Most of this week’s content has already been sent. Those sends included:

- Amazon, Apple & Uber Earnings Reviews + an Intel Coverage.

- My Updated Portfolio & Performance.

- Meta & Microsoft Earnings Reviews + a Coinbase Coverage.

- AMD & Alphabet Earnings Reviews + Visa & TransMedics Coverage.

- SoFi & PayPay Earnings Reviews.

- Long week. Fun week. Let’s do it again starting Monday.

Table of Contents

- 1. Robinhood (HOOD) – Earnings Review

- 2. SuperMicro (SMCI) – Yikes

- 3. Meta (META) – Follow-Up Analyst Q&A

- 4. Celsius (CELH) – M&A

- 5. Lemonade (LMND) – Earnings Review

- 6. Starbucks (SBUX) – Earnings Review

- 7. Lululemon (LULU) – Data & a Partnership

- 8. Mastercard (MA) – Earnings Snapshot & Consumer …

- 9. Market Headlines

- 10. Macro

1. Robinhood (HOOD) – Earnings Review

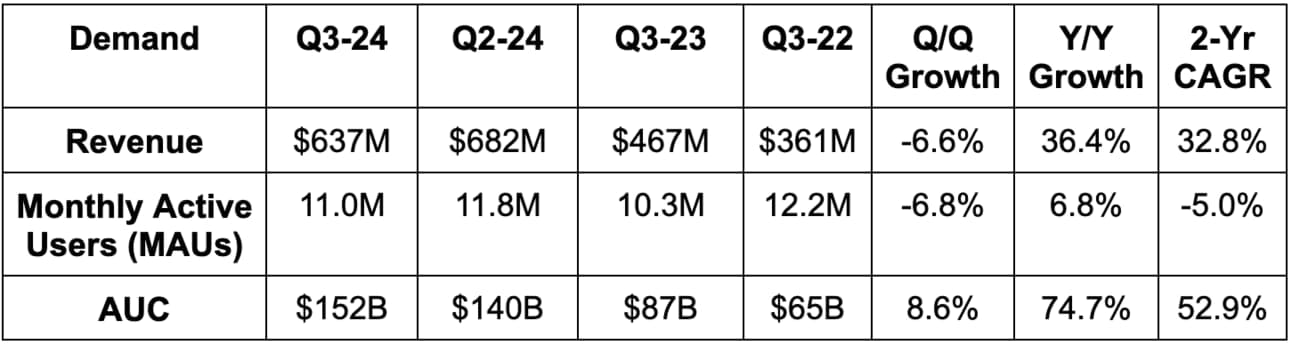

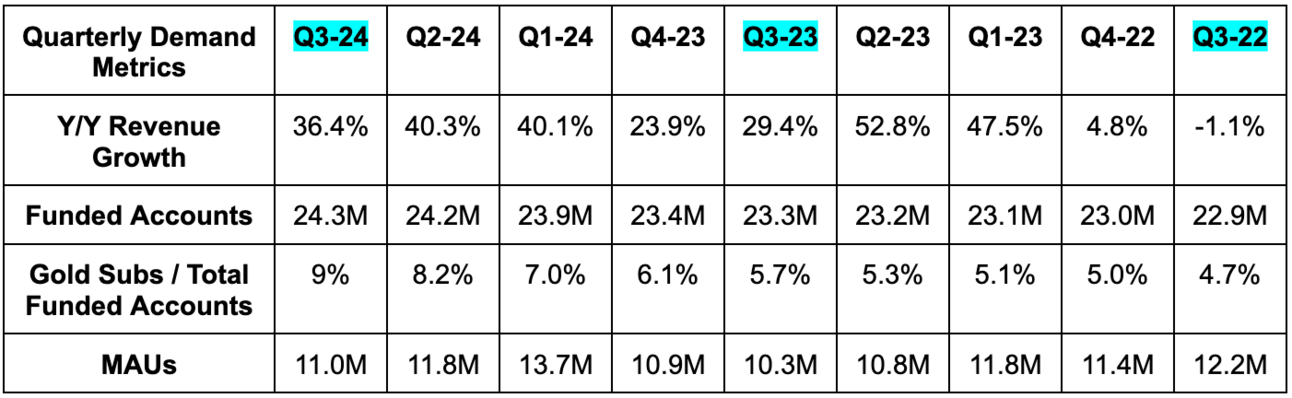

a. Demand

- Missed revenue estimate by 3.5%. All revenue buckets besides “other” missed.

