1. Meta Platforms (META) – Earnings Review

a. Demand

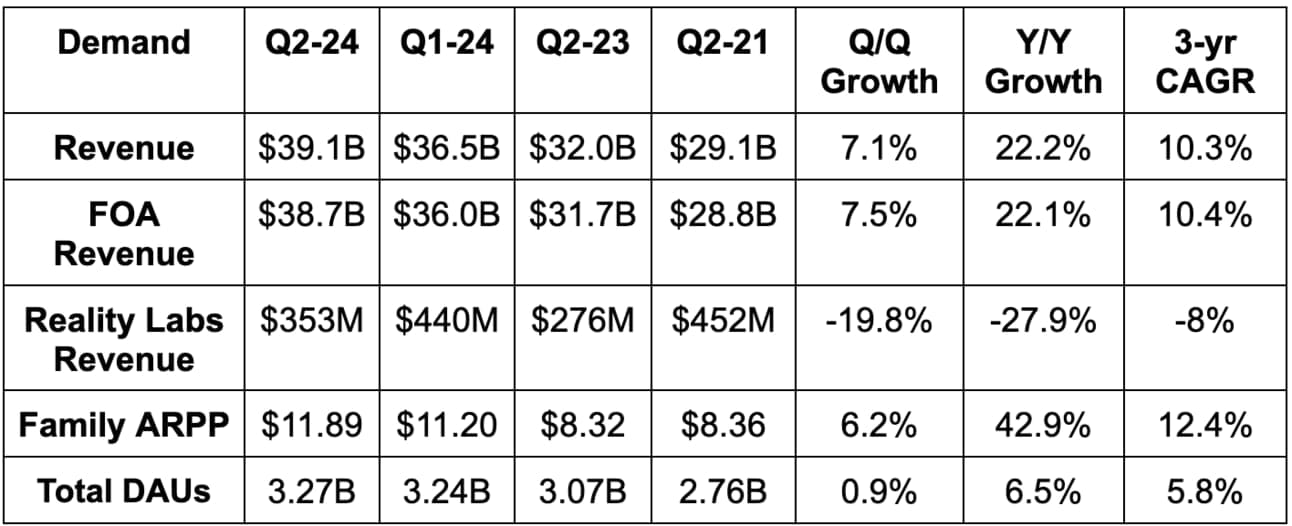

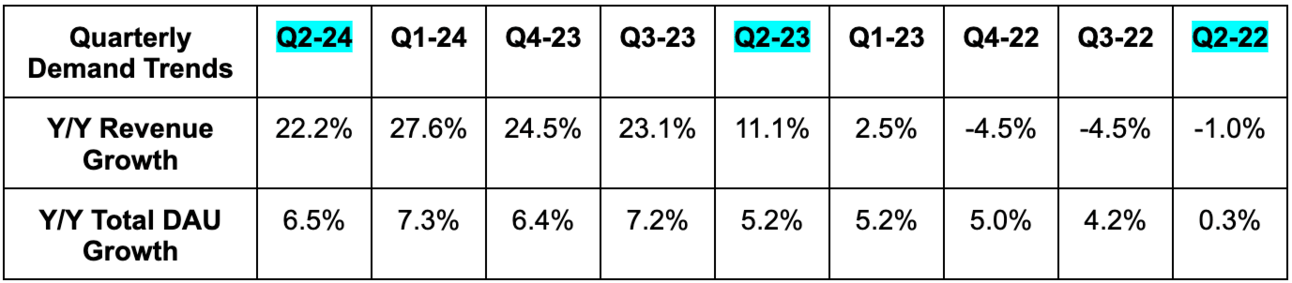

- Beat revenue estimates by 2% & beat guidance by 3.4%. Its 10.3% 3-year revenue compounded annual growth rate (CAGR) compares to 11.7% last quarter and 12.6% two quarters ago.

- Revenue rose 23% Y/Y on a foreign exchange neutral (FXN) basis.

- Beat total daily active user (DAU) estimates by 1.6%.

- Ad impressions rose by 10% Y/Y vs. 20% Y/Y last quarter.

