Table of Contents

- 1. Disney (DIS) — Earnings Review

- 2. Amazon (AMZN) — Earnings Review

- 3. Cloudflare (NET) — Earnings Review

1. Disney (DIS) — Earnings Review

a. Key Points

- Solid quarter across the board.

- Reiterated guidance.

- The film business has fully recovered.

- The Treasure cruise ship launch went “spectacularly.” Good proof of concept as Disney plans to roughly double its fleet size over the coming years.

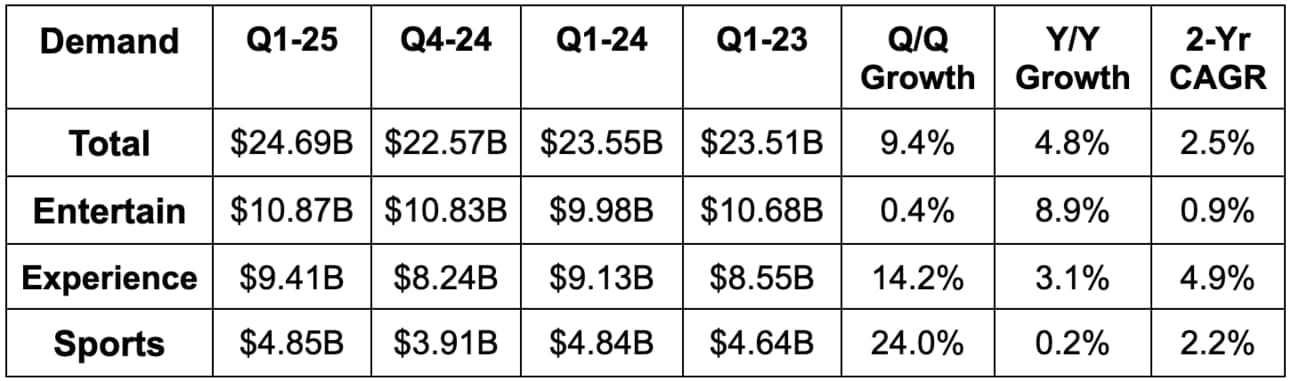

b. Demand

- Beat revenue estimates by 0.5%.

- Missed entertainment revenue estimates by 1.2%.

- Beat experiences revenue estimates by 1.2%.

- Beat sports revenue estimates by 3.2%.

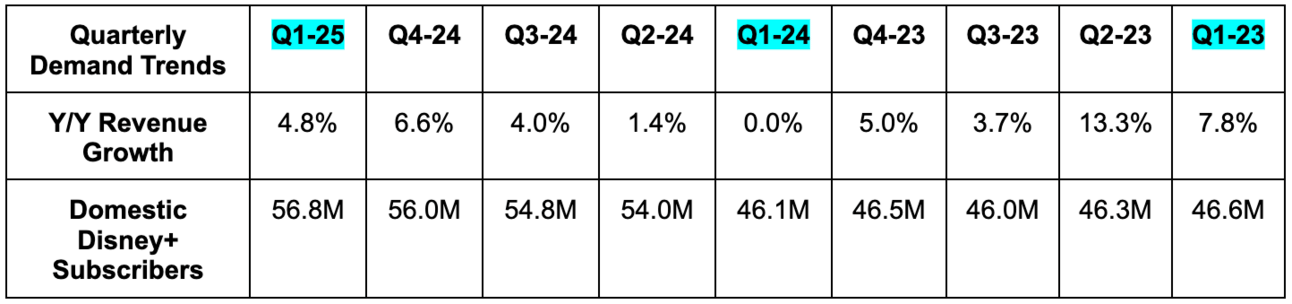

- Beat domestic Disney+ subscriber estimates by 2%. Met subscriber guidance.

- Disney+ subscribers overall fell 1% Y/Y (price hikes).

- Beat Hulu subscriber estimates by 2.4%. The portion of Hulu not merging with Fubo beat subscriber estimates by 3.5%.