- Transaction revenue rose 72% Y/Y.

- Net interest revenue rose 9% Y/Y.

- Average revenue per user rose 31% Y/Y.

- Met net funded accounts estimate; slightly beat assets under custody (AUC) estimates.

- It’s worth noting that while equity, options and crypto revenue were all weak, it did take material Y/Y market share in all 3 categories.

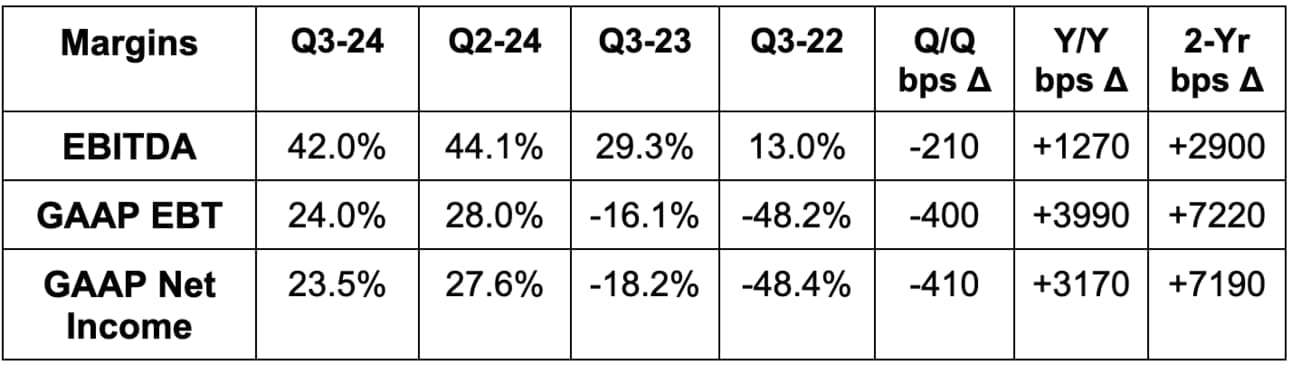

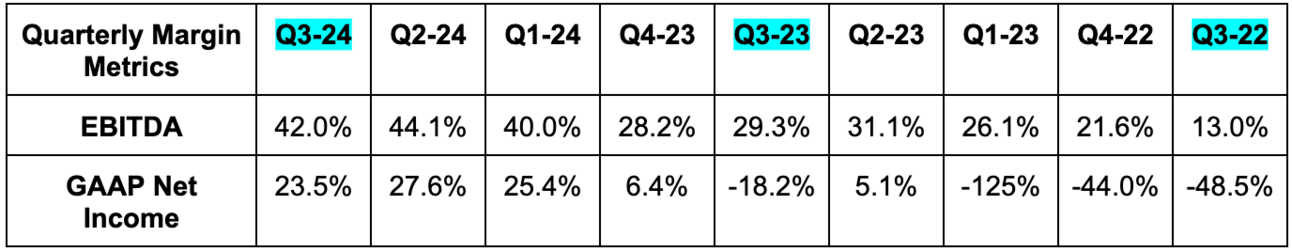

b. Profits & Margins

- Missed EBITDA estimates by 3.1%. Non-GAAP OpEx rose 12% Y/Y due to more growth spend.

- Slightly missed $0.18 GAAP EPS estimate by $0.01. GAAP OpEx fell 10% Y/Y due somewhat to lower stock comp, but mainly due to a $94 million gain from lower Y/Y regulatory accruals.

c. Balance Sheet

- $4.6 billion in cash & equivalents.

- No debt.

- Diluted share count rose 1% Y/Y.

- Basic share count fell 1.2% Y/Y.

- $39B in trailing 12-month net deposits vs. $33B Q/Q & $24B 2 quarters ago.

d. Guidance & Valuation

$1.85-$1.95 billion in annual OpEx was technically reiterated, but it said that it would likely end up near the high end of this range. That’s all we get for guidance. Its business is too reliant on trading volumes to expect it to be able to effectively guide for revenue. It would be a crapshoot. Smart from them.

