More content from this week:

- Nu & Disney Earnings Reviews.

- Shopify Earnings Review, & some Block Coverage Catch-up.

- Portfolio Update

More earnings reviews from the last three weeks:

- Meta & Microsoft Earnings Reviews

- AMD, Alphabet and Visa Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Tesla & Service Now Earnings Reviews

- Netflix and Taiwan Semi Earnings Reviews

- Robinhood, Starbucks & Lemonade Earnings Reviews

- Palantir & Hims Earnings Reviews

- Duolingo, Celsius & Mercado Libre Earnings Reviews

- Airbnb, Datadog and The Trade Desk Earnings Reviews

- DraftKings & Coupang Earnings Reviews

I plan on including the remaining Cloudflare earnings coverage and a full Sea Limited Earnings Review in my Nvidia and Snowflake Earnings Review article coming this week.

Table of Contents

- 1. Cava (CAVA) – Earnings Review

- 2. SoFi (SOFI) — Product Launch

- 3. Spotify (SPOT) – Earnings Review

- 4. On Running (ONON) – Earnings Review

- 5. Amazon (AMZN) & Hims (HIMS) – Pharmacy & More

- 6. DraftKings (DKNG) & The Sports Gambling Industr …

- 7. Progyny (PGNY) – Earnings

- 8. Headlines

- 9. Macro

1. Cava (CAVA) – Earnings Review

Read my Cava (and Sweetgreen) deep dive here.

a. Demand

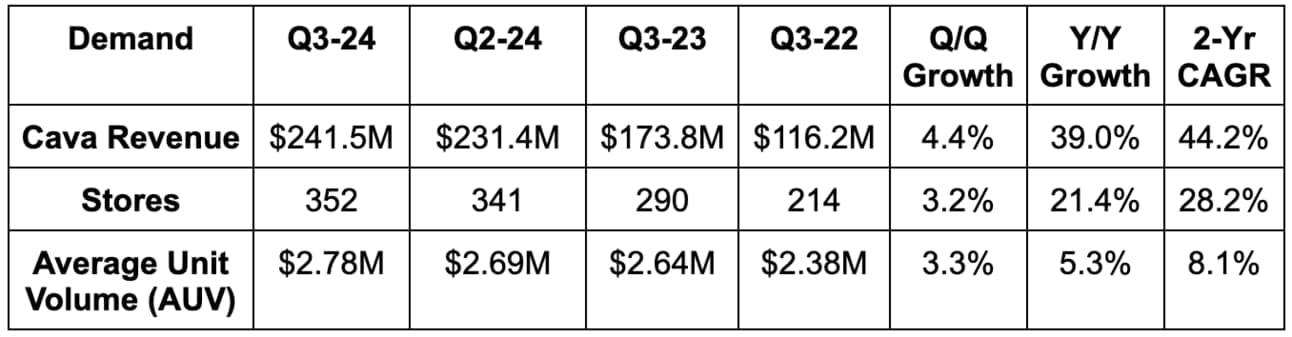

- Beat revenue estimates by 3.6%.

- 44.2% 2-yr revenue compounded annual growth rate (CAGR) vs. 48.2% Q/Q & 51.3% 2 Qs ago.

b. Profits & Margins

- Beat EBITDA estimates by 13%.

- Beat $9.5M GAAP EBIT estimates by $4.2M.

- Beat $0.11 GAAP EPS estimates by $0.04.

