1. Chipotle (CMG) – Earnings Review

a. Key Points

- Somewhat underwhelming quarter doesn’t interrupt fantastic multi-year trends.

- There was some traffic variability in December and the start of 2025. It remains confident in strong transaction growth for 2025.

- In-store efficiency initiatives are working.

- Poised for faster international expansion in 2025.

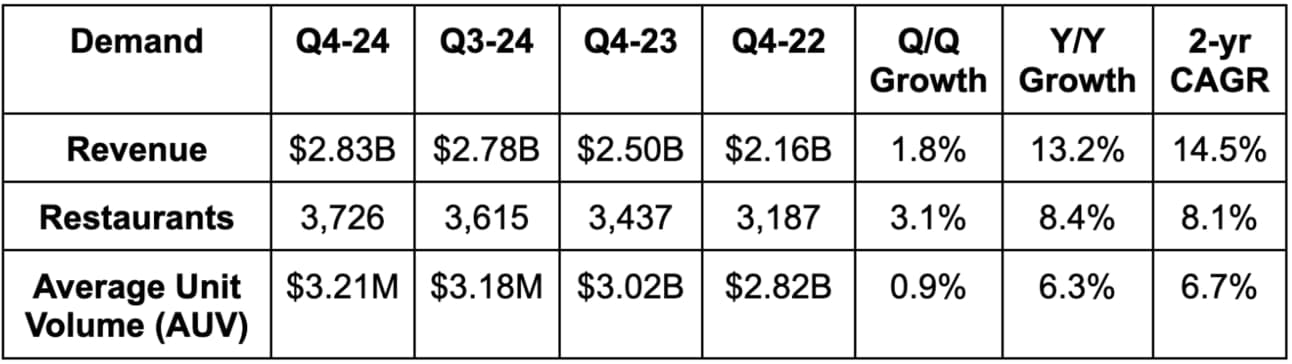

b. Demand

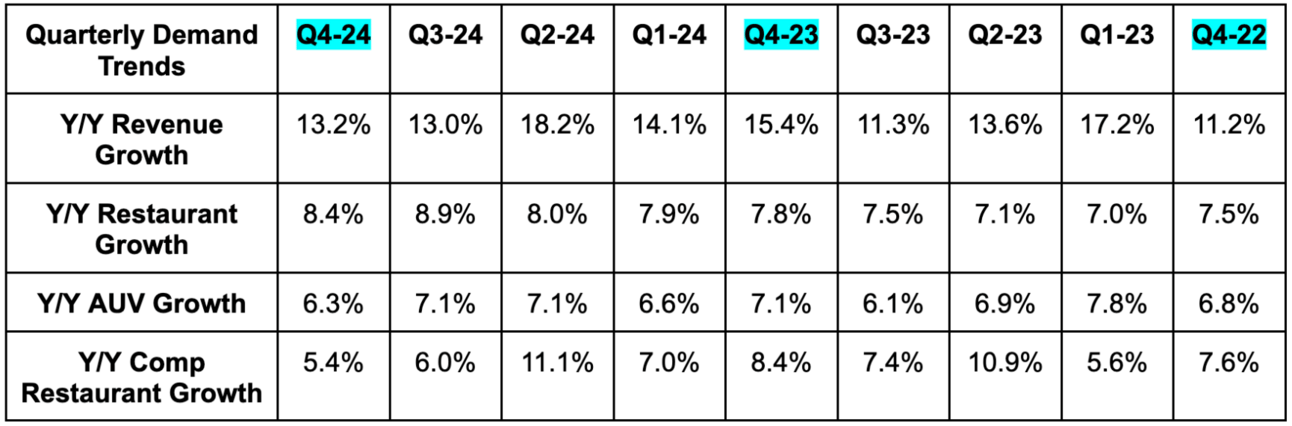

Chipotle missed revenue estimates by 0.7%. 5.4% comparable (comp) store sales was thanks to 4% transaction growth and 1.4% average ticket price (ATP) growth. This compares to 6% comp store sales growth last quarter, with 3.3% transaction growth and 2.7% ATP growth. Last year, comp store sales rose 8.4% Y/Y thanks to 7.4% transaction growth and 1% ATP growth.

c. Profits & Margins

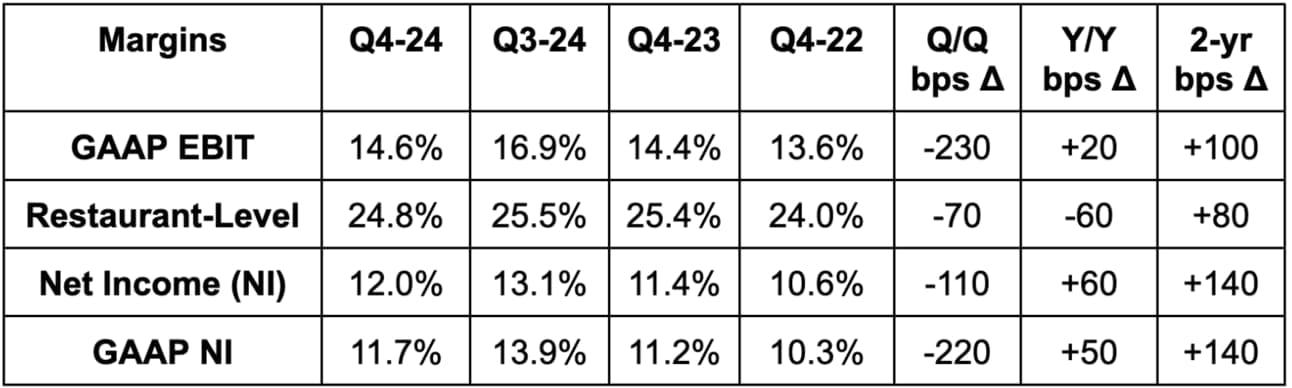

- Missed GAAP EBIT estimates by 3.3%.

- Beat 24.5% restaurant-level margin estimates by 30 bps.

- Met $0.24 GAAP EPS estimates. GAAP EPS rose by 20% Y/Y. Tax rate was 24.4% vs. 26.2% Y/Y.

GAAP food, beverage and packaging delevereged by 70 bps to 30.4% of revenue due to its focus on larger portions and the successful brisket promotion. Avocado inflation was better than expected, as price step-ups were delayed a bit (still coming); dairy inflation was about as expected. Price hikes help offset a bit of this delevereging. GAAP G&A was 6.7% of revenue and stable Y/Y. On a non-GAAP basis, excluding some compensation and legal reserves, G&A rose by 3% Y/Y to greatly trail revenue growth and provide non-GAAP leverage. GAAP labor was 25.2% of revenue vs. 25.0% Y/Y due to California wage laws.

d. Balance Sheet

- $748M in cash & equivalents.

- $868M in long-term investments.

- Diluted share count fell by about 1% Y/Y.

e. Guidance & Valuation

For the full year, 9% store growth and about 3% comparable sales growth guidance for 2025 leave us with about 12% revenue growth guidance for the year. This missed 13.3% growth estimates. If we instead assumed “low-to-mid single-digit” growth means 4% instead of 3%, then it would have only slightly missed estimates. This was partially related to lapping very successful releases in 2024, but there were more reasons that I’ll dig into in the next section.

