Table of Contents

- 1. Uber (UBER) – Earnings Review

- 2. Intel (INTC) — Earnings Snapshot

- 3. Amazon (AMZN) — Earnings Review

- 4. Apple (AAPL) – Earnings Review

1. Uber (UBER) – Earnings Review

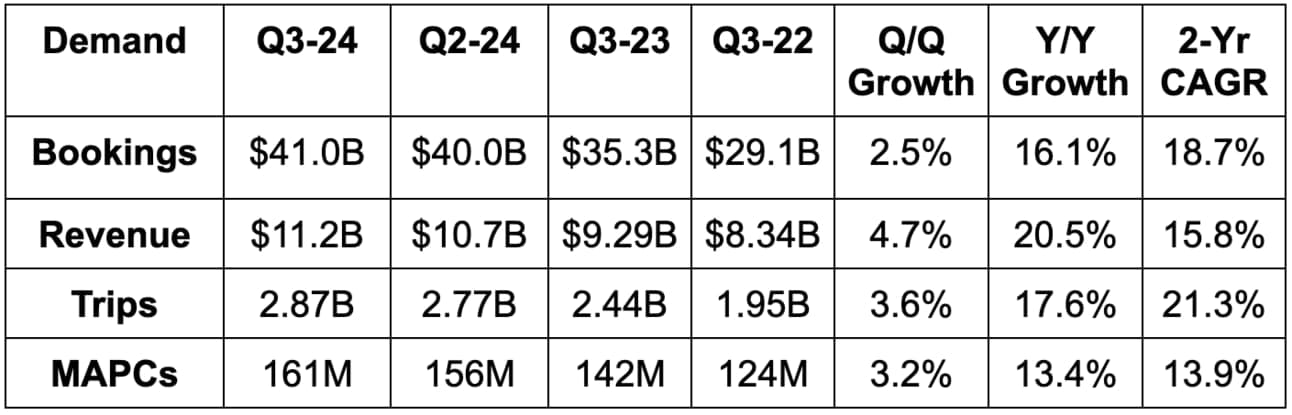

a. Demand

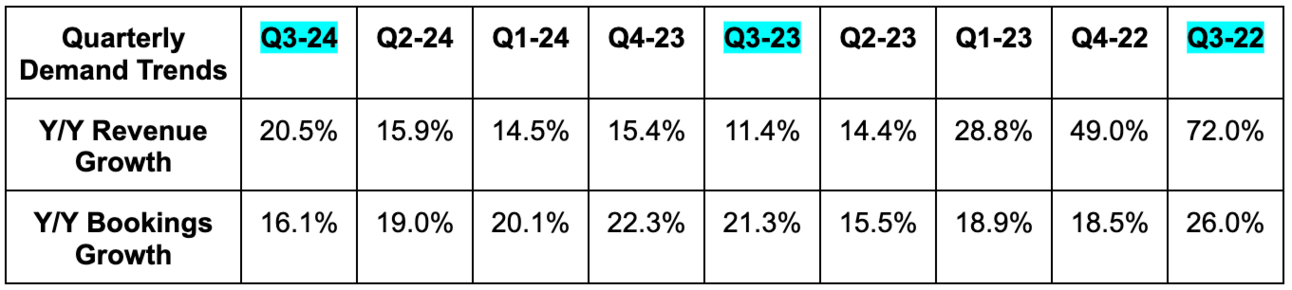

- Missed bookings estimates by 0.5% & met guidance. Foreign exchange (FX) headwinds were as expected.