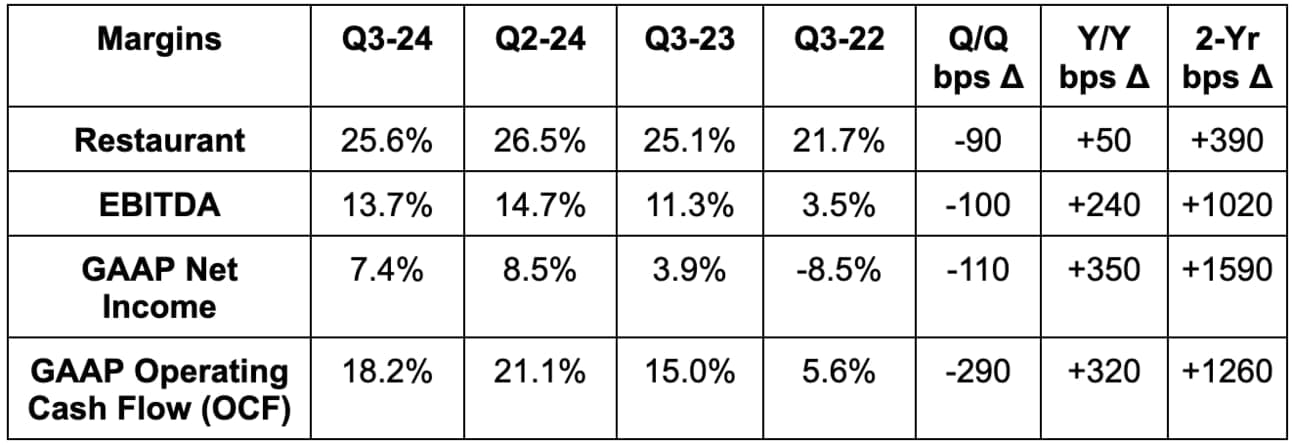

- Beat 25% restaurant-level margin estimates by 60 basis points (bps; 1 basis point = 0.01%).

- This is similar to gross margin.

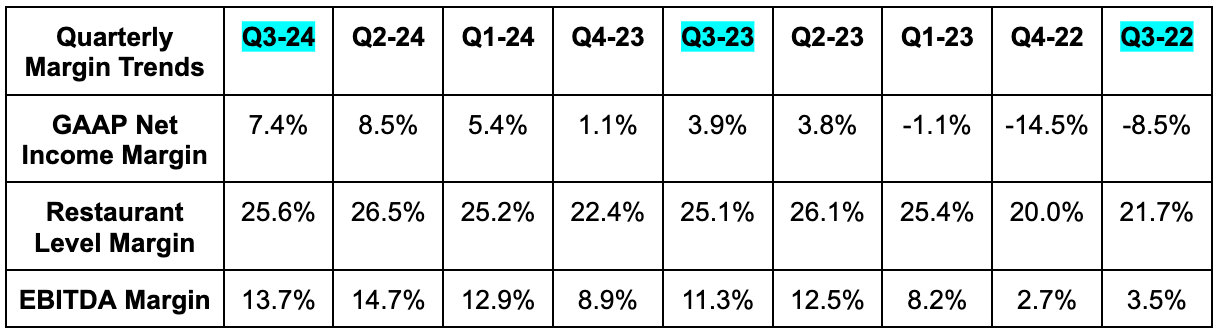

Food, beverage & packaging costs were 29.9% of revenue vs. 29.4% Y/Y. This was related to its steak launch (just like last quarter and as expected). Labor was 25.4% of revenue vs. 25.3% Y/Y despite 8% Y/Y wage inflation. Part of that wage inflation was from new California labor laws, which it didn’t offset with price hikes. Sales outperformance offset most of this headwind. Top-line strength also drove G&A leverage and 69% Y/Y growth in adjusted EBITDA. There is considerable fixed cost in this model with room to grow overall volume per store without expenses growing in tandem.

c. Balance Sheet

- $367M in cash & equivalents.

- Undrawn $75 million credit revolver.

- Diluted shares rose by 0.6% Y/Y. IPO-related dilution is quickly winding down as expected.

- No debt.

d. Annual Guidance & Valuation

- Raised new store guidance from 55.5 to 57.

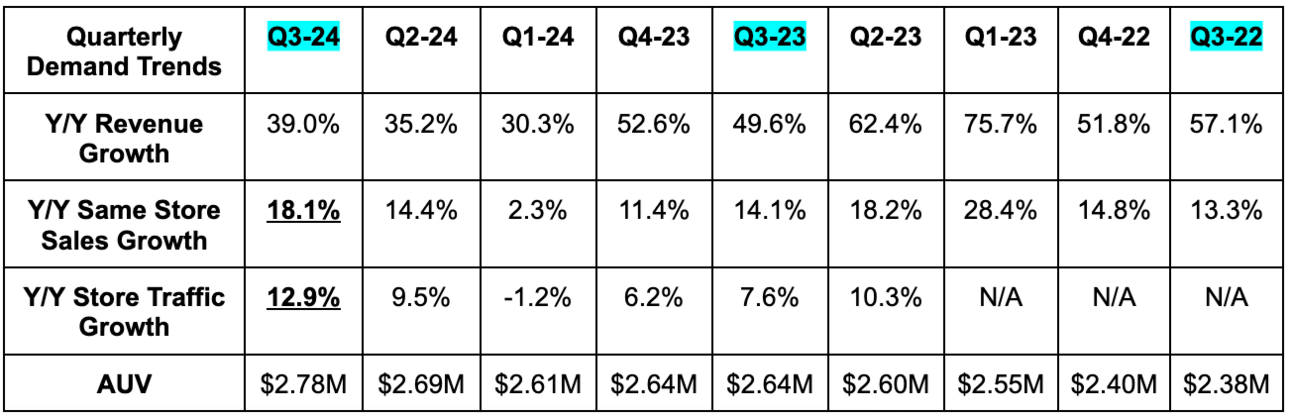

- Raised same store sales growth guidance from 9% to 12.5%. Really, really good.