- Hulu subscribers overall rose by 3% (price hikes).

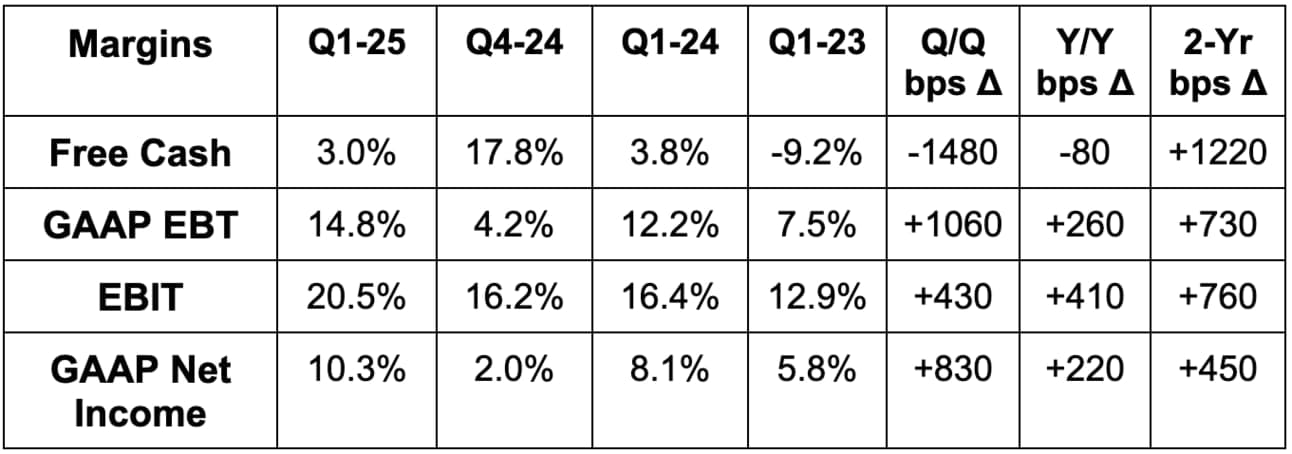

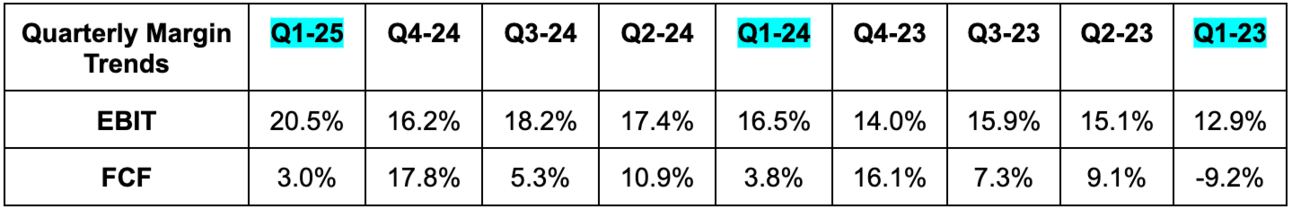

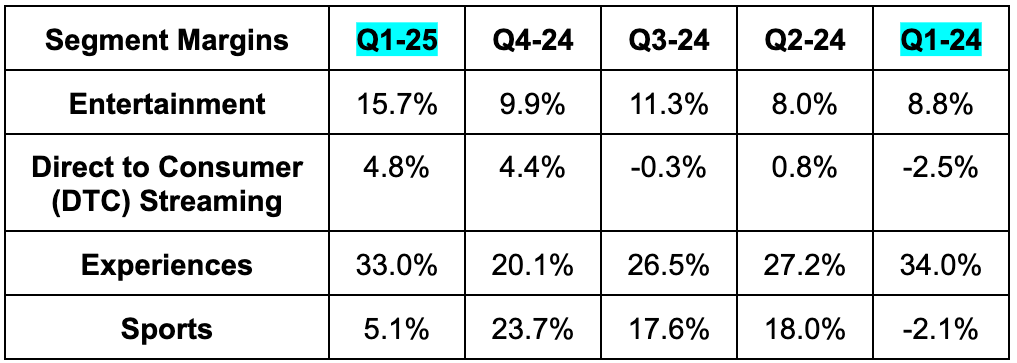

c. Profits & Margins

- Beat EBIT estimates by 18%.

- Beat Entertainment EBIT estimates by 17%. Disney incurred $195 million in total headwinds from hurricanes and cruise pre-opening costs. This compared to guidance calling for $220 million in headwinds, which helped a bit. Without this help, the segment still beat by 16%.

- Sports EBIT was $247M vs. $23M expected.

- Experiences EBIT beat by 4%.

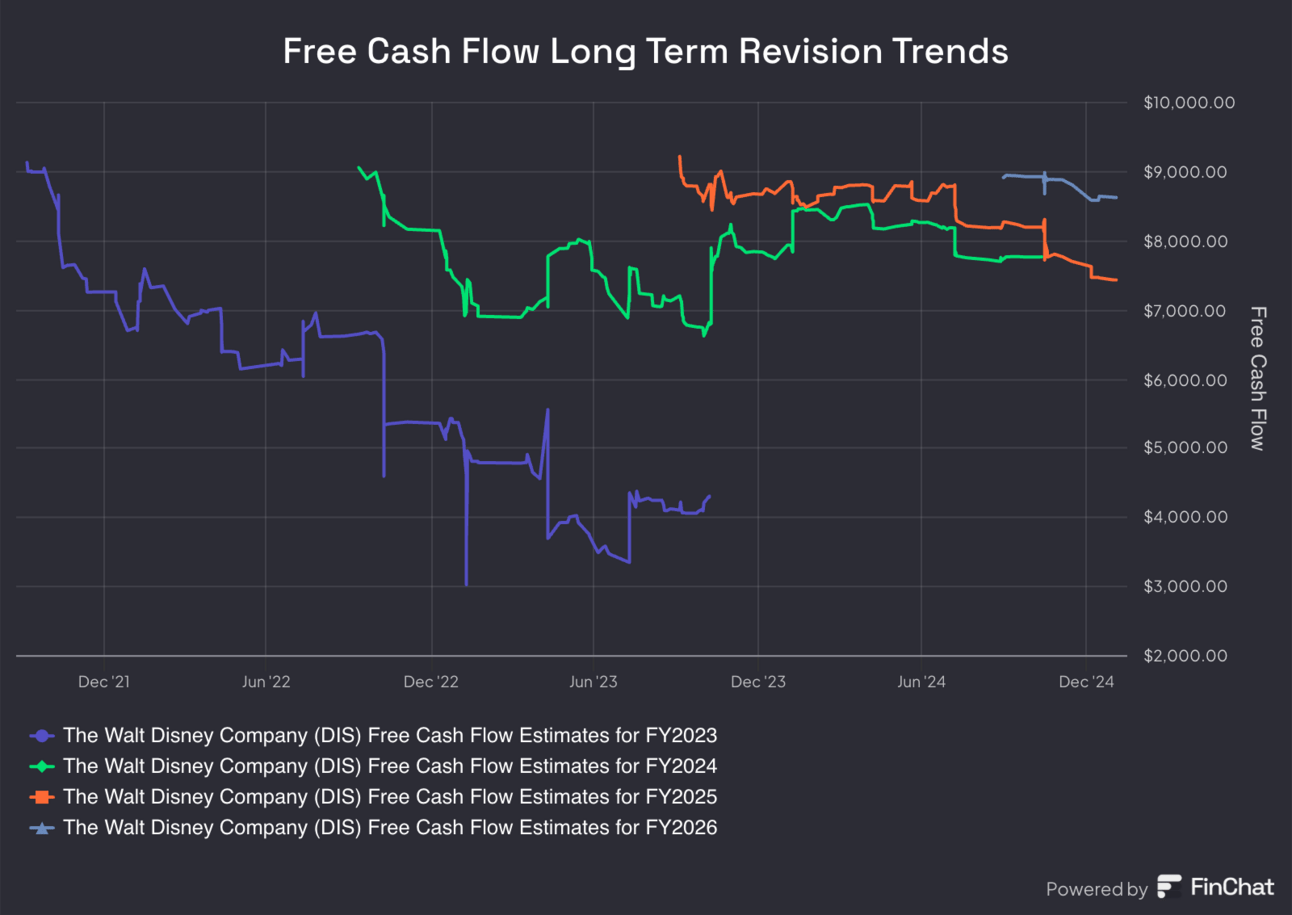

- Beat FCF estimates by 5%. $2.08B in CapEx vs. $815 Y/Y to support experience expansion.

- Beat $1.42 EPS estimates by $0.34.

d. Balance Sheet

- $5.5B in cash & equivalents; $8.9B in investments; $1.1B in land; $4.6B in projects in progress.

- $38.7B in debt.

- Declared a $0.50 per share dividend vs. $0.30 Y/Y.

- Diluted share count fell by 1% Y/Y.

e. Guidance & Valuation

Disney reiterated 2025 guidance. It continues to expect high single-digit EPS growth, 10%+ entertainment EBIT growth, 13% sports EBIT growth and 7% experiences EBIT growth. It also reiterated its $15 billion operating cash flow (OCF) guidance. After the large profit beats, some wanted an annual guidance raise. Here’s what leadership had to say about that:

“The strong Q1 increases our level of confidence in the guide… We're certainly not afraid to over-deliver if the business momentum gives us that… it's just premature to be thinking about raising guidance, in my opinion, after just 1 quarter results.”

