Most of the content from this week has already been sent:

- Trade Desk Earnings Review (and a Cloudflare Snapshot)

- Shopify & Mercado Libre Earnings Reviews

- Uber Earnings Review

- AMD & Datadog Earnings Reviews

- Lemonade Earnings Review (and a Celsius Snapshot)

- Palantir & Hims Earnings Reviews

- My Current Portfolio & Performance vs. The S&P 500.

Table of Contents

- 1. Earnings Snapshots – Axon (AXON), Rocket Labs ( …

- 2. DraftKings (DKNG) – Earnings Review

- 3. Coupang (CPNG) – Earnings Review

- 4. Alphabet (GOOGL) – Search

- 5. Headlines:

- 6. Macro

The Cloudflare Earnings Review will come on Tuesday alongside Nu Holdings.

1. Earnings Snapshots – Axon (AXON), Rocket Labs (RKLB), AppLovin (APP) & Coinbase (COIN)

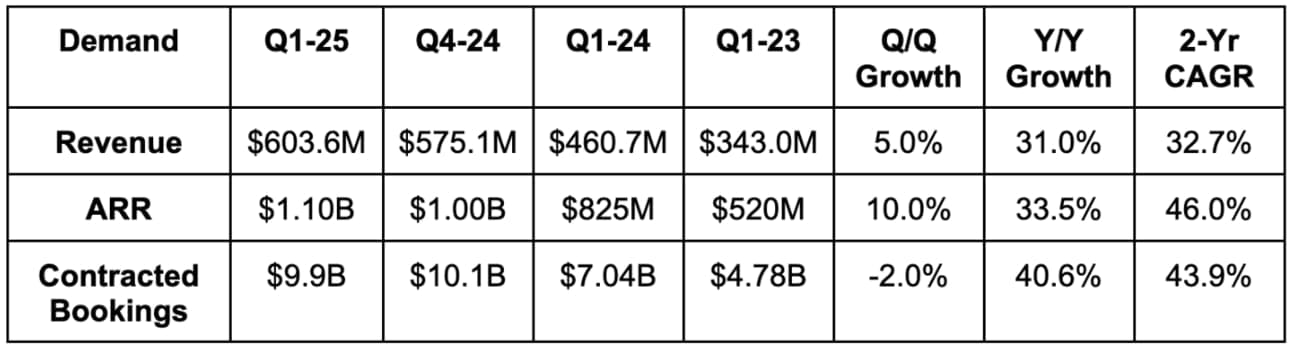

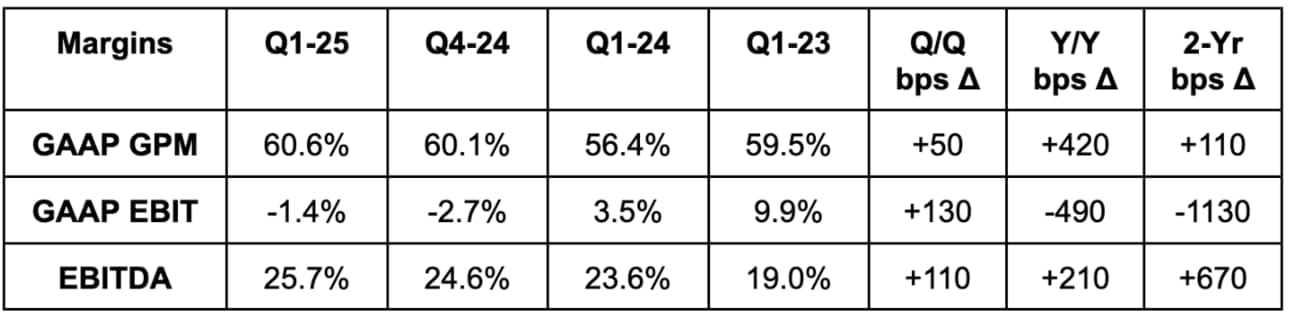

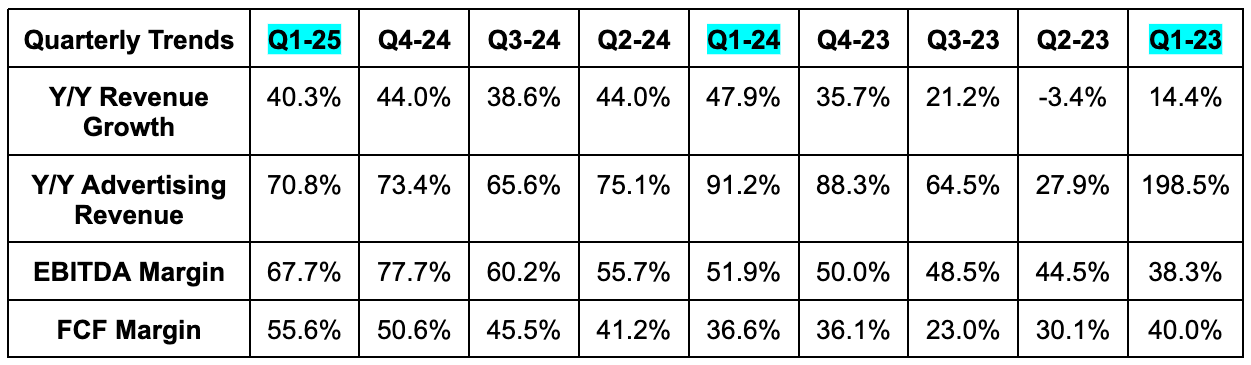

a. Axon (AXON)

Results:

- Beat revenue estimates by 3.0%.

- Beat EBITDA estimates by 14.1%.

- Beat GAAP EBIT estimates by 14.1%. Stock comp packages heavily impacted Q1-25, Q4-24 and Q1-24 GAAP EBIT.

- Beat $1.24 EPS estimates by $0.17.

Guidance & Valuation:

- Raised annual revenue guidance by 1.9%, which beat estimates by 1.1%.

- Raised annual EBITDA guidance by 2.0%, which beat estimates by 1.2%.

Axon trades for 110x forward EPS. EPS is expected to grow by 2.5% this year and by 22% next year. It also trades for 76x EBITDA, with 28% EBITDA compounding expected over the next two years.

Balance Sheet:

- $2.4B in cash & equivalents.

- $2B in total notes payable.

- 5.6% Y/Y share count dilution.

