Earnings reviews to read from this current season:

- Trade Desk, Duolingo & DraftKings earnings reviews

- Uber & Shopify earnings reviews

- Lemonade, Hims & Coupang Earnings Reviews

- Mercado Libre & Palantir Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

- Starbucks & Apple Earnings Reviews.

- Updated Portfolio & Performance vs. the S&P 500

Table of Contents

1. On Running (ONON) — Earnings Review

a. Key Points

- Excellent resilience vs. all of its peers.

- Raised annual guidance despite incremental headwinds.

- Product expansion is going well.

b. Demand

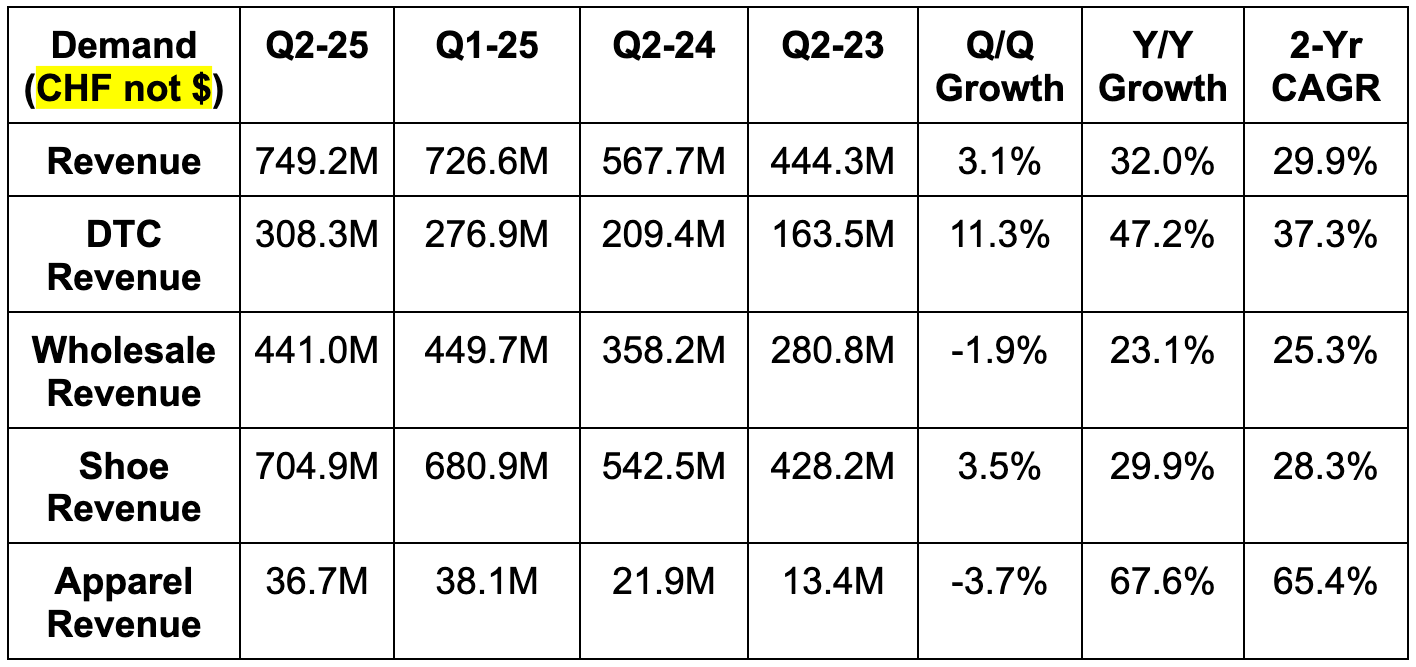

- Beat revenue estimates by 6.4%.

- Beat wholesale revenue estimates by 3.5%.

- Beat direct-to-consumer (DTC) revenue estimates by 11.3%.

There’s no single channel or geography to point to that explains this outperformance in isolation. Encouragingly, everything was strong for On Running during Q2. Every continent… every channel… every category… everything.