CFO Hugh Johnston

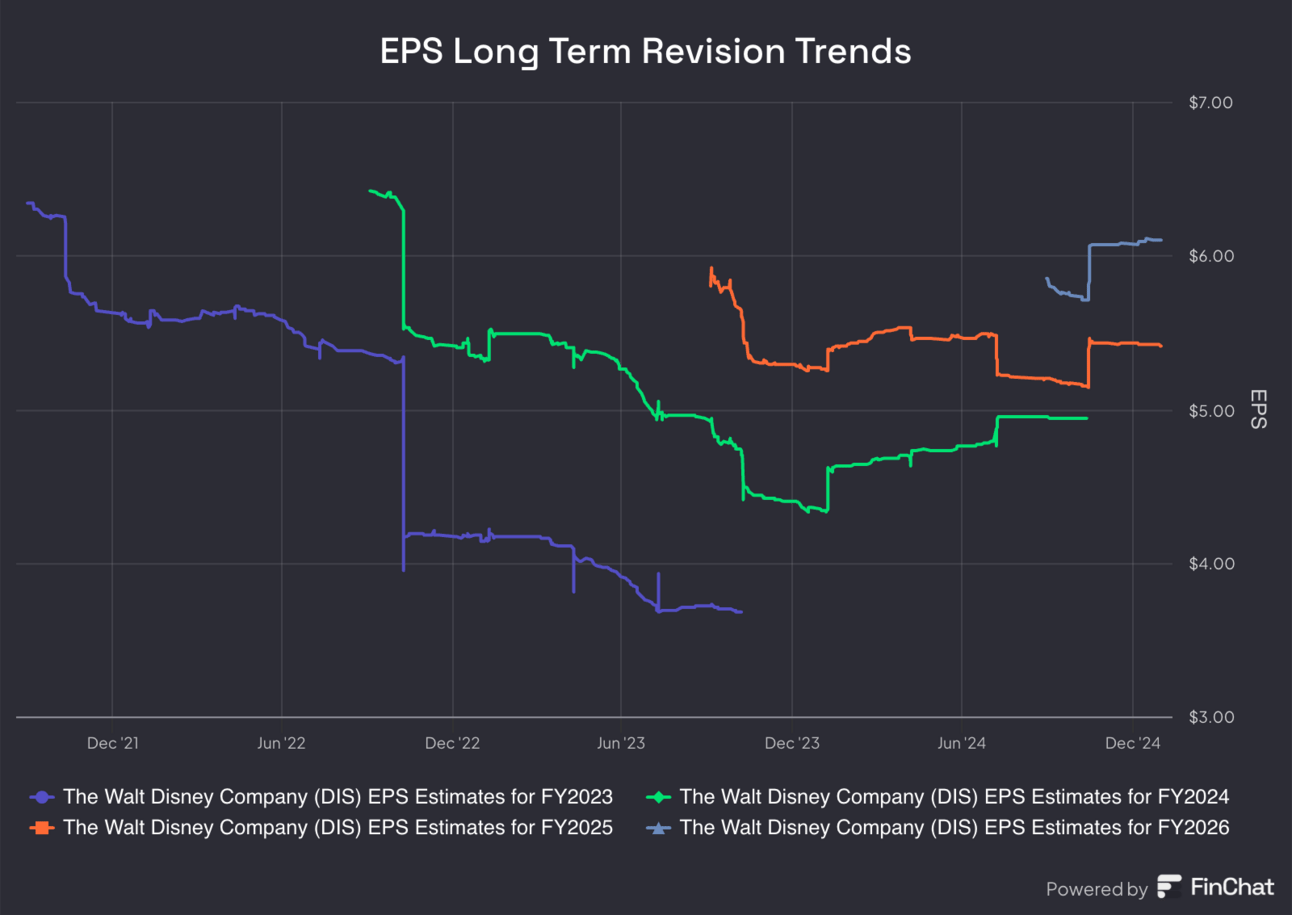

Disney trades for 20x forward EPS and 28x forward FCF. EPS is expected to grow by 10% this year and by 12% next year. FCF is expected to decline by 19% following 75% Y/Y growth and then grow by 25% the following year. EPS estimates should be safe. FCF estimates may fall a tad more.

f. Call & Release

Results Context:

Disney and Reliance Industries Limited (RIL) closed their transaction in November. This creates a joint venture combining Disney’s entertainment assets there (including Disney+ Hotstar) with RIL. Reliance owns 56% of the new entity, with Disney owning 37% and a private investor the remaining 7%. This had some significant impacts on the Entertainment and Sports segments this quarter. The transaction led to Disney’s India business generating $74 million in Entertainment EBIT vs. $254 million Y/Y and $9 million in sports EBIT vs. -$636 million Y/Y, thanks to things like fewer cricket rights for the quarter. Despite the EBIT headwind for Entertainment, the segment still generated nearly 100% Y/Y growth in profit. This is because of great content licensing success (thank you hit films) and streaming inflecting to positive EBIT Y/Y. Both of those buckets offset an 11% linear EBIT decline. Modest overall subscriber growth and higher subscriber fees both helped while foreign exchange hurt a bit.

The RIL deal is also why streaming advertising revenue actually fell by 2% Y/Y. When excluding this deal, ad growth was 16% Y/Y.

Next, note that Disney conducted sizable price hikes in the recent past for Disney+ and Hulu, which is why Disney+ subscribers fell slightly Q/Q. That’s expected to happen again this Q, as the price hikes finish working their way through the system. This also led to average revenue per user (ARPU) strength for the two products.

EBIT for domestic ESPN fell Y/Y due to more college football playoffs (CFP) and NFL playoff rights. This powered 9% Y/Y revenue growth and 15% advertising revenue growth alongside -9% Y/Y EBIT growth. Price hikes are also working their way through ESPN+, which led to -3% Y/Y subscriber growth and 7% average revenue per user (ARPU) growth. International ESPN EBIT benefited heavily from the RIL merger. Finally in sports, exiting its previously planned “Venu Sports” joint venture lowered segment EBIT by $50 million.

