Table of Contents

- 1. Earnings Snapshots – Enphase (ENPH); IBM; Lam R …

- 2. CrowdStrike (CRWD) – Carahsoft

- 3. Spotify (SPOT) and The Trade Desk (TTD) – Spoti …

- 4. SoFi (SOFI) – Lending Club & Thoughts Heading I …

- 5. Amazon (AMZN) – Anthropic (Private) & More Sell …

- 6. PayPal (PYPL) – Partnerships

- 7. Walmart (WMT) – Pharmacy Disruption

- 8. Market Headlines

- 9. Macro

In case you missed it, here’s what I published recently:

- Tesla and ServiceNow full earnings reviews.

- Unpacking the Starbucks earnings pre-announcement.

- Coverage of AmEx, Bank of America, ISRG and ASML earnings, along with full coverage of SentinelOne’s analyst day and more in the last news of the week.

- Portfolio earnings season preview.

- Netflix and Taiwan Semiconductor Earnings Reviews.

- SoFi Deep Dive.

So much more is coming soon. Earnings mania starts next week. I’ll send out detailed earnings reviews on Meta, Amazon, PayPal, Microsoft, AMD, Uber, SoFi, Alphabet and Apple. I’ll also send coverage of Visa, Mastercard, Intel, Coinbase, Robinhood and Chipotle earnings.

Coupang (CPNG) will also be the topic of my next deep dive. Tons of other coverage to get to while I make time for that.

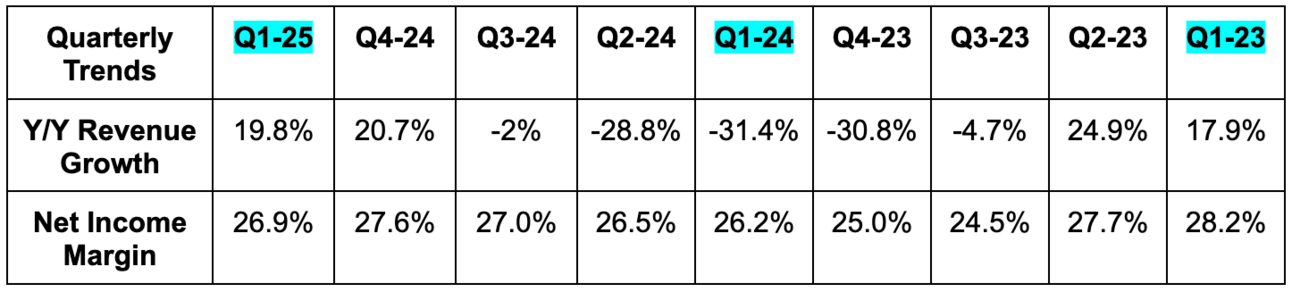

1. Earnings Snapshots – Enphase (ENPH); IBM; Lam Research (LRCX); Deckers Outdoor (DECK)

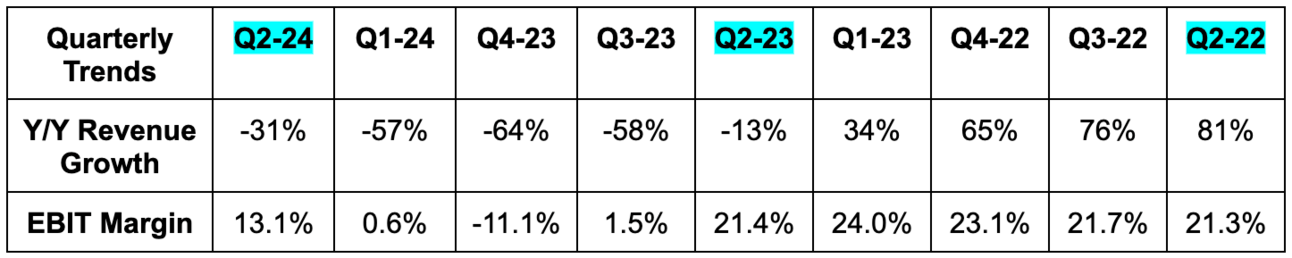

a. Enphase

Enphase exists in an extremely cyclical solar energy cycle. Higher rates recently made its installations more expensive for consumers and enterprises. Rate cuts take time to flow through to its sector (especially on the consumer side) to support demand. Bulls will say that easy monetary policy will be like wildfire for this business and that times are about to get much more fun. Bears point to company-specific production issues, tightening California solar energy re-selling regulation, and hefty Chinese competition/Europe struggles as the causes of this firm’s recent decline. While there do seem to be micro-level headwinds, I find it extremely probable that part of this weakness is macro-related. We will see which factors have the strongest impact in the coming quarters.

