Table of Contents

- a. Key Points

- b. Demand

- c. Profits & Margins

- d. Balance Sheet

- e. Guidance & Valuation

- f. Call & Release

- f. Take

a. Key Points

- The strong quarter was slightly held back by larger-than-expected FX headwinds. It still overcame this challenge to deliver mostly outperforming results.

- Guidance was held back by a massive FX headwind, LA Wildfires & Southeast snowstorms. If we exclude the incremental FX challenge (keeping weather headwinds) bookings guidance would have beaten estimates.

- “More confident than ever” on its autonomous vehicle (AV) positioning.

- Well on its way to achieving 3-year financial targets set in 2024.

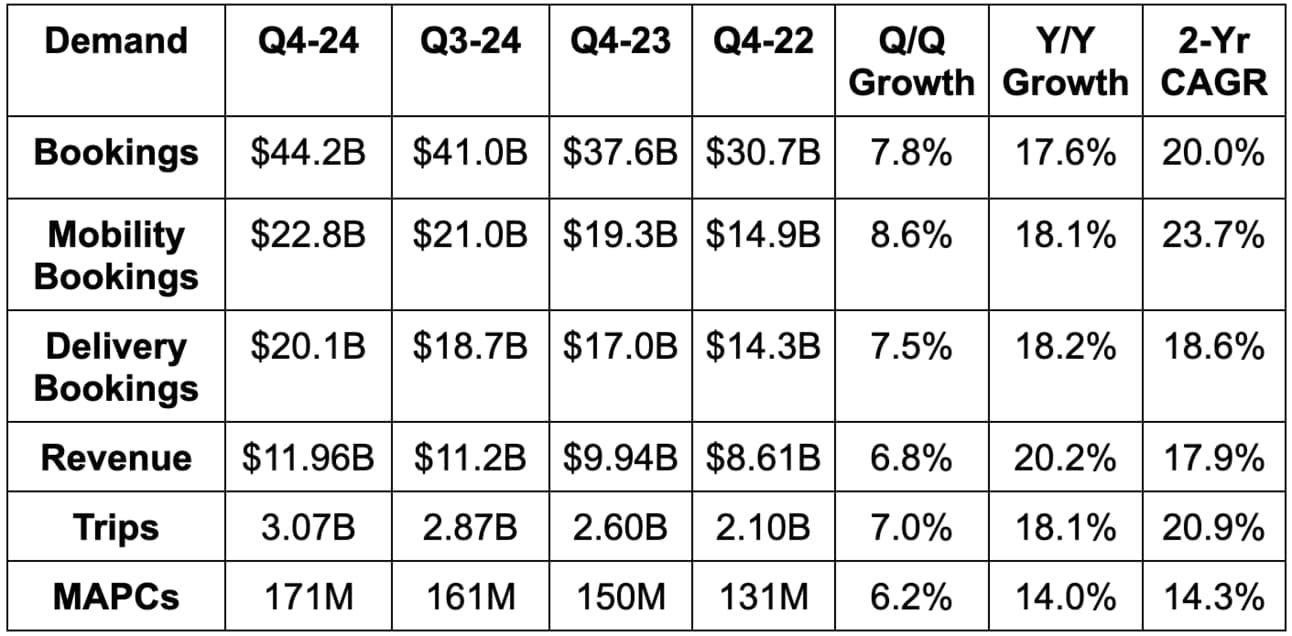

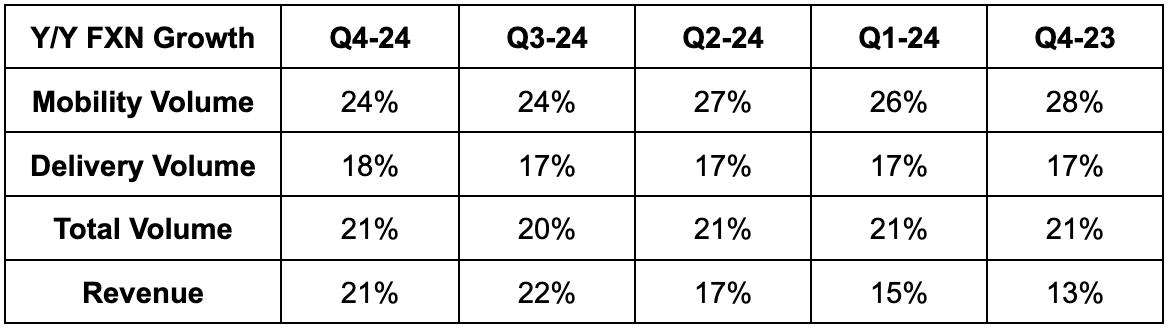

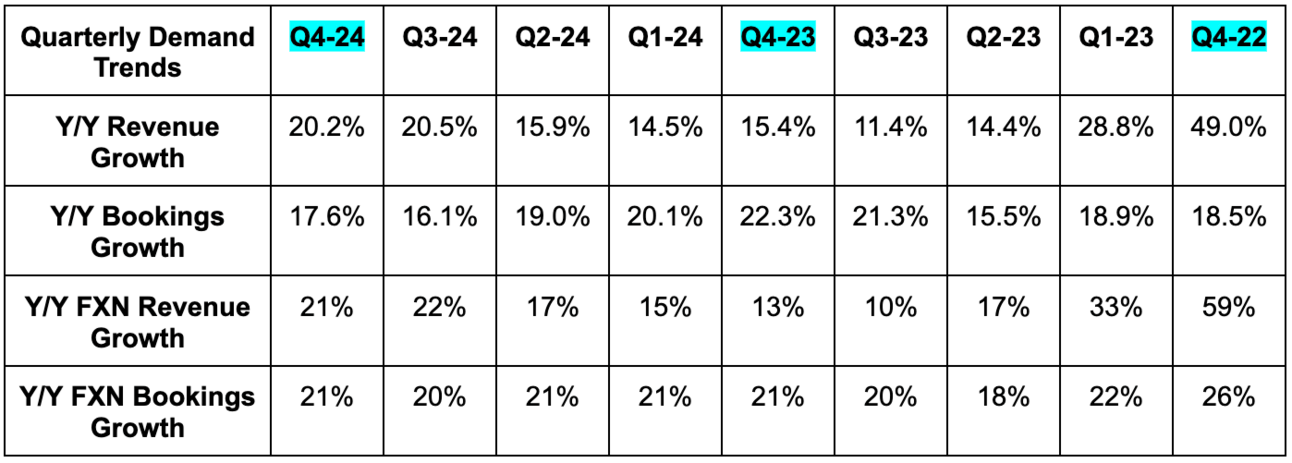

b. Demand

- Beat bookings estimates by 1.8% & beat guidance by 1.6%. This is despite a 3-point foreign exchange (FX) headwind during the quarter vs. a 2-point headwind assumed in its guidance.

- Mobility beat by 1.3%.

- Delivery beat by 2.0%.

- Freight slightly missed $1.31 billion bookings estimates.

- Beat revenue estimates by 1.6%.

- Beat user estimates by 1.5%.

- Met 6 trips per user estimates.

- Met stable Y/Y trip growth guidance with 18% Y/Y growth.

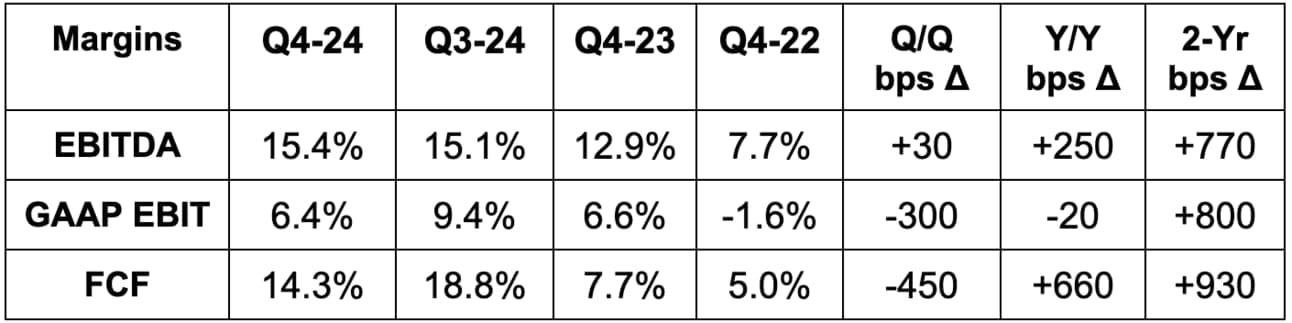

c. Profits & Margins

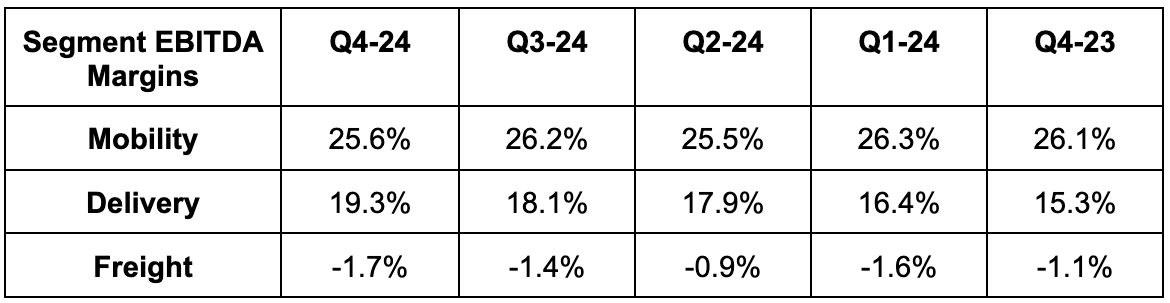

- Note that Uber costs are largely denominated in non-dollar currencies. This means there’s lower impact on profit than demand.

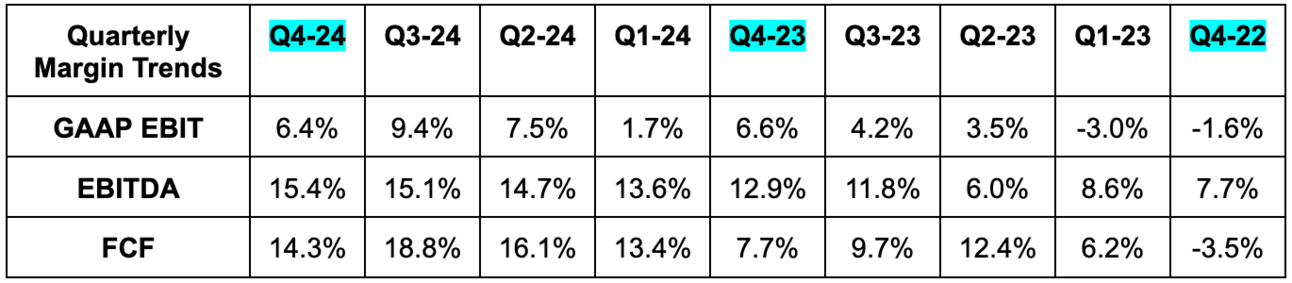

- Slightly missed EBITDA estimates & beat EBITDA guidance by 0.7%.

- Fixed cost leverage from continued revenue growth drove the margin expansion here. Ads growth for the delivery business helped too.

- Beat FCF estimates by 38%.

- Missed GAAP EBIT estimates by 35%. This was due to $462M in GAAP discrete legal charges. Excluding this impact, GAAP EBIT was about 5% ahead.

- Beat $0.48 GAAP EPS by a massive margin due to $6.38 billion in tax and equity valuation benefits. This is a worthless metric for Uber specifically.

d. Balance Sheet

- $7B in cash & equivalents.

- $15.5B in investments including restricted.

- $8.3B in debt. Redeemed $2B in debt during the quarter.

- Diluted share count rose 0.9% Y/Y.

“We believe we remain undervalued despite these strong fundamentals, and plan to be active and opportunistic buyers of our stock… we remain on track to steadily reduce our share count.”

CFO Prashanth Mahendra-Rajah

“Over the coming years, we plan to be opportunistic and monetize our $8.5B in equity stakes in a judicious manner to maximize the long-term value for Uber and our shareholders. We will utilize those proceeds in line with our capital allocation priorities.”

CFO Prashanth Mahendra-Rajah