Most of this week’s content has already been sent. In case you missed it:

- Amazon, Cloudflare (part 1) and Disney Earnings Reviews

- Uber Earnings Review

- Alphabet and AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- My Updated Holdings & Performance

And other reviews sent so far this season:

- Meta, Tesla & Starbucks Earnings Reviews + DeepSeek News & Implications

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

Next week’s coverage will include earnings reviews on Shopify, The Trade Desk, Datadog, DraftKings, Airbnb, Palo Alto and Robinhood. My catch-up review on Chipotle will be published with Shopify on Tuesday morning. I also am planning snapshots on AppLovin, Coinbase and Upstart. Finally, I will cover several interviews from the Goldman Investor conference. Peak busy season rolls on…

Table of Contents

- 1. Earnings Snapshots

- 2. Cloudflare (NET) – Conference Call Q&A

- 3. Spotify (SPOT) – Earnings Review

- 4. Celsius (CELH) – Weak Nielsen Data & Quick Thou …

- 5. Lemonade (LMND) — Synthetic Agent Extension

- 6. Market Headlines

- 7. Macro

1. Earnings Snapshots

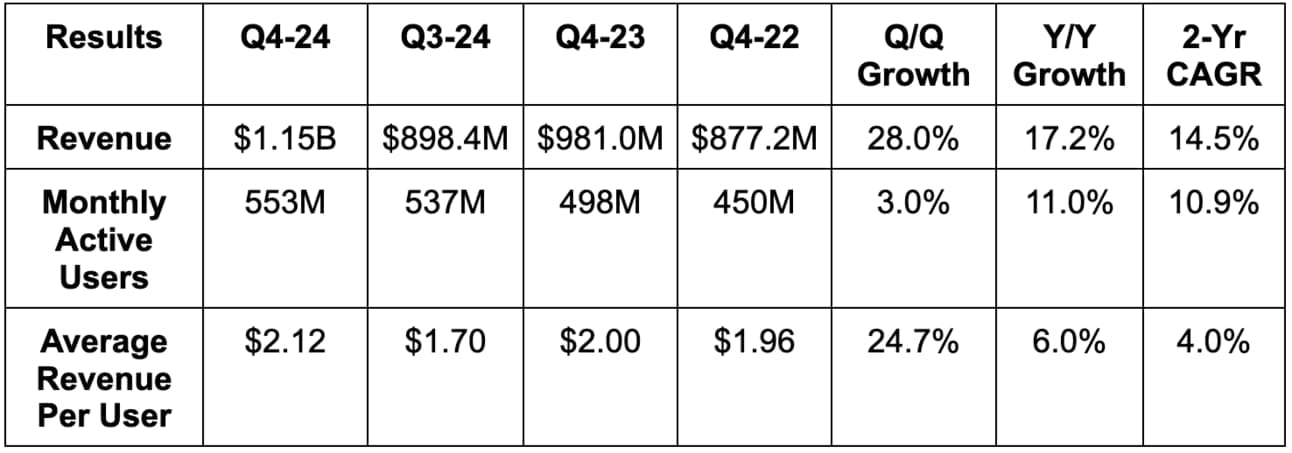

a. Pinterest (PINS) Earnings Snapshot

Results:

- Beat revenue estimates by 0.8% & beat guidance by 1.3%.

- Beat EBITDA estimates by 6%.

- Beat GAAP EBIT estimates by 6%. Beat OpEx guidance by 4%.

- Beat FCF estimates by 1%.

Guidance & Valuation:

- Q1 revenue guidance beat by 1.2%.

- Q1 EBITDA guidance beat by 18%.

- Slower pace of margin expansion in 2025 as expected.

Pins trades for 21x forward EPS. EPS is expected to grow by 45% this year and by 20% next year. Estimates materially rose following this report.

