Table of Contents

1. Microsoft (MSFT) – Earnings Review

a. Key Points

- For a world-class company like this one, the quarter was underwhelming.

- Great results for productivity and business. Cloud was a bit weak, which matters a lot.

- Azure remains supply constrained, but an execution-related blunder held growth back a tad too.

- Guidance underwhelmed, but that’s largely related to foreign exchange (FX).

- Copilot adoption momentum remains very strong across the board.

- No material changes to spending plans in the wake of the DeepSeek news.

b. Demand

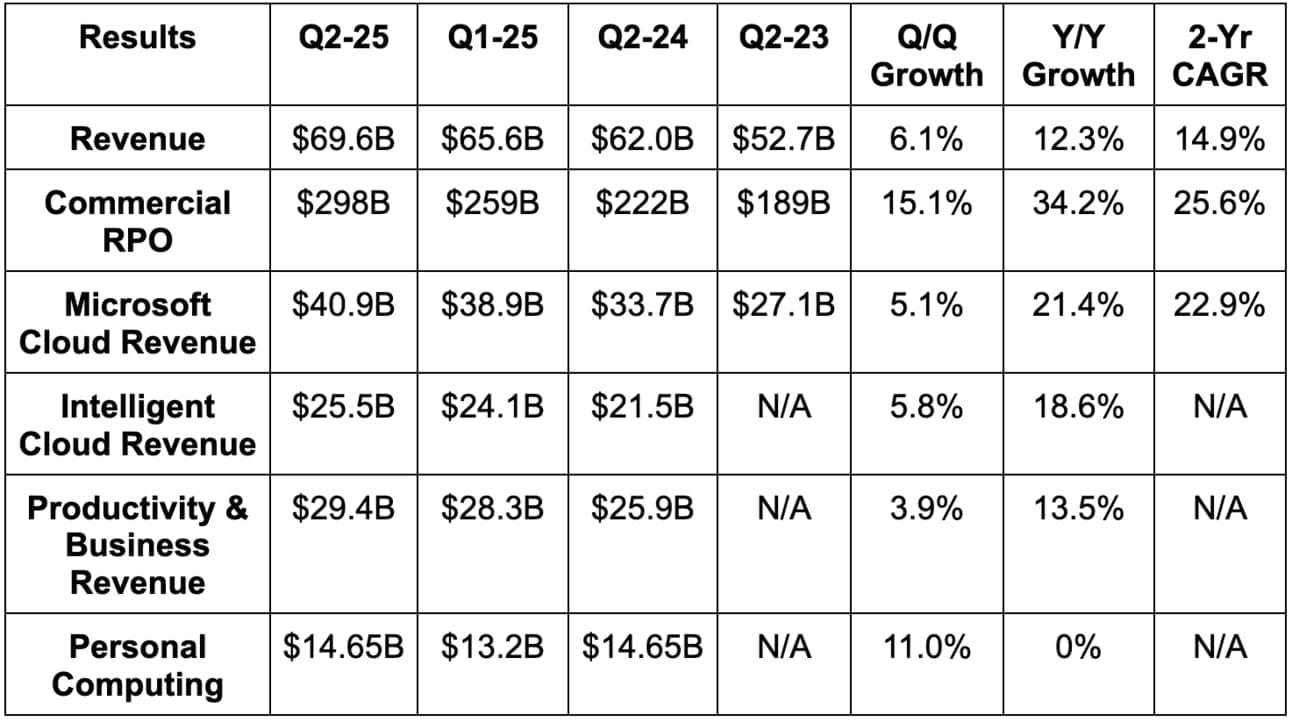

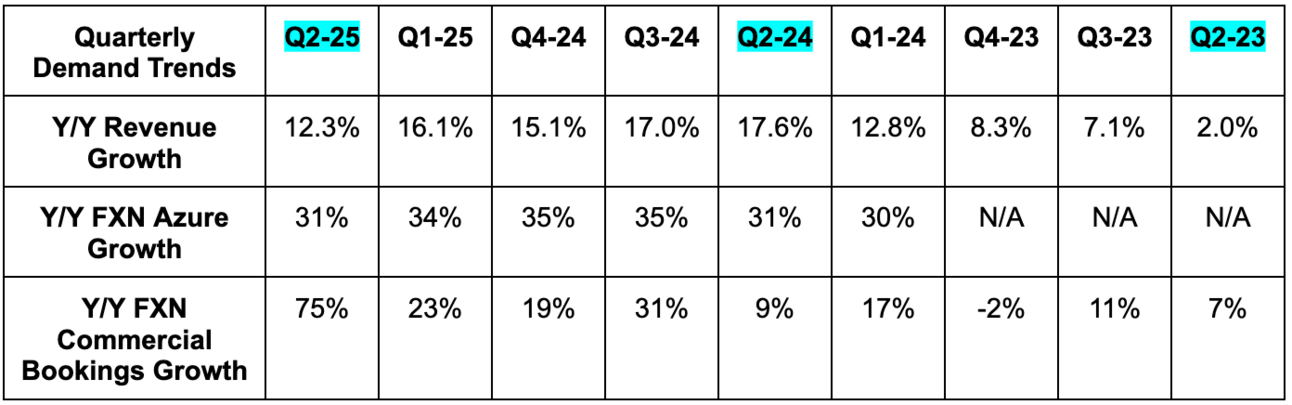

- Beat revenue estimates by 1.5% & beat guidance by 1.0%.