“While every country in Europe has its nuances, the overall business environment in the region is challenging. Power prices have declined from the early 2023 highs, the economic growth is slow, and the consumer confidence is limited.”

CEO Badri Kothandaraman

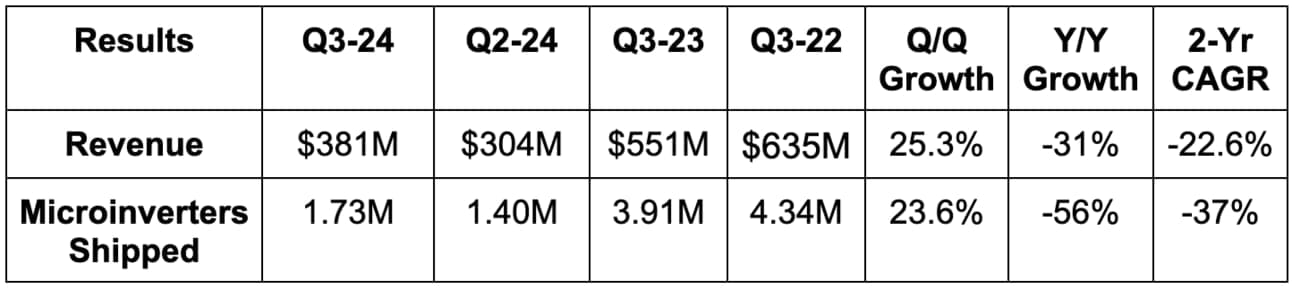

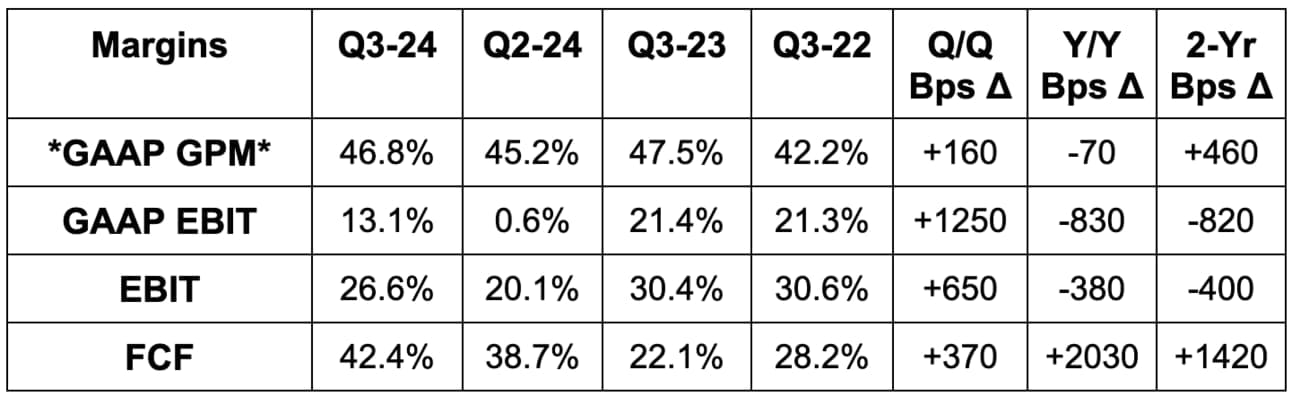

Results:

- Missed revenue estimates by 3.3% & missed guidance by 2.3%.

- Beat 46.5% GAAP gross profit margin (GPM) GPM guidance by 30 basis points (bps; 1 basis point = 0.01%).

- Met GPM estimate.

- GPM ex-regulatory credits was 38.9% vs. 41% Q/Q and 45.8% Y/Y.

- Beat $46 million GAAP EBIT estimates by $4 million & beat GAAP EBIT guidance by $9M.

- Slightly missed EBIT guidance.

- Missed $0.78 EPS estimates by $0.13. EPS fell 36% Y/Y.

