to build and how many H100 chips it illegally had access to. While the $5.6 million training figure floating around is likely way off, we just don’t know the actual price tag. There are still many, many moving pieces here (we don’t even know if this will eventually be banned by the west), but I did want to work through my thoughts. Here, I will assume there were actually large training efficiency gains discovered by DeepSeek and this piece will be highly opinionated.

Mega-Caps Besides Nvidia:

I do not think DeepSeek cutting model training costs is a large threat to these businesses. None of them struggle with competitive moats. All of them have world-class network effects, databases, infrastructure, product bundles and/or ecosystems. They do not need models to cost two fortunes to build to prevent others from being able to make them. They don’t need this to be yet another competitive differentiator.

Meta:

For Meta, the company has intentionally made itself an open-source player in this market. All of the work DeepSeek has done here is open source and a lot of it was built with the help of Llama. So? Meta can use all of this work for its own improvement (as Yann LeCun told us) to drive product parity and pocket a fortune in forgone CapEx. Or? It can just build way better models more efficiently. That choice will be a key theme throughout this piece for most companies mentioned.

Furthermore, it’s not like it’s meaningfully monetizing Llama directly. So? Workload pricing power isn’t a relevant debate like it is for OpenAI.

Meta can lean on having half of the world on its apps and all of the data that entails to ensure it stays competitively differentiated. It can also gate some of this data for its most advanced, proprietary Llama models to ensure they stay better than others if needed. At the end of the day, all of these models are complex algorithms that are only as good as the data they’re trained on. App quality also reflects this reality. Really what Meta wants to do here is use these models to create more apps to maximize engagement and create new ways for us to interact with agents and chatbots on its products. That will mean more monetization.

It also wants to use the models to create best-in-class AI hardware; I see no reason why LLMs being less expensive would do anything but help glasses development. To me, model cost reductions simply mean Meta can immediately do way more cool things with app building to accelerate these objectives.

And if models are truly becoming commodities (to be determined), what will matter? Cost advantages. How do you create those cost advantages? By open sourcing your products and inviting developers to do your optimization work for you. What do developers want to inspire them to build for you? Great models paired with more consumer traffic to give their work a better shot of being monetized through a platform they don’t hate building on. Who has that traffic and model combo? Meta. In the mind of Meta leadership, Deepseek isn’t a threat… it’s validation of open source being the correct approach. Maybe that’s why Meta reiterated its CapEx guide after all of this news broke. Full speed ahead.

Amazon:

For Amazon, if cost-to-train figures are remotely accurate, I think they will have overpaid for their Anthropic stake in hindsight. That will turn out to be a financial blip on the radar.

I think this is also mostly positive for the e-commerce king. While they are building their own foundational model and could potentially pocket some costs there, the main focus for AWS is creating best-in-class model choice. They just want Bedrock to be the place developers can go to use whatever model they want. They don’t care which model is chosen. If DeepSeek leads to other models becoming better and more efficient, AWS will offer those too. Alternatively, this could diminish the amount it could charge for renting GPU capacity, which is the biggest potential headwind here. At the same time, this headwind (if it manifests) will lead to lower CapEx to greatly offset profit obstacles. Finally, this will likely diminish workload pricing power for work on Anthropic and other models through AWS… but? If these GPU renting and workload pricing power challenges surface… it will mean a new tailwind for everything else AWS sells. It will mean far more data storing and processing demand, far more GenAI app-building that is hosted on AWS and far more usage of other supporting tools AWS provides such as SageMaker. It would also mean Amazon can update its own apps (that will hopefully now be way better than Alexa) with more utility. For example, it can do things like make its discovery agents far more powerful to improve conversion rates on its marketplace. That means real financial impact today.

Alphabet:

I also think Google will be entirely fine. They also overpaid for Anthropic and also could lose some GPU renting demand and pricing power (and so maybe shed some CapEx). But the full-stack AI approach here cannot be disrupted by one measly piece of that stack being cheaper to build. Google still has more search and video data than anyone else; it still has a fantastic team of AI researchers; it still is a leader in quantum computing and physical AI; it still has elite, scaled infrastructure; it still makes great machine learning chips; it still boasts a GenAI bundle ecosystem that is very difficult to disrupt. Vertical integration within Alphabet’s GenAI arm and its gigantic datasets make everything better together and should help to preserve GenAI workload pricing power I think better than AWS or Azure can. And again, any model-related workload pricing compression will support demand for most of the rest of its stack. When customers are using you for many more things… they quickly become dependent. That’s why Salesforce can pass on price hikes for average products with no pushback every year.

The full-stack fosters vendor consolidation and higher customer retention. That formula will be entirely fine regardless of where this DeepSeek news goes. And Gemini can take all of this DeepSeek work to use themselves just like Llama will.

For these three, simply put, the moats are fine and come from many facets of their operations. They have the assets to outcompete the field and the balance sheets to invest whenever that’s needed. Amazon and Google headwinds also feature fortunate offsets and all three will benefit from this in various ways.

Tesla:

I think Tesla will also be completely fine. It separates itself from its pack via building better cars more cheaply through unmatched vertical integration and software add-ons. Its work in AI is purpose-built for apps and physical AI applications like Optimus. Its supercomputer work, even if it overpaid for it, won’t suddenly become worthless if models are cheaper to train. Scaling these supercomputers will instead become much easier.

This work getting cheaper doesn’t mean companies can suddenly collect the vast data Tesla has scraped and build their own Cybercab or Optimus bot. It probably just means Tesla will either get more profitable or (more likely) realize its AV ambitions more quickly. Leading in EVs (and maybe AVs) doesn’t become worthless because tools used to augment current and future software offerings are cheaper. The hardware moat is real here.

Microsoft:

For Microsoft, while I don’t think this is an existential threat, I do think this is a bit more negative. They’ve made that company an instrumental, ingrained piece of their GenAI work. Furthermore, GenAI (Copilot) monetization has had a larger impact on Microsoft’s growth than any other enterprise software name I follow. Reviews for Copilot are not all that good, and willingness to pay for it could diminish. That would have a material impact on this business. At the same time, Microsoft has many competitive differentiators of its own outside of OpenAI models. It has more data than competition and a broader enterprise software bundle than them too. Azure would surely benefit from an uptick in data processing and GenAI app demand, and that would help offset some of the GPU renting and Copilot monetizing headwinds. Puts and takes are somewhat similar to Google and Amazon, but I think the app monetization risk is much larger here than it is for them. The other two are still working on building that revenue stream while Azure already has.

Apple:

Finally, on Apple, I don’t think this news is all that material. The company has mostly partnered in the realm of LLMs and can partner with others who build better models. They don’t rent GPU capacity to customers so won’t deal with that headwind.

Nvidia & AI Hardware:

I go back and forth here on what this means for Nvidia and see two potential outcomes.

First, if model training costs plummet and the world has more compute than it needs, that could sharply hurt forward demand for the company. If we need fewer GPUs to build the future, Nvidia suffers. No way around it. Secondly, and I think more probably, efficiency gains could simply pull forward model and app development by several years. It will allow current budgets to create far more advanced products than we otherwise would have in 2025. If models cost $10 million to build instead of $1 billion, that means we can build 100x larger and more complex models at the same cost. Again… There's a choice here for its customers. Either save a lot of money or build way better products with your existing budget. I think it is inevitable that some will see maintaining budgets as a way to leapfrog competition. It will only take one prominent player to make that choice… the rest will likely feel forced to follow to avoid being left behind. I think it would be a domino effect, with the overall impact to Nvidia being somewhat modest. Still negative… but not alarming.

Candidly, my confidence in implications for Nvidia and AI hardware names is lower than for the rest of Mag7 or enterprise software (next section). This is why quantifying DeepSeek’s impact today is a crapshoot. It’s a guessing game. Nobody has a clue how much of the potential efficiency gains will be pocketed and how much will be leveraged in development of more advanced products.

The risk for Nvidia and other hardware leaders like Broadcom is not that they suddenly won’t lead in their respective areas. It’s that the demand runway for this current hardware cycle was greatly shrunk from these advancements. Whether that risk manifests or not is to be determined.

Enterprise Software:

This is extremely positive for enterprise software names. They don’t deal with GPU renting headwinds and they have a choice too. They can rent model workloads and GPU capacity at lower levels to pocket savings… or they can build better products for their customers and give them the tools to build better products for themselves too.

Infrastructure monetization for all tech waves always comes before app monetization. One of the main bottlenecks for supporting app monetization was cost. If that bottleneck goes away, GenAI apps should explode. That’s great news for firms like Snowflake, Palantir, Salesforce and MongoDB, which all house and facilitate the building of these apps. More consumption of the platforms to use data and build apps means more revenue. It also points to the databases and software tools from these companies being more defensible niches than trying to build the best model.

It’s also fantastic news for Shopify, Servicenow, CrowdStrike and any other company trying to build and sell their own value-creating GenAI apps. All of them have AI products and basically none of them have turned those products into material revenue contributors (besides Palantir). There’s less risk associated with losing GenAI app pricing power for existing products than there is opportunity for building better apps that get these firms paid. This is great news for pretty much the entire sector.