Table of Contents

- 1. Block Shareholder Letter

- 2. Earnings Round-Up – On Running (ONON), Cava, Se …

- 3. Shopify (SHOP) — Earnings Review

I plan on finishing Block and NET earnings coverage for Saturday’s News of the Week article. That article will also include a Disney review, as well as Cava, Spotify, On Running and Sea Limited reviews. For now, I wanted to include snapshots of the reports that have already been released in this article.

1. Block Shareholder Letter

I sent a snapshot of the Block earnings results in the most recent News of the Week article. I didn’t have time last week to cover the shareholder letter or earnings transcript. I found time to read the letter, and wanted to send what I already have set to publish as soon as possible.

Block’s Credit Products:

Dorsey made credit the theme of this quarter’s shareholder letter, with a history lesson that I found useful. The company started off with merchant credit and its “Square Loans.” It offered broader access, transparent fees and a seamless ability to automatically repay loans with portions of sales. Sellers responded quite positively to this recipe, which makes sense considering they enjoyed 6% faster growth than non-borrowers. Retention for cross-sold customers also rose by 15% and products per borrower more than doubled to 3.7 as a result of this launch. In turn, added engagement meant more customer data to build richer profiles, with systems in place to ensure those insights are mined and understood in real time. This all means better underwriting and an aggregate 3% loss rate since inception a decade ago.

From there, Block expanded into consumer-facing credit with the launch of Cash App Borrow and the $29 billion purchase of Afterpay. Cash App Borrow offers micro-loans for up to $200 to help with bills or day-to-day expenses. It delivers a 13% boost to customer inflows and a 6% boost to transactions. Afterpay is its Buy Now, Pay Later (BNPL) platform that also delivers large boosts to customer engagement and lifetime value. This product will be integrated right into its debit card in the near future to offer what Block sees as a “better alternative to credit cards.” Similarly to its strong 3% loss rate on the merchant side, its aggregate BNPL and Cash App Borrow loss rates are 1% and 3% respectively.

On a related note, Block disclosed new return metrics that look excellent, while also telling us they can get even better. Some of that improvement will come from balance sheet optimization, as it does have some expensive warehouse credit reliance, and can shift that to cheaper deposits within Square Financial Services (SFS). Return optimism is also related to having engaged customers in an overarching product suite and the coinciding deeper borrower knowledge/data that entails. They’ll just keep getting more precise with underwriting borrowers.

Cash App:

Cash app gross profit rose by 21% Y/Y and drove the outperformance in this metric for the quarter. Monthly actives delivered $75 in gross profit per month vs. $65 Y/Y. Furthermore, Cash App Card actives rose 11% Y/Y and transacted 6 times on average. That rose, but the degree of growth was not quantified. Its priorities of growing inflows per active and paycheck deposit actives remain unchanged. It thinks it has a recipe of value to drive broader inclusion; anecdotes like 72% of its customers being Gen Z or Millennials vs. 57% on average support this notion. It also thinks its products can drive healthier customer finances, which should benefit overall spend volumes for Block.

On the commerce side, its Cash App Pay checkout product and digital wallet continued to “meaningfully grow volume and actives.” That’s despite most growth at this point coming from organic word-of-mouth channels. Cash App now plans to jumpstart marketing campaigns to build awareness. Other ways to quickly build awareness and adoption for this are through a partnership with large gig-economy players like Lyft, which was recently announced.

Similarly to Cash App Pay, it’s ready to accelerate marketing spend for its direct paycheck deposit business as well. It changed the app interface to make this offering, including a 4.5% savings yield and overdraft protection, more visible on the app. Just like for all other financial service firms fighting for direct deposits, winning these types of relationships with customers has a profoundly positive impact on engagement and retention metrics.

Square:

Square consolidated all administrative back office tools into a new dashboard app. Somewhat similarly to Shopify (not as broad, but deeper for financial services), this offers a unified suite for business management. As a next step here, it’s also beta testing a new app interface that aims to aggregate all point-of-sale tools — from processing to digital wallet integrations to inventory management — into a single page. It wants to make its product even easier and more obvious to use. Lower friction means more volume, which means more profit.

As part of the overarching orders platform for merchants like restaurants and bars, it added software-based bar tab functionality. This builds on last quarter’s Square Kiosk release, which is a full-service platform for ordering software and point-of-sale hardware.