- Price per impression rose by 10% Y/Y vs. 6% Y/Y last quarter. That represents its fastest price per impression growth in over 3 years. Strength was powered by robust ad demand and improving ad performance.

More Advertising Context:

- e-commerce, gaming, entertainment and media were the sectors with the strongest ad spending.

- Europe ad revenue rose 26% Y/Y vs. 33% Y/Y last quarter; Asia Pacific (APAC) ad revenue rose 20% Y/Y vs. 24% Y/Y growth last quarter; North American (UCAN) ad revenue rose 17% Y/Y vs. 22% Y/Y last quarter.

- It sees more opportunity to grow ad load on Reels and other lower monetizing areas.

- It sees real performance gains continuing. This is enabling more advertising revenue growth without solely raising ad load.

b. Profits & Margins

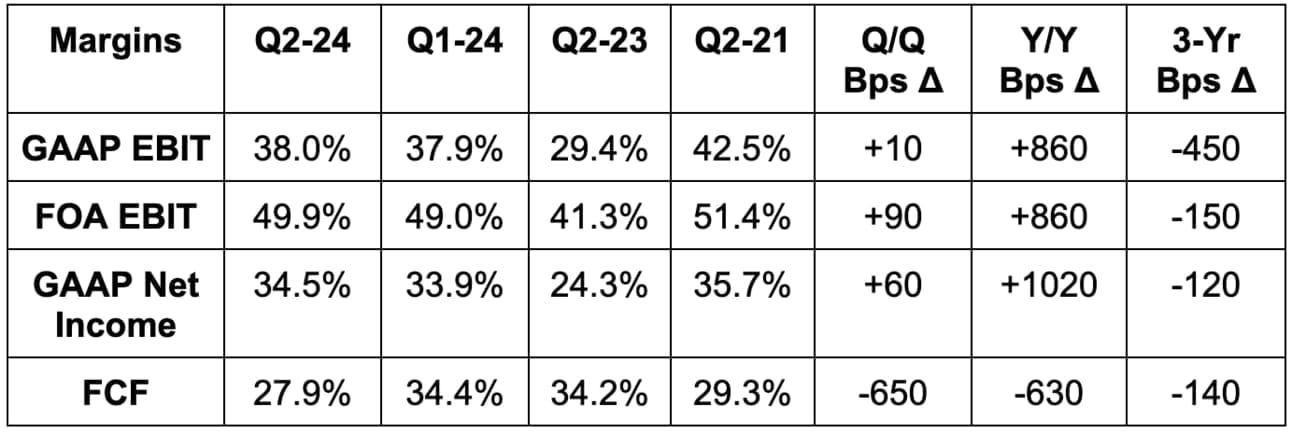

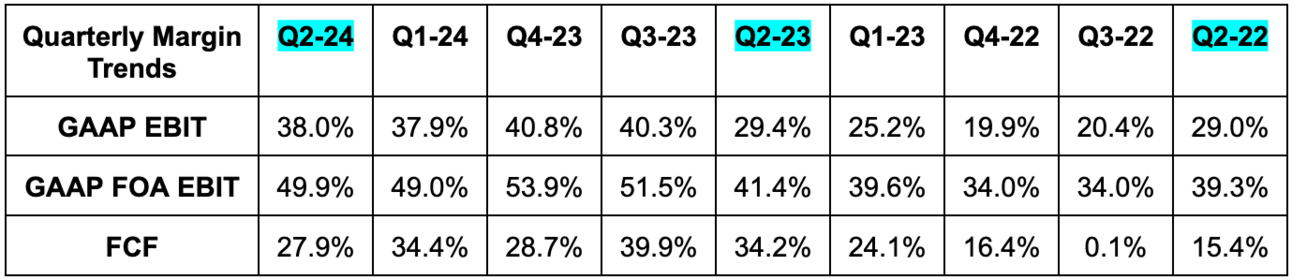

- Beat EBIT estimates by 3.1%.

- Beat $4.76 GAAP EPS estimates by $0.40. EPS rose by 73% Y/Y. This was partially helped by an 11% tax rate vs. 16% Y/Y. If tax rate was again 16%, EPS growth would have been 60% Y/Y.

Total costs and expenses rose by 5.6% Y/Y (+4% for the Family of Apps; +21% for Reality Labs). Cost of revenue rose 23% Y/Y via more infrastructure spend and Reality Labs inventory. R&D rose 13% Y/Y due to the same factors and also more headcount expenses. Sales & marketing fell 14% Y/ due to lower restructuring changes. G&A fell 12% Y/Y due to lower legal changes. These are all GAAP expenses.

c. Balance Sheet

- $58.1B in cash & equivalents.

- $6.2B in equity investments.

- $18.4B in long term debt.

- Diluted share count was flat Y/Y.

d. Guidance & Valuation

For the third quarter, Meta’s Q3 revenue guidance beat by 1.4%. It also reiterated its 2024 operating expense (OpEx) and capital expenditure (CapEx) guidance. This should lead to upward profit revisions for 2024. Finally, it sees “significant CapEx growth” in 2025. It told us to expect that last quarter too.

Trades for 23x this year’s earnings. Analysts currently expect EPS to rise by 35% Y/Y this year and by 14% Y/Y next year. Here’s how that multiple compares to its historical norms:

e. Call & Release

WhatsApp & Threads:

WhatsApp continues to blossom as a key cog in the Meta monetization machine. As Zuck shared a few weeks ago, Meta now has 100 million monthly active users (MAUs) in the states. It certainly took several years, but the app is beginning to thrive from a financial point of view. Paid messaging tools there powered 73% Y/Y growth to push its “other revenue” segment to $389 million for the period. That’s still tiny compared to Meta’s overall revenue base, but that won’t be true for long if this pace of progress endures. Like last quarter, the USA was highlighted as a standout for WhatsApp engagement and user growth. Considering Apple’s messaging dominance here, that’s quite notable.

Threads is now at 200 million monthly active users (MAUs) vs. 150 million last quarter and 30 million 6 months ago. Pace of sequential user growth is accelerating and Zuckerberg is convinced that this will evolve into another powerhouse app over time. Engagement trends are strong… retention trends are strong… it’s all strong.

Facebook Reaching Young Adults:

Based on the dinosaur label that legacy Facebook now has, one may be surprised to learn that 18-29 year-olds in the USA are the app’s most promising age cohort for growth. Reels is helping a lot here, but other tools like group messaging and also its thriving Facebook Marketplace are creating a resurgence in young adult interest.

Core AI:

Meta splits its AI work into two groups: Core AI and Gen AI. Core AI encompasses the near term financial opportunities here; it refers to using AI to augment its existing products. That can be further segmented into two categories that are tightly related: engagement and advertising. For engagement, increasingly precise models trained on Meta’s world-class datasets are leading to better content recommendations and matching. Its unified video rec engine, which now combines reels, long video and live video into one algorithm, is increasing Facebook engagement more than the large gains it got from first introducing accelerated compute GPUs. Infusion of short-form into the core Facebook experience is also leading to ad impression growth; Meta’s work to close the Reels monetization gap over the last few years ensures this impression growth features strong financial potential.

For advertisers, GenAI is pushing Meta to a point of simply needing an objective and a budget from advertisers. From there, it plans to use GenAI to know which customer segments to target (even better than the direct buyer does), exactly how to reach them and when to do so. It will handle creative content generation, ad return optimization, reporting and everything else.

Its Lattice tool is getting better and better at ranking placements to drive better performance. Its Advantage + campaign building and automation tool is driving a 22% return on ad spend (ROAS) boost for its U.S. advertisers. Generally speaking, it’s hard at work on debuting new products to make things easier for buyers. One example is its Flexible Format for Advantage Plus shopping. This lets advertisers add several pieces of campaign content, which Meta analyzes and selects based on highest ROAS expectations. Its Background Generation, Image Expansion and Text Generation tools have been popular for advertisers early on. 1 million of these buyers now use at least one of these tools on a monthly basis.

Gen AI:

GenAI is the other, longer term, and more speculative AI bucket. Meta AI is the product to focus on here. Zuckerberg set a goal to make this conversational GenAI assistant the most used free tool of its kind by year’s end. One quarter into its debut, he’s confident in that happening. Like every other Meta product, it will take its time on product market fit and scale. It will take its time on monetization for this and every other GenAI product and doesn’t expect a material revenue contribution this year.

The AI studio launched this week. This makes it easier to build GenAI characters (Meta built a Snoop Dogg AI for example) to use across its apps. This should enhance the personal feel of the products, which should be positive for the overall user experience.

Business AI use cases (which are directly related to the overarching Meta AI product) are also exciting. Excellent customer service is a difference maker in competitive sectors. Businesses need to service their customers in the best way possible, and budgets to do that are finite. That’s where business messaging and business AIs can come into play. They can allow enterprise clients to emulate high quality customer service gaps at a small fraction of the cost of doing so on their own. This is in very early testing with a select group of merchants. Zuck thinks every business with a website or a social media account will eventually find this valuable and I think this will be a centerpiece of its GenAI monetization down the road.

As announced earlier in the month. Llama 3.1 is the first open-source frontier (world-class) model on the planet. It offers better cost performance than closed models, which is an edge that should merely grow with more developer traffic. Why does this matter? GenAI models are racing to commoditization. The only two differentiators among high quality alternatives will be access to data and cost of service. Having half of the planet on its apps takes care of the data need. Open sourcing takes care of cost of service. It allows developers to freely utilize these models on any public cloud to build whatever they want. That will invariably entail apps that upgrade Llama’s efficiency, performance and utility. Open sourcing essentially invites the world to do your work for you. And? Open sourcing with great models and hefty potential consumer traffic is extremely compelling for developers. It has a very strong track record of driving vast cost savings from taking this approach. Zuck reminded us about how the Open Compute Project — which invited partners to standardize on its own infrastructure — has led to better interoperability and savings.

As an important aside, Meta is open sourcing Llama while also keeping some proprietary subsections of models for itself. I see this as the best approach and Meta now sees Llama 3.1 as on par with the best closed-source models out there. Llama 4 is coming next year.

On the call, Zuck acknowledged that GenAI work will take years to turn into material financial contributors. But just like for its apps, it’s seeing early signs that give it confidence in these projects being powerful needle-movers in the years ahead. Everything that could be going well here (strong traffic & its models being ranked highly) is.

Capacity Usage Flexibility:

Susan Li again told investors that CapEx will rise materially in 2025 to support AI infrastructure needs. Like with Google and Tesla, it sees more risk to under-spending here vs. adding too much capacity. Why? Because these assets depreciate rather slowly and it has several areas where any excess compute can be utilized. For example, if it has the training capacity it needs, it can shift Nvidia Hopper and Blackwell GPUs to inferencing. If GenAI doesn’t require as much infrastructure as it thinks, it can simply add general compute to these GPUs for Core AI use cases. It has real flexibility to allocate these resources wherever it needs on short notice. These dollars will not go to waste and Meta will continue to fixate on GenAI workload and other operating efficiencies to ensure costs don’t spiral out of control. This will not be another 2022 for the firm.

Hardware:

- The Ray Ban smart glasses remain supply-constrained as demand continues to outperform all expectations.

- Quest 3 headset sales are also above expectations.

f. Take

This was a flawless quarter. Asia Pacific ad growth of 20% wildly impressive to me. Its young adult resurgence on Facebook is too. That’s especially considering this quarter lapped 40%+ Y/Y growth there and the initial surge in Shein and Temu demand. Meta AI is well on its way to ubiquity and avoiding another annual CapEx guidance raise was important for profit estimate trends. Reality Labs continues to incinerate cash, yet margins remain elite. Just imagine what this can look like if that segment starts to see peak losses. More compounding, more cash printing, more new product traction and more leverage. More of the same for this elite company. Great quarter.

2. Lemonade (LMND) – Earnings Review

a. Demand

- Slightly missed In-Force Premium (IFP) guidance by 0.1%. Its 56.2% 2 year revenue CAGR compares to 64% last quarter and 68% 2 quarters ago.

- Beat Gross Earned Premium (GEP) guidance by 1.0%.

- Slightly beat revenue estimate by 0.5% & beat revenue guidance by 2.5%.

- Premium per customer rose 8% Y/Y due to premium hikes.