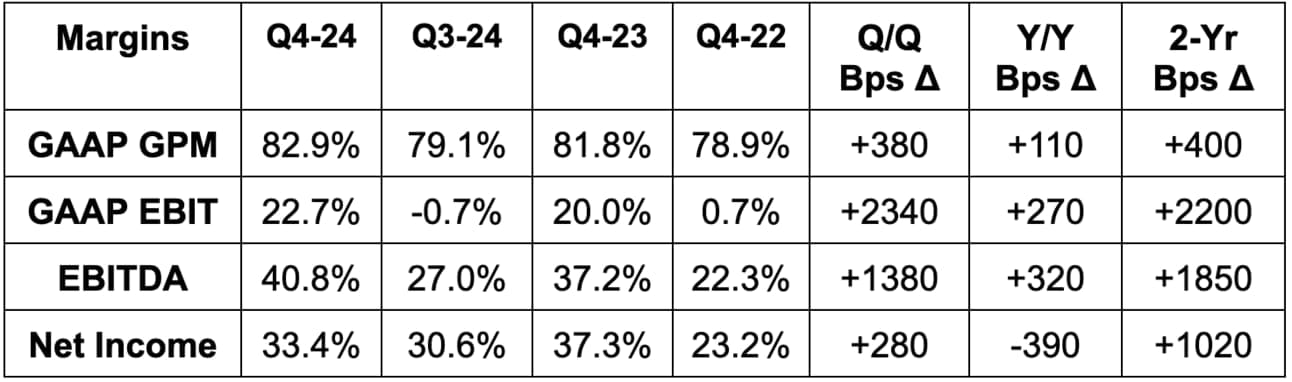

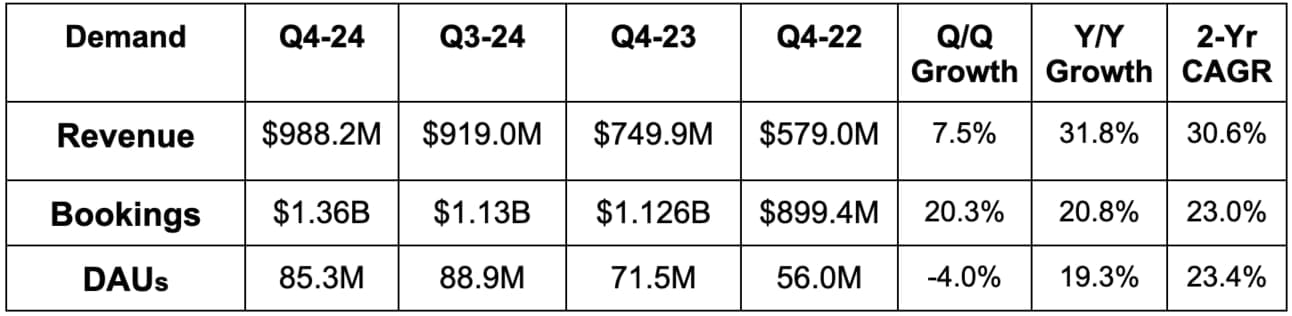

b. Roblox (RBLX) Earnings Snapshot

Results:

- Missed bookings estimates by 0.7% & beat bookings guidance by 0.8%.

- Beat revenue guidance by 4.4%.

- Beat $20M EBITDA guidance by $35M. Estimate data not comparable following accounting change.

- FCF doubled $108M guidance.

- Missed daily active user (DAU) estimates by 3.5%.

- Beat -$0.45 GAAP EPS estimates by $0.12.

Balance Sheet:

- $2.4B in cash & equivalents; $1.61B in long-term investments.

- $1B in long-term debt.

- Diluted share count rose by 5.4% Y/Y.

Guidance & Valuation:

- Annual bookings guidance slightly missed estimates. Q1 bookings guidance met estimates.

- EBITDA estimate data is not comparable to the new EBITDA disclosure format for RBLX. Backing out newly excluded items and making a best guess, it was roughly in line. Furthermore, annual estimates did modestly rise following this report.

- It expects $830 million in 2025 FCF, which missed $835M estimates.

- It also expects a $1.03 billion net loss for the year, which roughly met estimates.