- Beat free cash flow (FCF) estimate by 47%. Inventory is down 26% year-to-date, with liquidations helping generate more FCF.

Q4 Guidance & Valuation:

- Missed Q4 revenue estimates by 12.7%.

- Missed 49% Q4 GAAP GPM estimate by 50 bps.

- Missed $76 million Q4 GAAP EBIT estimate by $29 million or 38%.

ENPH trades for 24x forward earnings. EPS is expected to fall by 51% this year and grow by 82% next year (2-year CAGR of -10%).

Balance Sheet:

- $1.77 billion in cash & equivalents.

- $1.3 billion in debt.

- Diluted share count fell 2.8% Y/Y.

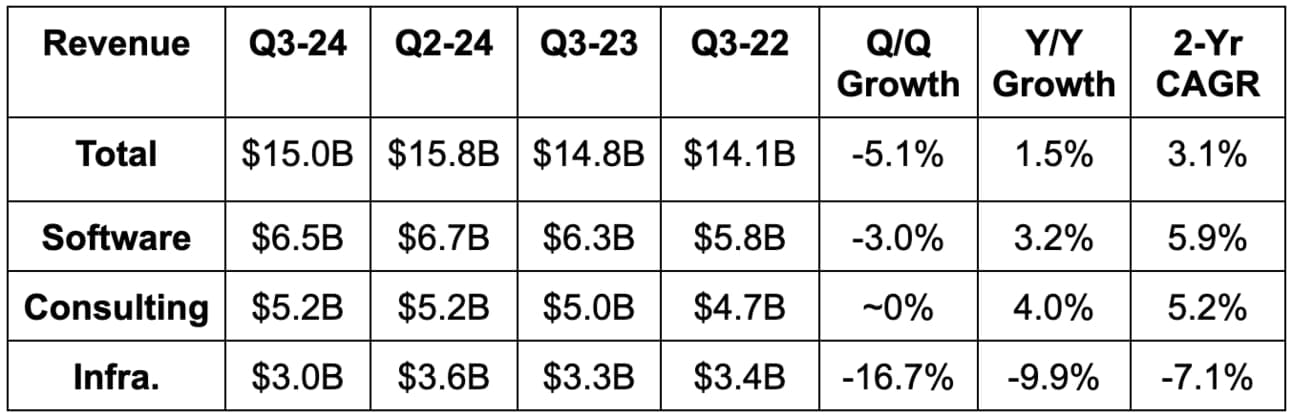

b. IBM

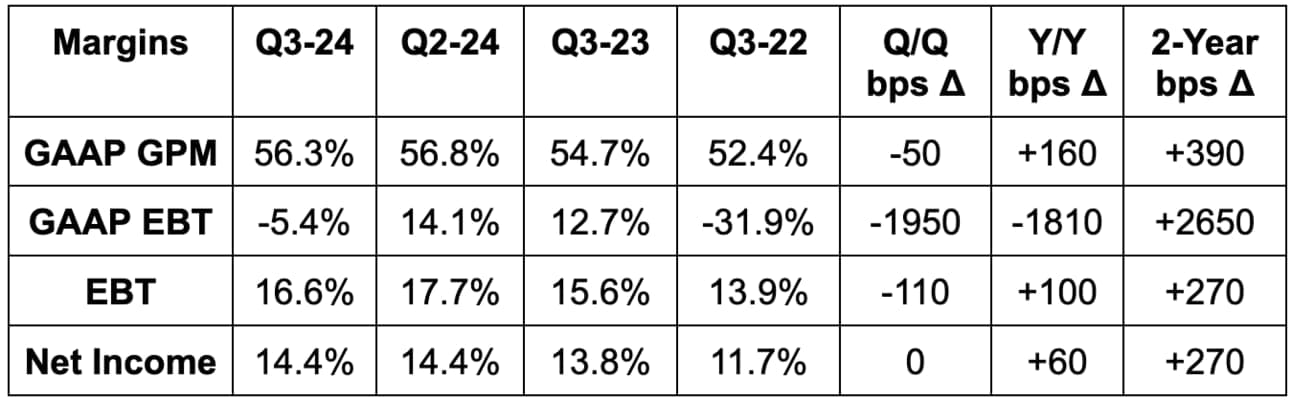

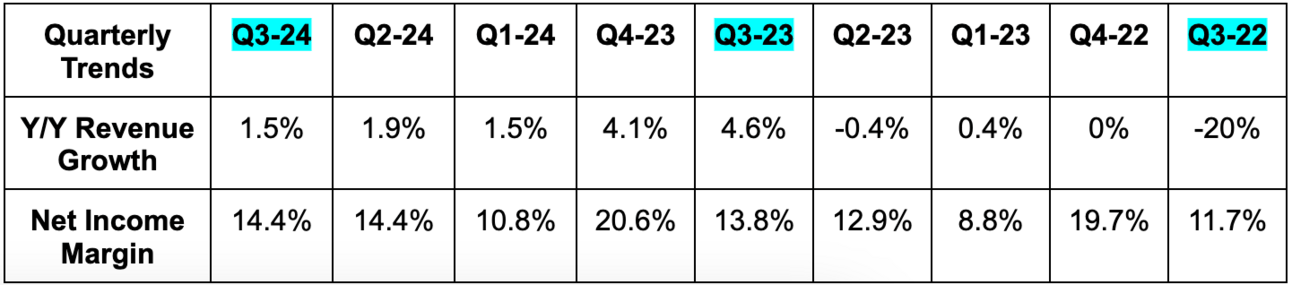

Results:

- Missed revenue estimate by 0.7%.

- Beat EBT estimate by 1%. Q3 2024 & Q3 2022 GAAP EBT margins include large pension charges.

- Beat $2.23 EPS estimate by $0.07. EPS rose 6% Y/Y.

- Met GPM estimate.

Guidance & Valuation:

IBM reiterated its annual $12 billion+ FCF guidance. This compares to $12.2 billion estimates. It also guided to stable growth rates in Q4 vs. Q3, which essentially met estimates.

IBM trades for 21x forward earnings. EPS is expected to compound at about a 5% clip over the coming years.

Balance Sheet:

- $13.7B in cash & equivalents.

- $56.6B in total debt.

- Stock comp rose 15% Y/Y. Share count was flat Y/Y.

- Dividends rose 1.7% Y/Y.

