Table of Contents

- 1. Duolingo (DUOL) – Earnings Review

- 2. Celsius (CELH) – Earnings Review

- 3. Mercado Libre (MELI) – Earnings Review

1.Duolingo (DUOL) – Earnings Review

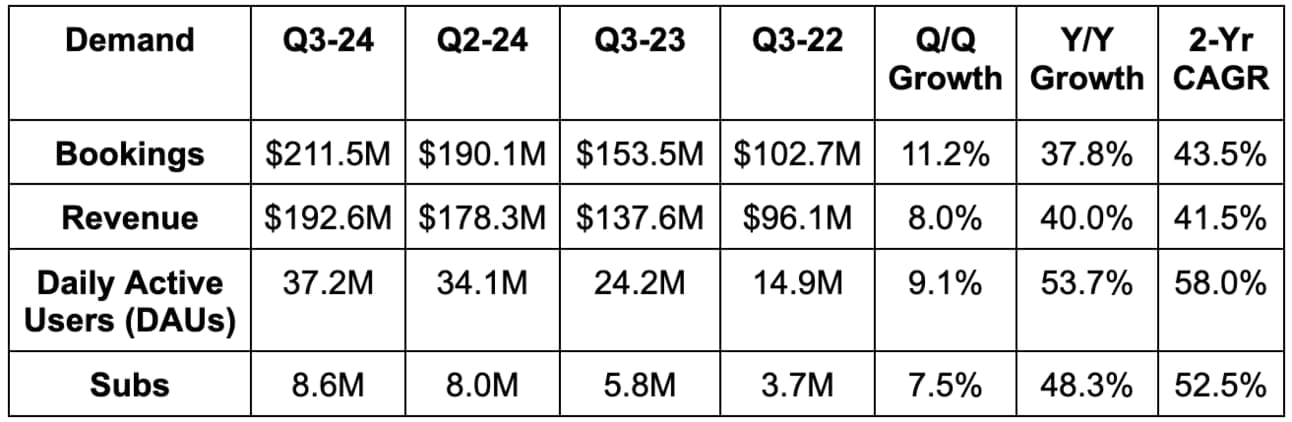

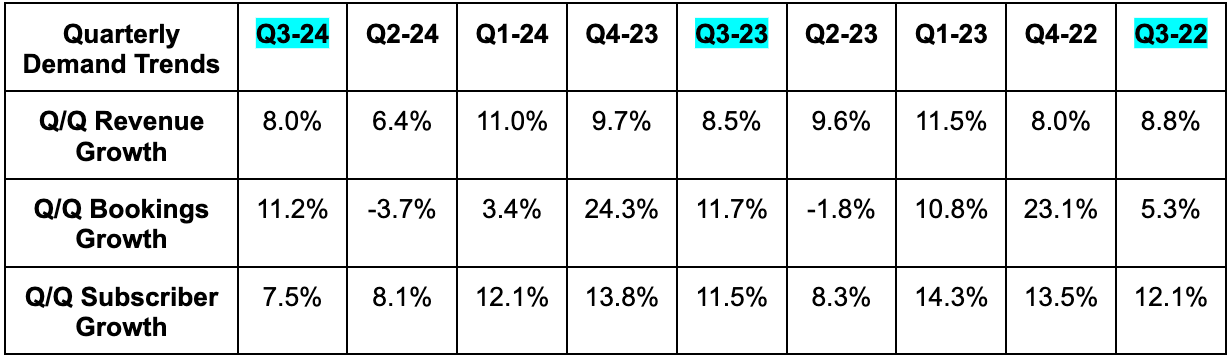

a. Demand

- Beat bookings guidance by 8%. Subscription bookings rose 45% Y/Y to $176.3 million. That’s the highest quality, more recurring portion of this bucket.

- Beat revenue estimates by 1.8% & beat guidance by 2.3%.

- The firm’s 43.5% 2-year revenue compounded annual growth rate (CAGR) compares to 42.0% Q/Q & 39.1% 2 Qs ago.

- Subscription revenue rose 49% Y/Y other revenue rose 10.4% Y/Y. “Other” includes its English proficiency exam, advertising and in-app purchases. Subscriptions are the focus.

- MAUs rose 36% Y/Y to 113 million. Paid subscribers represent 8.5% of monthly active users (MAUs) vs. 8.6% Q/Q & 8.0% Y/Y.

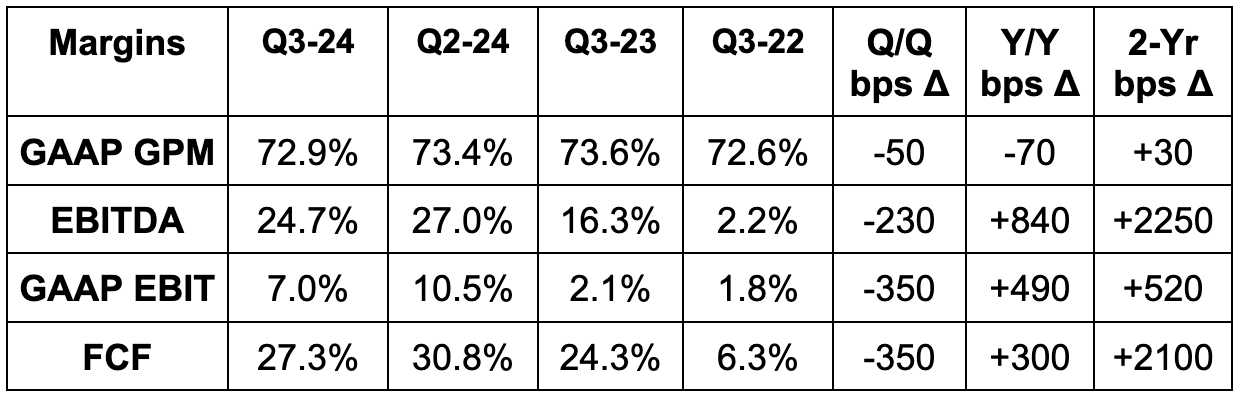

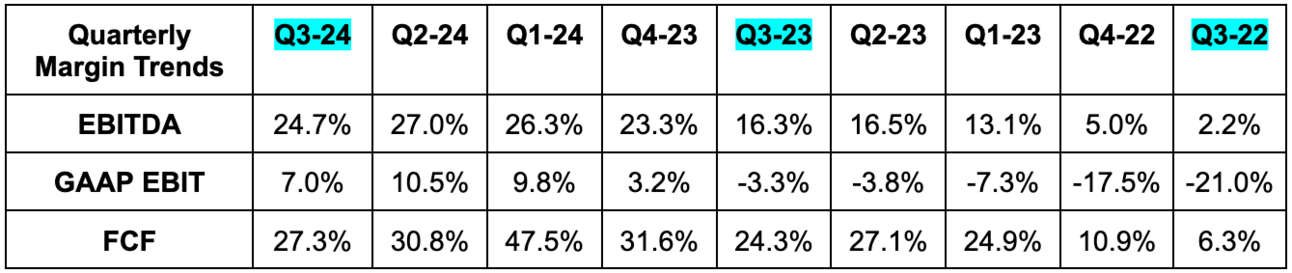

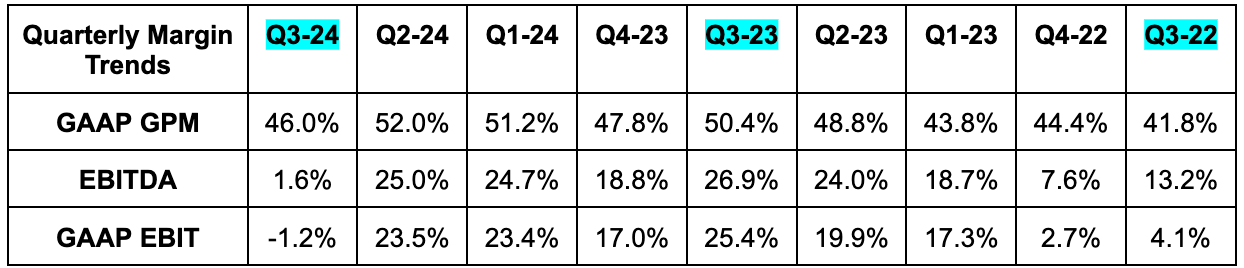

b. Profits & Margins

- Slightly missed gross profit margin (GPM) estimates. The Y/Y GPM contraction was related to other revenue. Subscription GPM helped offset the decline.

- Beat EBITDA estimates by 11.5% & beat guidance by 15%.

- The company delivered at least 2 points of non-GAAP operating leverage across all 3 major expense buckets – thanks to rapid revenue growth.

- Beat $10.8 million GAAP EBIT estimates by $2.8 million.

- The company delivered at least 3 points of GAAP operating leverage across all 3 major expense buckets – thanks to rapid revenue growth and lower stock comp.

- Beat $0.36 GAAP EPS estimate by $0.13 or 36%.

c. Balance Sheet

- Nearly $900M in cash & equivalents.

- No debt.

- Stock compensation rose 15% Y/Y year-to-date (YTD). Stock compensation represents 15% of year-to-date revenue vs. 18.5% Y/Y.

- Duolingo reiterated expectations for 1% total shareholder dilution this year.

d. 4th Quarter Guidance & Valuation

- Raised Q4 bookings guidance by 2.4%.

- Raised Q4 revenue guidance by 1.6%, which beat by 1.1%.

- Raised Q4 EBITDA guidance by 6.9%, which beat by 2%.

- When taking the Q3 outperformance and the Q4 raises together, annual guidance was materially raised across the board.

- Duolingo continues to expect sustainable 50%+ Y/Y daily active user (DAU) growth. It’s easy to shrug this off. But that is not normal. It’s excellent.

DUOL EPS is expected to grow by 86% Y/Y this year and by 29% Y/Y next year. Those growth estimates will rise following this report.

e. Call & Letter

Duolingo Max:

The new, GenAI-fueled Duolingo Max subscription tier is already contributing materially to bookings. This is a big step in its mission to teach as well as a human tutor. Unsurprisingly, this is bolstering customer lifetime value (LTV), retention and word-of-mouth growth. Its financial impact will merely rise as awareness grows and it rolls it out to the remaining 50% of its DAUs. Among the most popular tools is the live video chat that Duolingo debuted at Duocon in September. As a reminder, this product allows users to practice natural conversation. This is enabled by powerful, OpenAI-augmented, back-end algorithms responding through its familiar Lily character on the front end. The product has memory, and can bring up previous conversations to enhance individualization. So far, English learners are using it at 2x the pace of all other languages; again, this supports Duolingo’s large aforementioned advanced English opportunity.

Duolingo showed Lily’s new talents off to start its own earnings call. She filled in for Luis to kick things off in her typically sarcastic tone. This technically could have been a pre-recording, but when you actually use this new tool in-app, it will become clear that this character doesn’t need a fixed script.

This video product led to a surge in Duolingo Max bookings, which powered part of the 8% outperformance it posted. Duolingo did say it isn’t banking on this same tailwind next quarter. But? If history is any indication at all, this is it leaning pessimistic to tee itself up for more outperformance. They tell us all the time about why growth cannot possibly stay as strong as it is… and then it stays as strong as it is. Under-promise, over-deliver.

Duolingo Max Margin:

Duolingo Max generates more gross profit dollars per plan, but lower gross margin. This is related to incremental large language model (LLM) querying costs, which is a trade-off the company is happy to make. That’s understandable, considering Max also generates more cash flow per plan than other tiers. And while Duolingo Max LLM and amortization costs will lead to 100 bps of Q/Q GPM contraction next quarter, that will not be permanent. As leadership explained, it tasked its engineers with rolling out great products as quickly as possible. Per the team, they told these builders “not to worry too much about cost.” That optimization work will happen over time. The priority was driving expeditious product-market fit amid this rapidly evolving landscape. Leverage is coming.

As a related aside, tanking inference costs should embolden Duolingo to pursue more complex conversational tools. The trend will also make existing tools like the FaceTime product affordable for lower income nations.

Thriving DAU Growth:

Duolingo’s unmatched combination of DAU growth and scale is being powered by the same things as always. What you may ask? Consistent, thorough product split-testing to directly observe what works & craft products around those insights. It has accelerated its ability to run these tests in recent quarters, with the same success rate as before. This means ever faster product iterating and improving. It gets as precise as which shade of a certain color works in a certain setting to boost engagement by some microscopic amount. As leadership always says, these improvements compound over time, and they’re right. This fantastic quarter was simply more evidence. Duolingo is not an external marketing-led growth engine like its competition… It's an R&D-led growth engine.

This time around, leadership credited the strong DAU results to making the core app more social. For example, it extended user streaks to multiple learners with its friends streak debut. The user streak created an observed sense of competition and urgency to use the app more frequently, so engagement gains were large. By making this same idea more social, it’s notching incremental boosts. This may be a cute, cuddly owl on the outside... but it is a lean, mean, outcompeting machine on the inside. The team has a lot to do with that, as education technology is a very hard place to sustainably win. 54% DAU growth while lapping 60%+ DAU growth last year (and its margins) is the result.

Notably, the company enjoyed half of its active user growth coming from previously lapsed MAUs. The new social streak and other similar tools like friend quests, it thinks, are the reasons for the success. USA DAU expansion is also “similar” to overall 54% Y/Y growth, so this success isn’t being powered by lower monetizing counties.

“How did we pull this off? You know, the usual stuff, product improvements and social marketing. It just works.”

Lily

Advanced English:

As expected, the rollout of 20 new advanced English courses is receiving a warm welcome. Duolingo has already racked up 2 million DAUs here in a handful of months. To the team, there’s a long runway for making even more complex content to tap into the “enormous global demand” and to “unlock more user growth.”

More Notes:

- Duolingo expects Math and Music to become more material DAU growth drivers in the coming years. Both products are off to good starts.

- 21% of total subscribers are on the Family Plan vs. 18% Y/Y and 20% Q/Q. The dedicated Family Plan team is executing.

- France growth is strong following the onboarding of its new marketing manager there. It’s adding new managers in Turkey and Italy to support more growth.

- Subscriber retention is stable.

f. Take

This was a great quarter. The stock could easily cool off after a monstrous 3-month run, but the company is on a phenomenal path. It’s executing at a level of growth, scale and margin that nobody else can match. Nobody. I’ve published two pieces recently that included two separate Duolingo trims. The sales had nothing to do with fundamentals. They had everything to do with soaring estimates and expectations that were becoming wildly difficult to surpass. It was also a response to modest multiple expansion; this firm’s PEG ratio has risen from around 1.2x to probably 1.5x-1.6x following profit revisions. I don’t think it’s unfairly expensive, but I do think it’s now fairly priced.

When investors get this excited and this uniformly positive on a name, great quarters (like this absolutely was) are routinely shrugged off. This stock probably needs to take a breather, and I’d love to add some of the sale proceeds back if that occurs. Who knows what will happen tomorrow. Zooming out, things look great.

2.Celsius (CELH) – Earnings Review

a. Demand

Celsius missed greatly lowered analyst revenue estimates by 0.7%.

b. Profits & Margins

- Missed 46.6% GAAP GPM estimates by 60 bps.

- Missed $12.6 million EBITDA estimates by $6.2 million.

- Missed $0.03 GAAP EPS estimates by $0.03. It earned $0.00 per share vs. $0.30 Y/Y.

c. Balance Sheet

- $903M in cash & equivalents.

- $198M in inventory.

- $825M in convertible preferred shares.

d. Guidance & Valuation

Celsius doesn’t offer much formal guidance. It was asked if “low-to-mid-single digit revenue growth” for next quarter before the expected Pepsi impact (much more later) is about right. It said “yes.” I don’t know why they can’t just tell us this before being asked, but I was grateful for the response. Guidance was roughly in line with expectations.

Celsius EPS is expected to be flat Y/Y this year and grow by 29% Y/Y next year.