To augment go-to-market, it signed a new partnership with T-Mobile. This will make SQ’s commerce offerings more visible to businesses when they’re purchasing plans from the telecom giant. It partnered with another telecom player in Japan, along with Mercari’s fintech business (called MerPay) and a large card network there too. In France, its new strategy to empower third-party sales organizations is working. 50% of its new sales there are now externally driven, and it’s looking to emulate this success in other geographies. It also signed a distribution deal with the Restaurants Association of Ireland. As you can tell, channel partnerships continue to become an increasingly important source of growth.

It’s also working hard to become more of a primary financial service vendor for its merchant base – just like on the consumer side. Its bank attach rates with merchants are rising, thanks to new onboarding flows for its Square Debit Card. It also finished launching a new Bill Pay integration for this product, to make expense management all the more convenient.

I will offer my view of the quarter when I finish getting through all of the materials. As of now, it didn’t look amazing or terrible. Pretty average. More to learn.

2. Earnings Round-Up – On Running (ONON), Cava, Sea Limited (SE) & Spotify

a. On Running (ONON)

Results:

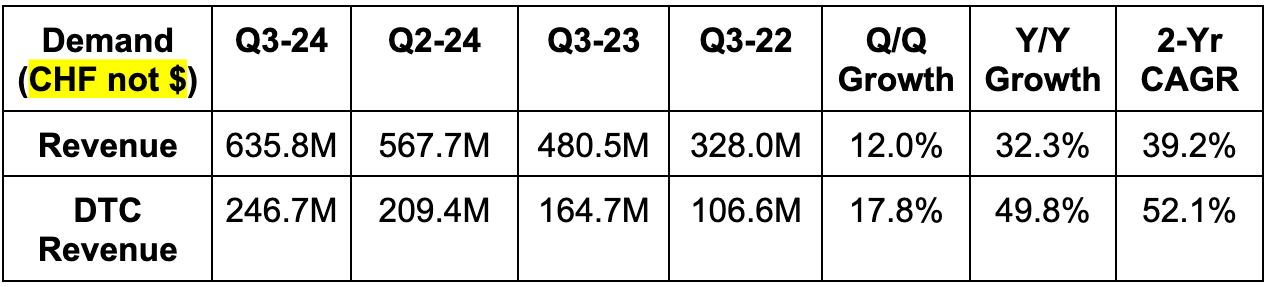

- Beat revenue estimatesby 3%. This was driven by direct-to-consumer (DTC).

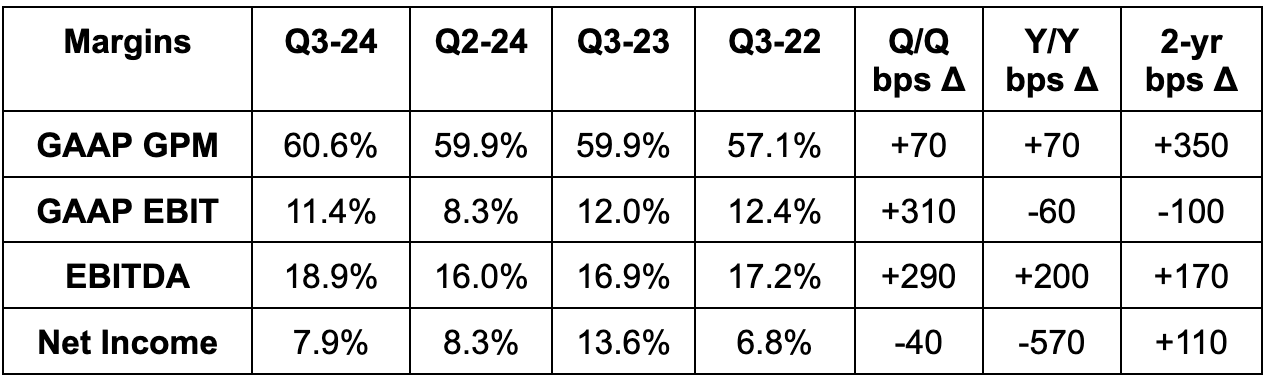

- Beat 60% GAAP GPM estimates by 60 bps.

- Beat EBITDA estimates by 11%.

- Missed $0.19 EPS estimates by $0.03. This was related to a 42.6 million CHF foreign exchange hit vs. a $13.8 million benefit Y/Y. Net income rose by 48% Y/Y when excluding all of this impact.

Annual Guidance & Valuation:

- Raised annual FXN growth guidance to 32% vs. 30% previously.

- Raised annual revenue guidance by 1.3%, which slightly beat estimates.

- Raised GPM guidance to 60.5% vs. 60% previously, which beat 60.2% estimates.

- Raised EBITDA margin guidance from 16.25% to closer to 16.5%, which beat estimates by a few percent.

EPS is expected to grow by 142% this year and by 15% next year.

Balance Sheet:

- CHF 749 million in cash & equivalents. Inventory fell slightly year-to-date.

- No debt.

- Diluted share count rose by 1.5% Y/Y.

b. Cava (CAVA)

Results:

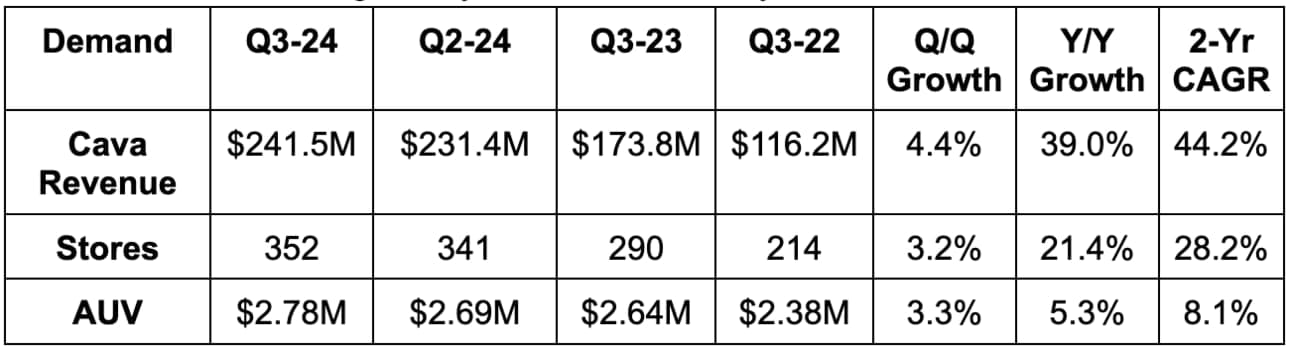

- Beat revenue estimate by 3.6%.

- Beat EBITDA estimate by 13%.

- Beat $9.5M GAAP EBIT estimate by $4.2M.

- Beat $0.11 GAAP EPS estimate by $0.04.

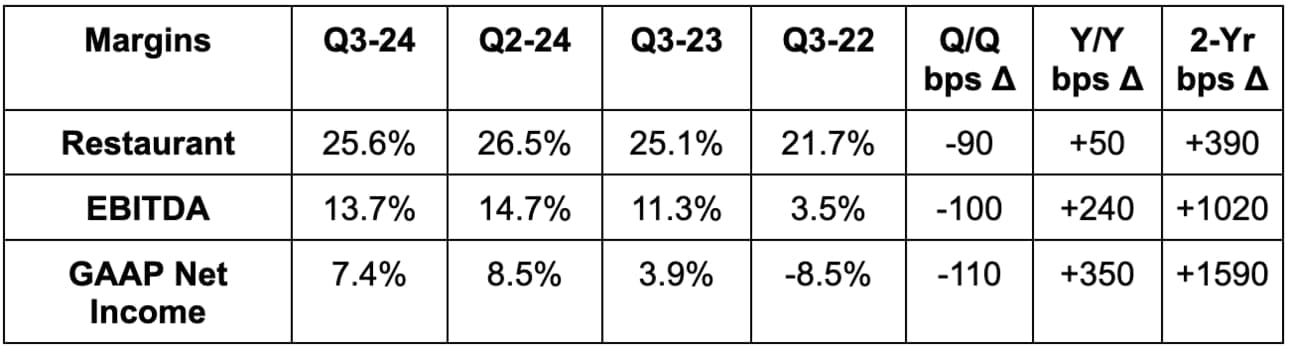

- Beat 25% restaurant-level margin estimate by 60 bps (similar to gross margin).

Annual Guidance & Valuation:

- Raised new store guide from 55.5 to 57.

- Raised same store sales growth guide from 9% to 12.5%.

- Raised restaurant-level margin guide from 24.45% to 24.75%.

- Raised EBITDA guide by 10%, which beat by 5.2%.

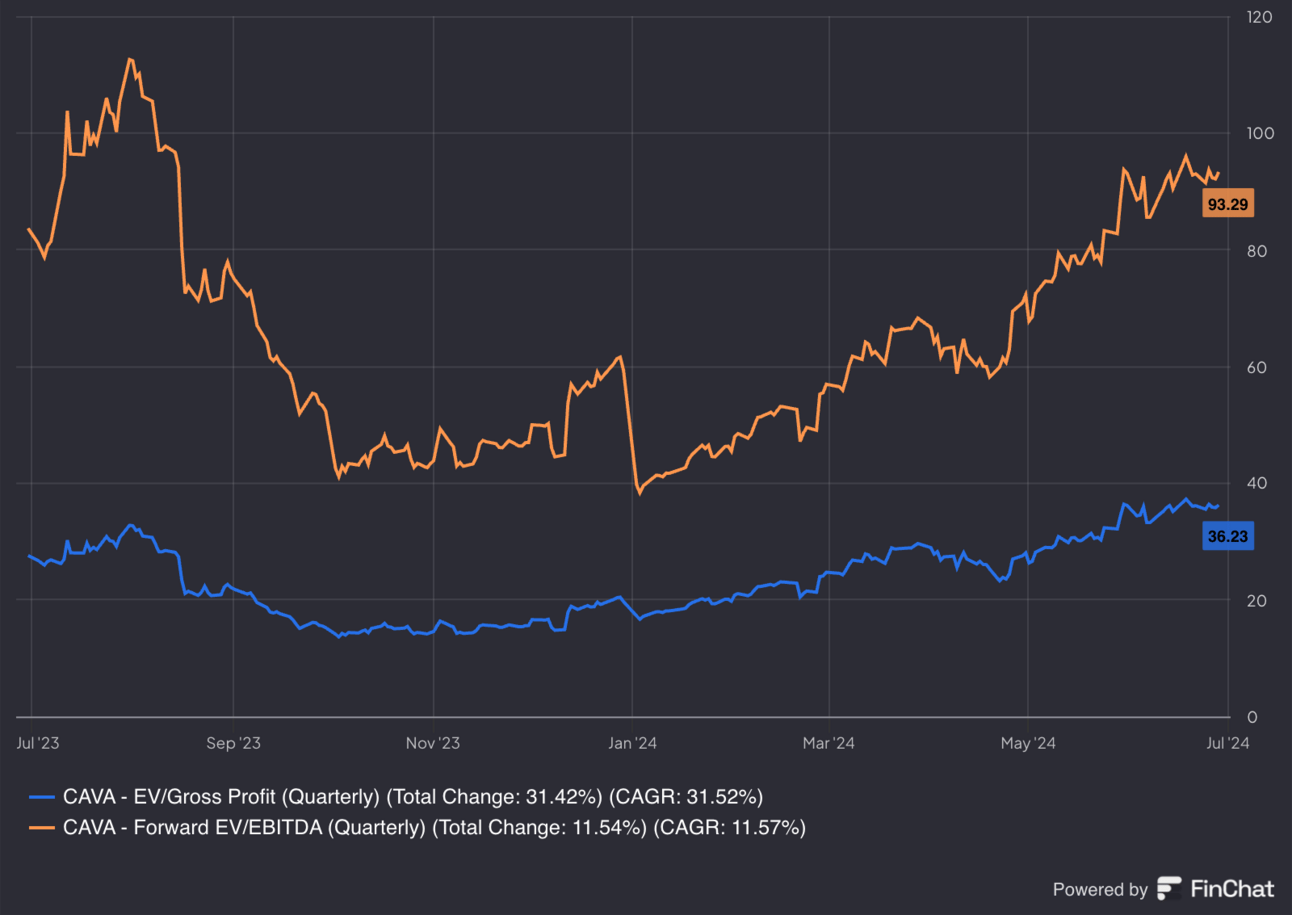

Following the post-earnings pop and likely upward profit revisions, these forward multiples are probably going to be roughly accurate. EBITDA is expected to grow by 58% this year and by 27% next year.