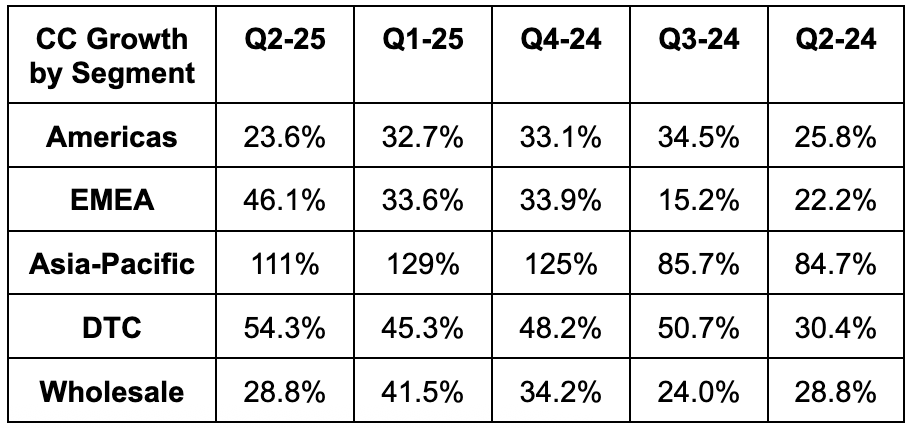

In the Americas, Europe, Middle East & Africa (EMEA) and APAC, durable growth was promising. It was in direct response to continued relevant product innovation, rising brand awareness, great store performance, controlled wholesale partner growth and strong sellout rates with those partners. For some specific highlights, Americas DTC revenue rose by 40% Y/Y. In EMEA, growth matched its fastest rate in two years, developed markets such as the UK kept steadily expanding and newer markets like France built immediate traction. And while both of these geographies are performing quite well, APAC is doing even better. Demand levels are in excess of current supply, China same-store sales growth was 50% Y/Y and e-commerce growth was well ahead of that rate.

“The result of all this is what we call consumer resilience. What we're seeing is that we are no longer just for early adopters. We are now resonating with a much wider audience. Our brand is over-indexing with Gen Z consumers.”

Co-Executive Chairman David Allemann

c. Profits & Margins

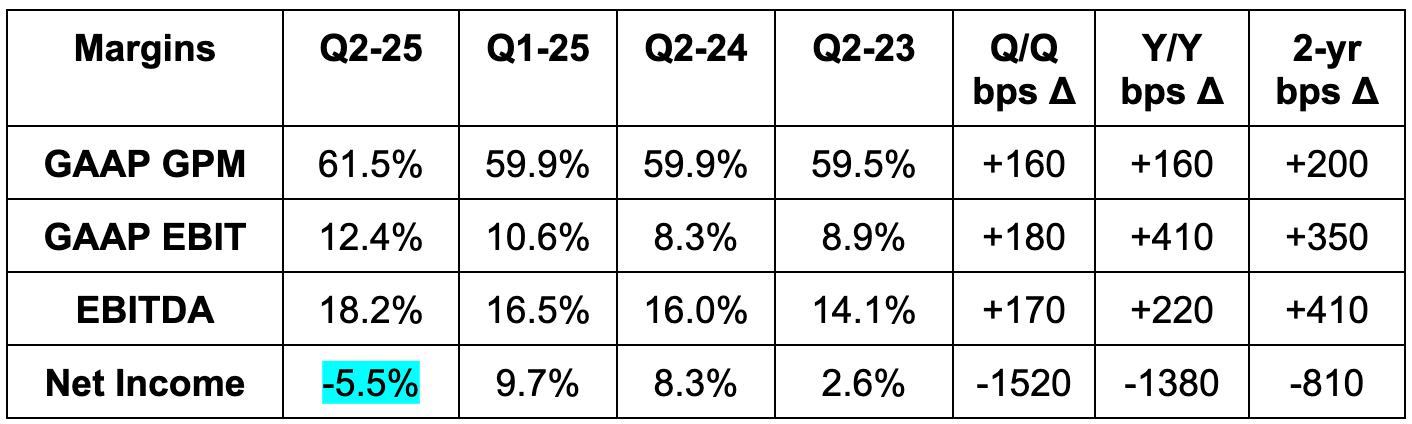

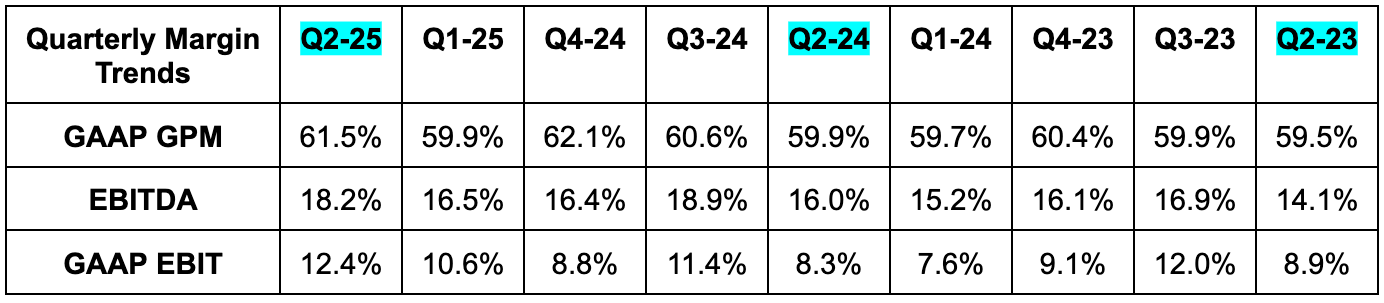

- Beat 59.9% GPM estimates by 160 basis points (bps; 1 basis point = 0.01%).

- Beat GAAP EBIT estimates by 38%.

- Beat EBITDA estimates by 18.3%.

- Missed CHF 0.20 per share EPS estimates by 0.32.

Gross margin was helped by DTC rising to a new record as a % of total revenue. Continued freight favorability following a lengthy stretch of rampant inflation and some foreign exchange favorability also helped gross margin outperformance. Notably, the price hikes it initiated in the USA happened in July, so there was no benefit this quarter.

Sales, general and administrative (SG&A) fell from 48.6% of revenue to 47.7% of revenue. A lot of that was thanks to thriving demand growth, but operational discipline in areas like distribution also helped. On is getting better at forecasting demand, placing goods closer to the end customer, cutting miles per fulfillment and augmenting overall efficiency. As always, it’s balancing this operational rigor with key investments in future growth. More on this later.

Net income and EPS are pretty irrelevant byproducts of foreign exchange fluctuations for this company. While FX helped input costs during the quarter, it also devalued assets held on ONON’s balance sheet, which technically count as net loss. This quarter, that lowered net income by about CHF 140 million. Without this impact, which is not related to core operations, EPS would have been CHF 0.32 per share vs. 0.20 expected. Net income margin would have been 13.2%.

d. Balance Sheet

- CHF 846.6M in cash & equivalents. This fell Q/Q due to FX losses.

- CHF 360.4M in inventory vs. 401.3M Y/Y. This is the luxury of getting far better at demand forecasting. They have a better sense of exactly what inventory is needed and where. This allows them to be more precise and operate with more favorable net working capital dynamics… expect that to be a positive ongoing theme.

- The team feels inventory is in a great spot. They’ve come a long way in a few years.

e. Guidance & Valuation

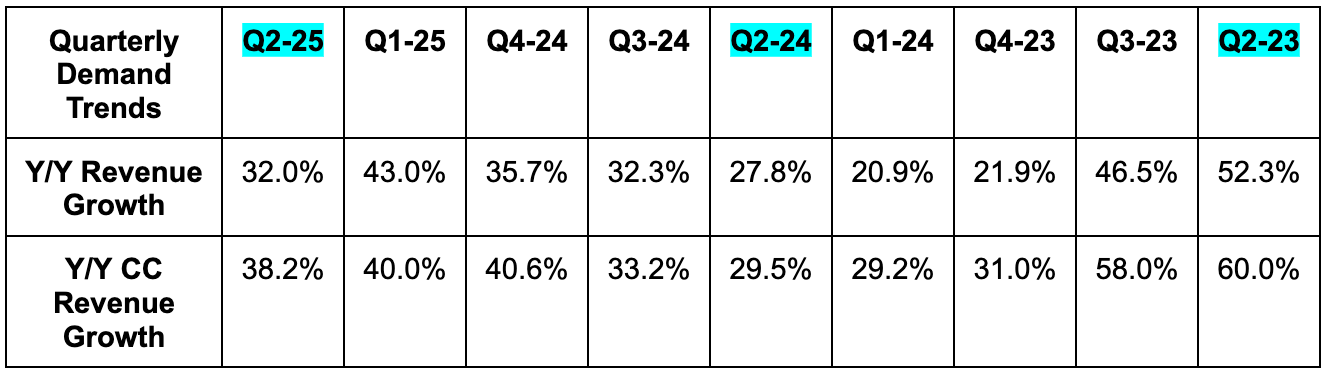

Annual guidance updates were quite strong. They raised 28%+ CC growth guidance to 31%+. This beat 27.7% CC growth expectations. The brightening forecast is based on great year-to-date performance, as well as strong order books for the rest of the year. Data… not hope. It also raised GPM guidance from 60.25% to 60.75%, which beat 60.5% expectations. And finally, it raised 17% EBITDA margin guidance to 17.25%, which slightly beat 17.2% estimates. With the large revenue raise, EBITDA dollar guidance was materially boosted and comfortably beat consensus.