EPS is expected to double this year and fall by 3% next year.

e. Call & Release

Robinhood Legend:

As announced at the launch event, Robinhood debuted Robinhood Legend as its new desktop mode during the quarter. This is to drive greater product parity with other trading-oriented interfaces and win over more active traders outside of the mobile market. Whether it’s index options, futures or realized profit/loss tools coming soon, Legend is a large step up in the power of its desktop offering.

“Yes. I would say that the folks that use the Robinhood Legend product tend to be among our most active. So the velocity is quite high.”

CEO Vlad Tenev

Robinhood Gold:

Robinhood Gold growth remains solid. Through lower contract fees, IRA matches, free margin up to $1,000, 3% cashback for its nearly 100,000 Gold credit card holders, this is doing well. Notably, revenue for the quarter was reduced by $27 million from paid account funding matches from Robinhood to win over new users. This more than doubled Q/Q to 4% of total revenue. The 3% cashback perks and large bonuses for switching are wonderful for competing in a commoditized sector. But? It’s also very expensive when Robinhood is paying $200,000 for certain large accounts to switch over. So far, leadership thinks payback periods are compelling; it’s confident in making up the difference via a 7x lift to AUC and a 2x lift to deposits that Gold members provide vs. non-members. It needs to be right.

“We expect contra revenues to grow sequentially by a similar amount in Q4 and then grow much slower in 2025.”

CFO Jason Warnick

Back to the Robinhood Gold credit card for a moment. App store ratings are sky-high so far and customer spending behavior and measured deposit uptick are both in line with expectations. This is immensely important, as this is what Robinhood is relying on to pay for the 3% cash back reward and inevitable charge-offs. Finally, most users have it “at the top of the wallet. Robinhood is going very slowly with the rollout despite increasing confidence in the product, which is the correct decision. Losses can pile up rapidly if underwriting algorithms are rushed. The waitlist to get a card reached 2 million users this quarter.

“If someone has the gold card, they love it. If they don't have it, they want to know when they're going to get it. And I hear you. We're working hard to increase the rollout, but we're also being patient and carefully studying customer behavior as we grow so that we manage credit risk to profitably scale over time.” – CEO Vlad Tenev

More on Promotional Activity:

- Will wind down the 1% gold deposit boost due to lower interest than other promotions.

- Its Hood Week asset transfer match, conversely, drove $2 billion in assets in 2 weeks.

More Growth Metrics:

Robinhood retirement accounts reached $9.9 billion in total AUC during the quarter. Quarter-to-date, it has already added another $1.1 billion to reach $11.0 billion. Good momentum. It crossed $200 million in transfer bonuses paid out to new accounts during the quarter. Again… really good for winning consumers and really expensive.

For overall deposits, growth remained strong at $10 billion, which represents 29% Y/Y growth. This was the first Q/Q decline in net deposit adds in a year, but the result is still undeniably solid. New cohorts are depositing 3x the amounts that cohorts 2 years ago did.

- Its margin book rose 53% Y/Y in size.

- Equity revenue rose 37% Y/Y to $37 million; crypto revenue rose 165% Y/Y to $61 million; options revenue rose 63% Y/Y to $202 million.

New Products:

- Robinhood launched the Presidential Election betting market very recently. This traded over 10 million contracts on the first day and is nearing 20 million contracts daily now.

- Enhanced its UK offering with stock lending, margin investing and approval for options trading as of last month.

- Bought Pluto to deepen its equity research offering with this AI firm.

- Debuted joint investment accounts.

- Introduced crypto transfers across Europe.

Q4 so Far:

“Net deposits are north of $4 billion and cash sweep balances are more than $25 billion so far through October. As for trading, equity notional volumes had their highest month in over 3 years. Option contracts look to be having one of the highest months ever and crypto notional volumes are over $5 billion, which is on track to exceed the Q3 monthly average.”

CFO Jason Warick

f. Take

I’ll split this into my views of the quarter and then the business overall. The quarter really wasn’t bad. The ugly stock reaction comes after explosive year-to-date gains that likely just needed to be digested. Very small misses vs. consensus were an easy excuse to justify that. Margins continue to head in the right direction, growth remains rock-solid, its balance sheet remains a large strength and it continues to attract more users at higher lifetime value. As a non-shareholder, I’m also excited to see what kind of impact Robinhood Legend can have on its retail desktop marketshare. It has been the largest share-taker in mobile for years… so why not desktop too? We shall see.

Now for the investment case and company. I hesitate to assume that this brokerage business can morph its suite into the kind of offering that can overcome inherent industry cyclicality. There’s a reason why sell-siders expect EPS to fall Y/Y next year — its results are mightily tied to asset volatility and trading volumes. I’m also skeptical that its large deposit and asset transfer bonuses can be a sustainable way to profitably grow users while expanding margins. It has done admirably in proving me wrong thus far, and I truly hope that continues for the bulls here. Finally, I was also worried about the credit card’s 3% cash back and potential for mounting losses considering HOOD’s lack of underwriting experience here. I am very glad to see the leadership team going so slowly with the rollout. Great decision.

All of this is to say that this is not my favorite investment. My thumb is pointed firmly sideways. I applaud the team and company for doing as well as they have over the last several quarters, but question whether this momentum can prove to be structural, rather than temporary. Hopefully, in a few years time, optimists will be able to come back to me and say “I told you so.”

2. SuperMicro (SMCI) – Yikes

In a letter sent to SMCI this past week, its auditor, Ernst & Young (EY), had some pretty damning things to say. EY wrote that they’re “no longer able to rely on management or the audit committee’s representations” and they’re “unwilling to be associated with the financial statements.” Hard to get much worse than that. While the valuation is dirt cheap, its liquid cooling niche is interesting and growth is rapid, I personally wouldn’t touch this with a 10 foot pole. The same team that ran into accounting and revenue recognition drama years ago is still there and now pulling the exact same stunts today. As public market investors, we rely on the honesty and reliability of a management team’s disclosures to gauge an investment’s appeal. If they can’t be trusted, which in my view is the case here, nothing else matters. I think getting delisted is more likely than recovering for the company.

3. Meta (META) – Follow-Up Analyst Q&A

CFO Susan Li hosted a Meta earnings follow up call for sell-siders as she always does. Here were the highlights.

Meta AI and Business AI use Cases:

In addition to being happy with overall Meta AI adoption, Li added that the product is especially popular in India thus far. On the earnings call, Meta talked about building consumer scale before monetizing its Meta AI work with AI agents like lead generators, custom service automations etc. As I spoke about in the review, this opportunity may not be very far off. It integrated Meta AI into click-to-message ads on WhatApp. The focus early on is in Asia, where it’s currently in experiment-and-learn mode.

Near-Term GenAI Impact:

My earnings review focused a lot on GenAI’s impact on engagement and monetization. We got some more examples during this call.

During the quarter, it consolidated recommendation algorithms on Instagram to narrow its focus and “drive higher engineering efficiency.” The model work that Meta has done on Reels and the switch from general compute CPUs to high performance GPUs to run that content matching have yielded large engagement gains for the company. It’s now evaluating every other part of its apps business to see where these same changes can be implemented. There’s a long way to go in terms of optimizing engagement and monetization through constant, GenAI-inspired improvements.

More Notes:

Meta is the only mega-cap tech name that uses a 5-year depreciation schedule for its short-lived servers. All others use 6 years, which means they incur lower apples-to-apples depreciation expenses than Meta does. Switching to 6 years for Amazon, Microsoft, Alphabet and others was a large source of short-term profit outperformance and this is a future profit lever that Meta can pull whenever it feels it needs to. There are no plans to do so, but Li hinted at being open to this idea.

Meta is seeing strong adoption for its Advantage + campaign building automation suite across shopping campaigns, app campaigns and soon-to-be lead generation campaigns.

4. Celsius (CELH) – M&A

Celsius bought Big Beverages Contract Manufacturing for $75 million in cash on hand. With the purchase, Celsius gets a 170,000 foot manufacturing facility and broader control of its supply chain and manufacturing. It will also give the beverage company more opportunity to innovate and run limited time offer products.

Big Beverages Contract Manufacturing has been a long time co-packing partner for Celsius so the integration should be seamless; the facility will just keep making the same thing. The vertical integration is expected to drive input cost savings and operating leverage over time. It also provides easy capacity expansion opportunities as Celsius continues to grow.

This makes sense to me. Celsius is working hard to preserve margins amid the weak backdrop of declining convenience store traffic and negative overall sector growth. Owning a larger piece of its supply chain, without diluting shareholders or raising debt, is a great way to do so. Importantly, this does not resolve any piece of the Pepsi inventory right-sizing headwind for Celsius. This simply means the product that Celsius is delivering to its main North American distribution partner will be made internally more frequently.