The majority of this week’s content has already been sent. In case you missed it:

- SoFi Earnings Review.

- PayPal Earnings Review.

- Meta, Robinhood & Starbucks Earnings Reviews.

- Amazon & Microsoft Earnings Reviews.

- Updated holdings & performance vs the S&P 500

Housekeeping:

Next week, earnings reviews will be sent on – Palantir, Hims, Datadog, AMD, UBER, Shopify, Trade Desk, Mercado Libre, DraftKings, Cloudflare, Lemonade, Coupang. Snapshots on Axon, Celsius, AppLovin and Coinbase will also come on Saturday.

The remainder of my Spotify & Airbnb reviews will come in the coming weeks. Not next week, considering there are more than 10 reviews I need to write, but they’re coming. Part one (detailed financials) was already sent for each.

Table of Contents

- 1. Brief Earnings Snapshots

- 2. Apple (AAPL) – Earnings Review

- 3. Duolingo (DUOL) – Earnings Review

- 4. Uber (UBER) – Autonomy Momentum

- 5. Headlines

- 6. Macro Data

1. Brief Earnings Snapshots

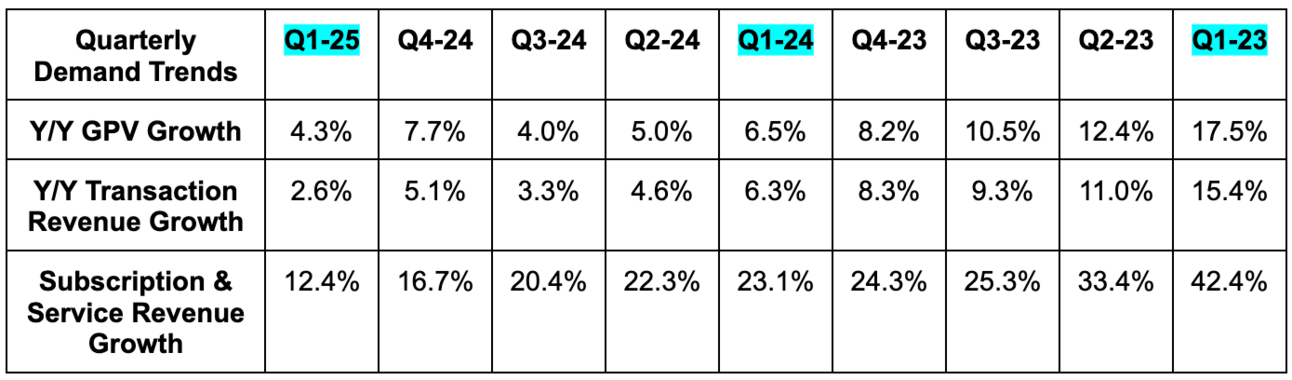

a. Block (XYZ — for some reason)

I do not plan on writing a review for Block. I think Square and Cash App are good assets. I think leadership needs to be completely overhauled. They’ve had more than enough time and things are getting worse. I don’t think giving this company a lot of attention is worth it until a new team steps in.

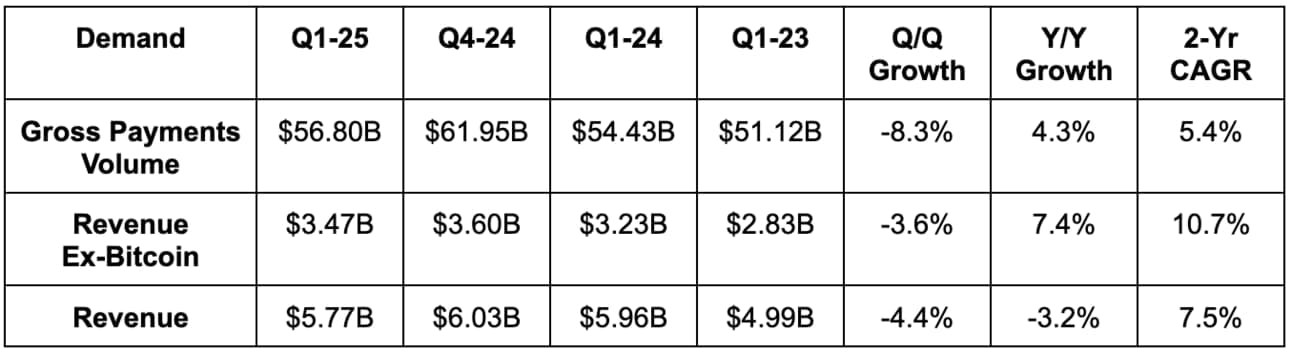

Demand:

- Missed revenue estimates by 6.6%.

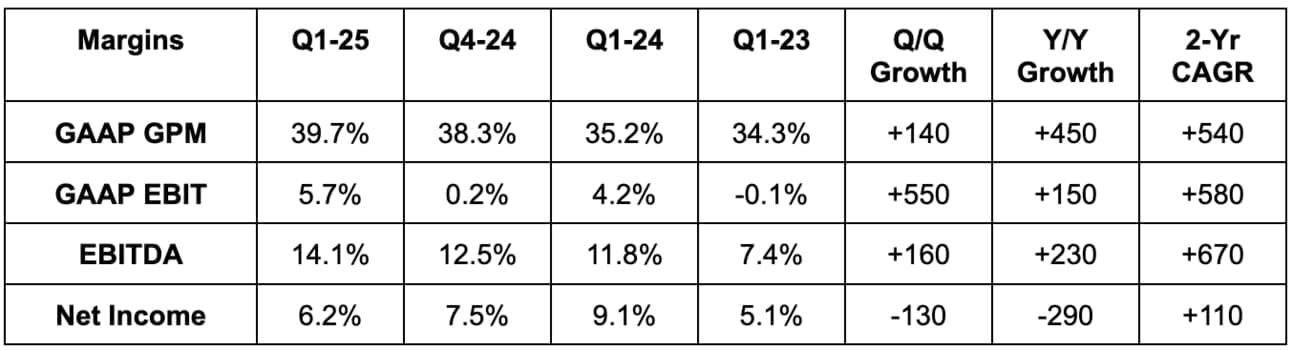

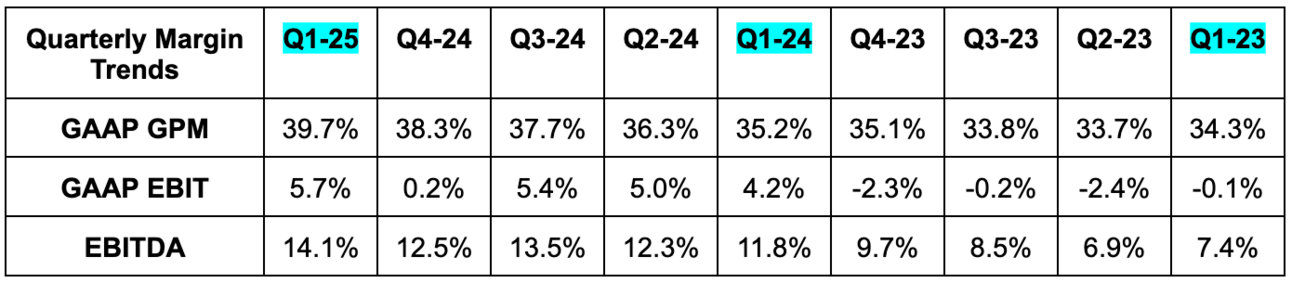

Profits & Margins:

- Beat EBITDA estimates by 3.1%.

- Missed GAAP EBIT estimates by 12.9%.

- Missed $0.48 GAAP EPS estimates by $0.18.

- Beat gross profit guidance by 1.3%.

- Beat adjusted operating income (not the same as EBITDA or GAAP EBIT) guidance by 8.4%.

Balance Sheet:

- $7.09B in cash & equivalents.

- $5.11B in long term debt.

- Diluted share count fell by 0.3% Y/Y.

Guidance & Valuation:

- Lowered annual gross profit guidance by 2.5%.

- Lowered annual adjusted EBIT guidance by 9.5%.

Block trades for 17x forward EPS. EPS is expected to fall by 55% Y/Y this year and grow by 58% Y/Y next year.

b. Mastercard (MA)

Demand:

- Beat revenue estimates by 1.8% & beat low double-digit growth guidance.

- USA volume rose 7% Y/Y; USA credit rose 6% Y/Y; debit rose 9% Y/Y.

- April USA volume growth accelerating to 8% Y/Y.

- Switched transactions growth accelerated from 9% to 11% Y/Y quarter-to-date.

- Rest of World volume rose 10% Y/Y. Credit rose 2% Y/Y; debit rose 7% Y/Y.

- Cross-border volume growth accelerated from 15% Y/Y in Q1 to 17% Y/Y quarter-to-date.

“We're operating in an uncertain environment. Consumer and business sentiment has weakened primarily due to concerns surrounding the impact from tariffs and geopolitical tensions. On the other hand, so far this year, the fundamentals that support consumer spending have been solid and our drivers are generally stable.”

CEO Michael Miebach

“The headline is that our business remains strong and consumer spending remains healthy. On the macroeconomic front, the fundamentals that support consumer and business spending have been solid to date. Specifically, unemployment rates remain low and for the most part, wage growth continues to outpace the rate of inflation. At the same time, increased economic and geopolitical uncertainty has weakened sentiment and creates risks. But remember, our business is diversified.”

CFO Sachin Mehra

Profits & Margins:

Beat $3.73 EPS estimates by $0.17 and met its low double-digit growth guidance range. It beat low-teensFXN EPS growth guidance with 15% Y/Y growth.

Balance Sheet:

- $7.6B in cash & equivalents.

- $18.8B in long-term debt.

- Share count fell by 2.2% Y/Y.

Guidance & Valuation:

- Raised annual growth guidance from 10%-12% to 13%-14%. This beat estimates and led to a 1% rise in consensus revenue.

- Raised annual EPS growth guidance from 10%-12% to 13%-14%. This roughly met guidance, with stable estimates following the call. This raise was related to currency favorability, as FXN EPS growth guidance was maintained.

Mastercard trades for 34x forward EPS. EPS is expected to grow by 10% this year (I think that will rise a bit more) and by 17% next year.

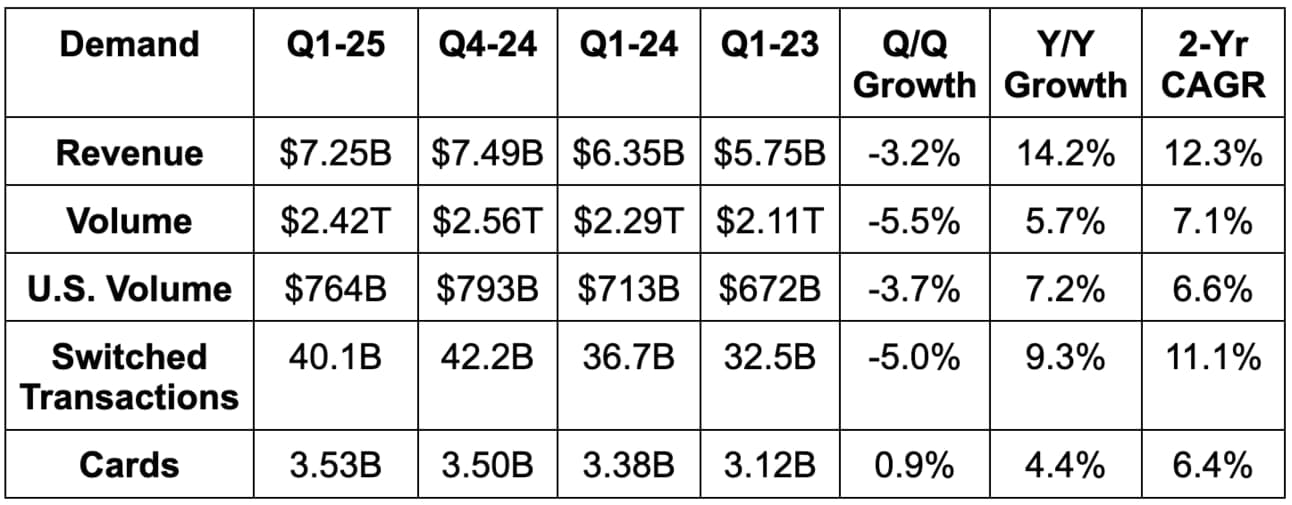

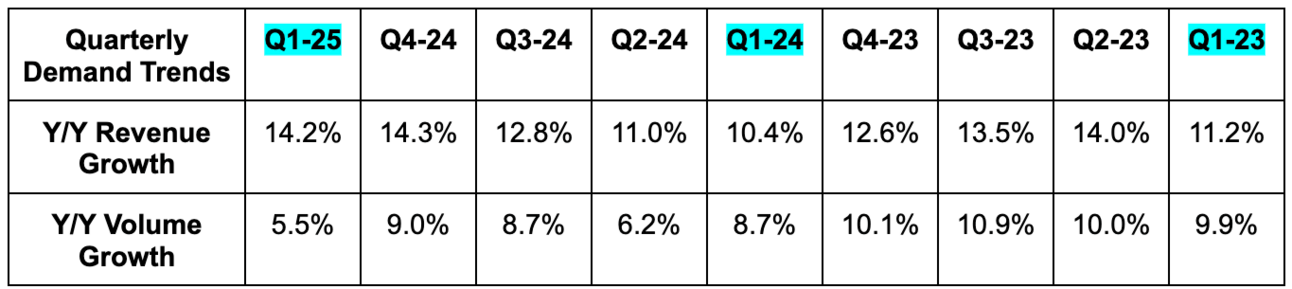

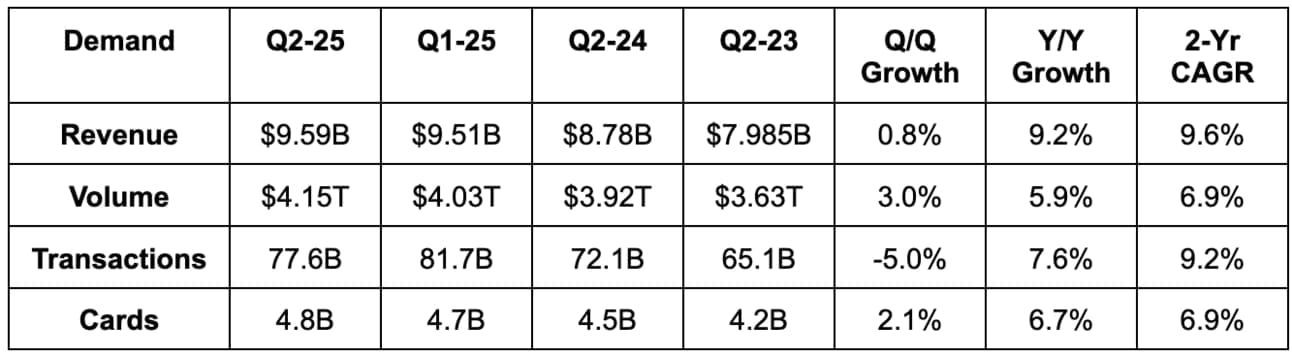

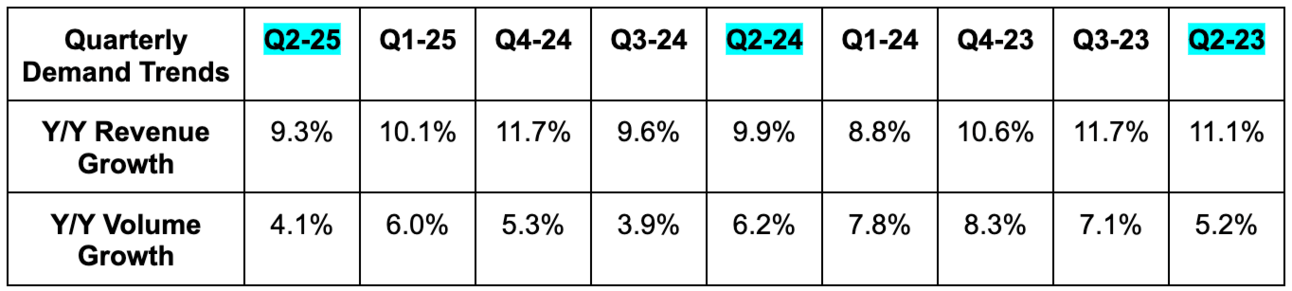

c. Visa (V)

Demand:

- Visa revenue beat estimates by 0.5%.

- 9.6% revenue growth roughly met guidance.

- Volume rose by 5% Y/Y vs. 7% Y/Y growth last quarter. FXN growth slowed from 9% to 8% over the same period.

- Debit rose by 7% Y/Y vs. 9% Y/Y growth last quarter. FXN growth slowed from 10% to 9% over the same period.

- Credit rose by 4% Y/Y vs. 6% Y/Y growth last quarter. FXN growth slowed from 8% to 6% over the same period.

It’s important to note that Leap Day made for tougher Y/Y comps. Growth has sped up sequentially so far this quarter, partially thanks to Easter and Ramadan timing.

“Our key business drivers were strong. Even with the lapping of leap day from last year and consumer spending remained resilient in an uncertain and dynamic environment.” – CEO Ryan Mclnerney

“Focusing on the U.S., in Q2 and through April 21, we have not seen any signs of overall consumer spending weakening. While spending growth differs among consumer spend bands, with the most affluent growing the fastest, all spend bands remain resilient and consistent with past quarters… Outside the U.S., we see similar stable trends.”

CEO Ryan McInerney

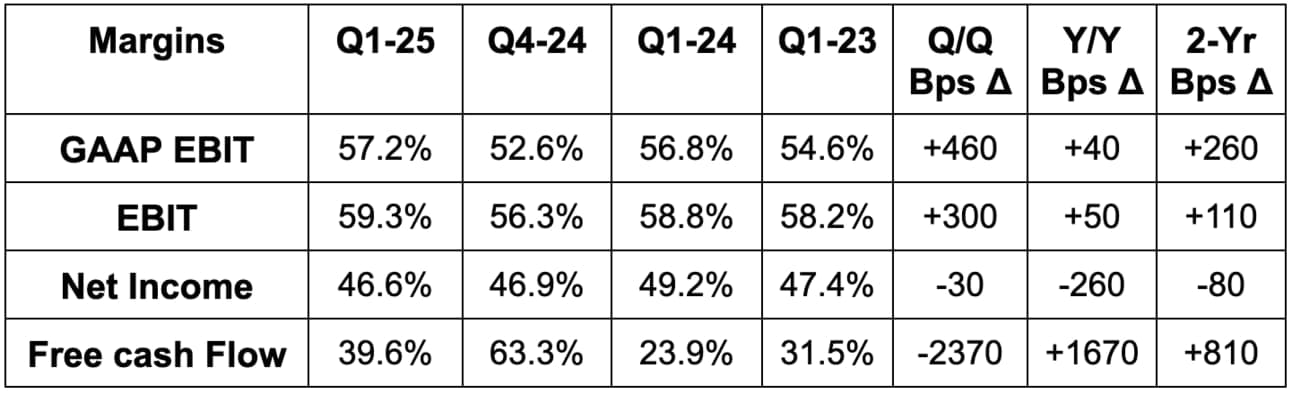

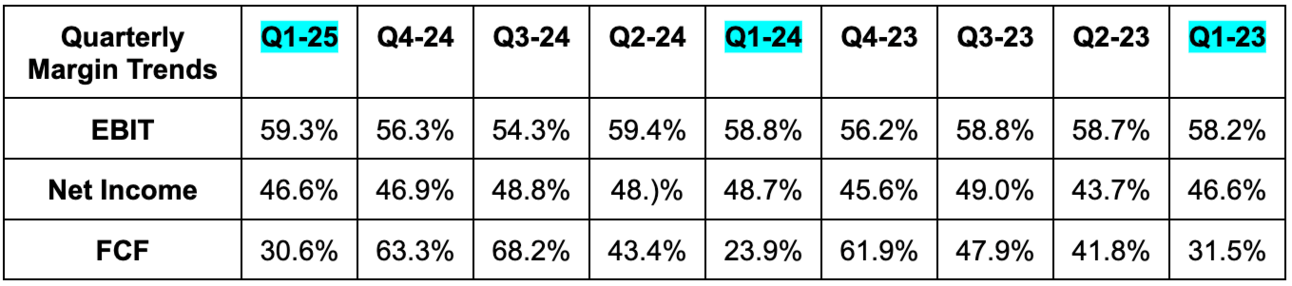

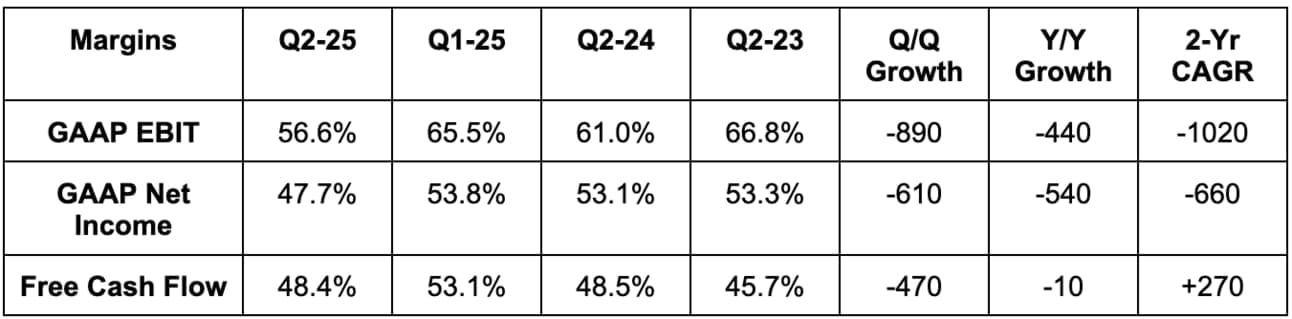

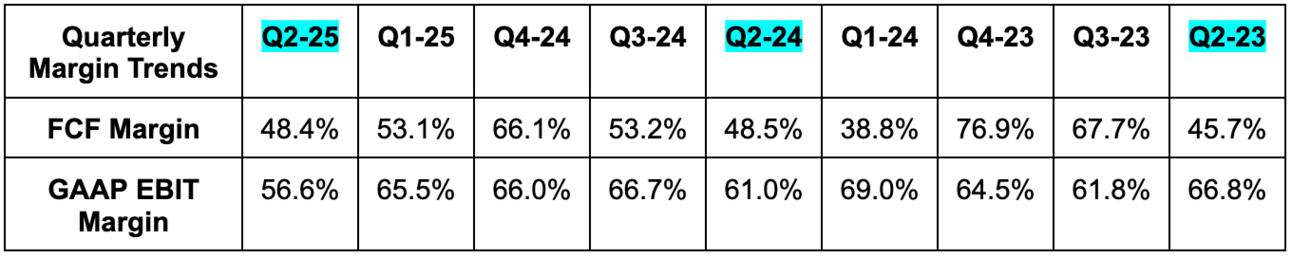

Profits & Margins:

- GAAP EBIT beat estimates by 1.2%.

- EPS beat $2.68 estimates by $0.08 & 10% Y/Y EPS growth beat high single-digit growth guidance.

Guidance & Valuation:

- Visa reiterated 10%-12% Y/Y annual revenue growth guidance, which roughly met estimates.

- Visa reiterated 13% Y/Y annual EPS growth guidance, which roughly met or slightly beat estimates. This led to modest upward EPS estimate revisions.

- It also reiterated 9%-11% OpEx growth for the year.

- For Q3 specifically, it expects 9%-11% revenue growth, 9%-11% OpEx growth and 8%-9% EPS growth.

Visa trades for 29x forward EPS. EPS is expected to grow by 17% this year and by 11% next year.

Balance Sheet:

- $11.73B in cash & equivalents.

- $16.B billion in long term debt.

- Share count fell by 3.2% Y/Y.