To make the outperformance even more impressive, guidance assumes some level of macro deterioration stemming from tariffs. Furthermore, guidance fully bakes in a near doubling of overall Vietnam and Cambodia tariff rates, which impacts ON’s cost structure significantly.

A few more notes:

- USA price hikes are helping the margin raises. They do not expect to raise prices again to meet these goals.

- Continued mix-shift towards DTC revenue is expected to be an enduring margin tailwind.

- They have not felt the need to renegotiate contracts with supply chain partners following tariff hikes.

- In terms of their 3-year plan laid out in 2023, they are well ahead of expectations and increasingly confident in those targets.

- Constant investments in perfecting manufacturing, logistics and every other part of this business helped them raise margin guidance (along with price hikes). Again, this was despite significant inter-quarter cost tariff headwinds.

- Modestly slower 2H growth vs. the first half of the year is related to macro conservatism and tougher comps.

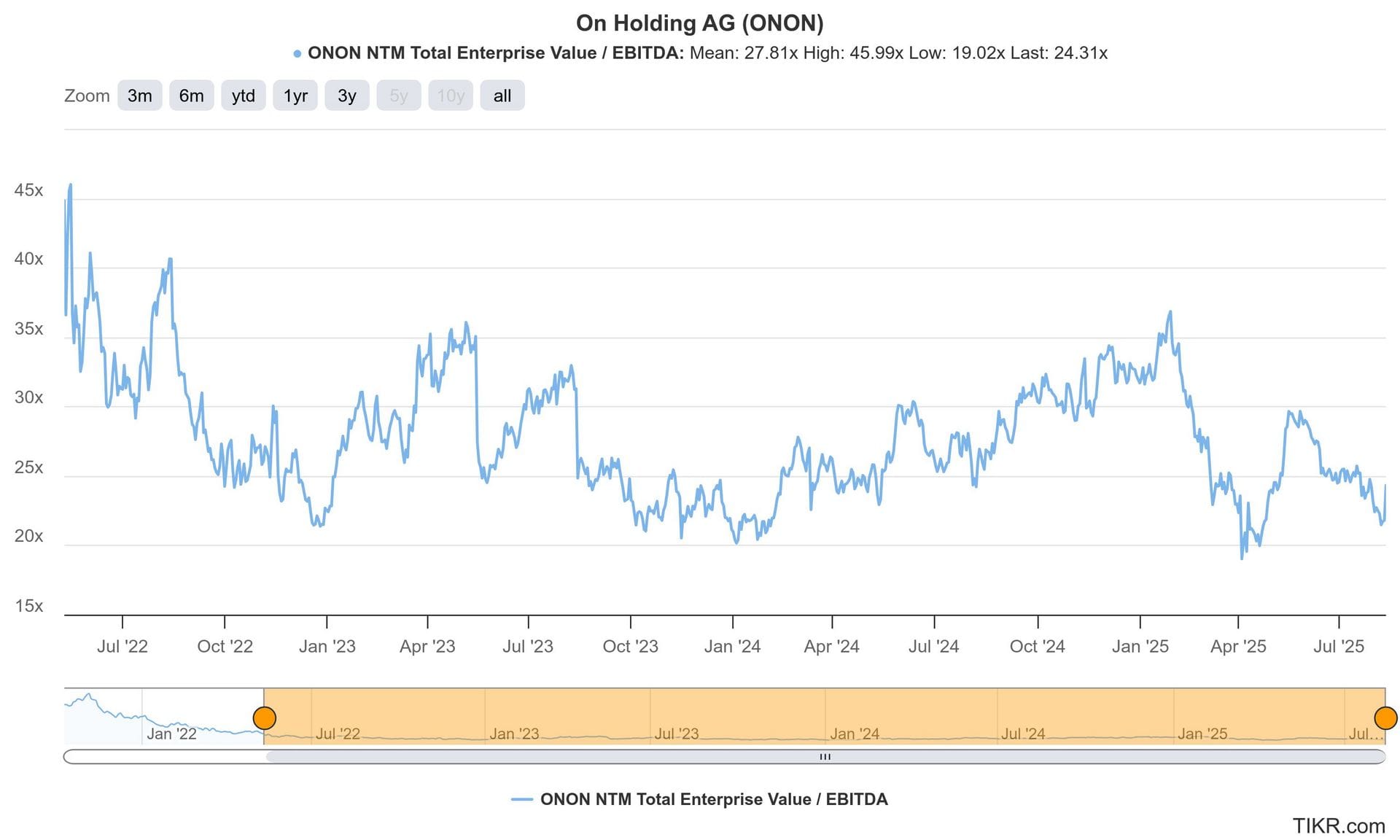

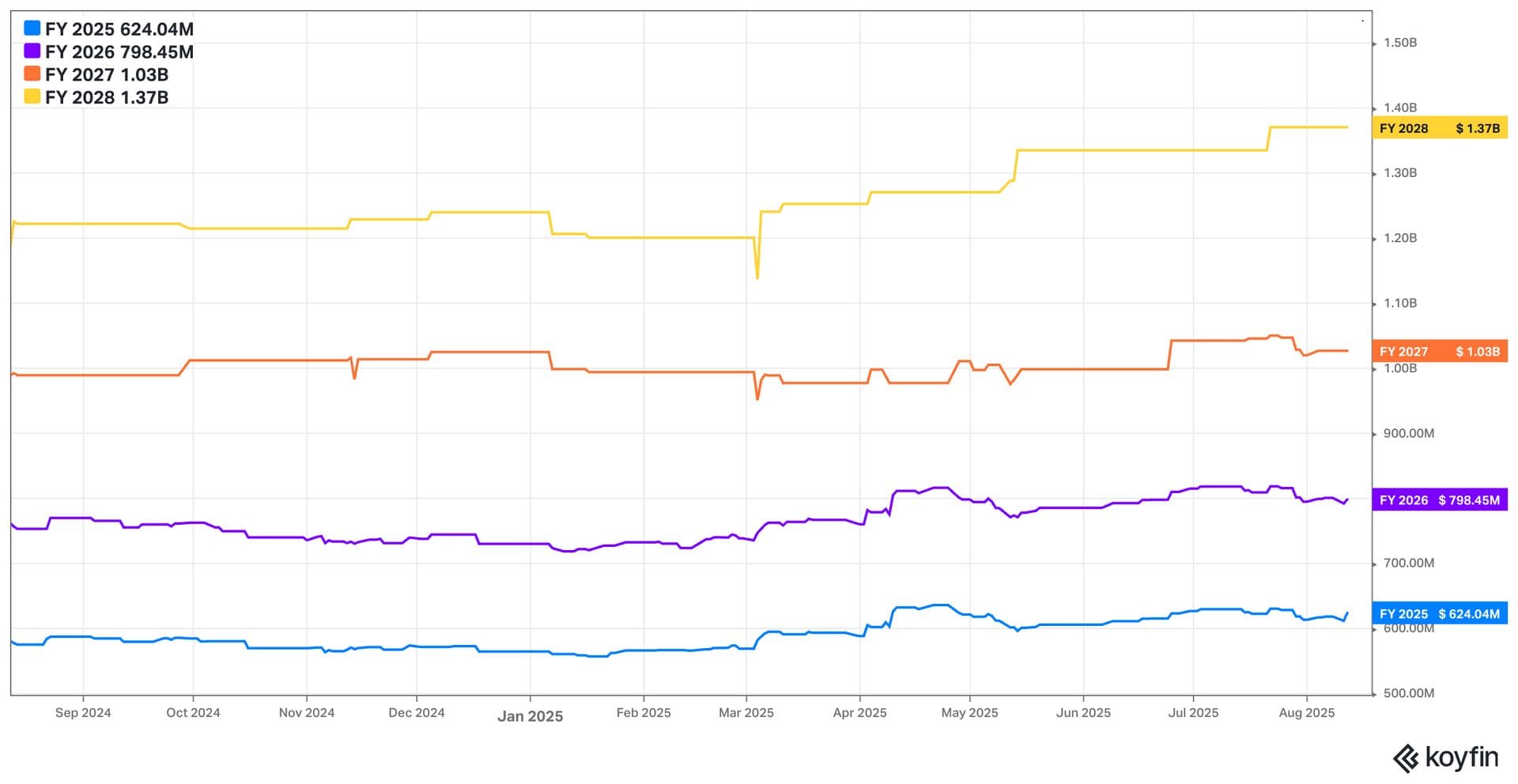

ONON trades for 24x forward EBITDA. EBITDA is expected to grow by 29% over the next two years. Estimates will likely rise following the strong report.