Other Reviews to Read From This Season:

- AMD & Datadog Earnings Reviews (& Coupang part 1).

- Palantir & Hims Earnings Reviews.

- Uber Earnings Review.

- Alphabet Earnings Review.

- Meta, Robinhood & Starbucks Reviews.

- Apple & Duolingo Earnings Reviews (sections 2 & 3).

- Tesla Earnings Review.

- Lemonade Earnings Review.

- Amazon & Microsoft Earnings Reviews.

- PayPal Earnings Review.

- SoFi Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

Table of Contents

- Other Reviews to Read From This Season:

- 1. Mercado Libre (MELI) – Earnings Review

- 2. Shopify (SHOP) — Earnings Review

There was a typo in last night’s Uber earnings review. The 19% bookings growth guidance was actually 18% Y/Y growth. That changes nothing else about the rest of the piece, but I apologize for the error anyway.

1. Mercado Libre (MELI) – Earnings Review

a. Mercado Libre 101

MELI is the e-commerce and logistics king of most of Latin America. It has a thriving marketplace and fulfillment business, with support for 3rd-party merchants. It also features a rapidly growing financial services suite and payments platform, entertainment offerings through partnerships, a rapidly growing ads business and a loyalty program called MELI+ where it laces a plethora of product utility into one unique consumer bundle. The business model resembles Amazon without cloud computing and with financial services. Here are the names of its various products:

- The e-commerce marketplace is called Mercado Marketplace.

- Logistics/Shipping is called Mercado Envios. Mercado Envios Full is its full-service logistics business for merchants. It handles all inbound and outbound activity, packaging and returns. It’s similar to Supply Chain by Amazon.

- The financial services business is called Mercado Pago, with its credit business called Mercado Crédito.

- MercadoShops is its white label store building for other merchants to create a site fully integrated into the Mercado Libre platform.

- Mercado Play is its entertainment business, with key partnerships with Disney leaned on to fill out the library.

- Mercado Coin is its stablecoin. This can be used to shop on its site with exclusive perks for using it.

b. Key Points & Accounting Housekeeping

- Argentina is coming back.

- Fantastic cross-selling momentum.

- Strong market share gains.

- Resilient credit health.

Note that Meli made a series of changes to reporting disclosures starting three quarters ago. One more quarter before comps normalize. First, for Mercado Pago, the interest income/expense item was moved from below the EBIT line to above it. This will make margin comps tougher in the charts below. For Mercado Envios, it changed its position from an agent to a principal. This means it now reports gross revenue and treats shipping as an input cost. Previously, it netted shipping costs out of reported revenue. As this increased reported revenue on an apples-to-apples basis, this will boost revenue growth a bit in the charts below. Finally, it removed peer-to-peer volume from total payment volume (TPV), which slows that growth item a bit in the charts below.