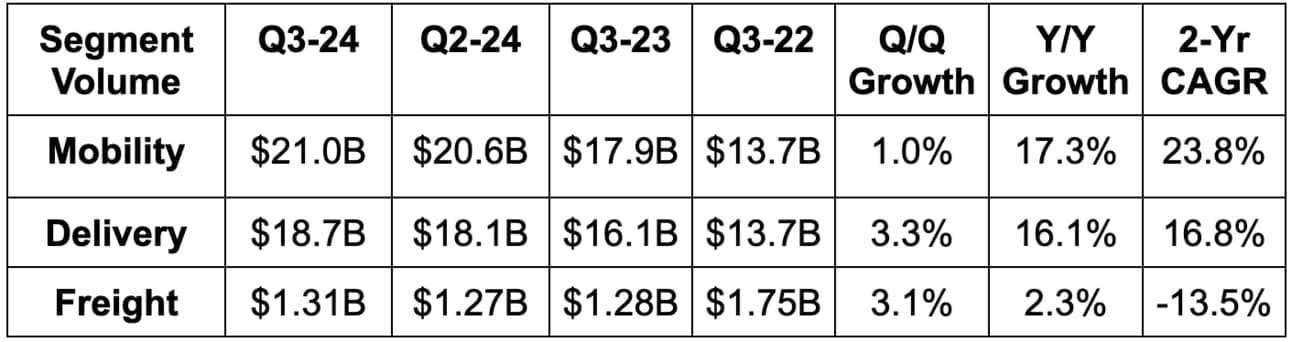

- Mobility bookings missed by 1.9%; Delivery bookings slightly beat; Freight bookings beat by 0.8%.

- Beat revenue estimates by 2.0%. All three segments beat by a similar amount.

- FX neutral (FXN) revenue growth was 22% Y/Y.

- Beat monthly active platform consumer (MAPC) estimates by 1 million.

- 5.9 trips per MAPC vs. 5.9 Q/Q and 5.7 Y/Y.

Revenue growth did outpace bookings growth. This is not a matter of Uber squeezing drivers, as driver earnings also rose faster than bookings growth. Instead, this is related to lower rider incentives and more advertising revenue.