- Beat Productivity and Business revenue estimates by 5% & beat guidance by 1.9%.

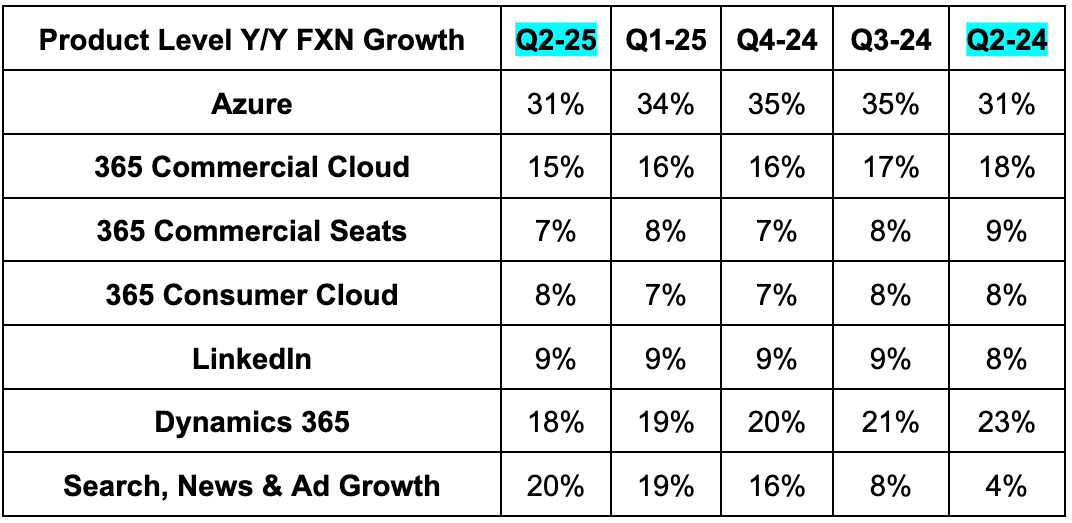

- 7% Microsoft 365 commercial seat growth was driven by small and medium businesses, as well as frontline workers.

- Missed Intelligent Cloud revenue estimates by 0.8% & missed guidance by 1.6%.

- 31% foreign exchange neutral (FXN) Azure growth missed 32% estimates and 31.5% guidance.

- Beat personal computing revenue estimates by 4.6% & beat guidance by 1.9%.

- Beat commercial remaining performance obligation (CRPO) estimates by 8%. This was greatly helped by new OpenAI commitments as part of the tweaked partnership announced this month amid the Project Stargate news. Relatedly, 75% Y/Y commercial bookings growth was also significantly aided by new OpenAI commitments.

On Intelligent Cloud and Azure specifically, the AI portion of Azure passed a $13 billion revenue run rate vs. more than $10 billion guided to last quarter. AI revenue rose 175% Y/Y and contributed 13 points to Azure growth. That portion of the intelligent cloud was better than expected, as it overcame some expected capacity constraints with strong execution. It’s killing it. Conversely, the segment-level miss for Intelligent Cloud overall was related to two things. First is a larger-than-expected FX headwind, which is outside of their control and not concerning. Even when excluding that, however, the segment still missed expectations slightly. That’s due to disappointing execution within the non-AI portion of Azure. This was especially true for channel partner selling, where MSFT tweaked their sales motion last summer to emphasize AI. It thinks that it deprioritized non-AI selling too much in the go-to-market and has left some demand on the table. It understandably wants to focus on AI services, but thinks it needs to shift the balance back a bit towards the middle. Candidly, I think this bodes very well for Google Cloud, Oracle Cloud Infrastructure (OCI) and AWS when they report earnings next month. If a key competitor is misstepping… they’re probably benefitting. Notably, during the Q&A, Amy Hood hinted at risk to its previous Azure growth acceleration due to this specific issue. As a reminder, they had expected this to come during the second half of the year, which means starting next quarter. That isn’t meaningfully happening based on the guidance laid out below. She didn’t explicitly say the reaccel isn’t coming in Q4… but did pour a bit of cold water on that expectation.