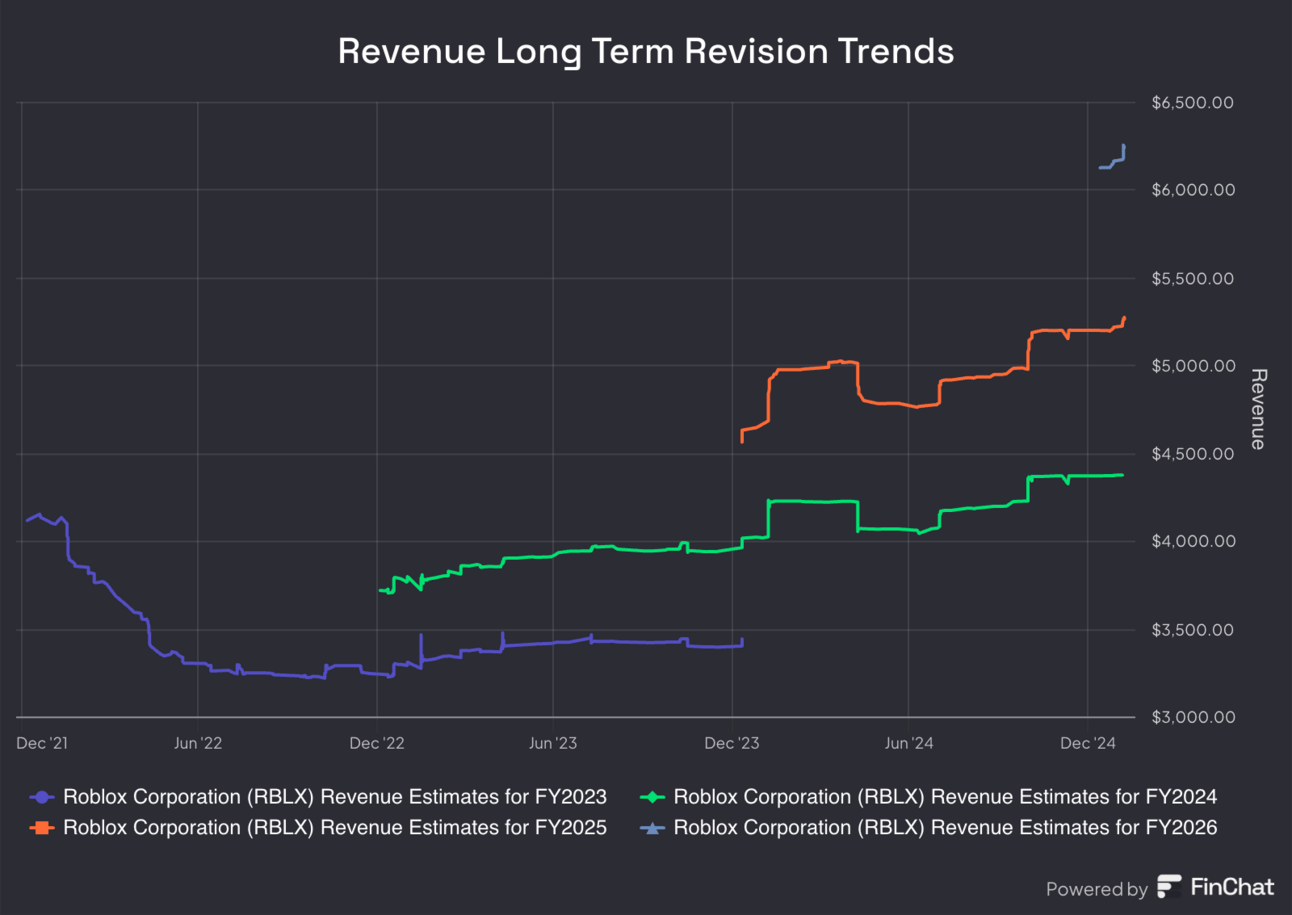

Roblox trades for 11x forward gross profit. Gross profit is expected to rise by 22% this year and by 19% next year.