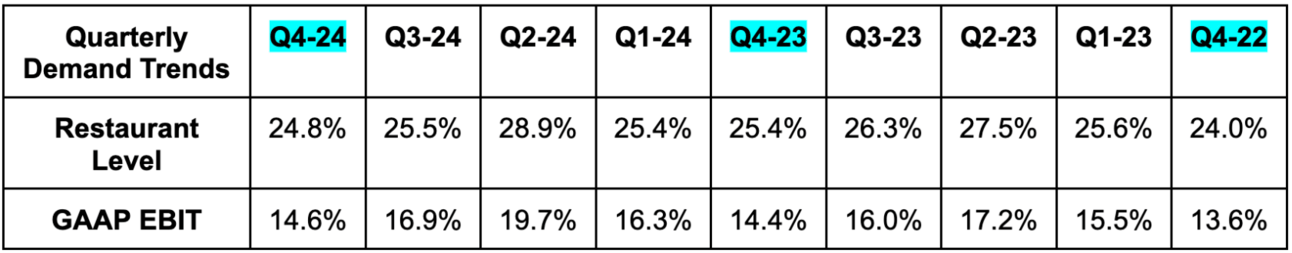

Guidance doesn’t include any potential tariffs, while about 50% of its avocados and 2% of its total food costs come from Mexico. Note that about 90 basis points (bps; 1 basis point = 0.01%) of comp store sales growth will roll off in Q2 from lapping price increases. It hiked prices twice last year due to California wage laws, but expects to hike prices once at its typical 2% menu inflation rate. Finally, it sees the 2025 restaurant-level margin being better during the second half of the year and slightly more pressured during the first half of the year. This is related to investments in larger portions last year following some consumer pushback. These investments will weigh on restaurant level margin by 60 bps in 2025 (front-half weighted). It expects to claw some of this margin back towards the end of the year. More on why later.

Chipotle trades for 45× 2025 EPS estimates. EPS is expected to compound at an 18% clip for the next two years after estimates fell a bit following this report. It remains confident in its path to 7,000 North American restaurants, $4 million in AUV and more operating leverage. It sees input cost inflation in the “low single-digit range” for Q1 and the full year.

It remains confident in multi-year mid-single digit comparable store sales growth.

f. Call & Release

December Traffic & 2025 Comp Sales:

Chipotle called out a bit of traffic weakness in the month of December. Things didn’t sharply sour, but trends got just a bit worse. The company still delivered 4% Y/Y transaction growth thanks to continued throughput gains and overarching operating momentum. Still, the 4% would have been higher without this softening. It attributed this to holiday timing, as Christmas and New Year’s both were during the week.

Traffic weakness continued into 2025, with “more volatile comps so far this year,” for different reasons. Leadership seems to have responded to this heightened volatility with uncertainty, which is always the correct thing to do when projecting future numbers. Weather patterns, a later return to school/work and a small LA wildfire impact have all hit comp sales trends by a full 4 points so far this year. Specifically, transactions fell 2% Y/Y in January, with the underlying trends up 2% Y/Y. This is why it now expects flat Y/Y transaction growth for Q1 and is a source of the first half restaurant-level margin pressure. More reasons why the first half should be worse than the second half:

- Strong product launches are expected to help comp sales during the second half.

- A 1-point headwind from Leap Year in Q1.

Run a Great Company with Great Food & Great Stores:

Supporting happy employees and delivering a great product for customers are both vital to running great stores. Along these lines, Chipotle continues to enjoy lower general manager (GM) turnover, which means lower disruption, better customer experience and a more successful company. In 2024, GM turnover neared an all-time low for the company, and 85% of all restaurant management roles were internally filled. It even promoted 3 new regional vice presidents who all started as crew members. As a result of this internal career mobility culture, throughput relatedly improved by another two entrees per peak 15-minute period; it reached its service goal during the quarter. Again… happier employees with more room for career advancement will work harder. That harder work will lead to a better guest experience. That better guest experience will fuel more growth. This is the formula Chipotle continues to effectively execute.

“Operationally, I feel like we've never been on better footing.”

CEO Scott Boatwright

Technology and AI are key pieces of managing the omni-channel experience for Chipotle. Most recently, it began developing an AI assistant. This detects where a customer’s usage pattern deviates from norms in a way that would lead to churn. It then nudges these customers with sweetened offers and suggestions to get them to convert.

Innovation to Perfect Throughput & Help Workers:

Chipotle continues to “modernize back of house operations” to perfect workflows and employee experiences. Part of this is simplifying meal prep timing, which has helped improve on-time prep. Another piece of this is upgrading Chipotle’s food prep equipment to make things easier for its team members. The company is implementing produce slicing machines in all restaurants to diminish tedious labor requirements and make jobs more enjoyable. This creates a more consistent, expeditiously-assembled end product to bolster throughput further (while maintaining quality). This investment is expected to partially offset the 60 bps hit from investing in larger portions last year. It remains fully confident in offsetting this entire headwind by the end of 2025. That confidence is via things like its new slicer and also supply chain efficiencies. Yet another reason why 2nd half margins are expected to be stronger.

“I think it is kind of a first half second half type of story. And a lot of that has to do with the portion investment and the fact that we believe that we can offset that investment in the second half of the year… Our goal this year is to drive positive transactions and flow that through to where we would see incremental 2025 restaurant level margin.”

CFO Adam Rymer

“So the produce slicer will save labor. We plan to redeploy some of that labor and capture part of it. How much is undecided at present.”

CEO Scott Boatwright

It’s also testing these slicers in tandem with its dual-sided grill (faster meat prep), three-pan rice cooker (prep rice right on the make-line) and dual-vat fryer (faster chip prep) all in the same unit. So far so good on this experiment, as Chipotle will now add these machines to every new store opening. It sounds like it will eventually retrofit existing units as well. It continues to develop its “autocado” (automated avocado slicer and pitter with a great name) and the next iteration of its digital make workflow. It’s early for both of these initiatives but it remains “optimistic.”

Marketing & Limited Time Offers (LTOs):

CMG’s leadership called its marketing playbook from 2024 “exceptional.” All of its brand campaigns delivered or over-delivered on desired results. Both LTOs (chicken al pastor and brisket) “surpassed expectations” and both drove “incremental transactions & spend.” The company also restarted its second partnership with the popular running app Strava. It thinks all of this positive work helped it gain momentum in key national brand categories such as ingredient quality, value, health and more. Looking ahead, its chipotle honey chicken test has been an obvious success. It was its best ever LTO for taste and will be coming to more stores soon. This was not included in 2025 guidance, so any materially incremental uplift from this launch should mean upside.

Grow the Store Footprint:

Chipotle again opened roughly 300 stores during the year, with 80% of those having a Chipotle drive-thru lane (Chipotlane). 1,000 of its stores now have these Chipotlanes, which continue to be overwhelmingly positive for driving incremental store traffic. It’s also a great product from a service standpoint, with customers moving from ordering to picking up in an average of 30 seconds. For context, Starbucks struggles to get items delivered to drive-thru customers in under 4 minutes.

Across the globe, it now has 85 international restaurants, with 55 in Canada, 27 in Europe and 3 in the Middle East. 2025 will be the year of accelerating openings across Canada and the Middle East, as well as “proving out the economic model in Europe” to set the table for more growth in the years ahead. It had been struggling with margin in Europe, but things have “measurably improved so much that it’s now looking at site development in specific areas of Western Europe.”

“We're taking a look at a couple of other partnerships as we speak today around the world.”

CEO Scott Boatwright

g. Take

This was not Chipotle’s best quarter, but I think the holiday timing, Leap Year and weather-related weakness are actually the reasons. I do not think this is at all a matter of bad execution or a weakening brand, just the same issues many others flagged to explain an underwhelming traffic start to 2025. I think it’s likely that traffic trends normalize and Chipotle can use a prudent 2025 guide to beat and raise multiple times throughout the year. While losing Brian Niccol was certainly not ideal, the new team seems more than capable of carrying the torch and pushing Chipotle through its next phase of global growth. When zooming out, we’re left with a margin-accretive compounder with a beloved brand and a long runway. We’re left with a company poised to expand across the globe in the coming years… with a product that has resonated everywhere it has been introduced thus far. These somewhat underwhelming results don’t make me think any less fondly of this company.