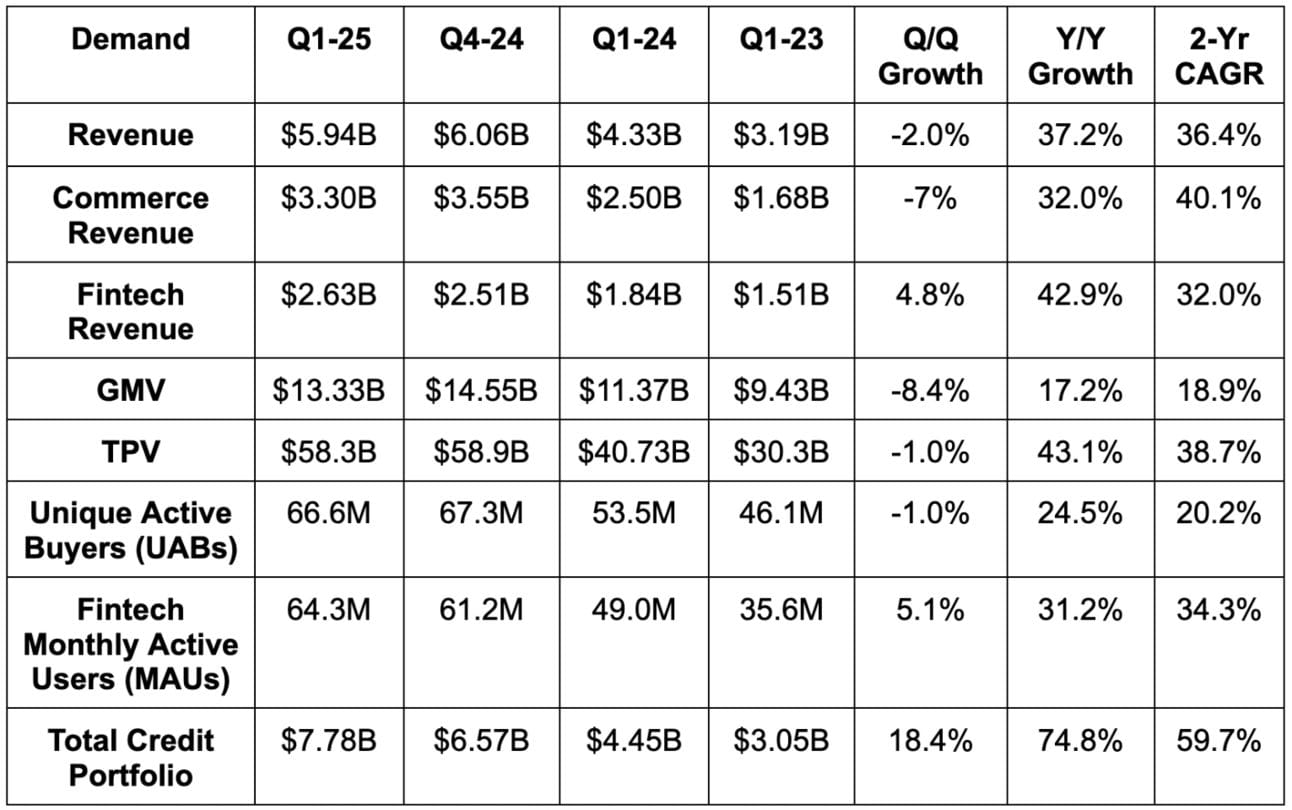

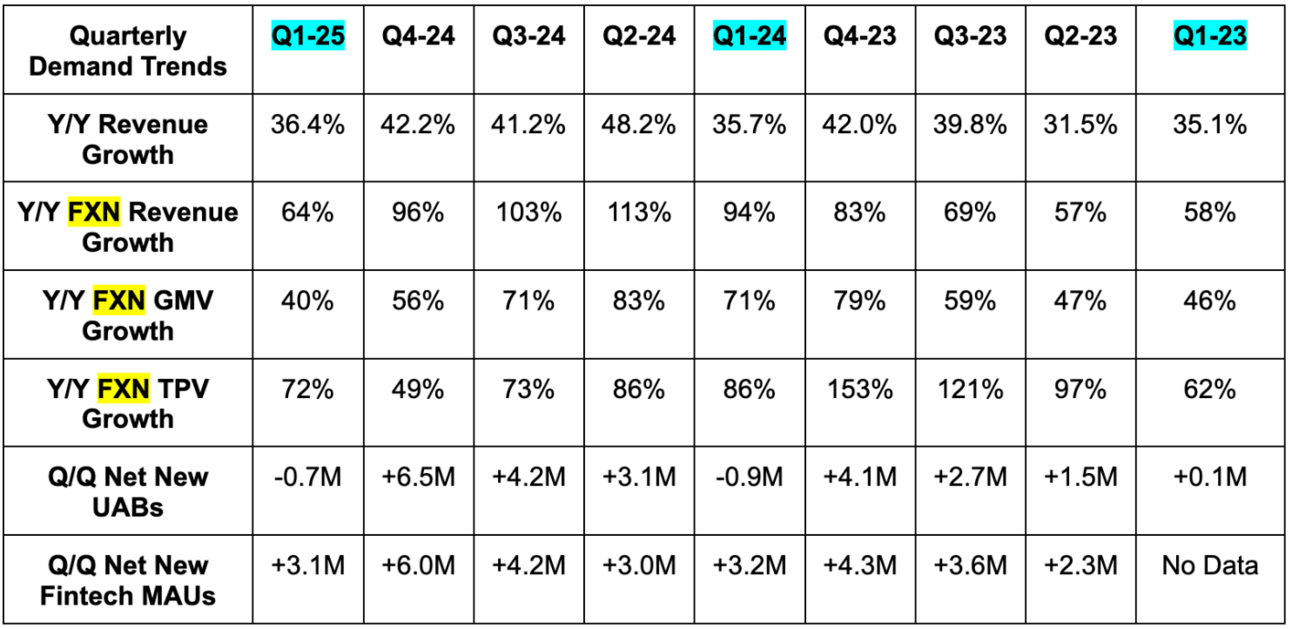

c. Demand

- Beat revenue estimate by 8%

- Beat gross merchandise value (GMV) estimate by 3%.

- Beat total payment volume (TPV) estimate by 11%; crushed FX neutral growth estimate.

Items sold per buyer actually fell from 7.6 to 7.4 Y/Y. This was due to rapid buyer growth, with new buyers always starting at lower frequencies and rising from there. This is why items sold growth was still able to accelerate for another quarter from 27% Y/Y to 28% Y/Y.

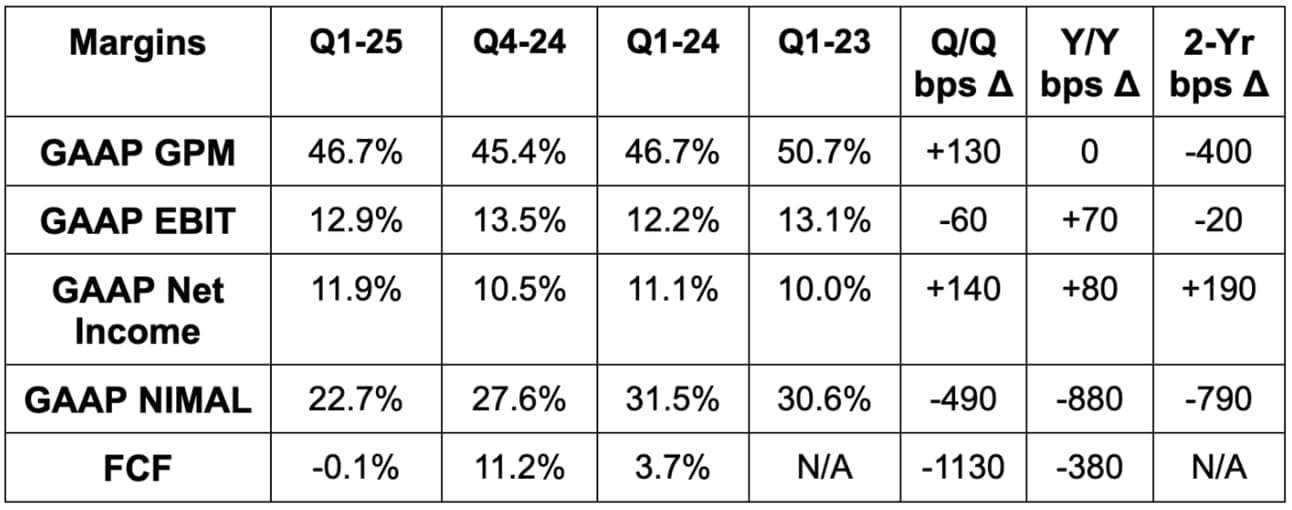

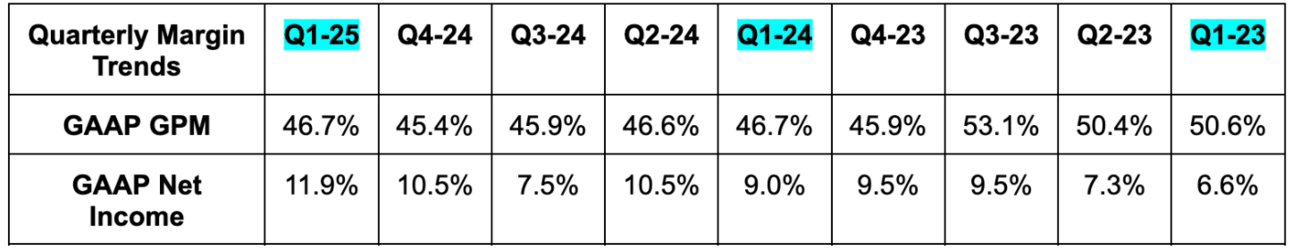

d. Profits & Margins

- Roughly met GPM estimate.

- Beat EBIT estimate by 19%.

- Beat $8.39 EPS estimate by $1.35.

- Sharply missed FCF estimate.

Note that cash flow from operations was over $1B for the quarter. FCF is heavily influenced by change in loan balance and MELI’s rapid credit book growth. It’s intentional and as planned. This reduced FCF by $770M during the quarter. If it were not investing in credit card growth, FCF margin would have been 13%. As it turns cash into credit and front-loads loss provisions, the successful ramp of the credit card heavily and negatively impacts FCF. It is a concession they are eager to make and one that I fully support.

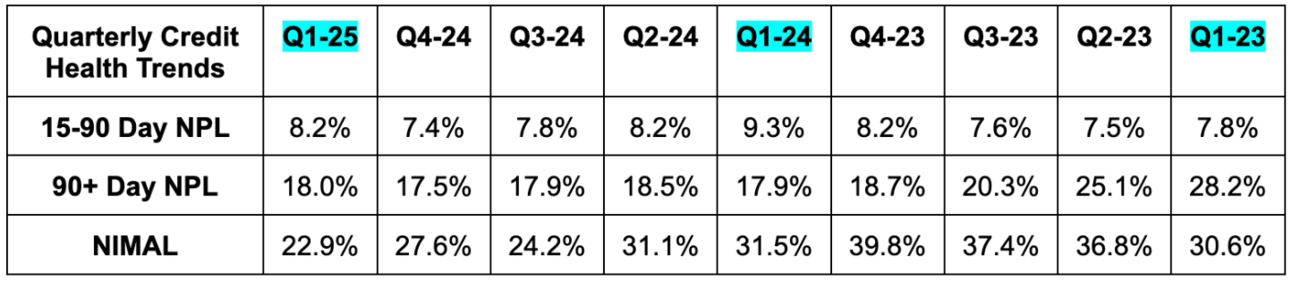

e. Credit Health

Definition: Net Interest Margin After losses (NIMAL) measures credit revenue - credit provisions - funding costs. It’s similar to NU’s risk-adjusted net interest margin (NIM). Higher is better. 15-90 day non-performing loan rate measures the proportion of loans 15-90 days past due. Lower is better.

Despite 75% credit portfolio growth (powered by credit cards), the metics you see above remain comfortably within its risk tolerance. First-time payment defaults in Brazil set another record low in March (despite some macro weakness there) and it’s leaning into more originations in some places because of this. It sounds like those places will mainly focus on prime credit customers and existing MELI users where credit risk is the lowest. It has pulled back a tad on subprime and micro originations in a precautionary manner following some of its competitors seeing deterioration. It still hasn’t seen any of that deterioration itself, but did want to play it safe. Always smart.

If things are going so well, why is NIMAL falling so sharply? Great question. This is because of a mix-shift away from personal loans and towards credit cards, as well as a move to higher credit quality consumers. Cards have lower profit spreads than riskier personal loans and are now 42% of its credit portfolio vs. 35% Y/Y. Affluent borrowers also come with lower profit spreads. The NIMAL hit is highest for new card issuance, as margins start at a bottom (front-loaded provisioning & general funding costs) and grow from there. Meaning? As this business matures and a larger portion of its cohorts are seasoned, the NIMAL hit will diminish. The same will be true for FCF margins.

“Underlying spreads and asset quality metrics remain robust.”

Shareholder Letter

f. Balance Sheet

- $8B in cash & equivalents.

- $1.5B restricted cash.

- $6.4B in loans payable.

- 0% Y/Y dilution.

g. Valuation

MELI trades for 48x EPS. EPS is expected to grow by 35% this year and by 32% next year. Estimates will surely rise following this report.

h. Call & Release

A Thriving Marketplace:

As you can see from the data above, the commerce business is doing quite well. And? The runway remains massive. Latin America is a full decade behind the USA in terms of e-commerce penetration, with Meli having just a 5% share of total commerce in its markets. Considering its beloved and ubiquitous brand in all of its markets, it has a fantastic opportunity to keep growing quickly at an enormous scale for a very long time. That’s why an obsessive focus on its value proposition and service improvements are both so important. Whatever it can do to take better care of its customers is great for business. I love when interests are aligned.

When they add assortment, optimize checkout experiences or add services like auto parts and repairs last quarter, more volume, more market share gains and more financial success follows. Prioritizing its consumers is why brand preference scores are at all-time highs and why unique buyers continue to briskly grow. This formula has been in place for years and, simply put, keeps working.

This quarter, the service expansion example cited was its budding grocery business. Items sold under this category rose 65% Y/Y, as it added tools such as repeat ordering, better search and more targeted advertising. More 1st-party inventory and updates to the user experience (UX) are also helping it gain the conviction needed to “get bolder in initiatives to generate new demand.” The product has been somewhat immature and nascent up until this quarter; they’ve had to work on improvements to make sure revenue growth came with delighted customers. It’s now at a point where it can get more aggressive. Considering the frequency of grocery shopping, MELI sees this as a real opportunity to create more engaged, more loyal and more dependent customers. And? Doing so will also have indirectly positive impacts on the entire ecosystem, considering grocery customers, on average, buy more things from its other categories.

- MELI plans to add a subscribe and save option to the grocery business in the coming quarters.

Mexico Commerce:

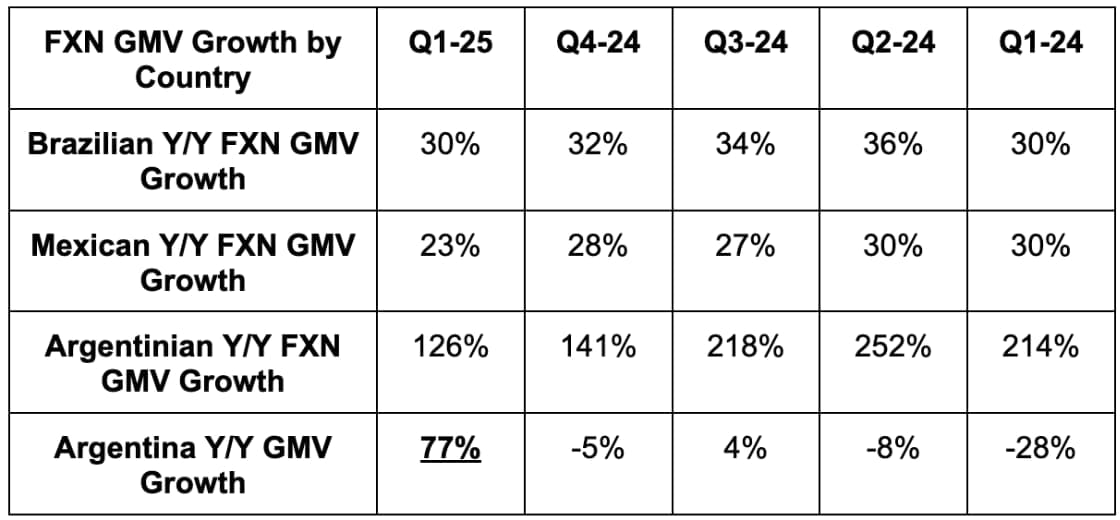

A category of technology sales in Mexico held back growth there to a modest degree. MELI was more than capable of overcoming this headwind elsewhere, but this still bothered them (as it would any good team). Competition cut prices and added generous financing terms and MELI also just didn’t have the assortment it needed. They’re fixing this with “several targeted initiatives” and are already seeing trends improve. Excluding this category, the 23% FXN volume growth in Mexico would have been around 30% Y/Y.

Logistics:

As we often talk about, a scaled logistics footprint to offer best-in-class delivery times and a broad range of options is so incredibly powerful for commerce conversion rates. It’s how MELI matches elite customer service on its marketplace with elite customer service on the fulfillment side. It’s how MELI creates the economies of scale and vertical integration-inspired efficiency to offer lower-priced goods and expedite the shift from offline to online commerce. And? It’s a profit driver too.

The hefty infrastructure investments needed to build its scale were very expensive and form an infrastructure moat that’s tough to match. Improvements to its fulfillment business will remain a constant priority, with localization work this quarter allowing them to lower cost per fulfillment across their 3 main markets. If this sounds like Amazon, that’s because the similarities between this business and the non-AWS part of that business are striking.

Interestingly, while MELI’s coverage continues to improve, same-and-next-day delivery rates continue to fall. Why? It’s because people are choosing slower options to save some money. Mix-shift towards this type of delivery rose 3 points Y/Y. This is in no way related to on-time delivery rates falling, as that metric set a new high during the quarter.

- Reports during the quarter on MELI adding to its Brazilian distribution center construction plans are wrong. There are no changes to its CapEx plans.

Argentinian Comeback:

Macro in Argentina is improving, as items sold rose 52% Y/Y and the country set a convincing new contribution margin record with 11 points of Y/Y expansion. Argentina carried the company’s margin profile this quarter, as Brazil and Mexico contribution margin fell 5 points Y/Y. That was as expected and related mainly to aforementioned rapid credit card growth. Argentinian operating leverage had a lot to do with better fixed cost leverage, as the country returned to expedient real revenue growth for MELI. Easy comps helped, but structural improvements in the economic backdrop and more market share gains both helped too.

Meli has been hard at work on improving shipping processes, inventory availability, controlling prices and adding more convenience to this business while macro remained sour. And now? Its product offering is in a great spot as the economy there begins to hum once more. This is the highest-margin ceiling country MELI operates in, so it’s encouraging to see things going so well there right now.

For more positive news, Argentinian credit trends are improving; profits for that specific product are ramping despite meteoric credit book growth and its front-loaded provisioning practices. Lower interest rates are helping, as they’re driving a mix-shift towards cards with higher take rates, while the deep breadth of its customer data profiles is boosting underwriting precision. Much of its consumer base in Argentina interacts with MELI on a daily basis, so they know these people better than a typical lender.

Advertising:

The Mercado Play app is now available on 70 million smart TVs in Latin America. This features a large library of free content, and so ample opportunity for growing its advertising business. As leadership told us during the call, 50%+ of Latin America does not pay for streaming subscriptions. It’s much different than here in the USA. This could be a key unlock for monetizing those customers in new ways, with easy opportunities to promote goods on its marketplace and drive more cross-selling. Overall ad revenue rose 50% Y/Y FXN and the team is “confident in their long-term ambition of becoming a much larger player in Latin America’s digital advertising market.

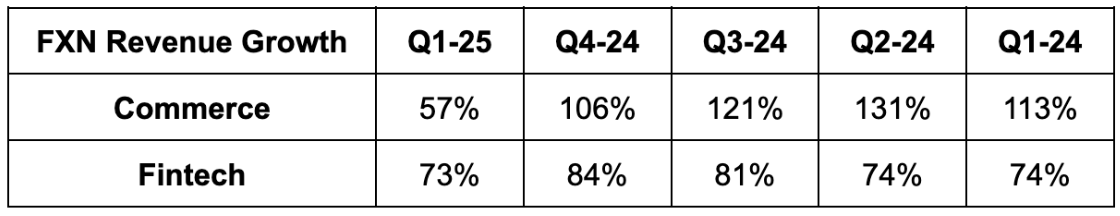

Fintech:

The team thinks years of “work to build a competitive product stack and user experience” have positioned it to drive profitable fintech growth in the years to come. Net promoter scores across core markets keep rising and MELI’s value proposition keeps resonating. A big piece of that value prop is the high-yield savings account it offers, which dwarfs the putrid rates most incumbent banks offer (not Nu Bank). It strives to give customers the most yield for their savings in its markets, and can do so affordably thanks to its digitally-native, low-fixed-cost business.

They don’t quite match Nu’s cost advantages in using deposits to fund credit, as MELI is still more reliant on more expensive warehouse funding. But they do match Nu’s lack of cumbersome fixed costs inherently present in legacy models. And? MELI doesn’t need its deposit and credit franchises to be the main profit drivers of this business (like Nu does). It can offer great perks and operate at a lower margin than Nu can because it has so much more opportunity to sell other products. And? Fintech users engage with these other products much more than non-users. Meli is working harder to drive even more of this cross-selling advantage by rebranding MercadoPago to something that more closely resembles its marketplace. It also de-cluttered the UX to improve discoverability of core features.

- Assets under management rose 103% Y/Y to $11.22B

Acquiring TPV:

Acquiring TPV refers to the piece of MercadoPago that lets merchants seamlessly tap into these easier payment options to augment conversion rates (through software and point of sale hardware). Acquiring TPV happens whenever MercadoPago is used as the main payment facilitator/processor on the marketplace or on a merchant’s own site (“off-platform” acquiring TPV). Acquiring TPV continued to grow at a 30% Y/Y clip in Brazil and a 50% Y/Y clip in Mexico.

Acquiring TPV is also a great top-of-funnel tool to drive merchant adoption of its fintech products. It’s a big reason why merchants with a credit product rose from 16.9% to 26.3% Y/Y. It thinks there’s so much opportunity to raise this, especially in Argentina where some product updates, like a new recurring payments offering, are helping create more interest.

Competition:

Meli has seen no early material impact on the competitive landscape following TikTok Shop entering Brazil and Temu entering Argentina. In the past, this has created faster shifts to online commerce and is something MELI welcomes as inevitable. It knows it can win if it executes.