Streaming Progress & Growth:

Streaming continues to be a “success story” in the eyes of Disney leadership. Most of that progress can be seen in outperforming Y/Y EBIT growth, while leadership also hinted at current streaming guidance being conservative.

This success is not currently showing up in subscriber growth for Disney+ specifically, as again Disney is still dealing with higher churn related to large recent price hikes across the products. The company expects to grow overall streaming subscribers for the year, and Q1 outperformance increases its overall confidence in doing so.

Looking ahead, there are a few large pieces of Disney’s plans to drive durably profitable growth in streaming. First is on the product side. Whether it’s updating a rather stale home page, advancing content matching algorithms, building curated content playlists, operationalizing its paid sharing rollouts, conducting needed work on the international ad tier offering or creating more targeted, relevant ad experiences, there are many things to do here. Iger doesn’t see one project as the most important, but sees them all contributing to improving engagement and retention. It has made “significant progress” on this platform enhancement initiative but there’s still more work to do.

The other big piece of its plan is offering Hulu and its ESPN Flagship streaming product (coming this fall) right from within Disney+ (and as standalone products too). For Hulu, adding it to the Disney+ content library as an add-on directly drove engagement and made Disney+ the primary streaming product for 50%+ of bundlers. This “reaffirms the belief in the power and value of aggregating content and brands in one app.”

ESPN is still in its transition phase from linear-only to linear and direct-to-consumer (DTC). When that happens, the app will add features like betting, stats, fantasy sports and so much more to deepen engagement. For now, ESPN+ (and its far slimmer offering) remains the centerpiece of its sports streaming approach. Disney continues to gradually infuse new sports studio shows into the ESPN+ offering, with a new sports studio with a new SportsCenter show (SC+) exclusively aired there. SC+ is a baby step while ESPN Flagship is the major leap.

Management also addressed other competitors like Netflix entering the live sports fold:

“Other streamers are getting into sports. We have the advantage of not only an unmatched menu of sports & programming, but we're on 365 days a year, 24 hours a day. So if you're a sports fan, it's not about 1 boxing event or 1 day of football, it's about sports every single day of the year and every hour of the day.”

CEO Bob Iger

Linear Decay Process:

For the last few years, the permanent, inevitable decline of linear television has been a large headwind for Disney’s results. This year, streaming should greatly close the EBIT gap with linear, while also generating more than double the revenue that linear will. There’s a lot of leverage left to enjoy for that now larger revenue base.

Streaming’s EBIT progress has helped remove linear as a financial burden in the eyes of Iger. He thinks linear is now enhancing Disney’s overall go-to-market by serving as a top-of-funnel to entice people to eventually join a streaming service. He thinks linear is now “enhancing the overall television business,” as shows like Abbott Elementary see very different audiences between linear and DTC. It’s still more incremental than many think.

While streaming will be the future, Disney doesn’t want to force people to cut the cord before they’re ready. It wants consumers to be able to watch its content in whatever way they’d like to. Whether that’s a traditional linear bundle, emerging “skinny bundles” (more granular channel packages offered DTC) or watching through an app, it wants to be there. That’s why products like ESPN will continue to be offered via traditional outlets years after the app goes like this year.

Entertainment – FUBO, ESPN Flagship Venu & Skinny Bundles:

We got some more details on the Fubo venture, exiting Venu and the advance of skinny bundles. First, why Fubo? I spoke about it a bit here (section 3), and leadership added a bit more color. To Iger, this deal means Hulu’s Live TV business (which is what is merging with FUBO) will get the time and resources that it deserves to make it a best-in-class product. This is a non-core business for Disney overall and even Hulu specifically. Disney did not want to make it a major focus area, and this helps it prioritize. As long as they’re right to trust Fubo’s current leadership team, which will be highly influenced by Disney’s majority stake and board presence, I think this was a good decision.

Part of this arrangement entails Fubo creating another skinny bundle out of the overarching sports rights between the two companies. That will give ESPN yet another distribution outlet, along with other skinny bundles like the DirecTV My Sports package. These skinny bundles, to Iger, made Venu “redundant,” which is part of why the company backed out.

Content Success:

In films, Disney’s choice to “return creativity to the center of the company” is paying dividends. It was the first company to cross $5 billion in box office revenue since 2019 and delivered the top 3 films of the year; it has a large slate of titles including Zootopia 2 and Avatar 3 coming this year. Moana 2 crossed $1 billion in sales and helped make the original Moana the most streamed movie in the USA for the second straight year. A new Moana stage show was also made a central piece of the Treasure cruise ship entertainment repertoire. This just goes to show how powerful a hit film franchise can be for the rest of Disney’s business. In TV, Disney had the top 4 shows in the USA by hours streamed. Bluey… AKA ole reliable… took the top spot, with Grey’s Anatomy, Family Guy and Bob’s Burgers rounding out the top 4. ABC’s David Muir remained #1 in news for his 9th straight year.

Top 3 films and top 4 shows streamed. That’s pretty good… right? I include this to remind everyone that Disney still has a fortress of high-quality intellectual property. To me, this creates a highly compelling worst-case scenario for the streaming business. Either it continues to grow on its own, or realizes mega-cap tech names like Amazon, Apple, Alphabet and Netflix are too tough to outspend and outcompete. In that world, I think Disney could build a massively successful licensing business to keep its IP alive and well and its parks packed. Content is king… and the king provides insulation from being left behind as this industry rapidly evolves. I do think Disney+ will succeed alone and do think Disney is best-positioned out of legacy media to keep winning. But I also love a compelling plan B.

- Monday Night Football enjoyed its second-best viewership season in its 19 years of having it.

- ABC enjoyed 56% Y/Y growth in average college football viewership, as more SEC football rights were clearly welcomed.

Experiences:

There’s a lot of skepticism surrounding Disney’s ability to reach its 7% EBIT growth target for this segment in 2025. Flat growth in Q1 and a reliance on back-half-weighted revenue have a lot to do with that, but again, that flat growth was related to hurricanes and pre-opening costs. Guest spending levels continue to grow and traffic was just fine when excluding extreme weather. Regardless, EBIT outperformed management’s internal expectations. To CFO Hugh Johnston, Q1 made them more confident in this 7% goal being comfortably attainable. Confidence is also coming from strong bookings trends that persisted throughout the quarter and a “spectacular” launch for its new Disney Treasure cruise ship. Rooms are selling out and this product will be profitable on a non-GAAP basis immediately.

“Overall, our level of confidence in the Experiences guide is high.”

CFO Hugh Johnston

NBA Ratings Weakness:

They were asked about ratings declines in the NBA as its content fees rise and it’s locked in for 11 years. They’re not concerned and view it as a “marquee part of ESPN’s offering.” They sort of need to say this after committing so much money, but still good to hear.

g. Take

Another rock-solid quarter for Disney. Iger has clearly gotten this company on the right track and I think guidance for the year will eventually be raised, likely next quarter. Disney’s streaming business has obviously turned a corner while product enhancements, bundling and hit films should all help deliver slow and steady subscriber growth over the coming years. I do not think paid password sharing will provide the kind of aggressive acceleration in subscriber growth that Netflix enjoyed, as that product is higher-quality today than Disney+, but I do still think that will help. Streaming is rapidly turning into a formidable EBIT replacement for linear’s permanent decline, and I would argue the ceiling for streaming is higher, given the inherently more precise advertising processes it supports vs. cable.

Disney’s experiences business dealt with headwinds better than it was supported to and the sports business is poised to launch its ESPN Flagship streaming service this fall. The valuation is reasonable, the execution is brightening and I continue to be a confident shareholder for now. I personally like the idea of having a boring blue-chip company in the portfolio like this one.