Other Reviews to Read From This Season:

- AMD & Datadog Earnings Reviews (& Coupang part 1).

- Palantir & Hims Earnings Reviews.

- Alphabet Earnings Review.

- Meta, Robinhood & Starbucks Reviews.

- Apple & Duolingo Earnings Reviews (sections 2 & 3).

- Tesla Earnings Review.

- Lemonade Earnings Review.

- Amazon & Microsoft Earnings Reviews.

- PayPal Earnings Review.

- SoFi Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

Housekeeping & News:

The new website (in the works) will include an integrated place for me to share real-time push notifications on stock news — without inundating your inbox with emails. That’s when I plan to move much of my X content there. The service will be included with current subscriptions. For now, I am still using X to share headline news, so I wanted to include three important notes here for you all.

- Apple is supposedly exploring other AI options for iPhone search. Considering Alphabet is currently the default option, that could impact its market share. It could also potentially create a lot of cash availability for Alphabet if they choose to cut their $20B contract to be the default option. I think that’s likely. I continue to think Alphabet can do very well with 50% search share instead of 100%. GenAI is vastly expanding search use cases, so it can cede ground to others while still growing very nicely for a long time. Pairing this idea with leadership in streaming, AI, cloud infrastructure, digital subscriptions and a 16x forward multiple… I do not see today as a time to panic.

- Powell’s press conference today was quite similar to the last one. He spent 30 minutes basically saying “we need more time to figure out what to do and how new policies will impact the dual mandate.” It was more of the same. I’ll offer a lot more detail here on Saturday, but there really wasn’t much newness.

Table of Contents

- a. Uber Key Points

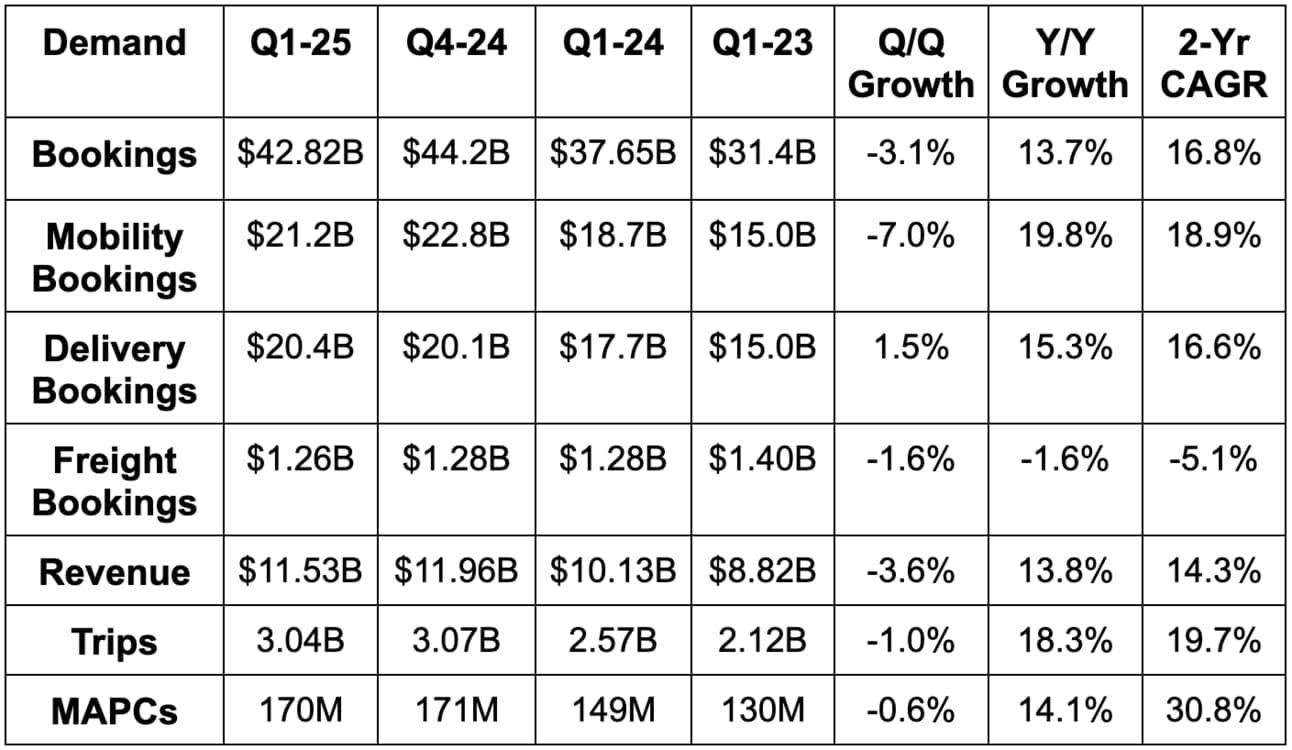

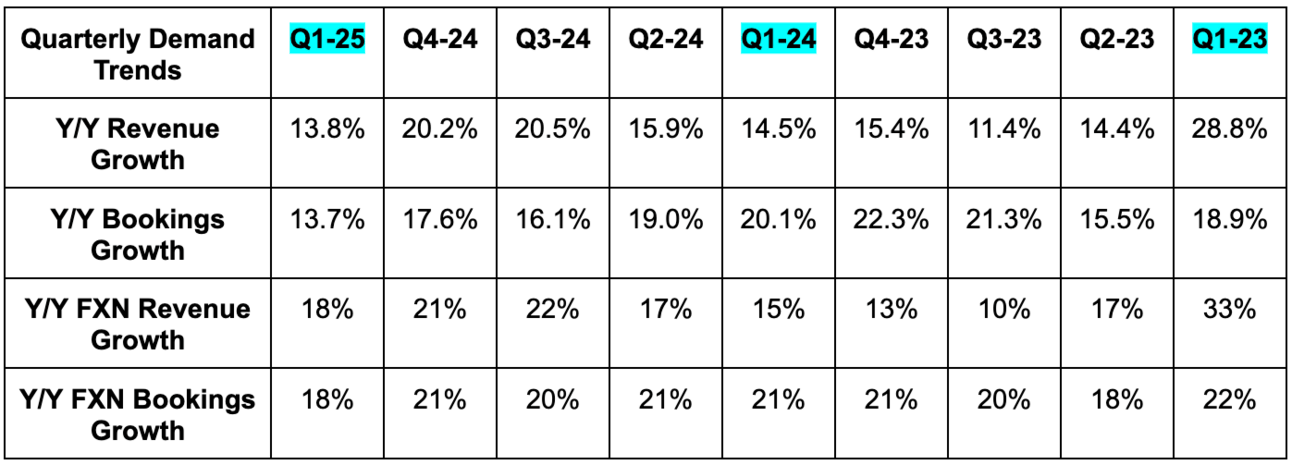

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Release

- g. Take

a. Uber Key Points

- No macro weakness in sight.

- The cross-selling engine is firing on all cylinders.

- Uber One continues to thrive and improve revenue quality.

- Buying Trendyol’s delivery business in Turkey.

b. Demand

- Missed revenue estimates by 0.7%.

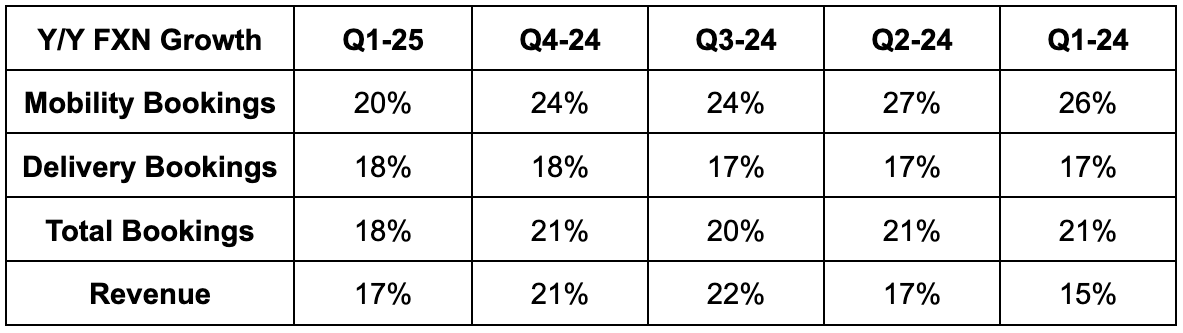

- Most of its mature markets are still comfortably growing in excess of 10% Y/Y on a foreign exchange neutral (FXN) basis.

- Beat monthly active platform consumer (MAPC) estimates by 1%.

- Missed bookings estimates by 0.6% & slightly beat guidance.

- Missed 19% foreign exchange neutral bookings guidance with 18% Y/Y growth.

“Uber delivered a strong start to the year against a dizzying backdrop of headlines on trade and economic policy.”

CEO Dara Khosrowshahi

FXN growth is arguably more important for Uber than any other company we talk about. It hedges out all upside and downside risk pertaining to profits. So? FXN revenue growth is what is correlated with profit growth. Not GAAP revenue growth.