c. Lam Research

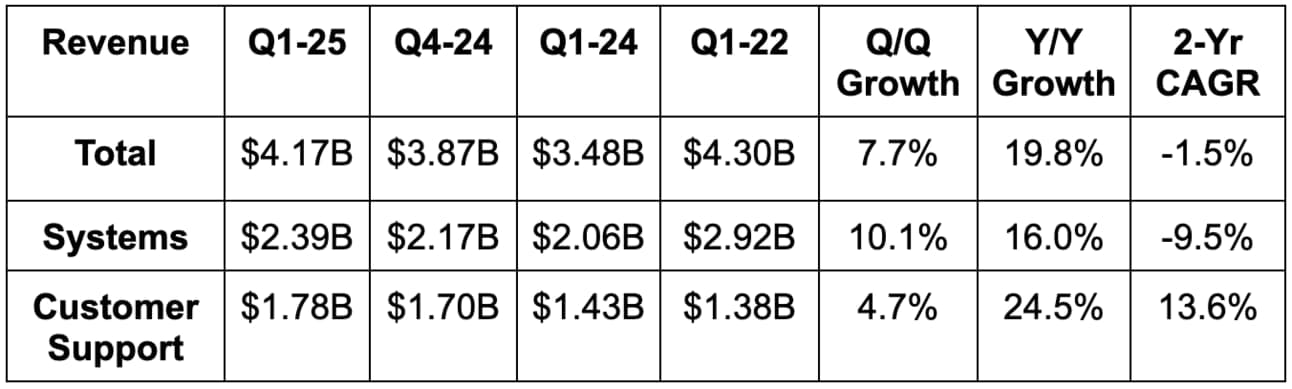

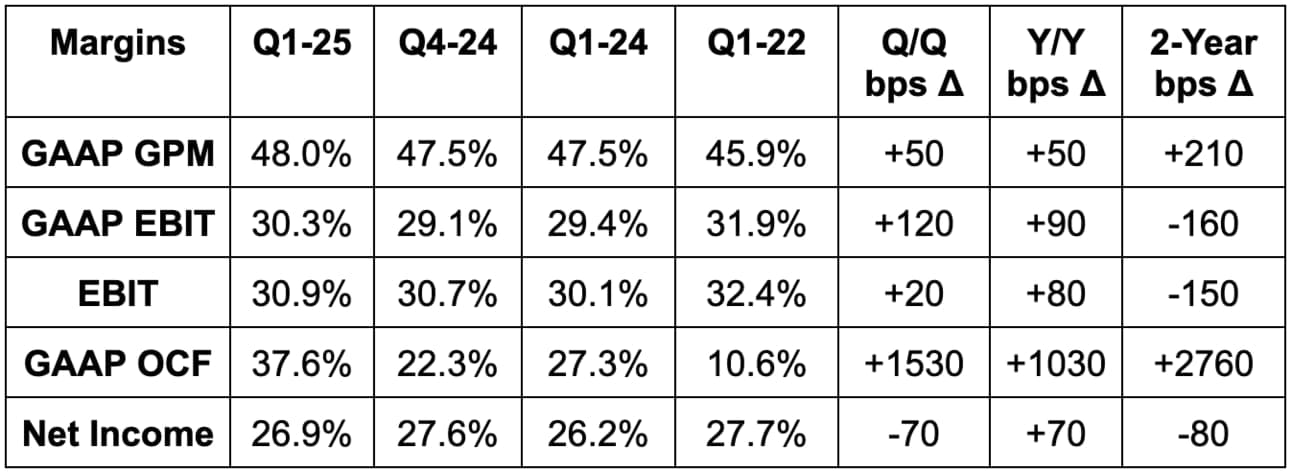

Results:

- Beat revenue estimates by 2.7% & beat guidance by 3.0%.

- Beat 46.9% GAAP GPM guidance by 110 bps.

- Beat EBIT estimate by 6.3% & beat guidance by 8.1%.

- Beat $8.00 GAAP EPS estimate by $0.56 & beat guidance by $0.59. GAAP EPS rose 22% Y/Y.

FY Q2 2025 Guidance & Valuation:

- Q4 revenue guidance beat by 1%.

- Q4 EBIT guidance beat by 1.5%.

- Q4 $8.70 EPS guidance beat by $0.30.

LRCX trades for 22x forward earnings. Earnings are expected to grow by 17% this year and by 19% next year.

Balance Sheet:

- $6.07 billion in cash & equivalents.

- $4.21 billion inventory vs. $4.75 billion Y/Y.

- About $5 billion in total debt ($504 million is current).

- Dividends rose 15% Y/Y to $2.30 per share.

- Diluted share count fell by 2% Y/Y.