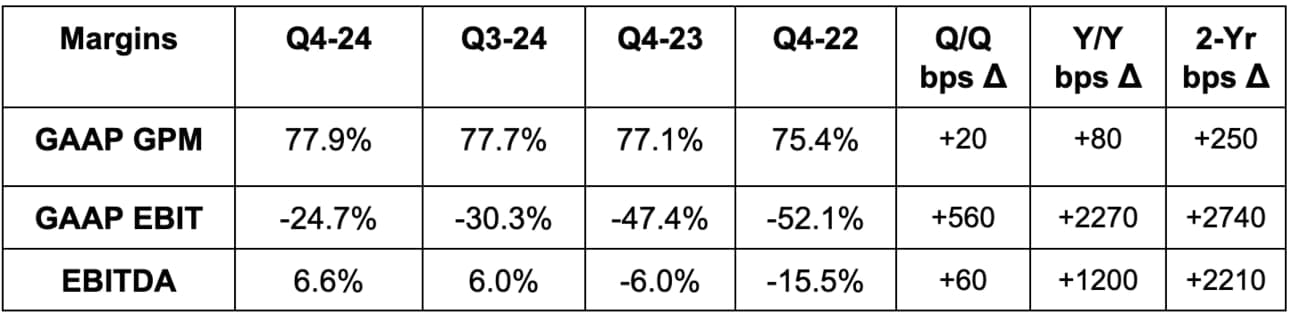

c. Affirm (AFRM) Earnings Snapshot

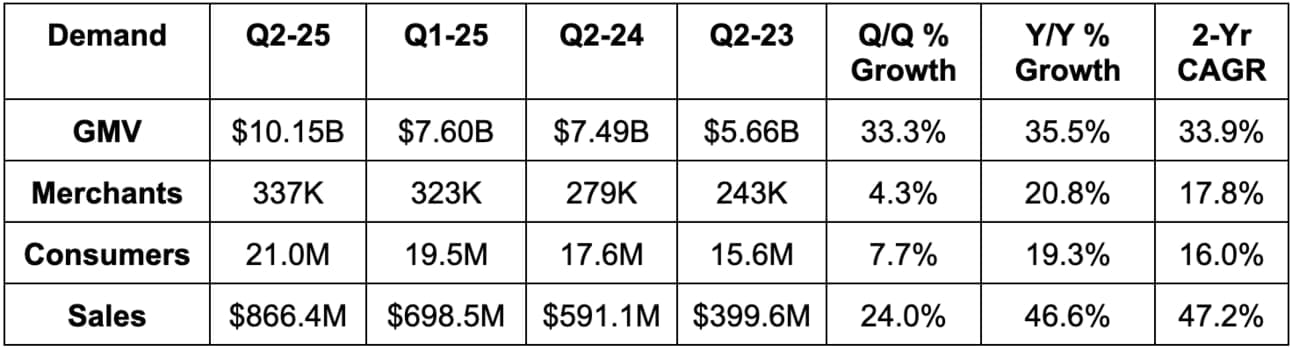

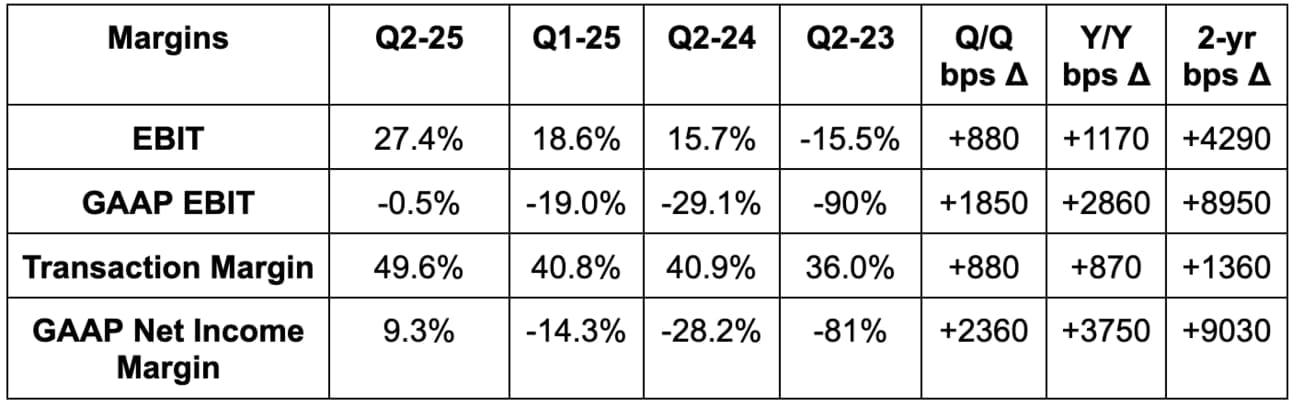

Results:

- Beat gross merchandise value (GMV) guidance by 6%.

- Beat revenue estimates by 7.2% & beat guidance by 9.7%.

- Beat 45.4% transaction margin estimates by 420 bps & beat guidance by 440 bps.

- Beat 22% EBIT margin estimates by 540 basis points (bps; 1 basis point = 0.01%).

Balance Sheet:

- $1.20B in cash & equivalents; $666M in securities available for sale at fair value.

- $363M allowance for credit losses vs. $350M Q/Q.

- $1.15B in convertible senior notes.

- $2.17B in funding debt.

- Diluted share count rose by 12.2%; basic share count rose by 4.7%.

Guidance:

- Raised annual GMV guidance by 3.1%.

- Set concrete annual revenue guidance of $3.16B, which implies a raise and beat estimates by 1.6%.

- Set concrete annual 45.4% transaction margin guidance, which implies a raise and beat over estimates of 44%.

- Raised annual EBIT margin guidance from 20% to 23%., which beat estimates.

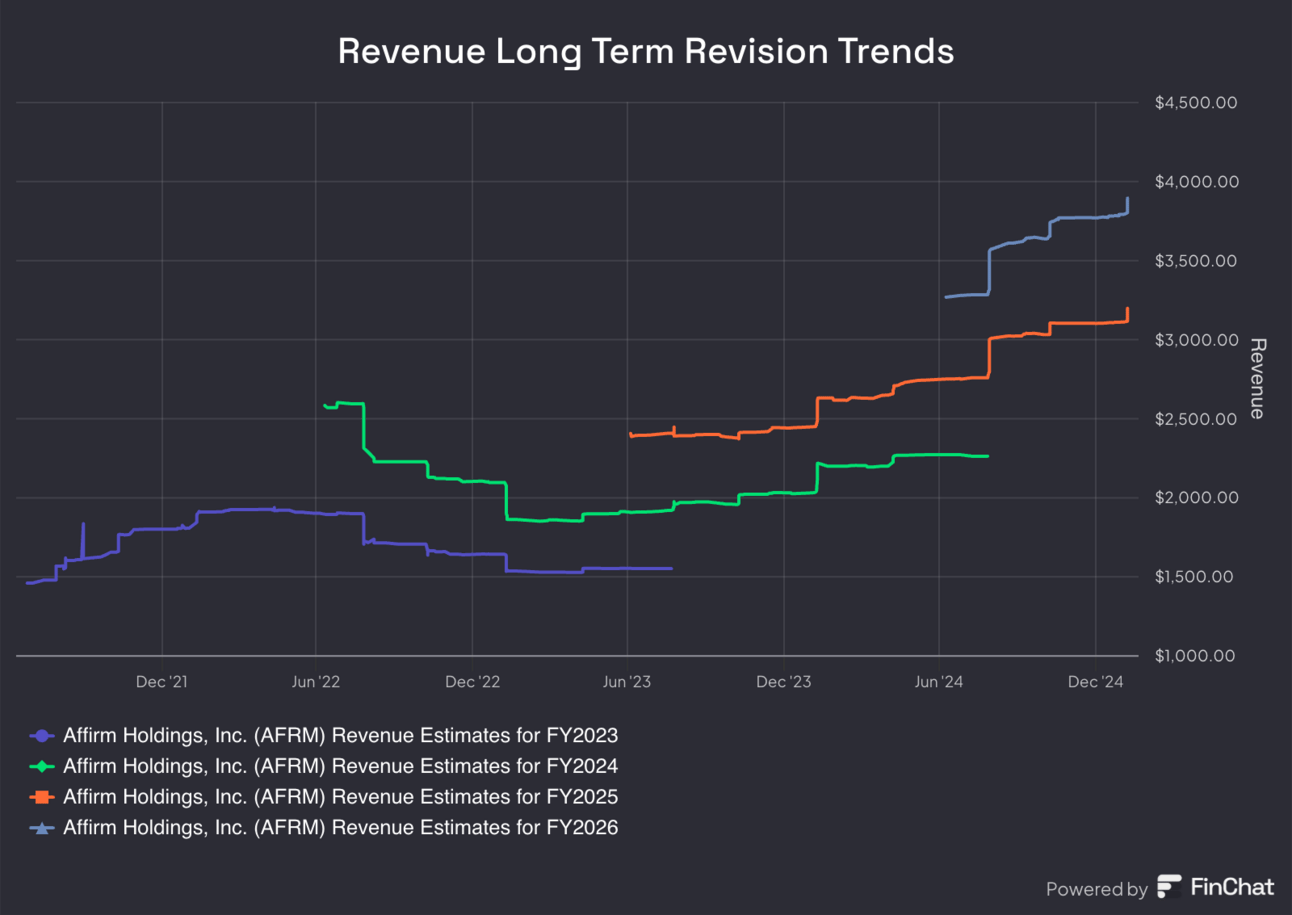

Affirm trades for 12x forward gross (or transaction) profit. Gross profit is expected to grow by 46% this year and by about 25% next year.

2. Cloudflare (NET) – Conference Call Q&A

This is a review of the call Q&A. Coverage of everything else from this report can be found here.

More on DeepSeek & Efficiency:

Cloudflare thinks models are racing to open source and commoditization, and it sees innovation out of companies like Meta and DeepSeek as the real tipping point for that process. That’s entirely “good for Cloudflare.” Founder/CEO Matthew Prince thinks recent developments “demonstrate that there is room for efficiency” and that spending trillions is not the only way to win here.

And as Prince reminded us, “Cloudflare is extremely good at wringing out as much efficiency as possible.” It has made software-based optimizations of compute infrastructure a prominent part of its value proposition, and that is paying off. It envisions the same opportunities in inference efficiency that DeepSeek delivered in training; the company welcomes the conversation and focus shifting to productivity and post-training inference. This means two things: more demand for inference, where Cloudflare specializes, and more focus on cost and performance leadership, which NET delivers in droves. It’s a good spot to be in.

How does Cloudflare deliver superior cost dynamics beyond constant hardware optimizations? Its pay-as-you-go model does not require companies to agree to large, upfront commitments before they know what they’re going to use. Conversely, as Prince put it, hyperscalers generally rent out a virtual machine (VM) to customers and let them figure out the optimization work. They make you opt into more volume and time to secure desired discounts, when that generally just leads to a lot of waste outside of peak hours. This leads to capacity utilization rates that routinely range from 5%-10%. With Cloudflare, they average 70% utilization capacity for CPUs and are already seeing a clear path to 70% for GPUs too. This means it can “effectively get 7x more work out of $1 in CapEx spent.” That’s why its developer platform (Workers and Workers AI) is enjoying such explosive growth, as traffic always follows relative cost advantages within high-demand markets.

AI App Development Maturity:

NET provided great examples of what apps customers are building with the Workers platform. I think that’s important, considering most companies are still working on turning conceptual GenAI and agentic AI ideas into tangible financial value creation. A finance company is using it to automate M&A due diligence; another customer built an app to surface potential client information to improve salesforce interactions; a media firm is using it to handle legal inquiries (that’s trust); Cloudflare built an app internally for incident management to cut about 5 hours of labor per day. For now, augmenting productivity is really what all of these apps are getting at. Down the road, GenAI and training chatbots will morph into agentic AI, heavier reliance on inference workloads, and goal-oriented AI. You won’t just be able to ask… are bananas good for me? You’ll be able to say “make sure bananas are good for me and, if so, find the best prices online and order them for delivery tomorrow morning.” That’s where we are headed, and again, NET’s inference niche ideally positions it to capitalize.

“AI over the last year has felt like it went from kind of an interesting science project. It's something that's turning into real use cases… I know there's a lot of hype around AI. I wasn't quite sure how quickly that would turn into real ROI to customers. I think in the last couple of quarters, we're starting to see where people are using Workers AI to deliver real value, not just a cool demo.”

Founder CEO Matthew Prince

A Bit More Color on Go-To-Market: