Table of Contents

- 1. Earnings Round-Up – Visa (V), Mastercard (MA), …

- 2. Detailed ServiceNow Earnings Review

- 3. Market Headlines

- 4. Macro

Most of this week’s content was already sent. In case you missed it:

- SoFi Earnings Review

- Portfolio Earnings Season Preview

- Meta, Tesla & Starbucks Earnings Reviews + DeepSeek News & Implications

- Microsoft & Apple Earnings Reviews

- Portfolio & Performance Update

1. Earnings Round-Up – Visa (V), Mastercard (MA), Intel (INTC) & IBM (IBM) Snapshots

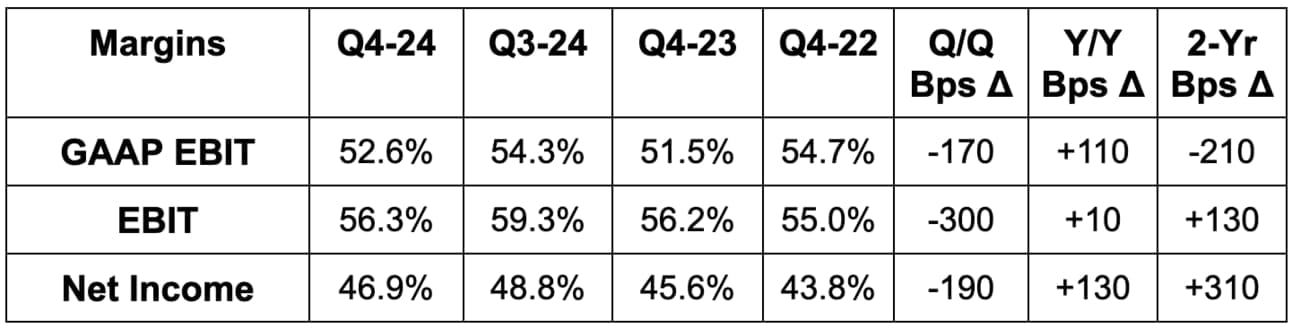

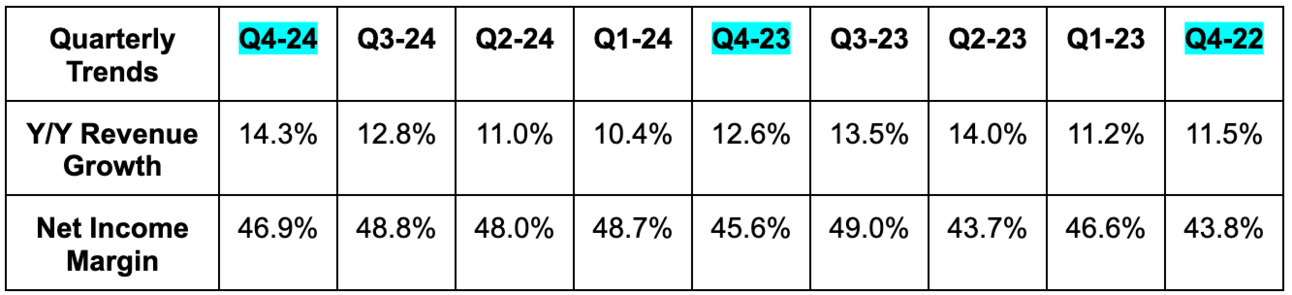

a. Visa Snapshot

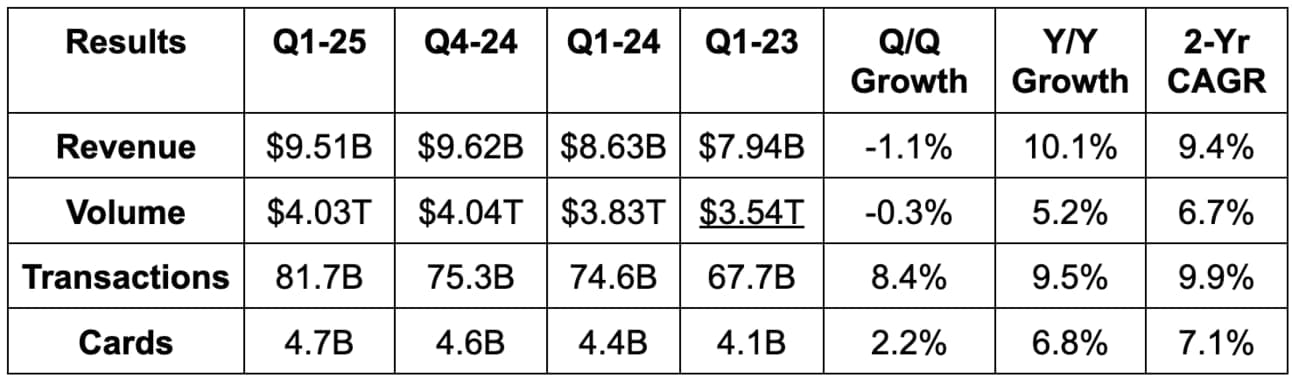

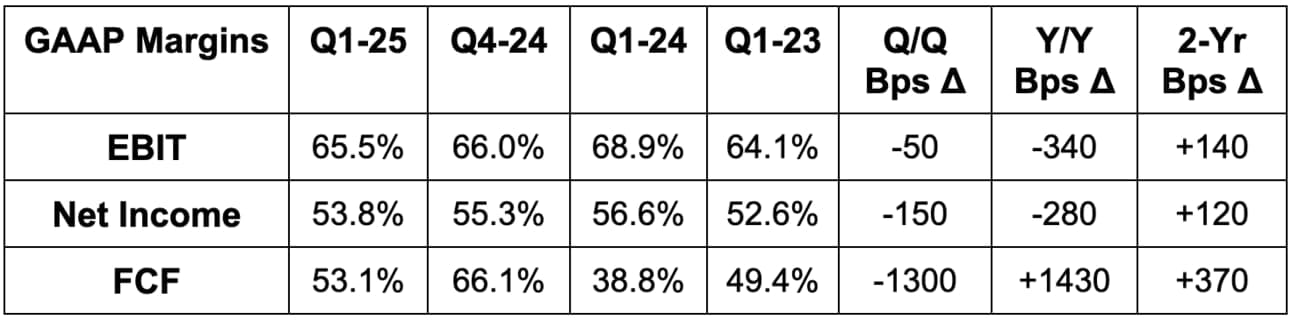

Results:

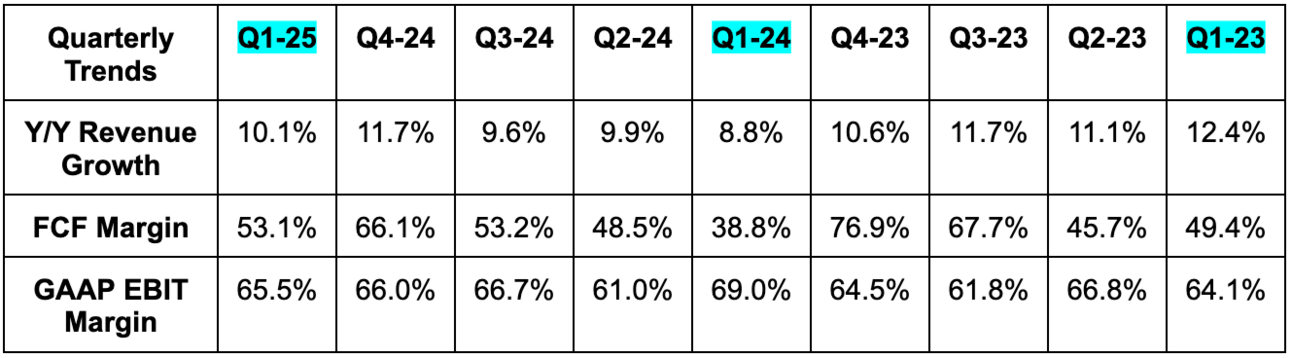

- Beat revenue estimates by 1.8% & beat high single-digit revenue growth guidance with 10.1% Y/Y growth.

- Its 9.4% 2-year revenue CAGR compares to 11.2% last quarter and 10.6% the quarter before that.

- Beat EBIT estimate by 2.5%. OpEx growth of 11% Y/Y came in at the high end of its guidance range, but the revenue outperformance still enabled the beat.

- Beat $2.64 EPS estimates by $0.11

- Consumer credit volume rose 5% Y/Y; consumer debit volume rose 8% Y/Y; commercial volume rose 4% Y/Y; cash volume fell 1% Y/Y; total volume rose 5% Y/Y.

Balance Sheet:

- $16.1 billion in cash, cash equivalents & investment securities.

- $20.6 billion in total debt ($3.9 billion is current).

- Diluted share count fell 2.9% Y/Y.

- Dividends rose by 10.4% Y/Y.

Guidance & Valuation:

- Raised 2025 revenue growth guidance from roughly 9%-10% to roughly 11%-12% growth, which beat 9.5% growth estimates.

- Raised 2025 EPS growth guidance from roughly 12% to roughly 13% growth, which beat 11.3% growth estimates.

- Q2 growth guidance was also modestly ahead of expectations across the board.

So far this quarter, U.S. payments volume has accelerated from 7% to 8% Y/Y growth. This acceleration is coming from debit not credit, which not only bodes well for the economy, but for consumer balance sheets as well. When pairing this with credit repayment data from J.P Morgan, Bank of America, American Express and several others, economic and consumer health continues to be resilient in the USA. You’ll see that Mastercard said the same thing in a moment. Furthermore, U.S. consumer holiday spending saw some of its best traction with discretionary categories, showing the disposable income levels may be improving.

“Retail holiday spending growth was a couple of points higher than last year and retail spending growth on key shopping days from Thanksgiving to Cyber Monday was several points higher. E-commerce was a higher share of retail holiday spending versus last year. … Travel volumes performed well across our regional corridors due to broader strength in both consumer and commercial spending.”

CFO Christopher Suh

EPS is expected to smoothly compound at a 12.5% clip for the next two years. FCF is expected to grow by 21% this year and by 8% next year. Estimates should move higher following this report.

b. Mastercard Snapshot

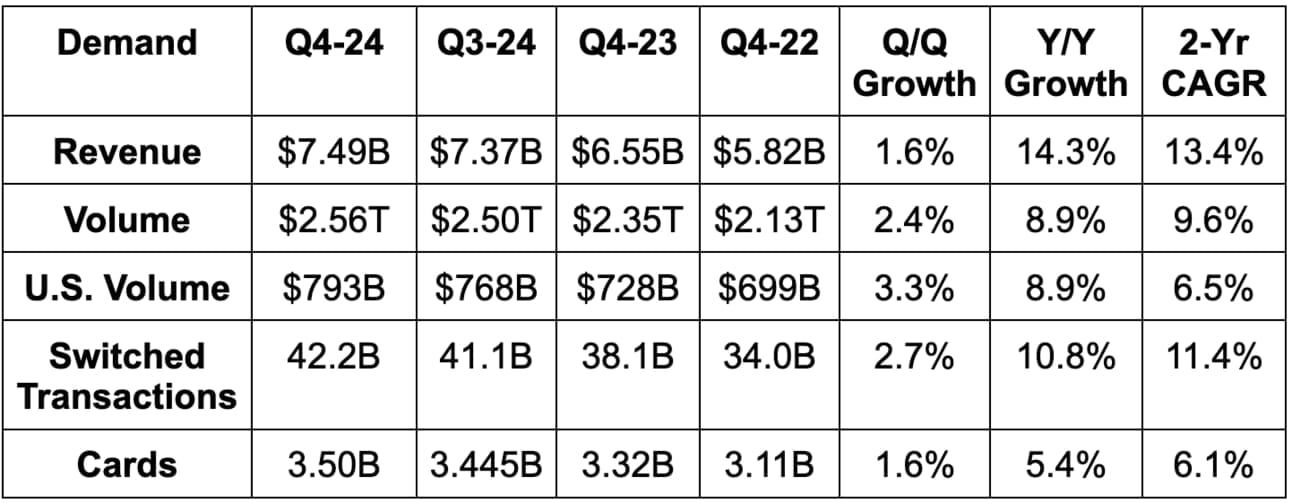

Results:

- Beat revenue estimates by 1.5% & came in at the high end of low-teens revenue growth guidance.

- Beat EBIT estimates by 1%; met OpEx growth guidance. GAAP OpEx was above expectations, largely due to its “Recorded Future” acquisition closing a quarter early. This means there will be a full year of impact on expenses.

- Beat $3.69 EPS estimate by $0.13.

Balance Sheet:

- $8.44B in cash & equivalents; $330M in investments.

- Diluted share count fell by 2.1% Y/Y.

- 13.4% Y/Y dividend growth.

- $18.23 billion in total debt.

Guidance & Valuation:

- Low double-digit revenue growth guidance for 2025 roughly met 11.9% growth estimates and led to modest upward estimate revisions. Early M&A closing likely helped a bit.

- Low-teens OpEx growth guidance for 2025 led to EPS estimates falling by 2%.

EPS is expected to grow by 9% this year and by 18% next year.

Consumer & Economic Health Commentary:

“The macroeconomic environment continues to perform well, and it is underpinned by healthy consumer spending as we've seen in today's news. The labor market is strong with low unemployment and continued wage growth. Inflation has moderated, but to varying degrees across categories and countries. Consumers remain engaged. Affluent consumers have benefited from the wealth effect, while the mass segment remains supported by the labor market.”

CEO Michael Miebach

“Our Economics Institute expects a year of global economic expansion in 2025, defined by shifts in monetary and fiscal policy, albeit geopolitical concerns remain. Overall, we remain positive about our growth outlook.”

CEO Michael Miebach

“The macro environment remains supportive of our base case, reflecting healthy consumer spending.”

CFO Sachin Mehra

“Cross-border volumes benefited from healthy spending, easier comps as well as a pull forward of travel spend..”

CFO Sachin Mehra

“Now looking through the first 4 weeks of January, the metrics are holding up well and are generally in line with the fourth quarter.”