- Raised restaurant-level margin guidance from 24.45% to 24.75%.

- Raised EBITDA guidance by 10%, which beat by 5.2%.

Quick accounting note for Q4. The company’s tax loss benefit allowance will likely be released as it durably inflects to profitability. This will lead to a large GAAP EPS benefit.

It offered some early comments for 2025. It sees at least 17% Y/Y store growth vs. its previous guidance of 15% Y/Y growth. It also sees stable Y/Y restaurant level margin from a strong starting point. That’s notable. When a quick-service company accelerates new store growth from a larger base, one may expect restaurant-level margin to temporarily suffer. It takes time for volumes to ramp and for fixed cost leverage to unfold. Considering this, the 17%+ unit growth guidance for 2025 paired with expectations of stable Y/Y restaurant-level margin is notably impressive. It’s the result of these recent new stores doing way better than they were supposed to.

Cava EPS is expected to compound at a 28% clip through 2025 and 2026. EBITDA is expected to compound at a 30% clip during that time. This gives it a net income PEG of nearly 10x and an EBITDA PEG of over 3x. This is one of the most expensive names in markets.

e. Call Highlights

Empowering Employees to Provide Great Service:

Cava is determined to use AI to augment its workforce, rather than supplant it. The company is adamant that the personal, human touch in restaurants is a “contrarian” differentiator. These strong results tell me that they’re right. Its new in-store “AI video technology” tracks ingredient depletion to nudge employees to replenish needed items. Following an intricate and successful testing process, it’s in 4 restaurants and will expand from there. This technology will be used for its in-store food prep lines, as well as the digital order make-line.

It also debuted a new model for labor allocation. This creates more concrete rules on where employees are placed during its busy hours; it also shifts some non-peak labor hours to peak. This was up and running ahead of schedule like everything else Cava releases is. It called the impact so far “promising,” while the program has also uncovered new potential to “strategically invest in lower-volume restaurants to drive increased revenue.” It is noticing a strong positive correlation between giving these stores more support and the locations generating more volume. It’s a small part of the overall portfolio, so the AUV benefit will be limited. Never the less, it will be yet another tailwind.

Loyalty Program Relaunch:

The revamped loyalty initiative has already boosted percent of sales coming from the program by 200 basis points. Right now, it’s a bankable points model; in the future, the company plans to use this growing customer database to personalize experiences further. It’s worth noting that the microservice-based architecture that Cava was built on (and the deep dive covers in detail) is what enables all of this rapid learning. It’s the malleable set-up that allows it to collect and utilize this data for its loyalty program, app, in-store experience etc. in one cohesive manner. That drives agility and informed decisions. Microservices represent the building blocks that form a singular, organized unit of insight-gleaning.

Food:

The launch of its garlic ranch pita chip (I’m hungry) is off to a great start. That’s not at all surprising, considering the slow, stage-gate process it follows when debuting any new menu item. That’s also why its steak launch was such a hit success. This is not random… It's data-driven. This launch was cited as a large piece of the 8 point brand awareness boost that Cava has enjoyed since the IPO.

Growing Footprint:

Cava called its 2024 store openings its “strongest class yet,” with significant outperformance vs. expectations. This further emboldened conviction in its growth opportunity and the number of stores per market possible. Next year, as part of its impressive 17%+ unit growth guide, it plans to enter South Florida and 2 new Midwestern markets (hopefully Detroit). To make store outperformance even more impressive, the success is not external marketing-driven. It’s actually despite cutting marketing in places like Chicago because the stores were getting too busy. Bonkers.

f. Take – Masterfully Executing

Let’s just take a minute to appreciate these numbers. The raise comes after two other large raises earlier in the year. Cava’s execution is exceedingly impressive and has been since its IPO and founding. The opportunity is large and they’re taking advantage. I don’t generally talk like this about companies… but the consistently massive beats-and-raises paired with that gaudy same store sales growth is not normal. So what’s the secret sauce (couldn’t resist) here?