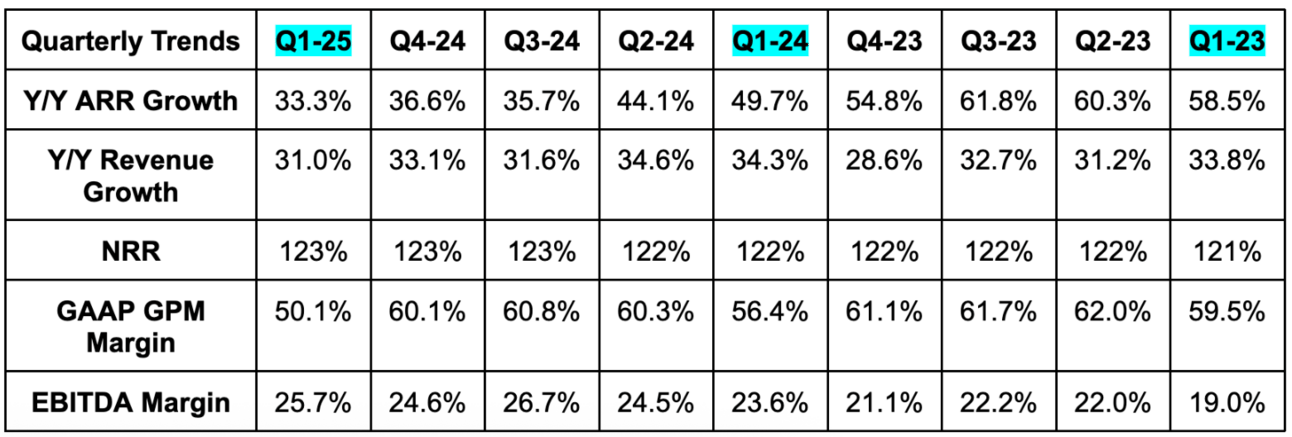

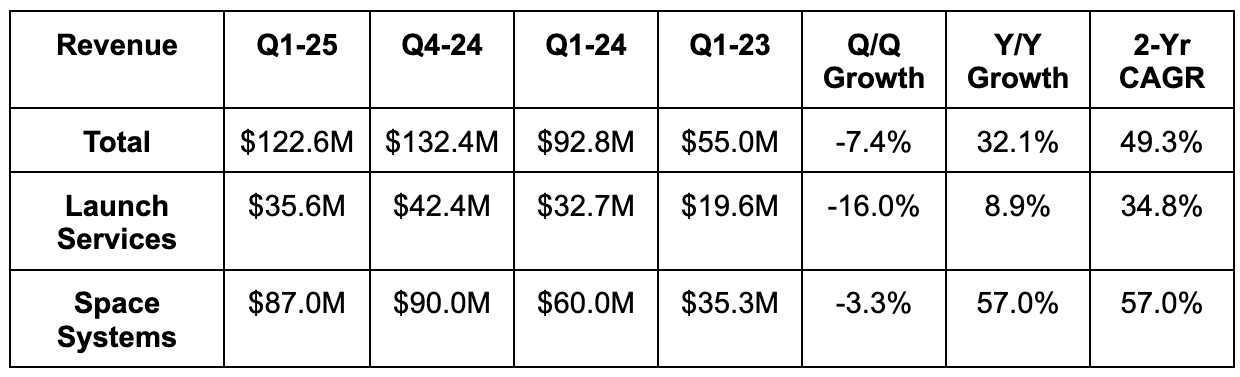

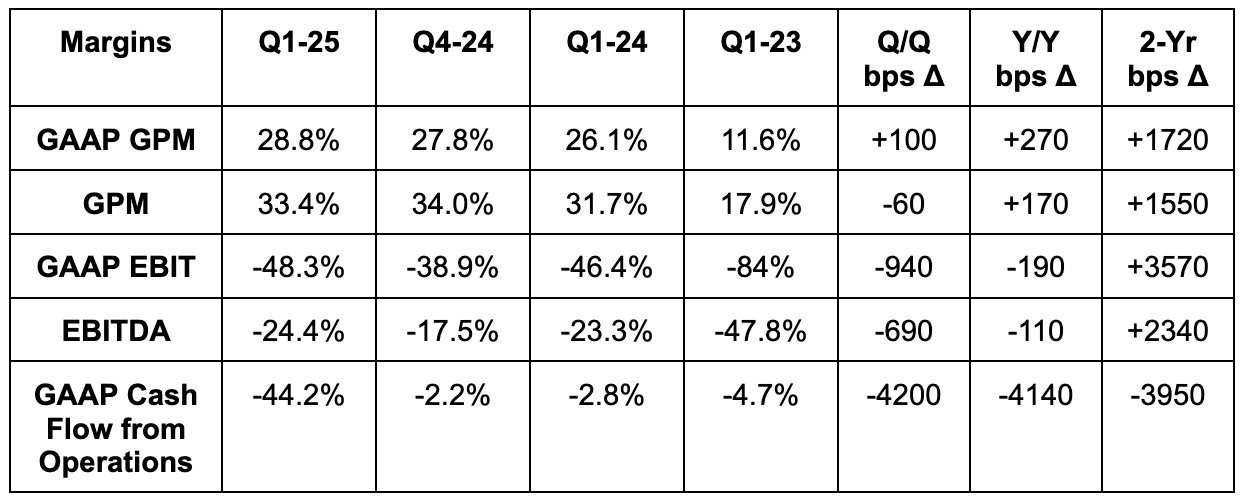

b. Rocket Labs (RKLB)

Results:

- Beat revenue estimate by 1% and beat guidance by 2.5%.

- Beat 26.0% GAAP GPM guidance by 280 bps.

- Beat 31% GPM guidance by 240 bps.

- Beat -45M EBIT estimate by $9M & beat guidance by $4M.

- Beat -$34M EBITDA estimate by $4M & beat guidance by $4M.

- Beat -$0.09 EPS estimate by $0.02.

- Cash flow is extremely lumpy on a quarterly basis.

Guidance & Valuation:

- Revenue guidance missed by 1.5%.

- -$29M EBITDA guidance missed by $9M

- -$36M EBIT guidance missed by $2M.

RKLB trades for 17x forward sales (no profit). Revenue is expected to grow by 31% this year and by 55% next year. It is expected to turn EBITDA positive during 2026.

Balance Sheet:

- $425M in cash & equivalents.

- $77M in traditional debt.

- $346M in convertible senior notes.

- 3.2% Y/Y share count dilution.

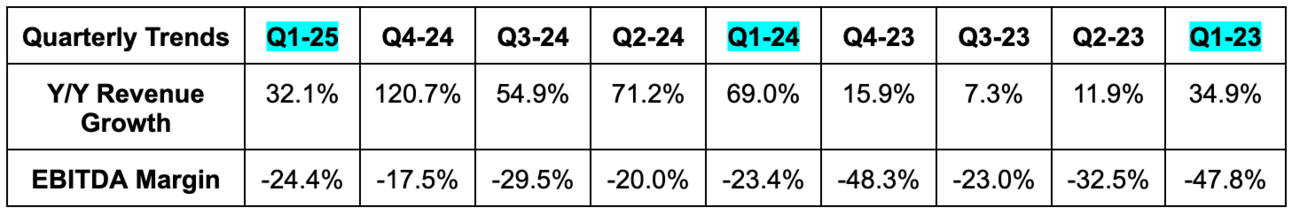

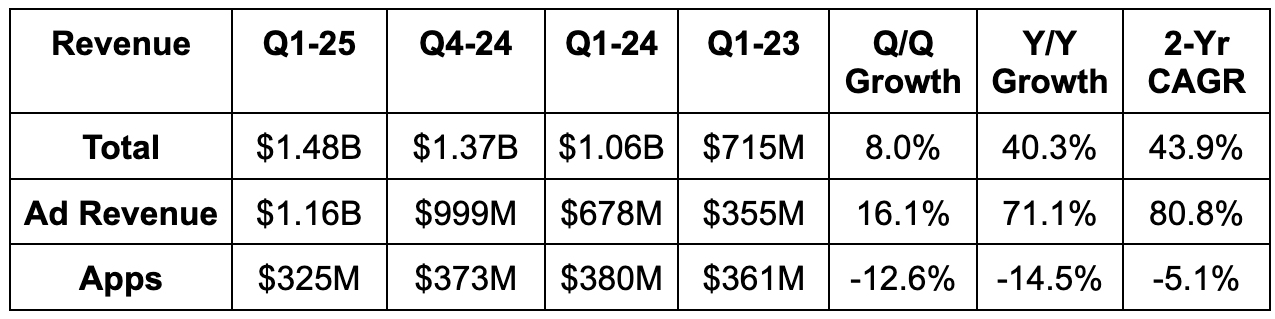

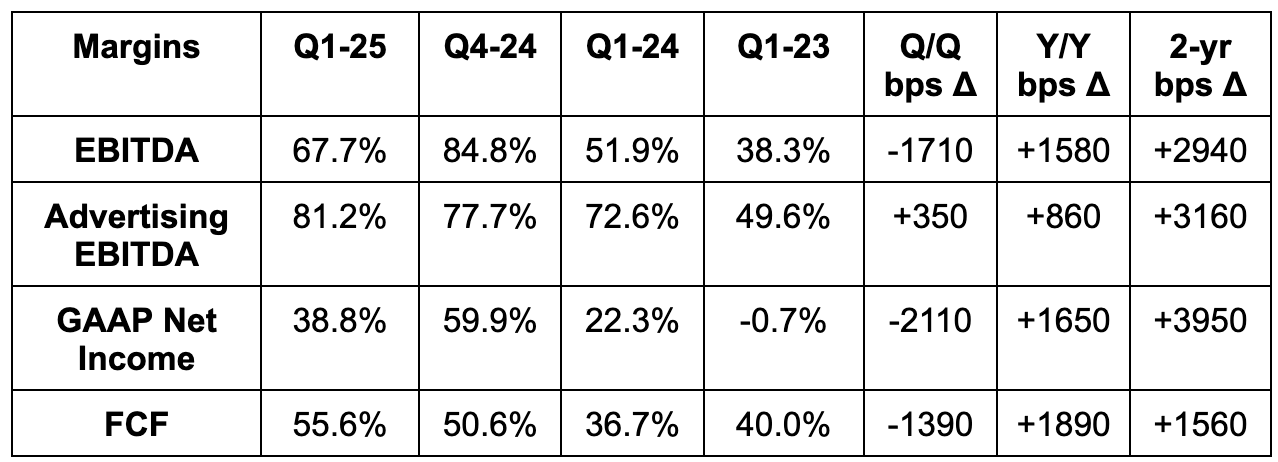

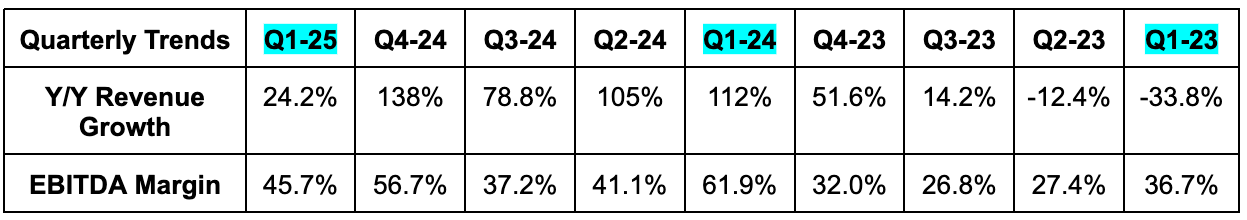

c. AppLovin (APP)

Results:

- Beat revenue estimate by 7.4% & beat guidance by 8.0%.

- Ad revenue beat guidance by 11.5%; apps revenue (far less important) missed guidance by 3%.

- Beat EBITDA estimates by 15.1% & beat guidance by 15.5%.

- Beat advertising EBITDA guidance by 15.7%.

- Beat $1.96 EPS estimates by $0.42.

Guidance & Valuation:

APP sold its mobile gaming business after the quarter and only guided for the advertising portion of its business for Q2. That guidance led to revenue estimates rising by 2% (despite the sale) and EBITDA estimates rising by 11%. So we can call this a comfortable beat.

APP trades for 38x forward EPS. EPS is expected to grow by 44% this year and by 18% next year.

Balance Sheet:

- $551M in cash & equivalents.

- $3.7B in total debt.

- Share count fell by 1.2% Y/Y.

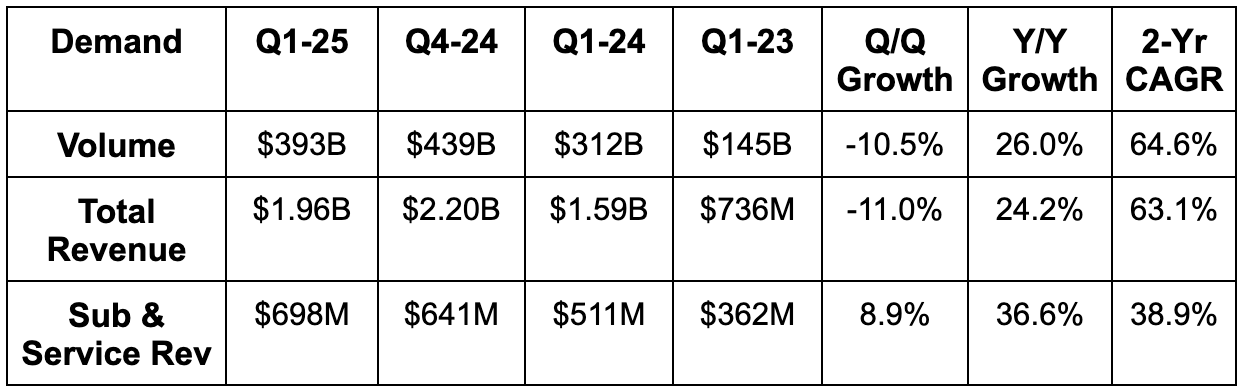

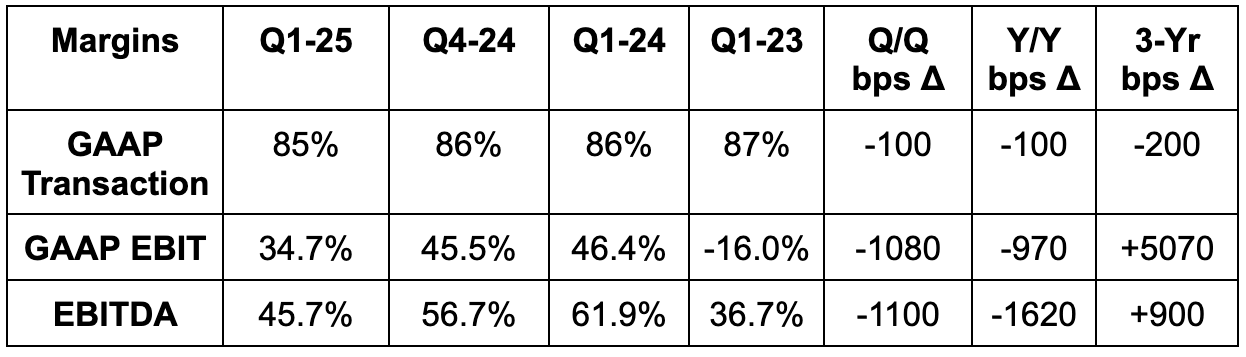

d. Coinbase (COIN)

Results:

- Missed revenue estimate by 2.1%. Missed subscription & service revenue guidance by 3.7%.

- Slightly missed EBITDA estimates.

- Beat GAAP EBIT estimates by 3.3%.

- They technically missed $1.87 GAAP EPS estimates by $1.63. Net income is an irrelevant byproduct of crypto asset valuation changes in this specific case. Noise. Focus on GAAP EBIT & EBITDA.

This business model is violently cyclical. For context, its 4-year revenue CAGR from Q1 2021 to Q1 2025 is 5.2%. Massive peaks and valleys here.

Guidance & Valuation:

Coinbase guidance (doesn’t give overall revenue or profit guidance) led to Q2 revenue estimates falling by 13.8% and Q2 EBITDA estimates falling by 22%.

COIN trades for 16x EBITDA. EBITDA is expected to fall by 7% this year and rise by 14% next year.

Balance Sheet:

- $8.05B in cash & equivalents.

- $4.24B in debt.

- 1.2% Y/Y share count dilution.