CFO Sachin Mehra

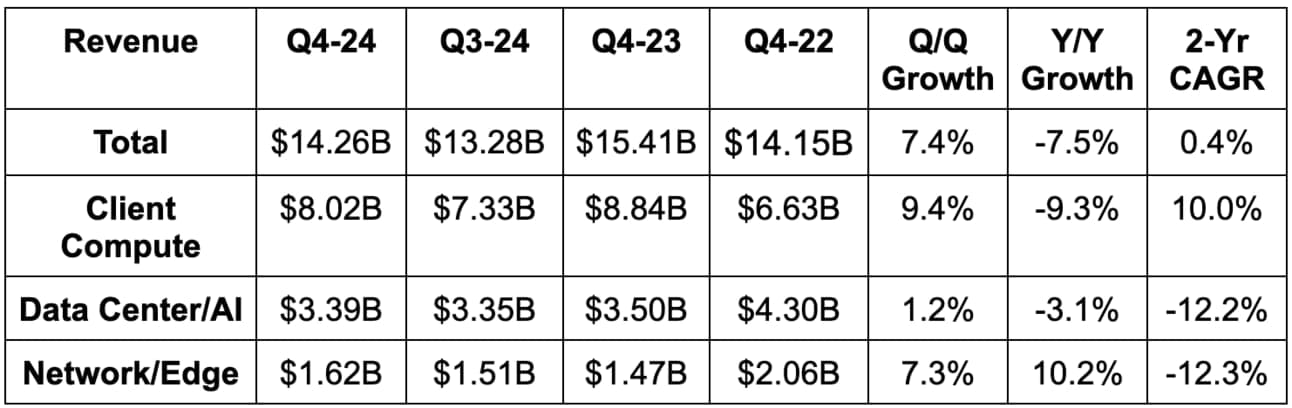

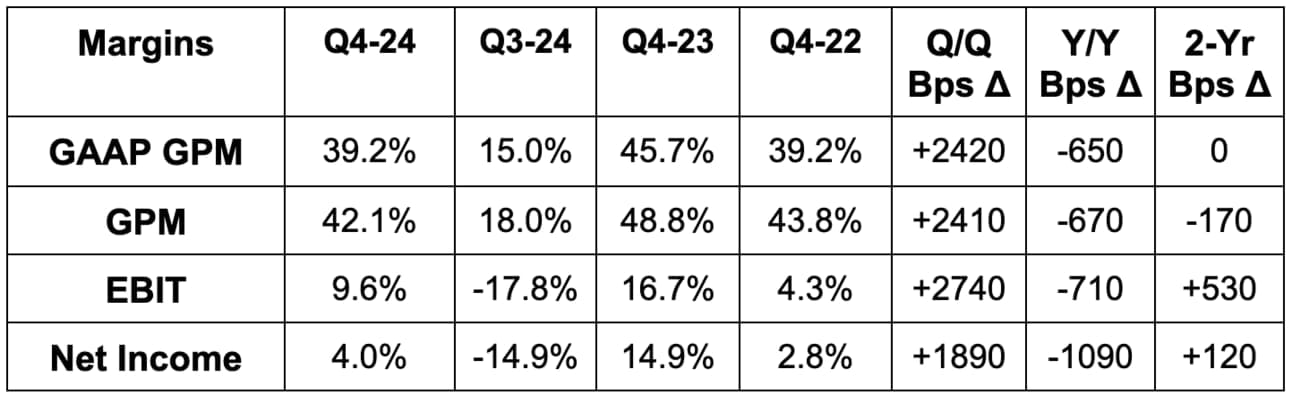

c. Intel Snapshot

Results:

- Beat revenue estimates by 3.2%; Client compute beat by 2.3%; Data Center & AI slightly beat; Network and Edge beat by 8%; Foundry slightly beat.

- Beat 39% GPM estimates by 310 bps.

- Beat $567M EBIT estimates by about $800M.

Balance Sheet:

- $21.5B in cash & equivalents.

- $12.2B in inventory vs. $11.1B Y/Y.

- About $50B in total debt.

- Diluted share count rose 1.4% Y/Y.

- Dividends fell by about 50% in 2024.

Guidance & Valuation:

Revenue guidance missed by 5%; gross margin guidance missed by 300 bps; EPS guidance missed $0.08 estimates by $0.08. It also expects a 33.8% GAAP GPM and -$0.27 in GAAP EPS next quarter.

d. IBM Snapshot

Results:

- IBM missed 1.5% Y/Y growth guidance but met 2% Y/Y FXN growth guidance. It very slightly beat revenue estimates.

- Software revenue met estimates.

- Delivered $13.5B in FCF for the year vs. guidance of $12.0B+

- Beat $3.78 EPS estimates by $0.14.

Balance Sheet:

- $14.8B in cash & equivalents; $55.0B in total debt.

- Dividends rose 1.8% Y/Y.

- Diluted share count rose by about 0.5% Y/Y.

Guidance & Valuation:

For 2025, IBM guided to 5% FXN revenue growth and 3% revenue growth. Analysts expected 4% Y/Y revenue growth. It also guided to $13.5 billion in FCF, which beat estimates by 3.8%. Finally, it guided to 50 bps of EBT margin expansion Y/Y, which beat estimates by 20 bps. This led to a modest rise in forward earnings estimates.

EPS is expected to compound at a 5% 2-yr pace. FCF is expected to compound at a 6% 2-yr pace.