Table of Contents

- 1. Earnings Round-Up – AMD, Block & Intel

- 2. Cloudflare (NET) – Earnings Review

- 3. Mercado Libre (MELI) – Earnings Review

- 4. DraftKings (DKNG) – Earnings Call Highlights

- 5. Uber (UBER) – Self-Driving Cars

- 6. Market Headlines:

- 7. Macro & Some Market Commentary:

In case you missed it from this past week:

- SoFi & PayPal Earnings Reviews

- Microsoft & Starbucks Earnings Reviews.

- Apple, Amazon & DraftKings (part 1) Earnings Reviews.

1. Earnings Round-Up – AMD, Block & Intel

As expected, I could not get to everything that I wanted to this week. I will tuck AMD and Block earnings reviews into earnings articles for next week.

a. AMD (AMD)

Results:

- Beat revenue estimate by 2.1% & beat guide by 2.5%.

- Slightly beat GPM estimate & met GPM estimate.

- Met EPS estimate. EPS rose by 19% from $0.58 to $0.69 Y/Y

- Slightly missed GAAP EPS estimate.

- Note that Xilinx M&A continues to heavily impact GAAP margins.

Balance Sheet:

- $5.3B in cash & equivalents.

- $1.7B in total debt.

- Share count ~flat Y/Y.

Guidance & Valuation:

Q3 revenue guidance beat by 1.5%, while its 53.5% GPM guide missed 54.0% estimates.

b. Block (SQ)

Results:

- Missed revenue estimate by 2.3%.

- Gross profit beat guidance by about 2.2%.

- Beat EBITDA estimate by 10.4% & beat EBITDA guide by 11.6%.

- Beat GAAP EBIT estimate by a robust 32%.

- Beat $0.84 EPS estimates by $0.09.

Balance Sheet:

- $8.4B in cash & equivalents. $961M in loans held for sale vs. $775M 6 months ago.

- $6.1B in total debt ($1B is current).

- Diluted share count rose by 4.5% Y/Y; basic share count rose by a modest 1.8% Y/Y.

Annual Guidance & Valuation:

- Raised gross profit guide by 1.3%.

- Raised EBITDA guide by 5.1%, which beat by 3.9%.

- For Q3, EBITDA guidance was 2.5% ahead of expectations.

Block trades for 17x 2024 earnings. EPS is expected to grow by 95% this year and by 28% next year. It is currently inflected to positive GAAP EPS as well.

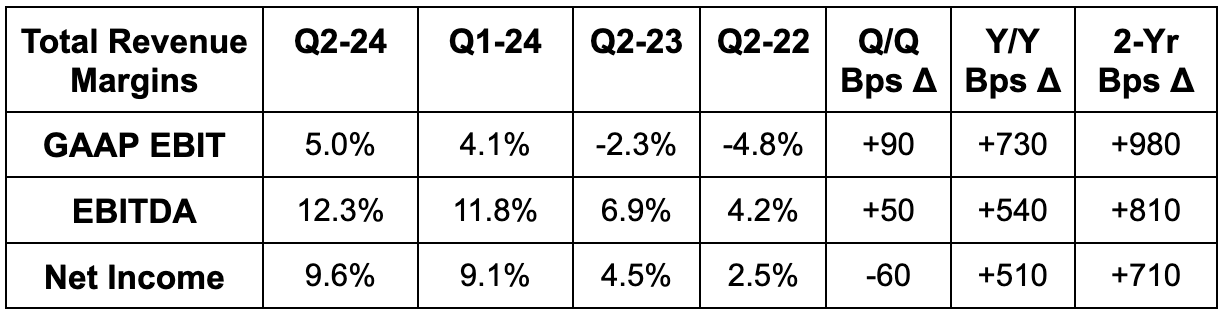

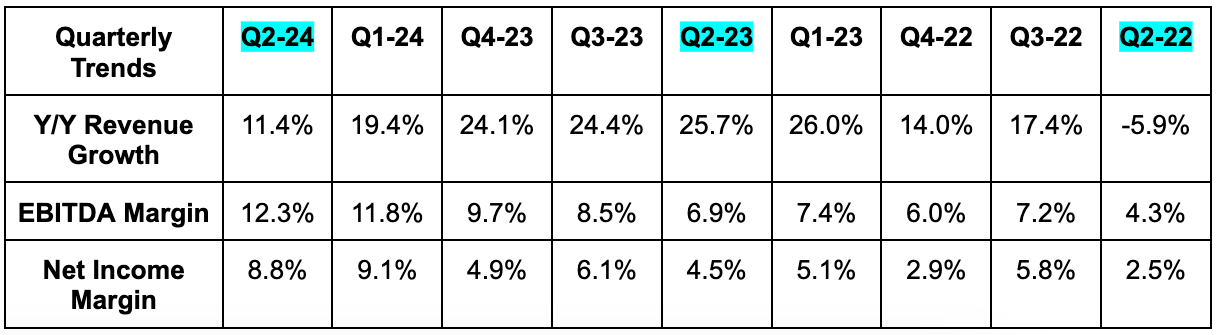

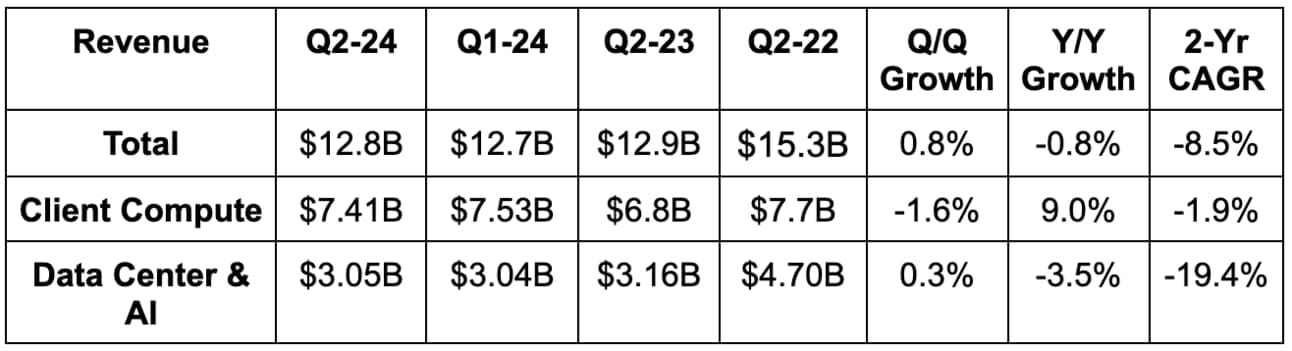

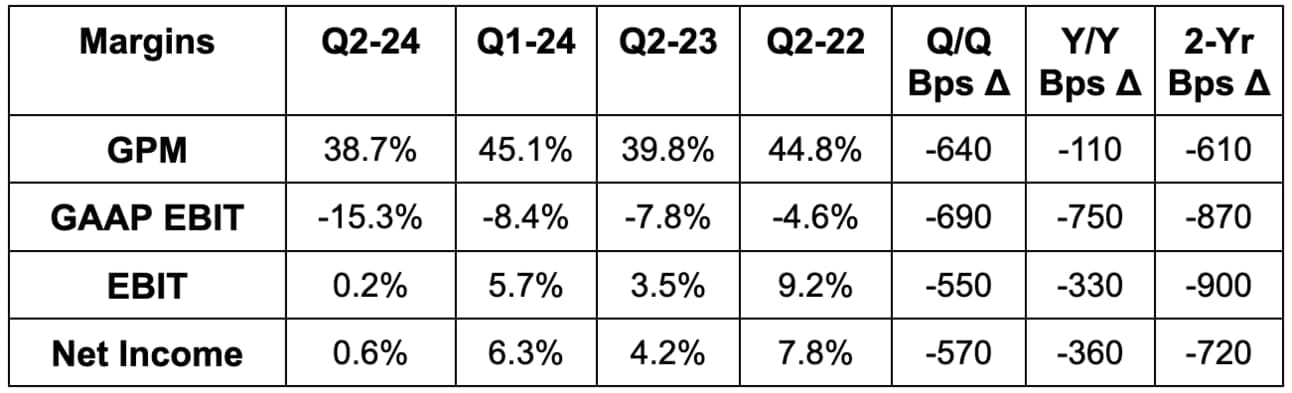

c. Intel (INTC)

This was really bad. Intel bulls are pretty much relying on this morphing into a Taiwan Semi competitor through government subsidies and factory build-outs. That is a long road and meanwhile the existing core business is not in good shape. If you can’t deliver strong data center revenue growth in this environment, you probably never will. They need a new core.