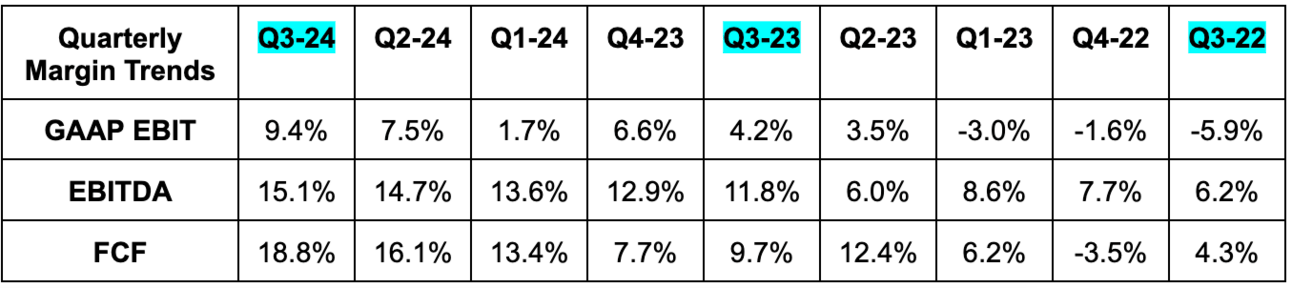

b. Profits & Margins

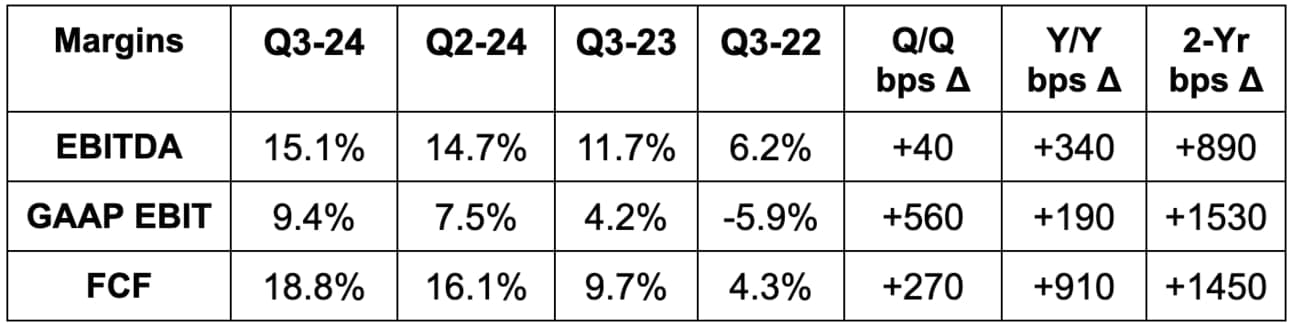

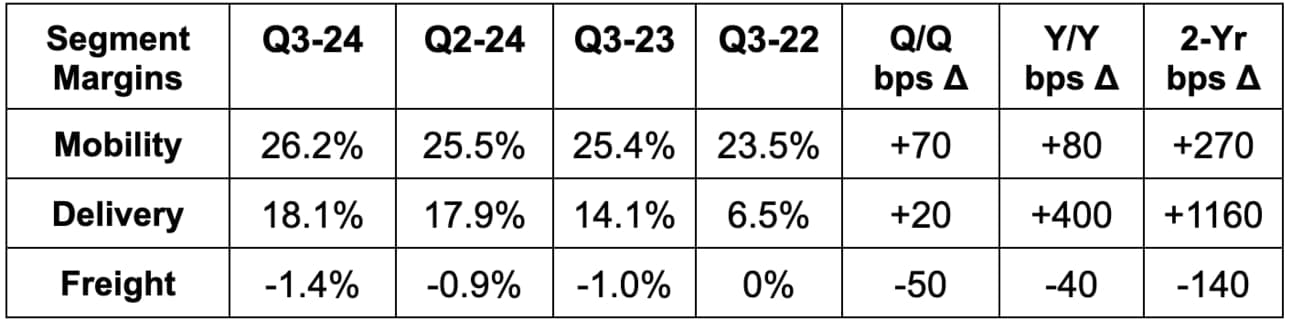

- Beat EBITDA estimates by 3.0% & beat guidance by 3.7%. Mobility & delivery beat. Freight missed.

- Beat GAAP EBIT estimates by 6.0%.

- Large GAAP EPS beat driven by a $900 million boost in equity investment valuation.

- Beat FCF estimates by about 50%. This is lumpy on a quarterly basis. The GAAP EBIT & EBITDA beats are what to focus on. Without this help, it still earned $0.78 per share in GAAP EPS, which beat by $0.30.

c. Balance Sheet

- $9.1B in cash & equivalents. $2 billion will be used this quarter to pay down debt.

- $7.9B in unrestricted equity investments vs. $6B Y/Y. $6.5 billion in restricted equity investments.

- $11B in total debt.

- Diluted share count rose by 2% Y/Y (sorry that said 6% in the Max one-pager; bad typo; apologies). It plans to begin growing buybacks to the point of reducing overall share count starting next year. Cash cow.

d. Q4 Guidance & Valuation

- Bookings guidance slightly missed estimates by 0.3%.

- EBITDA guidance slightly missed estimates by 0.6%.

- It sees stable Y/Y trip growth, meaning roughly 17.6% in Q4.

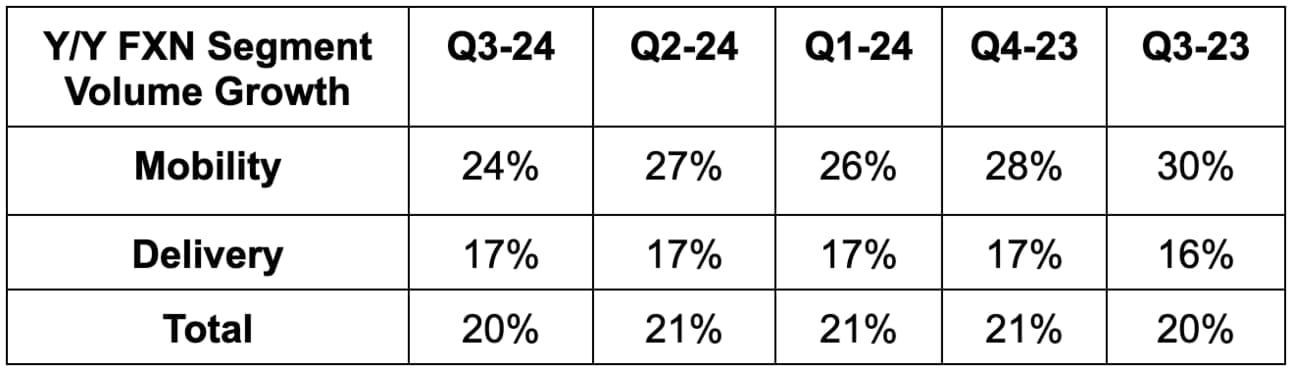

- On track to deliver 20%+ Y/Y FXN bookings growth.

“Our performance thus far should give investors confidence in our ability to deliver on our 2026 commitments.”

CFO Prashanth Mahendra-Rajah

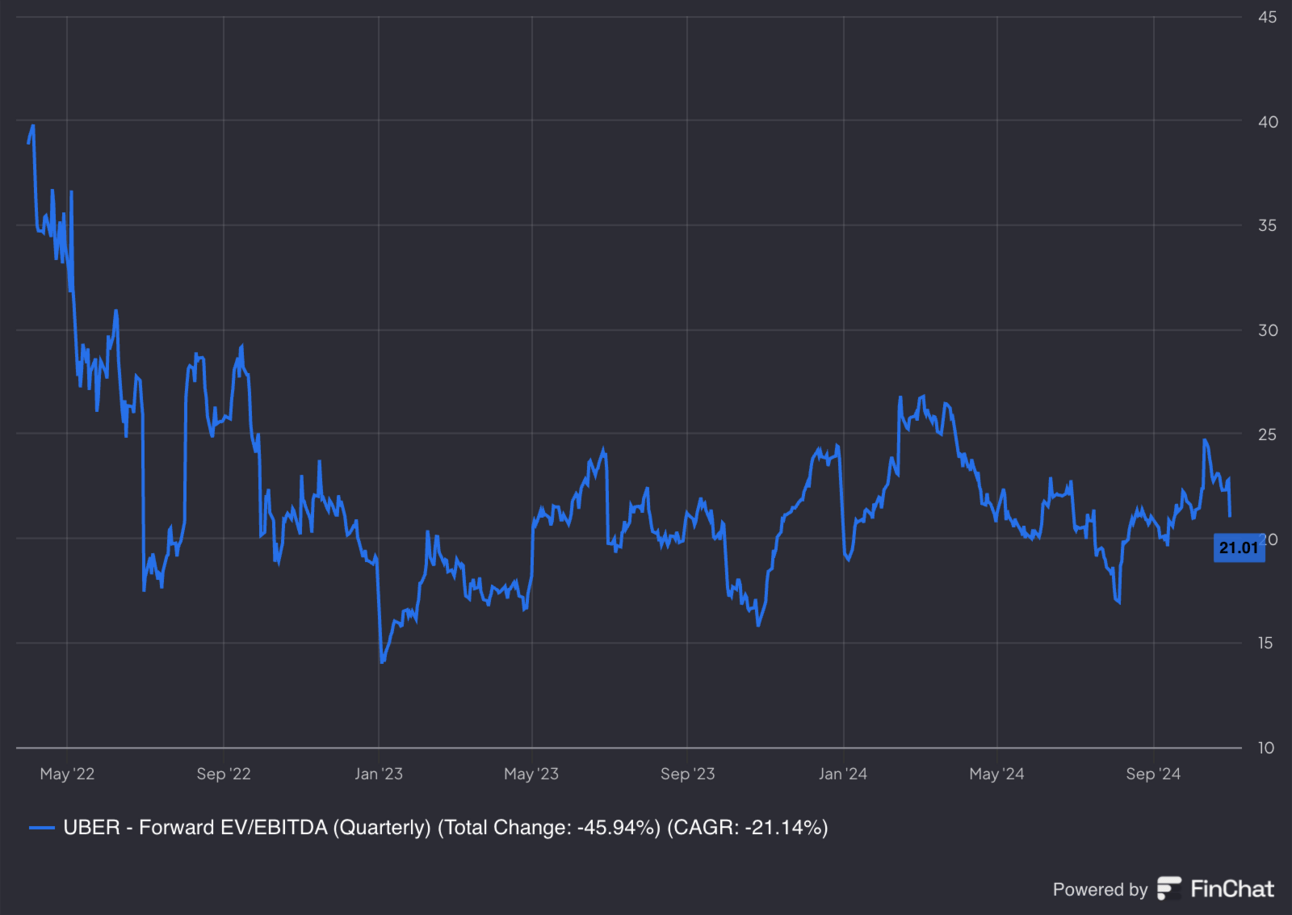

Uber trades for 23x forward earnings. EPS is expected to compound at a 35% clip over the next two years.

e. Call & Release

Sharpening Core Business Edges:

The core Uber business remains healthy. Drivers and couriers rose to 7.8 million, as it accelerated Q/Q adds. Uber’s growing supply lead means lower wait times, lower surcharges and better customer service. Riders follow supply. Strong MAPC growth was also nicely complemented by continued 4% Y/Y growth in trip frequency. All of this enables continued 20% Y/Y FXN bookings growth at massive scale. Secular tailwinds, including a shift to services and rising “consumer preference for on-demand convenience,” are firmly intact; Uber is taking advantage better than anyone else. As an important aside, its merchant supply growth on the delivery side works wonders in bolstering selection and raising conversion rates for the company and its restaurant partners. Supply matters so much.

It’s taking sharpening edges in other ways too. The Uber One subscription is now up to 25 million members, representing 70% Y/Y growth. For some context of how impressive that is, consider another wildly popular consumer brand in Robinhood. Robinhood’s Gold subscription (not the same product but a similar idea) saw 65% Y/Y growth at less than 10% of the scale this quarter. Uber One is a budding monster, with traction directly enabling the company to flex its value proposition by affordably offering deeper deals. How? These members consume more products (hence the retention benefit) and spend 3X more per month than non-members. All of this creates the most efficient base of revenue in the ride-sharing and delivery spaces, which allows Uber to invest more in growth, product perfection, discounts and awareness. Uber One now accounts for 35% of total core business bookings. Higher revenue visibility and quality… with lower churn… and lower marketing intensity.

This means best-in-class margins, liquidity and now cost of capital to offer yet another unique advantage vs. Lyft and others. This quarter, Uber achieved investment grade credit ratings from S&P, Moody’s and Fitch. It then issued $4 billion in new credit to replace older borrowings and reduce its cost of debt by 125 basis points. It thinks there’s more to do here to ensure its access to liquidity is cheaper than for competition.

Finally, Uber’s cross-selling engine is unmatched, meaning a superior lifetime value to customer acquisition cost (LTV to CAC) dynamic vs. others like Lyft and DoorDash. It offers a true platform for moving people and goods with far more options to cross-sell. Similarly to Uber One boosting retention, multi-product adoption generally speaking also improves revenue quality.

Non-Core Business:

The cross-selling advantage will merely grow as Uber successfully debuts more products. Its existing brand awareness and consumer traffic give it a better chance of finding traction than anyone else in the space, and that’s apparent in its results. The firm’s new bets portfolio is now up to a $20 billion volume run rate (not so new anymore). Impressively, the bucket continues to overindex in terms of new customer contribution, as 25% of first time trips during the quarter were from these offerings. New bets are also fostering incremental growth and are not overly cannibalistic to existing use cases. Great to hear.

Aside from new products, more complete geographic coverage is a key focus area. 45% of the USA still doesn’t have access to reliable Uber service. This includes my densely populated Detroit suburb, where I can’t get a ride in less than 20 minutes. Its leading scale gives it a great chance to rationally pursue this demand, while higher willingness to spend and wait from these suburban consumers helps too. To capitalize on these observed preferences, Uber is debuting its Reserve and UberX priority products.

As Dara put it in the Q&A, rapid growth in the suburbs has almost been “accidental” and he sometimes “kicks himself” for not seeing this opportunity sooner. They’re now leaning in.

- As a reminder, Uber has an Instacart partnership where it runs their delivery. Instacart is a lot more popular in the suburbs. Uber will grow through that partnership and on its own too.

The pristine health of Uber’s core business gives it the clear right to go pursue these newer opportunities and its early traction is promising.

Segment Details:

For mobility, the UK, Germany and Argentina yielded the strongest growth. This was augmented by the addition of commercial fleet partnerships like Black Cabs in London and a new relationship in Denmark to re-open that market to the company. It has added 3 new markets in the last year through these types of arrangements. Some municipalities are more dedicated to protecting cab drivers and Uber can easily help them do that while adding supply in large chunks. Win-win.

The teen account launch is also going well and is “highly incremental” to the overall business. Trips rose 40% Q/Q (small base) here. Uber added new parental controls like guardian booking to give parents more authority over bookings. Lastly, while the shuttle launch was heckled by some investors, it’s going very well. Most of the routes are selling out with little to no marketing effort and Uber will expand the product going forward.

For delivery, this quarter marked Uber’s 6th straight period of Y/Y MAPC growth acceleration. Notably, “order frequency in each of the last 6 annual cohorts has grown every year.” Merchant growth remained strong at 16% Y/Y to ensure adequate marketplace selection. As a result of all of this, Uber thinks it set new all-time highs for market share across the “vast majority of top markets.”

- The company recently debuted the “Student Value Menu” to make discounts and promotions more visible for cost-conscious customers.

- Added Spirit Hallowwen, Oxxo and Co-Op in the UK to its grocery and retail delivery roster.

- 16% of delivery customers now use grocery vs. 14% Y/Y.

- Its white label delivery product (called Uber Direct) added Darden restaurants as a new multi-year partner. The relationship will start with Olive Garden deliveries this year.

Finally, freight’s growth was powered by revenue per load rather than volume recoveries. Sector headwinds remain strong. No change there. It’s in wait for macro to brighten mode.

Advertising:

Advertising revenue rose 80% Y/Y and contributed to more operating leverage. Like Meta with Reels and Alphabet with AI overviews, Uber already has the traffic and the impressions to sell. It’s now just about getting paid. To effectively do so, it knows it still has work to do on targeting, measurement and formats. This quarter, it added a “First Impression” format to let advertisers “temporarily take over the home feed.” On the measurement side, its T-Mobile partnership will allow it to upgrade geo-targeting and data processing to improve impression decisioning.

Autonomous Vehicles:

I think the firm’s expanded partnership with Waymo was a bit overlooked. Why? Because now Waymo is exclusively offering rides through the Uber app in new cities. I guess Uber’s ability to maximize fleet utilization, optimize management and advance routing algorithms all matter a little to them. I guess Uber’s network effect… even for a mega-cap with 7 products at 2 billion+ MAUs and 2 gigantic map offerings… is still valuable.

This is encouraging. During the quarter, it inked new partnerships with Cruise, WeRide and Wayve to bring its total partner roster to 14. Partners include Waymo, BYD, GM, Toyota, Hyundai and more. Dara teased more announcements coming soon.

On Expedia M&A Rumors:

“On M&A, we remain extraordinary disciplined and I want to emphasize that all opportunities are reviewed with a rigorous value creation mindset; Uber's bar for M&A has never been higher. The best deal is not having to do a deal... So we are excited to continue on our exceptional path of organic growth while sticking to our firm commitment of capital returns.”

CFO Prashanth Mahendra-Rajah

f. Take

Very strong showing. The core business is thriving and its competitive leads are expanding. A tiny guidance miss is not going to make me turn sour on this fundamental darling… not even close. Margins are moving briskly higher, cost of capital is tanking, its cash pile is ballooning and its revenue quality is improving. Everything that can be going well for Uber is going well. I see what the stock price did today, and I am not fretting. I actually used proceeds from my recently significant Uber trims to add back to my existing stake (as shared earlier today in the Max note).

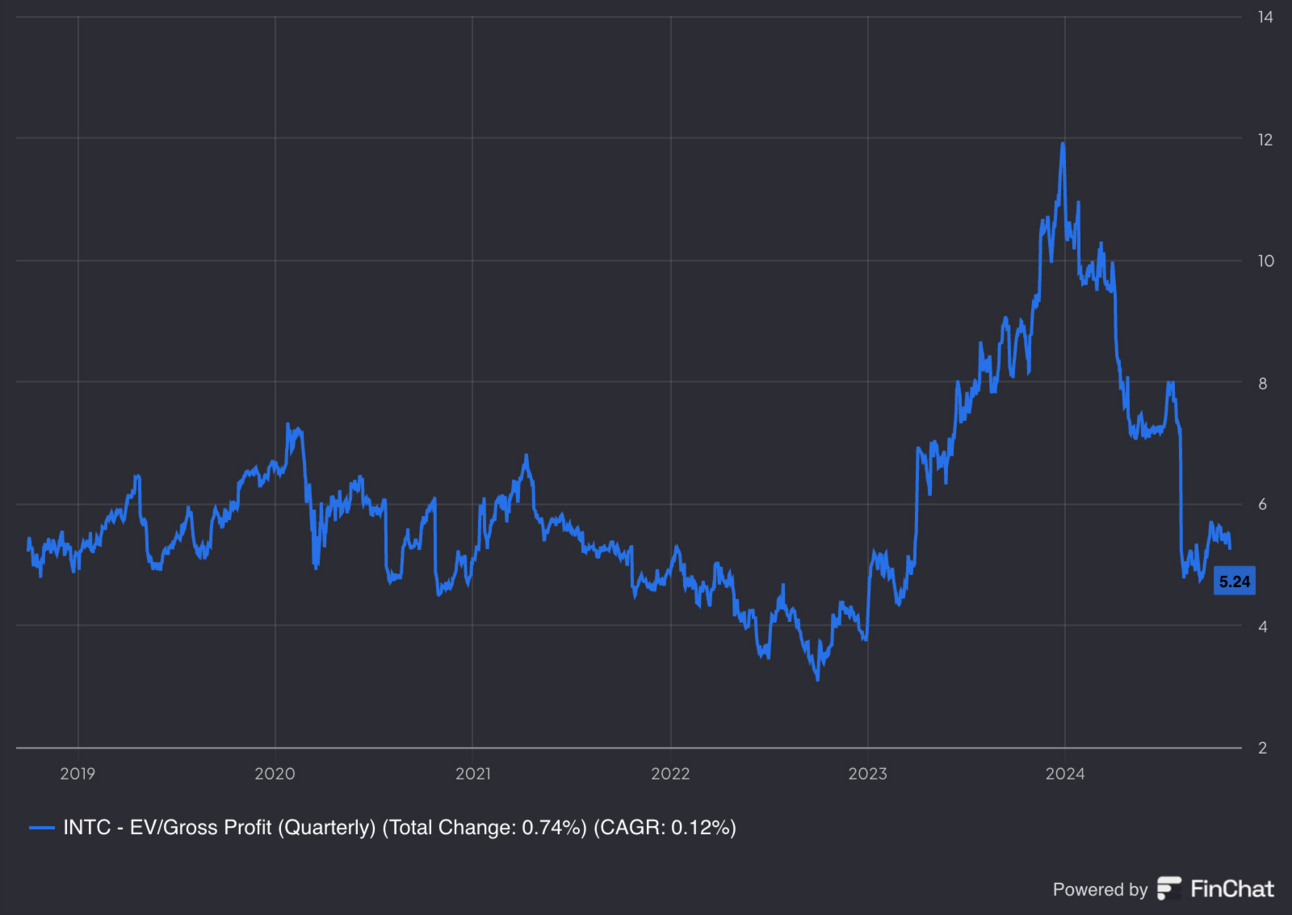

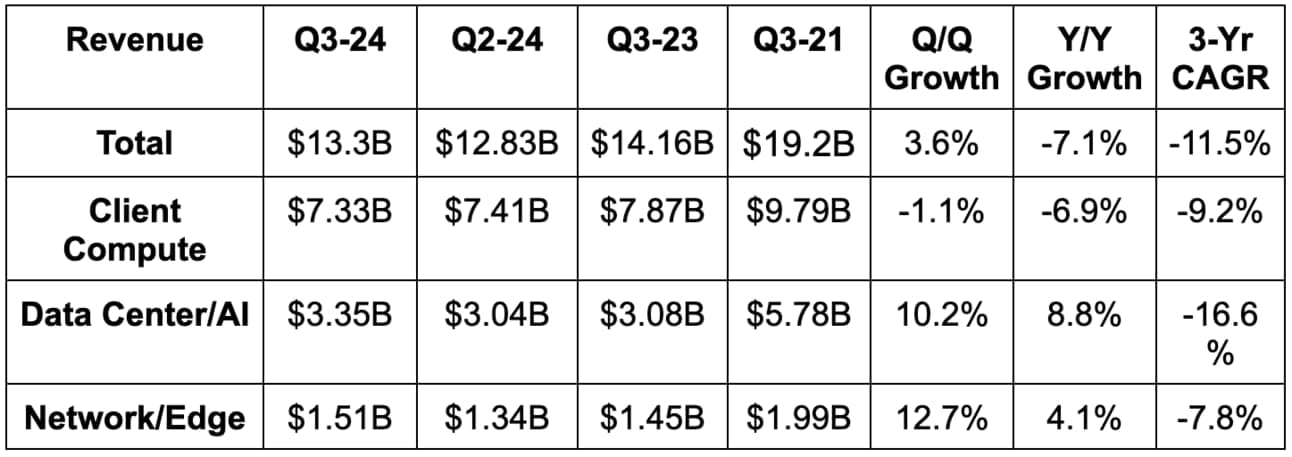

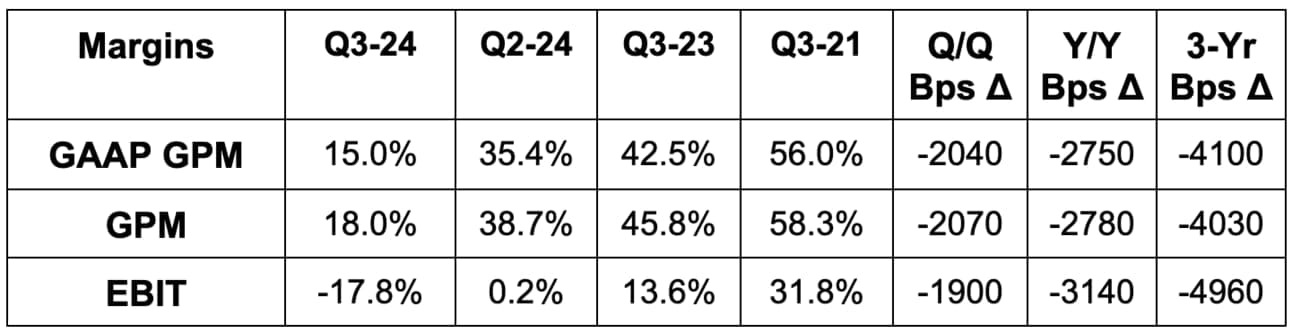

2. Intel (INTC) — Earnings Snapshot

Expectations could not have been much lower heading into this report. And furthermore, results for Intel don’t really matter all that much. Nobody expects it to effectively compete with Nvidia or AMD in data center GPUs or CPUs. It’s all about how well it can position itself to compete with Taiwan Semi years down the road in its foundry business.

Results:

- Beat revenue estimates by 2% & beat guidance by 7.3%.

- Sharply, sharply missed 38% gross margin estimates & guidance.

- Missed -$0.03 EPS estimates & missed identical guidance by $0.43.

- Restructuring charges impacted GAAP margins (not non-GAAP).

Balance Sheet:

- $24B in cash & equivalents; $12B in inventory vs. $11.1B year-to-date.

- $50B in total debt.

- Diluted share count rose 1.5% Y/Y.

- PP&E incentives greatly influence quarterly FCF generation. Still, it burned $2.7 billion in cash this quarter.

Q4 Guidance & Valuation:

- Beat revenue estimates by 0.7%.

- Beat 38.7% GPM estimates by 80 basis points (bps; 1 basis point = 0.01%)

- Beat $0.07 EPS estimates by $0.05

- Beat -$0.24 GAAP EPS estimates by $0.07.