Most of this week’s content has already been sent. In case you missed it:

- Airbnb, Datadog & The Trade Desk Earnings Reviews.

- Duolingo, Mercado Libre & Celsius Earnings Reviews.

- Palantir & Hims Earnings Reviews.

Table of Contents

- 1. Earnings Round-Up – Block & Axon

- 2. CrowdStrike (CRWD) – M&A & Europe

- 3. Shopify (SHOP) – Point of Sale (POS)

- 4. DraftKings (DKNG) – Earnings Review

- 5. Coupang (CPNG) – Earnings Review

- 6. Cloudflare (NET) – Earnings Review Part 1

- 7. M&A

- 8. Market Headlines:

- 9. Macro

1. Earnings Round-Up – Block & Axon

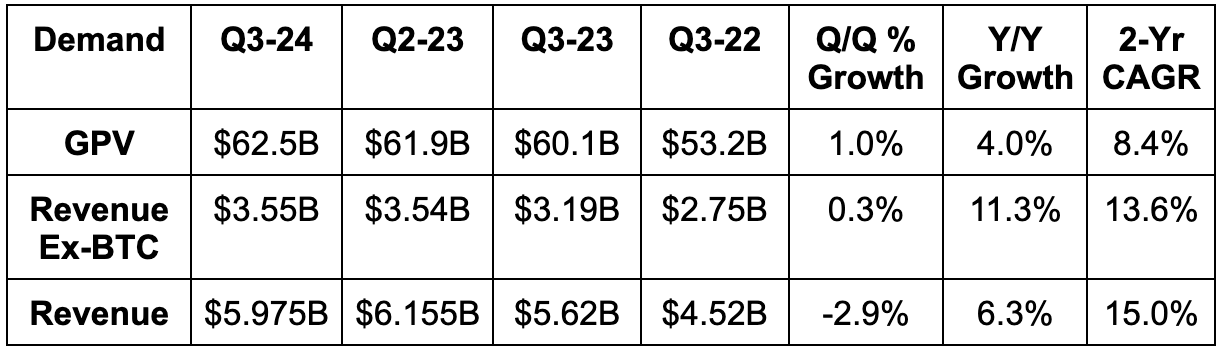

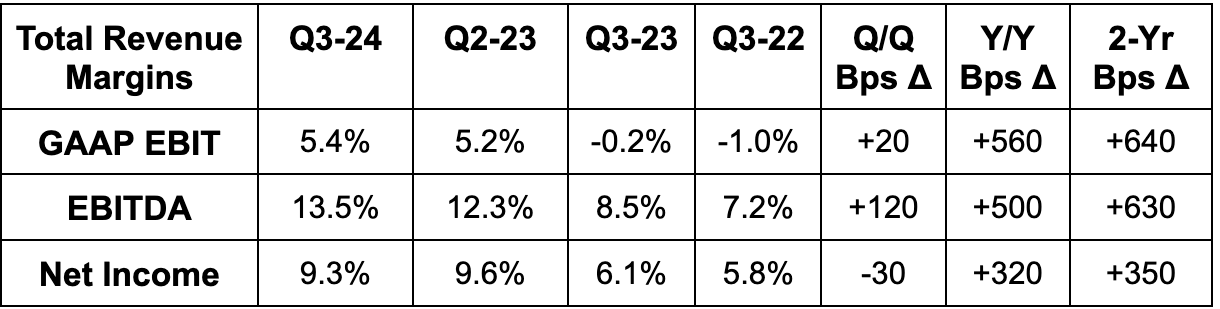

a. Block

Results:

- Missed revenue estimates by 4.5%.

- Beat GAAP gross profit guidance by 1.3%.

- Beat EBITDA estimates by 14.7% & beat guidance by 16.2%.

- Beat GAAP EBIT estimates by 35% or $83 million.

- Beat $0.45 GAAP EPS estimates by $0.10. Met $0.88 EPS estimates.

Guidance & Valuation:

- Lowered Q4 profit guidance by 1.3%.

- Lowered Q4 EBITDA guidance by 2.0%.

EPS is expected to grow by 95% this year and by 27% next year.

Balance Sheet:

- $8.3B in cash & equivalents.

- $6.1B in total debt.

- Diluted share count rose 3.5% Y/Y.

- Basic share count rose by 0.8% Y/Y.

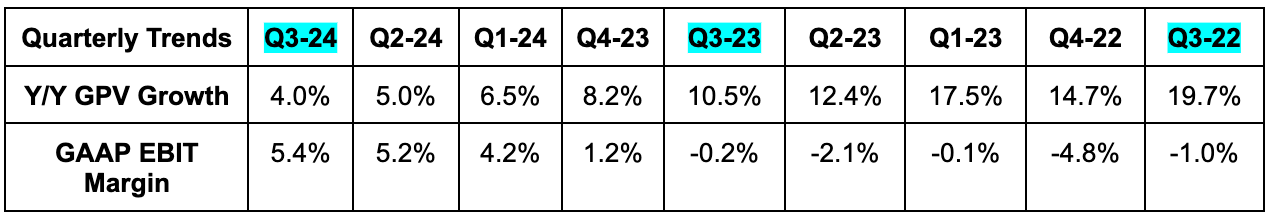

b. Axon (AXON)

Results:

- Beat revenue estimates by 3.6%.

- Beat EBITDA estimates by 22%.

- Beat $24M GAAP EBIT estimate by $20M.

- Beat $1.20 EPS estimates by $0.25.

Guidance:

- Raised annual revenue guidance by 2.2%, which beat by 2%.

- Raised annual EBITDA guidance by 9%, which beat by 7%.

- The beats were larger than Q3 outperformance, as Q4 guidance was ahead across the board.

Valuation:

Axon trades for 109x forward EPS and 66x forward FCF. EPS is expected to grow by 23% Y/Y this year, 18% next year and 25% the following year. FCF is expected to fall 28% Y/Y this year, rise by 60% next year and rise by 117% the following year.

2. CrowdStrike (CRWD) – M&A & Europe

CrowdStrike is buying Adaptive Shield to expand its identity security suite. Falcon is comprehensive in on-premise identity-based security, but perhaps a bit less advanced in SaaS-level identity security. This gives them that SaaS muscle to provide what it calls the “only platform to unify Cloud & ID security with integrated SaaS protection. Specifically, Adaptive Shield provides SaaS Security Posture Management (SSPM) to identify improper hygiene and misconfigurations for cloud-based software. It also beefs up CRWD’s

Adaptive Shield is an Israel-based company that just finished raising $10 million in fresh funding. Revenue for 2024 is somewhere around $15 million and roughly doubling Y/Y. CrowdStrike is paying 20x sales for this, with a $300 price tag. That’s expensive, but so was Humio when CRWD bought it for 50x sales. Today, that purchase looks like a grand slam as its Security Information and Event Management (SIEM) product thrives and grows well beyond the price tag. That’s the power of integrating great tools into the overarching, single-agent Falcon platform and gaining access to its large roster of clients to sell to. This offers broad visibility into user trends to augment identity security and ensure traffic isn’t gaining improper permissions. It also has ID-based Threat Detection and Response, to augment CRWD’s existing offering.

I like the purchase because of this team’s flawless track record and the expanding opportunities it brings. To me, CrowdStrike’s willingness to shell out $300 million in cash indicates confidence that the residual liability of the July outage is manageable. This offers evidence that its extended free trials and credits response is enough. That’s great news. Furthermore, Adaptive Shield has a phenomenal reputation among security disruptors. This company being willing to join CRWD a few months after its blunder is also encouraging.

In other news, CrowdStrike is bringing more of its world-class threat hunting services across the pond as it launches an “AI Red Team” service in Europe. This will help “proactively identify and help mitigate AI system vulnerabilities, including Large Language Model (LLM)” protection. GenAI means exploding data processing volumes, infrastructure footprints and app opportunities. All of that will need protecting. Enter Falcon.

3. Shopify (SHOP) – Point of Sale (POS)

We write a lot about Shopify’s Point of Sale (POS) suite and how it blends order management, inventory maintenance and all other administrative work… across all customer channels… online, social and offline… into a unified, lightning-fast, readily malleable system. That’s purely qualitative, and I love when these ideas are backed up with quantitative data. This is especially true when that data comes from a 3rd party rather than internally. This week, EY published a report detailing the impact of Shopify (POS). Here were the findings:

- Cuts total cost of ownership by 22%.

- Streamlined POS workflows raise overall sales by 5%.

- Embracing its fully omni-channel POS suite boosts sales by another nearly 9%.

- Onboarding is 20% faster than other alternatives, for smaller disruption and lower selling friction.

There’s no reason not to go with this product, which is why tiny companies and Fortune 500 enterprises are going all in here. We’ve heard a lot of anecdotes about Shopify taking an accelerated amount of market share from the commerce offering at Salesforce. This is one of the many reasons why.

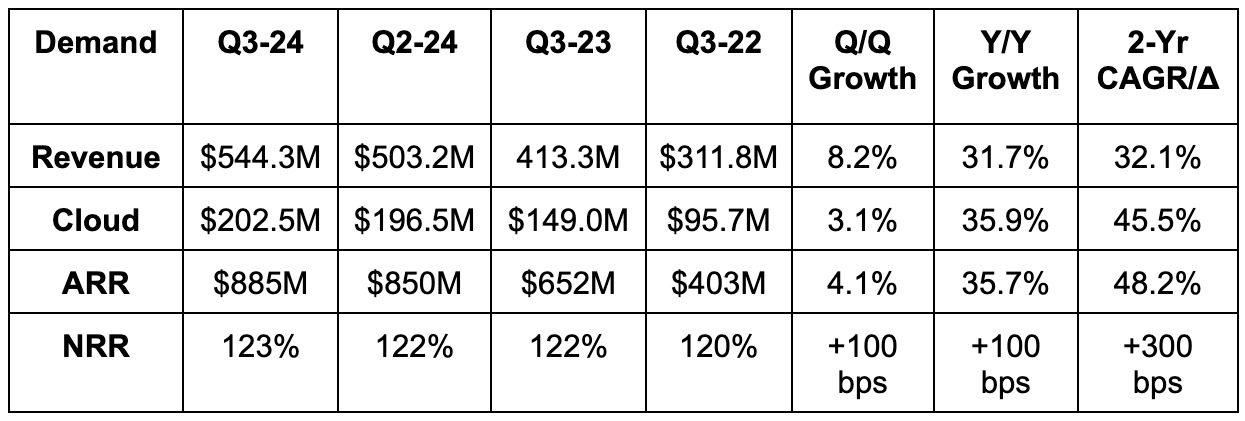

4. DraftKings (DKNG) – Earnings Review

a. Demand

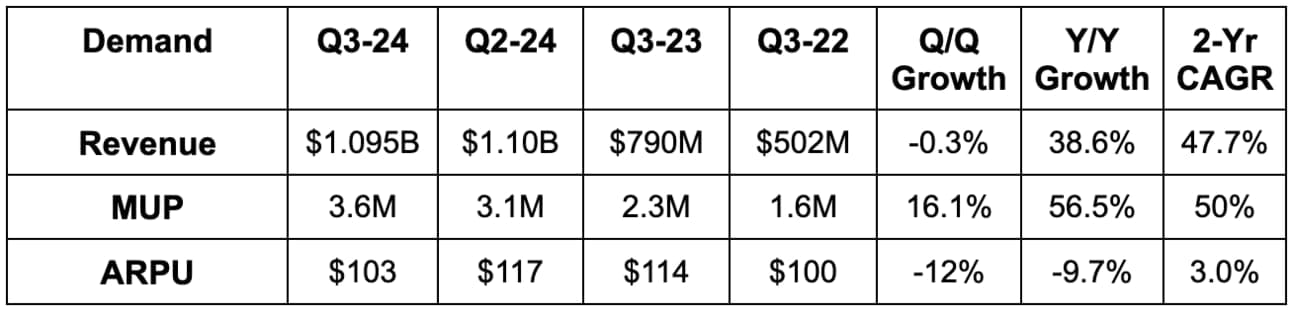

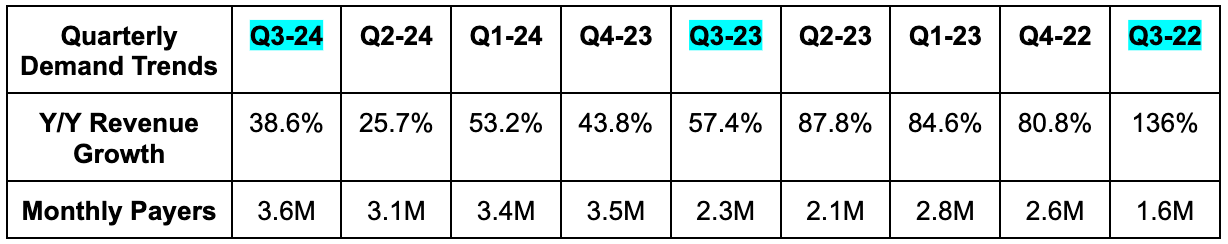

- DraftKings missed revenue estimates by 1.4%.

- Online sportsbook volume (handle) rose 25% Y/Y while revenue rose 39% Y/Y as its hold rate (take rate) rose. iGaming revenue rose 26% Y/Y.

- Note that monthly unique payer (MUP) growth excluding the Jackpocket acquisition was 27% Y/Y. New customer cohort quality is consistent with other recent cohorts. DKNG enjoys its highest value customers right when a state is legalized. That falls for a few years and then levels off. Good to see it keep leveling off.

- Also note that Jackpocket is why Average Revenue per User (ARPU) fell Q/Q. ARPU rose 8% Y/Y excluding Jackpocket.

- DKNG’s footprint for sports gambling and iCasino includes 49% and 11% of the population, respectively. Missouri just joined the fold.

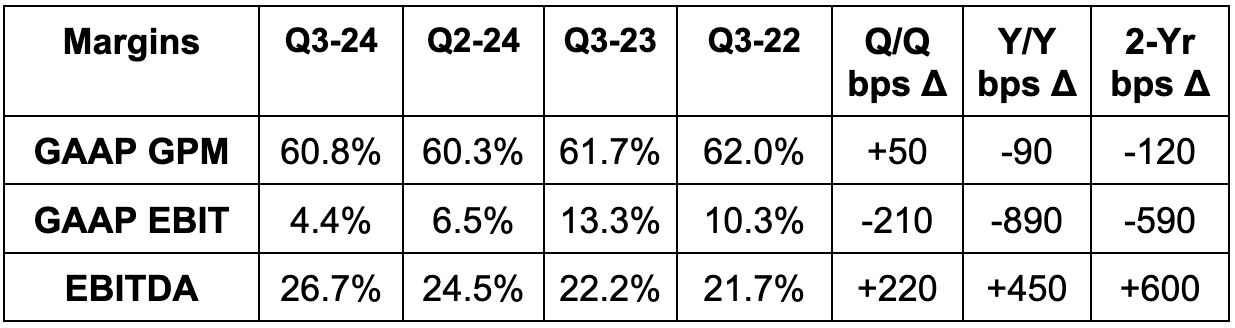

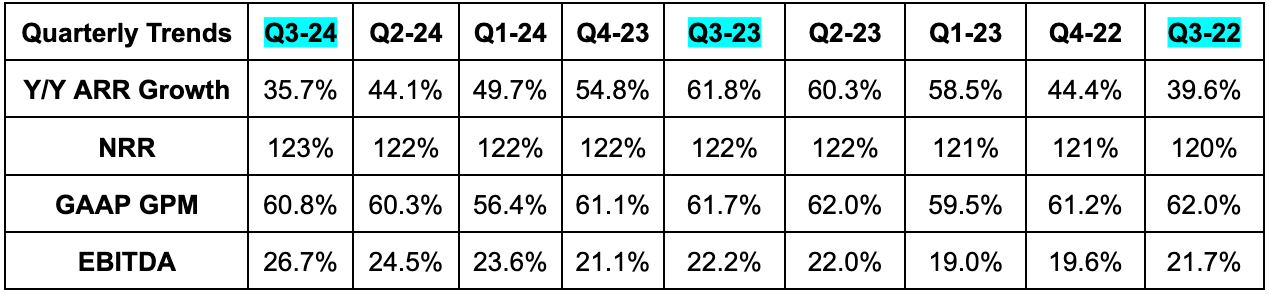

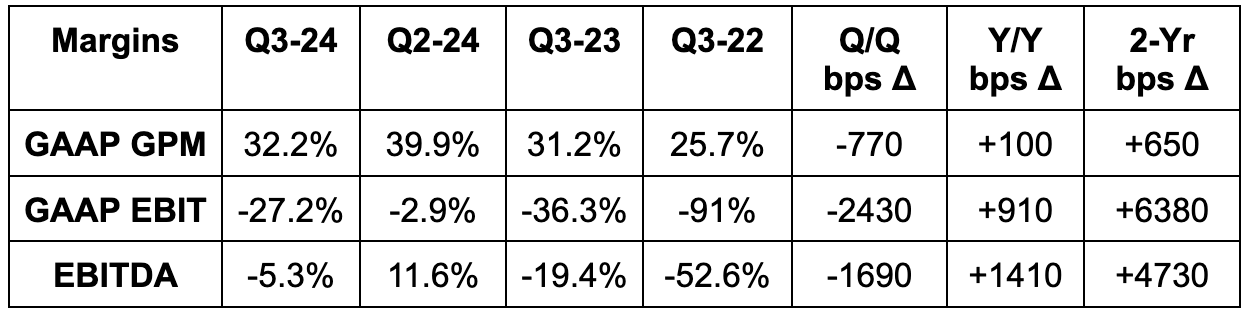

b. Profits & Margins

- Beat 38% gross profit margin (GPM) estimates by 200 basis points (bps; 1 basis point = 0.01%). This was also above guidance, thanks to better than expected hold rate.

- Beat negative $73 million EBITDA estimates by $15 million or 21%. Sales & marketing expenses were as expected. The beat was driven by GPM outperformance.

- Beat $0.24 EPS estimate by $0.07.

c. Balance Sheet

- $877M in cash & equivalents.

- $1.25B in convertible notes.

- No traditional debt.

- No buybacks yet this quarter. It told investors to expand the company to be “more active with repurchases in future quarters as FCF scales.”

- Stock comp dollars fell 5% Y/Y. Year-to-date, compensation represents just 8% of revenue. That’s quite low compared to companies at similar stages of their growth curves.

d. Guidance & Valuation

- Lowered 2024 revenue guide by 5%, which missed by 4.5%.

- Lowered 2024 EBITDA guide by $120M, which missed by 32%.

- Set $6.4B 2025 revenue target, which beat by 2.2%. At its last investor day, it guided to $6.2B in revenue by 2026. It’s more than a year ahead. This is related to vastly outperforming sector-wide growth.

- Set 46% 2025 GPM target, which beat 44.6% estimates.

- Set an 11.0% handle hold rate (take rate) target, which compares to 10.5% Y/Y. This is still materially below Fanduel, and DraftKings expects to continue closing the gap. That means revenue growth will be above volume growth for the time being.

- Set a stock comp target of 6% of revenue vs. 8% of revenue so far this year.

- Reiterated $950M 2025 EBITDA target, which beat by 0.5%.

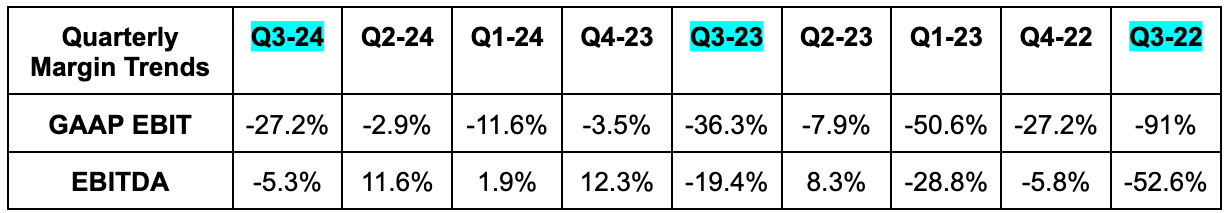

Guidance was the main theme of the prepared remarks & Q&A; a lot to unpack here. It’s strange to see the sharp EBITDA cut for 2024, paired with outperforming 2025 guidance. This is 100% related to the most unfavorable customer outcomes that DKNG has ever witnessed early in Q4. Specifically, of the $120 million reduction, there was a -$175 million impact from this alone. It would have raised 2024 guidance without this. This is not structural, so not overly concerning. Still, it does highlight the risk of outcome luck volatility on short-term DraftKings results.

This volatility will be sharpest right now, as its EBITDA base just turned positive and is quite small. The outsized impact will shrink as it gets larger & larger. For now, there’s risk of profit misses here and there because of this. It does have other levers to pull, like OpEx efficiency gain and promotional efficiency improvements across states. These promotional efficiency improvements include the beginnings of it offsetting higher tax rates in Illinois. Still, it does show us that DraftKings doesn’t have control of outcomes, which impact results. It’s tempting to be seduced by this noise, but I think it is important to focus on multi-year trends and the cost lines that it can control… efficient marketing… product enhancements… stock comp control… etc.

We also got a plethora of commentary surrounding 2025 guidance indicating an overly cautious/conservative stance. Aside from not including any Missouri legalization impact (2% of the population), its internal goals for hold rate are above 11%. It stated that explicitly. It’s assuming flat Y/Y market share and is not relying heavily on new customer cohorts to ramp betting volume to reach its goals. That is despite an expected ramp based on older cohort data. In its EBITDA guidance, it’s baking in continued strong new customer growth, which is a large short-term profit headwind as these customers enjoy incentives to use the app. If that environment slows, EBITDA will outperform as it pulls back on its flexible marketing spend. It also leaned pessimistic on its ability to recoup EBITDA losses from Illinois’s new tax policy through promotional cuts. Lots and lots of intentional pessimism…

While talking down expectations on one hand, Founder/CEO Jason Robbins added that things look “maybe even a bit better than expected.” He explicitly said we “could see some EBITDA upside” but wasn’t ready to commit to it. Smart. Under-promise, over-deliver. While this all probably means targets will rise throughout the year, I actually think this is a win even if they don’t. Why? Because that will mean customer acquisition was better than expected, which then means a higher long-term profit ceiling. I’d rather have more EBITDA in 2026-2030 than more EBITDA in 2025.

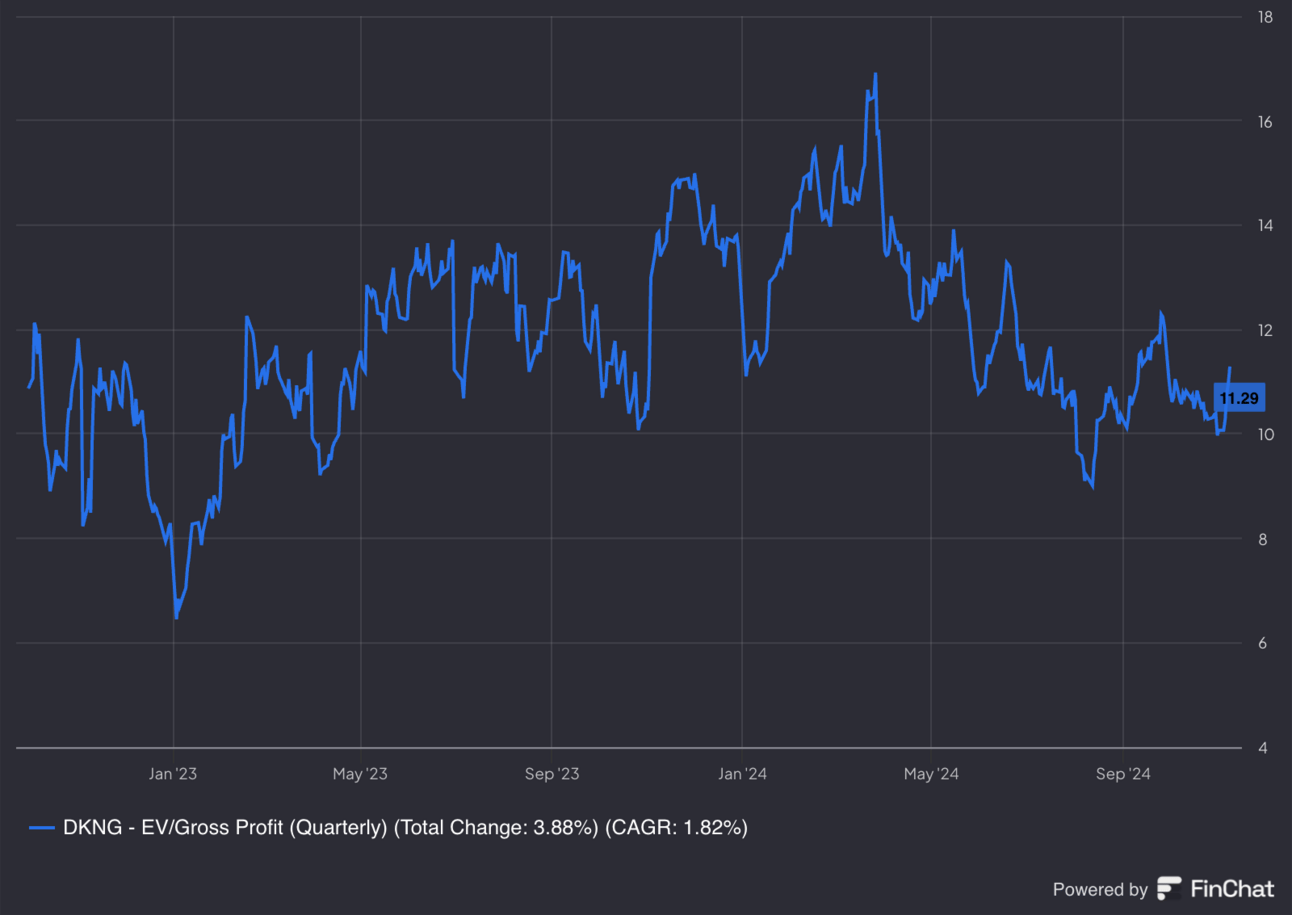

DKNG trades for 37x forward earnings and is turning profitable this year. EPS is expected to grow by 139% next year and 60% the following year.

e. Call, Letter & Presentation

Continued Efficient Customer Acquisition:

In a sector of very similar competing products, DraftKings continues to show clear signs of standing out in terms of promotion effectiveness. Net new customers added rose 14% Y/Y while customer acquisition cost fell by another 20% Y/Y and promotions as a percentage of revenue fell 3 points Y/Y. It’s also getting far more efficient in uncovering high lifetime value users, and avoiding less profitable customers. Its increasingly national marketing footprint is naturally making advertising more efficient, while, to help further, #1 user experience and product offering awards across sporting betting and iCasino from research firms like Eilers & Krejcik Gaming.

Closing the Hold Rate Gap & Expanding Better Choice:

DraftKings continues to add more same-game parlay options to grow overall take rate. This is what Fanduel has done so successfully… DraftKings is following that playbook. This quarter, NFL parlay mix as a percent of total bets rose 5 points Y/Y. It added in-house same-game parlay in 50 new NBA betting markets across the nation. Sticking with the NBA for a moment, its “King of the Court” marketing campaign was highlighted as a fantastic success. And that matters a lot. DKNG kills it in football, but lags others more noticeably in basketball. There’s no reason for that, aside from better execution and focus. Addressing that has become a priority and the season is off to a great start. New “game storyline” exclusive NBA bets should augment this momentum.

On the micro-betting side of things (player props), it’s adding more parlay menu items and broadening its overall offering. Its integration of Simplebet and in-house real-time score, stats and viewing capabilities should help it stand out among a sea of competitors.