Results:

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected.”

CEO Pat Gelsinger

- Missed revenue estimate & its same revenue guidance by 1.1% each. Not awful.

- Missed its 43.5% non-GAAP GPM guidance by 480 bps. That is awful.

- Missed $407M EBIT estimates by $383M or 90%+. That is not a typo.

- Missed $0.10 EPS estimates by $0.08 & missed its guide by $0.03.

Balance Sheet:

- $29.2B in cash & equivalents.

- Inventory grew slightly Y/Y to $11.2B.

- Will suspend its dividend.

- 15% layoff announced.

- $48.3B in total debt.

- Diluted share count rose 1.7% Y/Y.

Guidance & Valuation:

- Q3 revenue guidance missed estimates by 10%.

- Q3 gross margin guidance of 38.0% sharply missed estimates.

- Q3 EPS guidance of -$0.03 sharply missed by $0.35.

Following downward profit revisions, INTC trades for 80x 2024 earnings. Earnings are expected to meaningfully fall this year, and then rise from $0.26 to $1.56 next year. I’d imagine those $1.56 estimates will see downward revisions in the coming weeks.

2. Cloudflare (NET) – Earnings Review

Cloudflare 101:

Here, I’ll introduce Cloudflare’s product suite and niche. This will be partially review for consistent readers and for those who are well-versed in its product suite:

In essence, Cloudflare makes the internet faster and more secure. They have a massive global Content Delivery Network (CDN) to move traffic closer to the end user, which cuts web latency. They actively assist clients in optimizing traffic speed and consistency as well. It also has a suite of security tools to protect customers from Distributed Denial of Service (DDoS) attacks. This form of hacking aims to inundate and overwhelm networks with traffic. NET doesn’t sell physical firewall hardware, but instead a virtual, cloud-native “Magic Firewall” to supplant these hardware needs. It offers web application firewalls too for app-level security, while Magic Firewall is for network-level security. Magic WAN is Magic Firewall’s partner in crime. Magic WAN connects networks while Magic Firewall protects them. The closest cybersecurity competitor in public markets is Zscaler.

A Few Key Products to Know Aside from Those Already Mentioned:

Workers Platform is its server-less (so fully managed by Cloudflare) product suite for developers to build, maintain, secure and deploy applications. This allows for caching of content and apps across Cloudflare’s global network for faster delivery. Its newer Workers AI product allows developers to access models and infuse GenAI tools (like sentiment analysis) into Cloudflare-hosted apps and networks. Workers AI pairs seamlessly with its “Vectorize.” Vectorize offers a style of data querying that allows for visualization of patterns. Another key example of Cloudflare’s GenAI tools is its R2 product. This allows cloud workloads and data to be freely moved among public clouds with no tax. Key in a multi-cloud world. This is popular for model building and implementation as models are voracious users of data and data is routinely hosted in many clouds.

- Cloudflare AI is its overarching suite of AI tools, which include the developer AI tools in Workers AI, among others.

- Hyperdrive is a notable product within Workers AI. This allows any legacy database to plug into NET’s global CDN. It makes NET an easier migration partner as it helps customers embrace next-gen data bases, on-premise-to-cloud migrations and GenAI.

Cloudflare Access is its Zero Trust Network Access (ZTNA) program. This directly competes with Zscaler. Zero trust means that a user or device must be constantly verified (or never trusted). Cloudflare does this in a seamless manner so as to minimize user friction. It considers device type, location, usage patterns (or signatures) and other contextual clues to better authorize permission requests. This way, it knows when to block those requests or when to require more information. It then deploys a minimal privilege approach to ensure only the necessary permissions are granted to workers. Nothing more, nothing less. Zero Trust ensures an adversary can’t breach the most vulnerable part of a tech stack and move freely throughout it thereafter.

Secure Access Service Edge (SASE) platform is a term for how Cloudflare conjoins web performance and security use cases. This drives vendor consolidation, controls costs and augments performance. Cloudflare One is its overarching product bundle subscription combining its suite.

Cloud Access Security Broker (CASB) is a security tool to provide firms with a birds-eye-view of application usage. It hosts and secures client data and uncovers suspicious activity or deviations in typical usage patterns to flag threats. It plugs into NET’s Secure Web Gateway (SWG), which is essentially a digital security guard ensuring protection from a firm’s secure network and assets and the open internet. It ties closely to NET’s data loss prevention (DLP) tool and URL filtering tool.

Browser Isolation is Net’s managed service for providing users with a purely secluded environment to search and scrape the web. This will be an increasingly important tool for its GenAI inference products that are now building steam. That’s where Cloudflare expects to realize the bulk of GenAI’s potential financial value. Models are trained once and periodically updated with new data. After that, the value of those models lies in their ability to connect dots and drive insights (or inferences). That’s where Cloudflare presides. It provides a managed cloud platform to do all of that app and model work in a secure and compliant fashion.

“Today, we have inference-tuned GPUs live in 167 cities worldwide, making us, we believe, the most global cloud inference solution. Inference requests powered by Cloudflare AI increased more than 700% quarter-over-quarter.”

Founder/CEO Matthew Prince

a. Demand

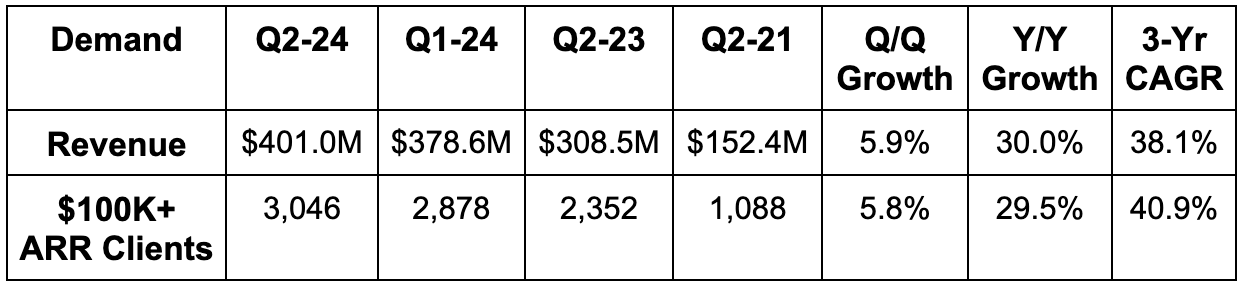

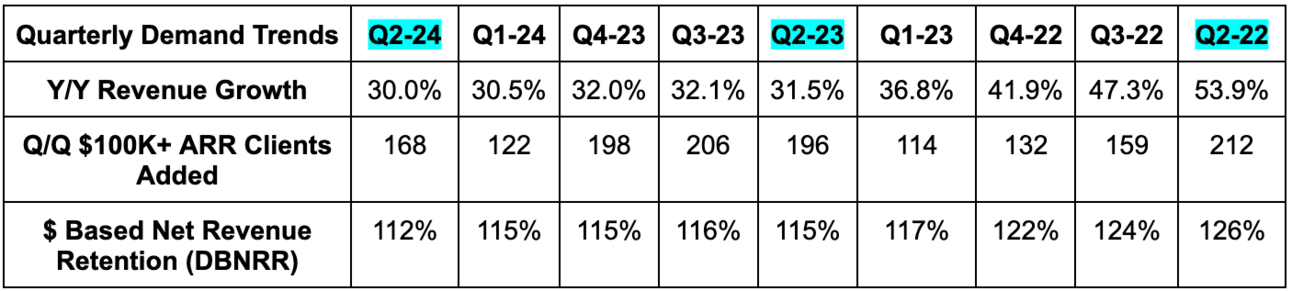

Cloudflare beat revenue estimates by 1.6% & beat its guidance by 1.8%. Its 38.1% 3-year revenue compounded annual growth rate (CAGR) compares to 40% last quarter and 40.9% two quarters ago.

- Revenue growth across all regions ranged from 28% Y/Y to 32% Y/Y.

- Total paying customers rose 21% Y/Y to 210,200.

- Remaining performance obligations (RPO) (forward-looking demand metric) rose 37% Y/Y to $1.41 billion.

b. Profits & Margins

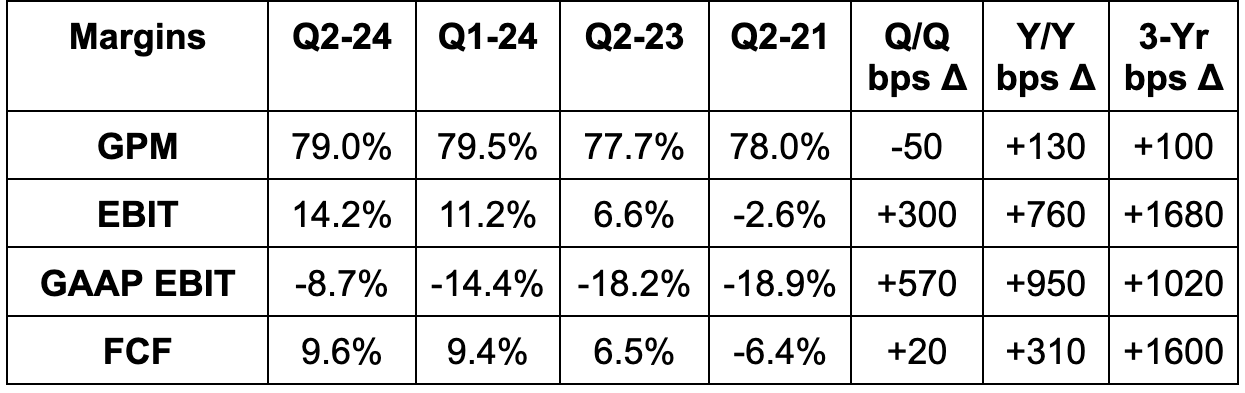

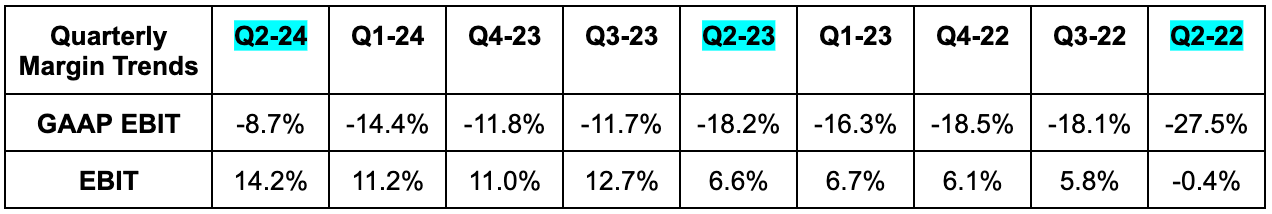

- Beat EBIT estimates and its same EBIT guidance by 61%.

- Beat $0.14 EPS estimates and its same guide by $0.06. EPS doubled Y/Y.

- Beat 78.5% non-GAAP GPM estimates by 50 basis points (bps; 1 basis point = 0.01%).

Within the strong EBIT leverage Y/Y, sales & marketing delivered 400 bps of expansion despite ramping hiring, R&D delivered 100 bps of expansion and G&A delivered 200 bps of expansion. Headcount rose 15% Y/Y. From a CapEx point of view, network CapEx remained at a modest 6% of revenue. Still, investment timing will lead to that rising to 11% of revenue for the full year. Just like public cloud providers, NET feels the need to build more capacity to meet demand (on a much smaller scale).

c. Balance Sheet

- $1.76B in cash & equivalents.

- $1.29B in convertible senior notes.

- No traditional debt.

- Diluted share count rose 2.5% Y/Y.

d. Annual Guidance & Valuation

Annual Guidance Updates:

- Raised annual revenue guide by 1.8%, which beat by 1.6%.

- Raised annual EPS guide from $0.61 to $0.70, which beat by $0.08.

- Reiterated its $162 million free cash flow (FCF) guidance, which missed by 3%.

Third quarter guidance was a slight miss on revenue & a slight beat on EBIT. This implies a Q4 guide that is solidly ahead of expectations.

“We remain prudent in our outlook for 2024.”

CFO Thomas Seifert

Net trades for 110x 2024 earnings. EPS is expected to grow by 44% Y/Y this year and by 13% Y/Y next year. Here’s how its current EBITDA multiple compares to historical norms: