In case you Missed It:

- SoFi Earnings Review.

- Alphabet Earnings Review.

- Tesla Earnings Review.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix and Taiwan Semi Earnings Reviews.

- My portfolio & performance vs. the S&P 500 as of today.

Table of Contents

1. Starbucks & Spotify — Brief Earnings Snapshots

These “snapshots” function as brief 30,000 ft. overviews of respective quarters. I will publish the detailed “reviews” for both this week.

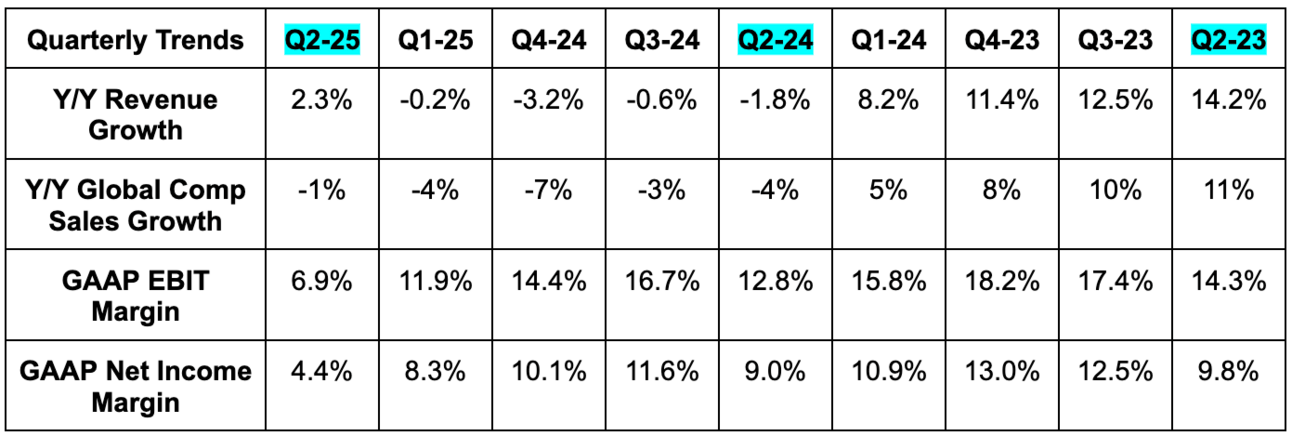

a. Starbucks

Max subs – as I said in the earnings preview article, this was always going to be a bad quarter. I need to read everything before I comment. If I had to guess, this was Mr. Market getting too excited about Brian Niccol fixing a gigantic mess overnight. As the preview explicitly said, I was hopeful for a negative share price reaction so that I could build out the stake at lower multiples. That may be happening. I’ve been consistently adamant that Niccol will fix Starbucks (just like Chipotle) and that it will take more time than many want it to. Patience is required. I cannot make any final decisions until I read the entire report, but I think there’s a good chance that the accumulating will keep happening. I’ll keep you posted in real-time as always.

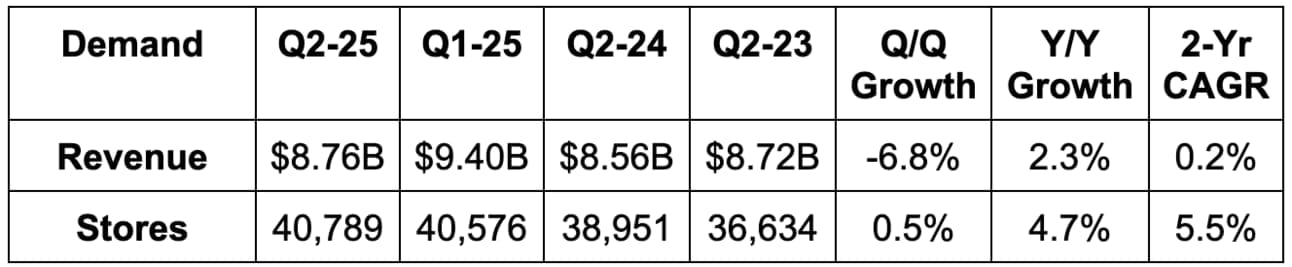

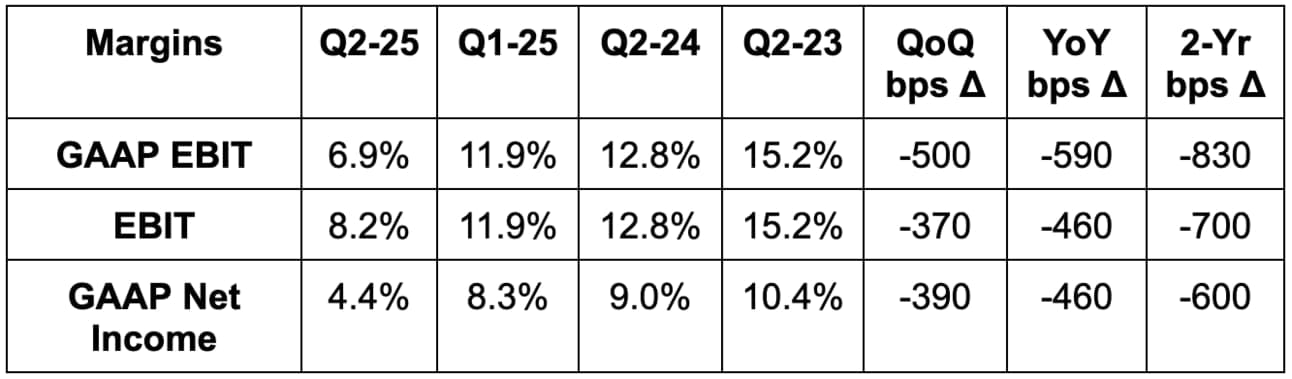

Results:

- Missed revenue estimates by 0.8%.

- International beat by 2%; North America missed by 2%.

- Missed comparable store sales estimates of 0.5% with -1% Y/Y growth. China and International beat estimates; the USA missed slightly.

- Missed $826M GAAP EBIT estimates by $225M or 27%.

- Missed $0.49 EPS estimates by $0.08.

Guidance & Valuation:

No guidance was offered in the initial investor materials.

Starbucks trades for 28x forward earnings and likely closer to 35x following this report. EPS is expected to contract by 13% this year and estimates will fall more after this report. EPS is expected to grow by 23% in 2026 and by 21% in 2027.

Balance Sheet:

- $3B in cash & equivalents.

- $14.8B in total debt.

- Diluted share count rose by 0.4% Y/Y.

- Dividends rose by 7% Y/Y.

b. Spotify

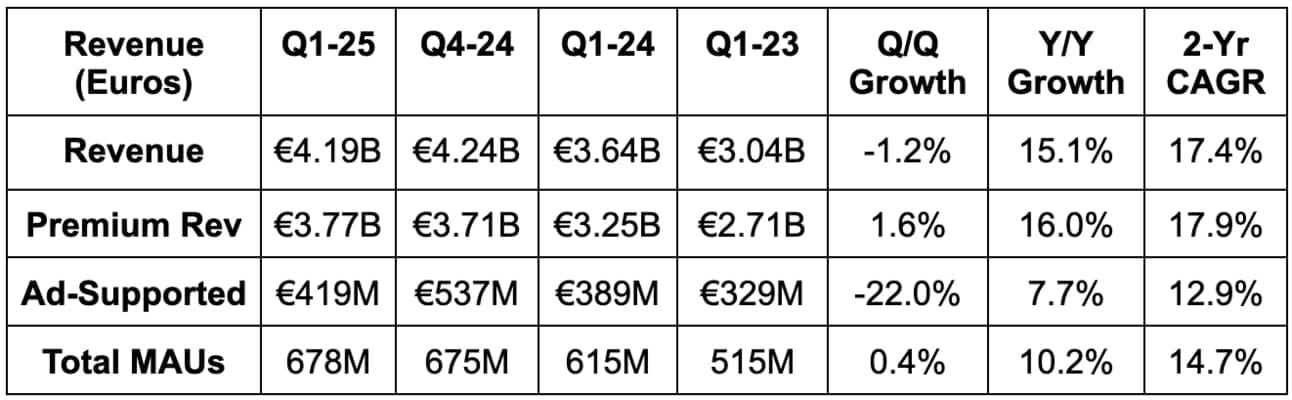

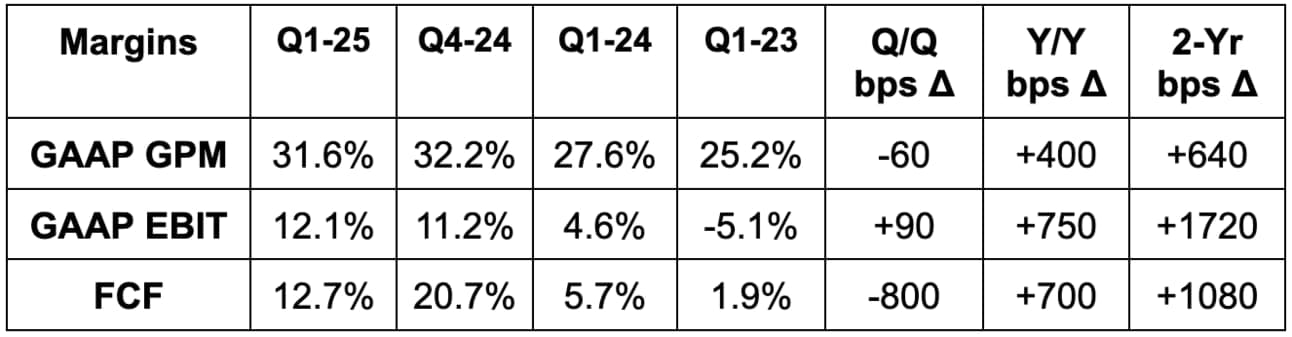

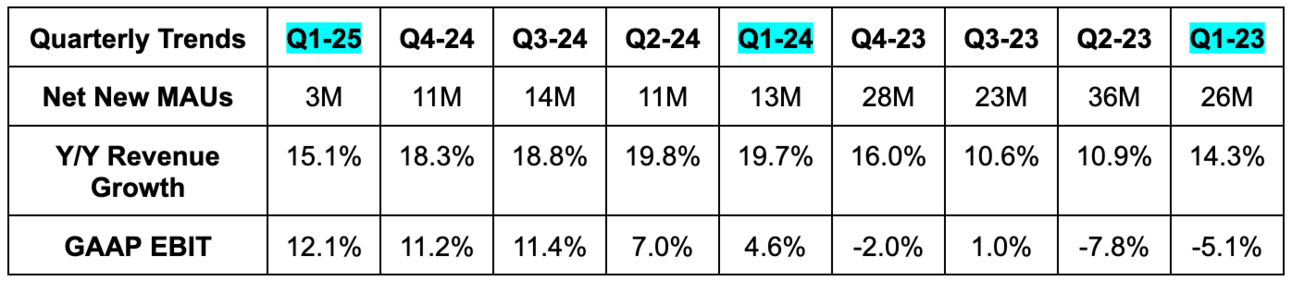

Results:

- Slightly missed revenue estimates & identical guidance by 0.3% each. Currency headwinds were larger than expected. That’s the source of the miss.

- Met total monthly active user (MAU) guidance; beat premium subscriber guidance by 1.1%.

- Beat 31.5% GPM estimates & identical guidance by 10 basis points (bps; 1 basis point = 0.01%) each.

- Missed EBIT estimates by 1.5% & missed guidance by 7.9%. It included €17M in payroll tax charges that rise with a higher share price. It incurred €76M in these charges. Had these charges been as expected, it would have beaten guidance by 1.8%.

- I would love for Spotify to report adjusted EBIT to eliminate this irrelevant noise from the picture of run rate profitability.

- Free cash flow (FCF) beat estimates by 9.5%.

Q2 Guidance & Valuation:

- Q2 revenue guidance missed estimates by 1.6%.

- Q2 GPM guidance met estimates.

- Q2 EBIT guidance missed estimates by 2.7%.

Spotify trades for 46x forward FCF. That is by far the best metric for this firm considering the payroll tax noise on the income statement. FCF is expected to grow by 30% Y/Y this year and by 26% Y/Y next year. FCF estimates likely will modestly rise following this report.

Balance Sheet:

- €7.8B in cash & equivalents.

- €2B in long-term investments.

- €1.65B in convertible senior notes.

- Share count rose by 3.1% Y/Y.