Housekeeping:

Hi friends! I had a bit of a personal health issue today that required an impromptu visit to two eye doctors. I’m fine, but my pupils were dilated a few different times amid all of the testing. My vision is still a bit blurry, but I’m pretty confident I was able to edit this effectively. If there’s an extra typo in here, I apologize. The Chipotle review will be out tomorrow before the market close. The Alphabet review will be out Friday morning. I have a follow-up appointment late tomorrow afternoon that I can’t re-schedule and my vision will be messed up for most of the night. This won’t be a f recurring issue and I apologize. I’m frustrated by this but I have to take care of myself.

In case you missed it:

- Netflix and Taiwan Semi Earnings Reviews

- Tesla Earnings Review

- Earnings Season Preview.

- Updated Portfolio & Performance vs. the S&P 500 with a New Holding.

Table of Contents

- a. ServiceNow 101

- b. Key Points

- c. Demand

- d. Profits & Margins

- e. Balance Sheet

- f. Guidance & Valuation

- g. Call & Release

- h. Take

a. ServiceNow 101

ServiceNow is one of the largest enterprise software firms in the world. It automates workflows, tech stacks and projects to augment customer efficiency. For this reason, it calls itself the “leading digital workflow company.” Workflow automation buckets include: service management, operations, asset management, security, customer management, employee management and creator management. These are further grouped into workflow buckets like “Customer & Employee Workflows,” “Creative Workflows” and “Technology Workflows.” Two products to know within the Tech Workflow category include Information Technology Operations Management (ITOM) and Information Technology Service Management (ITSM). The names of these products tell you exactly which types of workflows they’re meant to automate.

All products and services are neatly tied into its “Now Platform.” The firm describes this overarching ecosystem layer as a way to “optimize processes, connect silos and accelerate innovation on a single unifying platform.” That’s a fancy way of saying that it makes every piece of work more seamless and expedient.

ServiceNow has been hard at work on GenAI innovation to bolster automation capabilities. Its Now Platform “Vancouver” release got the ball rolling by consolidating all GenAI model and app projects into an intuitive set of products. It recently built on that debut with Now Platform “Washington D.C.” and “Xanadu” releases. These are both essentially a large batch of GenAI-inspired upgrades to the Now platform. They add to the progress of the Vancouver release. Washington D.C. more seamlessly ties together NOW’s product categories to drive better interdepartmental work and communication. It makes using all of its tools and capabilities across teams more intuitive and obvious. Xanadu focused on completing the Microsoft Copilot integration and infusing Agentic AI (goal-oriented AI that you simply tell what to do) into the Now platform. More specifically, the release focused on two product categories. First, its security and threat management products. Xanadu uses models that are trained on a company’s own data, which has been shown to accelerate incident response. Automated threat triaging helps too. Second, Xanadu adds new capabilities within financial and supply chain workflows – starting in sourcing and procurement.

ServiceNow also offers the “workflow studio” as a way to create intricate workflows via a wonderfully easy, no-code or low-code drag-and-drop process. It’s a unified workspace to tap into all of the automation and workflow performance analytics tools ServiceNow provides, without needing to be a talented developer to work with them. Various teams can easily access the studio to enable seamless collaboration and better work.

These platforms establish the foundation for its own GenAI apps used internally and sold to customers. A big example is “Now Assist AI.” This is ServiceNow’s GenAI assistant/companion app infused across most of its products. More GenAI product examples include:

- The AI Lighthouse Program: This aims to expedite GenAI adoption through Nvidia and Accenture partnerships. NOW brings the apps; NVDA brings the hardware; Accenture brings the professional services.

- The RaptorDB Lighthouse Program: Its newest database that’s built to support the speed and needed scalability of GenAI use cases. It offers an extensive list of 1st and 3rd party data sources to utilize, with easy conversational querying to up-level data scientist productivity.

- StarCoder 2: This provides access to large language models (LLMs) to automate code creation. Bring Your Own (BYO) GenAI model support allows for ultimate developer flexibility as they pick and choose which models serve them the best.

- The NOW App Engine: ServiceNow’s platform for building apps. Creator Studio was just added to the NOW App engine to push its “low-code app leadership” to fully no-code building.

- Now Assist Skill Kit: Helps developers deploy new GenAI prompts and workflows. ServiceNow has templates for pretty much all common needs, but it cannot possibly build models for every niche workflow. That’s where this comes into play.

“Plus SKUs” are how ServiceNow bundles all of its GenAI work into subscription packages. It up-charges clients for access to these SKUs, as its approach to GenAI monetization has been more aggressive than most. These Plus SKUs do things like automate customer service, expedite issue resolution and provide more conversational fetching/querying of a firm’s data.

b. Key Points

- Great quarter and guidance amid the uncertainty.

- Fantastic AI momentum and financial impact.

- Public sector momentum remains strong.

c. Demand

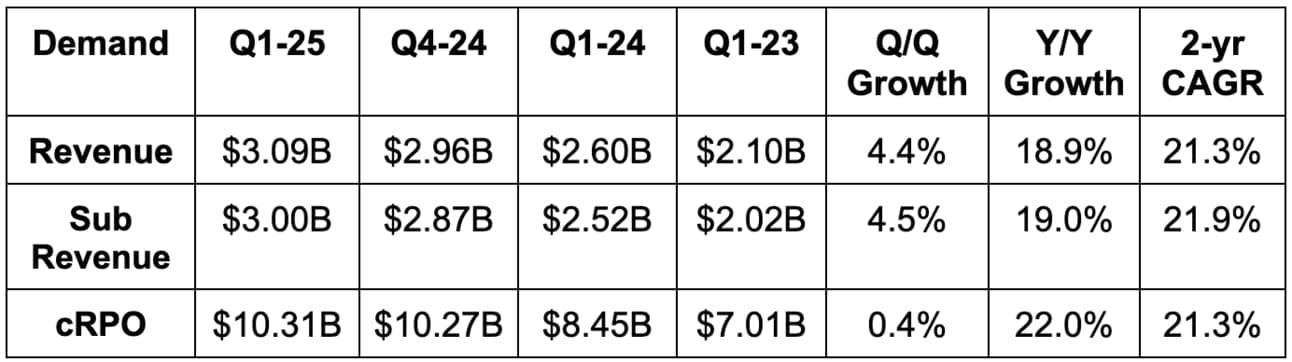

- Beat $3B subscription revenue estimates by 1% & beat guidance by 1.1%.

- Foreign exchange neutral (FXN) subscription revenue growth was 20% Y/Y.

- Slightly beat revenue estimates by 0.2%.

- Outperformance was despite some revenue slipping into Q2 via deal timing.

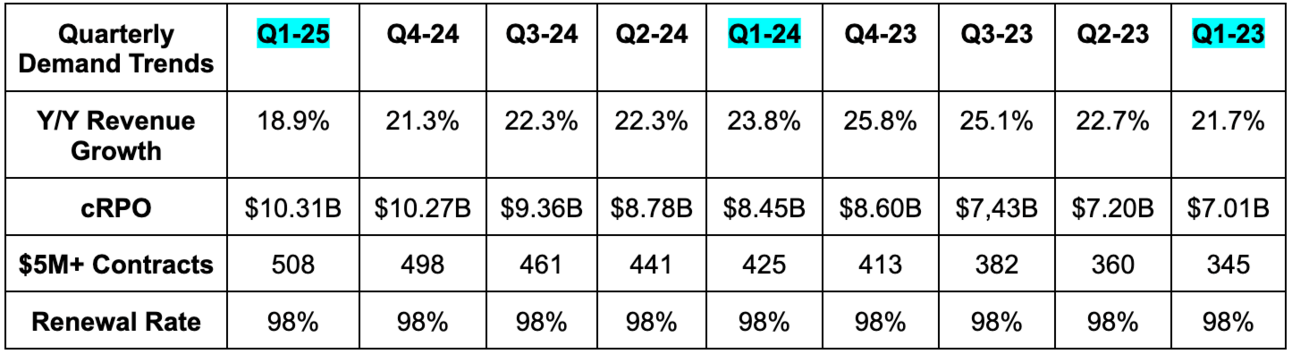

- The 21.3% 2-year revenue compounded annual growth rate (CAGR) compares to 23.5% last quarter and 23.6% two quarters ago.

- Beat current remaining performance obligation (cRPO) estimates by 2.1%. Beat 20.5% cRPO FXN growth guidance with 22.0% Y/Y growth.

- ServiceNow’s renewal rate remained at a sky-high 98%.

Revenue growth from the manufacturing sector and the U.S. public sector were the two quarterly standouts. Manufacturing doubled Y/Y while the public sector rose 30% Y/Y to comfortably surpass expectations. Much more on this later. Finally, there were no changes in demand patterns or behavior from tariffs. Meaning? There were no pull-forwards to help this quarter’s revenue in a one-off manner (a good thing).