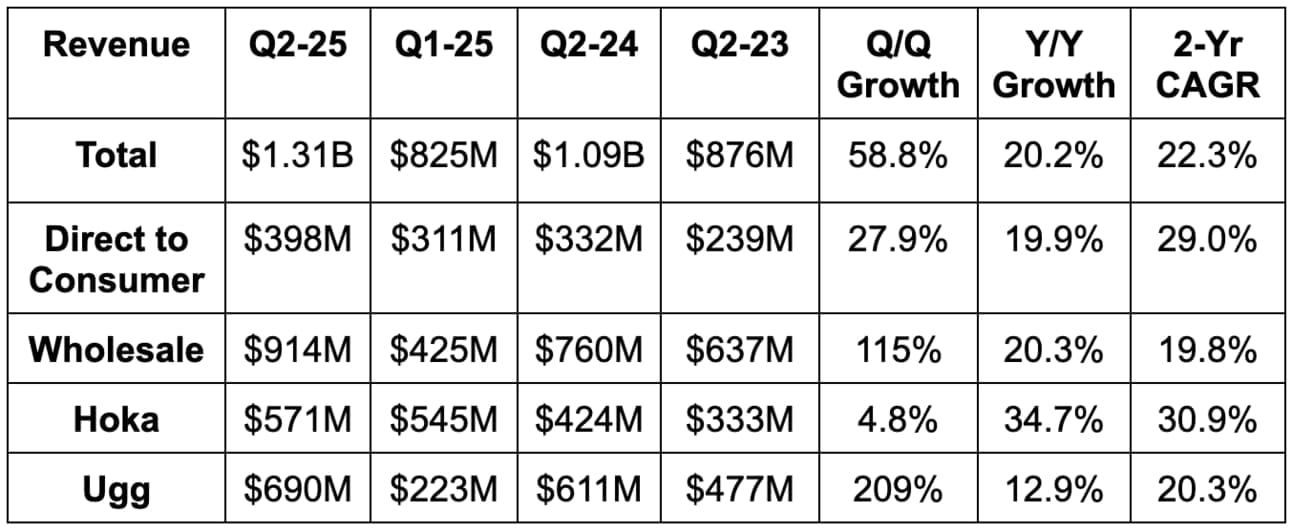

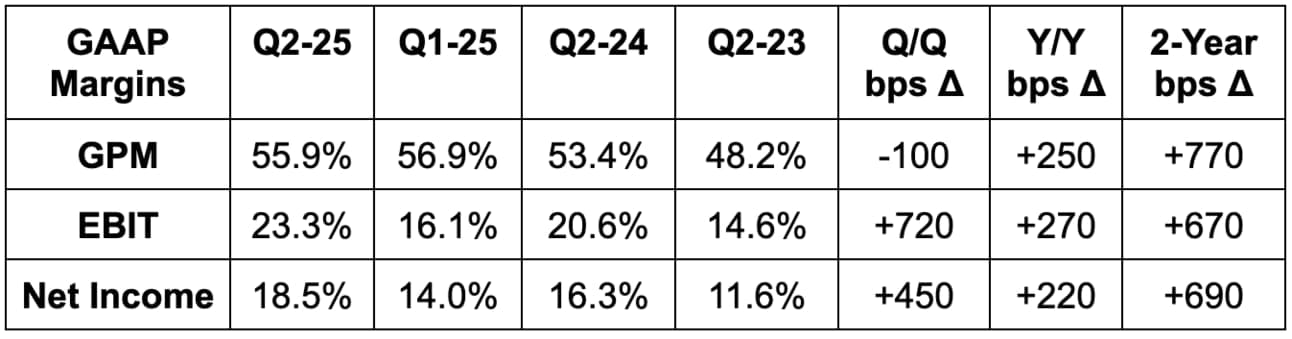

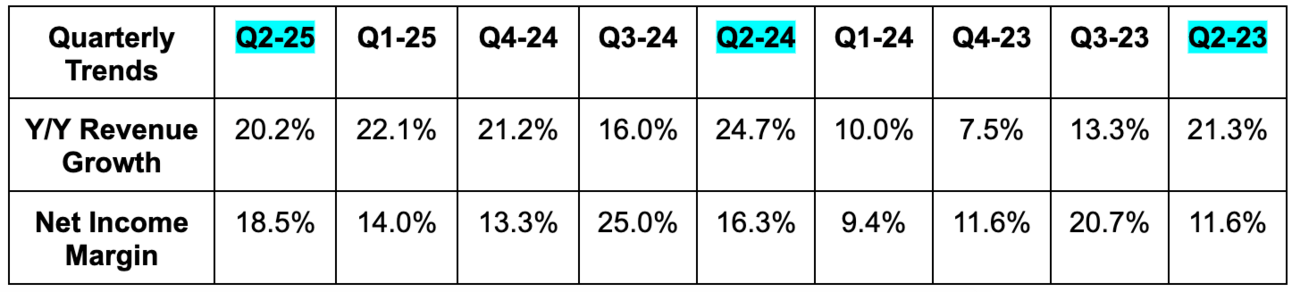

d. Deckers Outdoor (DECK)

Deckers owns Hoka, Teva, Ugg and other shoe brands.

Results:

- Beat revenue estimates by 9%. All major segments beat comfortably, including a 10% Hoka beat and a 9% Ugg beat. Wholesale beat by 11%; direct-to-consumer (DTC) beat by 5%.

- Beat 52.1% GPM estimates by 380 bps. Really good.

- Beat EBIT estimates by 33%.

- Beat $1.24 EPS estimates by $0.35 for a 29% net income beat. EPS rose 51% Y/Y.

Annual Guidance & Valuation:

- Raised annual revenue guidance by 2.1%, slightly missing estimates.

- The size of the Q2 revenue beat was slightly larger than the annual guidance raise, implying a slightly worse 2nd half forecast than last quarter. At the same time, Deckers is a king of under-promise and over-deliver.

- Raised annual GAAP GPM guidance from 54.0% to 55.3%, which beat 54.5% estimates.

- Raised $926 million GAAP EBIT guidance by 5.3%, which missed by 1.6%.

- Raised $5.00 GAAP EPS guidance by $0.20 to $5.20, which missed by $0.14.