They sell Mediterranean food, and while that is a growth story within U.S. cuisine, can’t anyone sell Mediterranean food? Yes. But not everyone has this world-class team and systems to deliver consistent quality and value. The company resembles Duolingo in this way. They both operate in different sectors that are quite difficult to win in at scale. And yet? They both shatter expectations at every turn. Both are obsessively data-driven and fixated on thoroughly testing every single piece of their business. There is no guessing here on what works and what doesn’t. When Cava releases a new food item, an app feature, a loyalty program perk or anything else, it knows that item will work because it has structural evidence to support it. Compare that to the old Starbucks team rushing new menu items with their fingers crossed. One final note on this elite team. When they set a schedule, they beat it. Whether it’s a rip-and-replace overhaul of their app, the introduction of their new loyalty program, the entrance into new markets or anything else… they beat it. In my mind, Brett Schulman is on Brian Niccol’s level.

Now… for the elephant in the room. The valuation is crazy. It has been crazy since the company has gone public and has merely gotten more stretched since then. I think it’s safe to assume some level of outperformance vs. estimates going forward, but that wouldn’t change this being one of the most expensive names in markets. It sports the kind of valuation where a slightly-better-than-expected or in-line quarter will likely be severely punished. It needs to be perfect and then some. I can’t own it at the price, but I’d love to own it at a more reasonable level in the future. If that opportunity doesn’t come then, oh well.

2. SoFi (SOFI) — Product Launch

SoFi announced a revamped Robo Advisor platform to deepen its existing, award-winning automated investing suite. It offers three new portfolios:

- “Classic” → basket of stocks and bonds

- “Classic with Alternatives” → basket of stocks and bonds with alternative asset classes like multi-strategy funds

- “Sustainable” → basket of stocks and bonds with strong environmental, social and governance (ESG) ratings.

The was built in partnership with BlackRock to “expose investors without significant financial resources, or a wealth manager, to new strategies and funds.” Not only does SoFi offer financial planners within its low cost Plus subscription, but now this launch significantly augments Robo-access with alternative assets like real estate to eliminate the need for massive pre-existing wealth to responsibly participate in that industry.

Most people aren’t like you and me. They don’t want to read about companies and spend their time building investment case puzzles. I was shocked when I heard that news for the first time, but I digress. Most people want to use financial markets to build wealth on auto pilot, as they prioritize other things. Specifically, 80% of SoFi survey respondents were interested in auto-investing in alternative investments like this new tool offers.

3. Spotify (SPOT) – Earnings Review

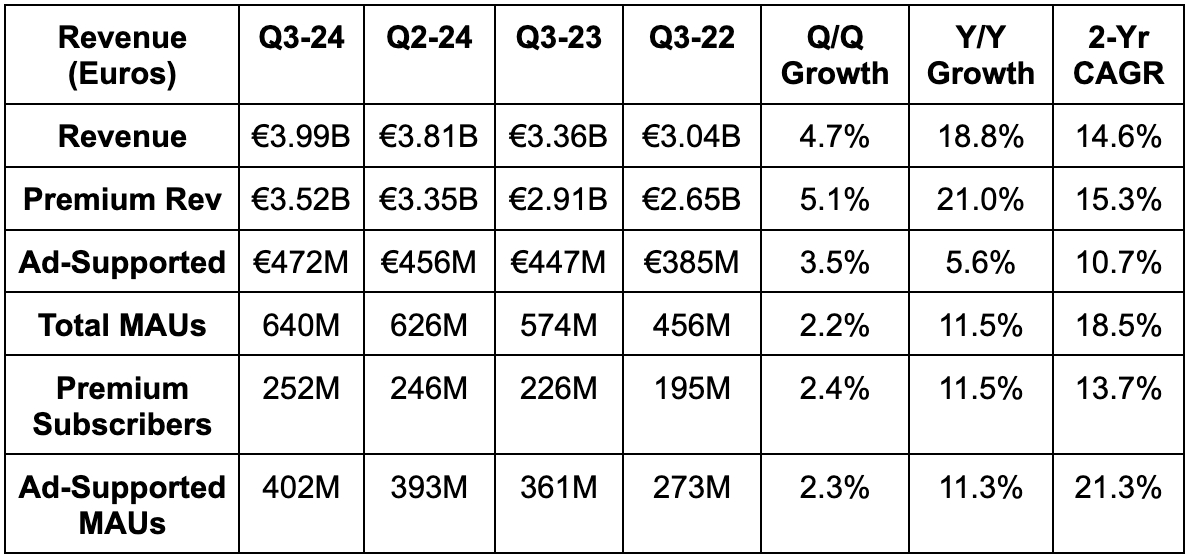

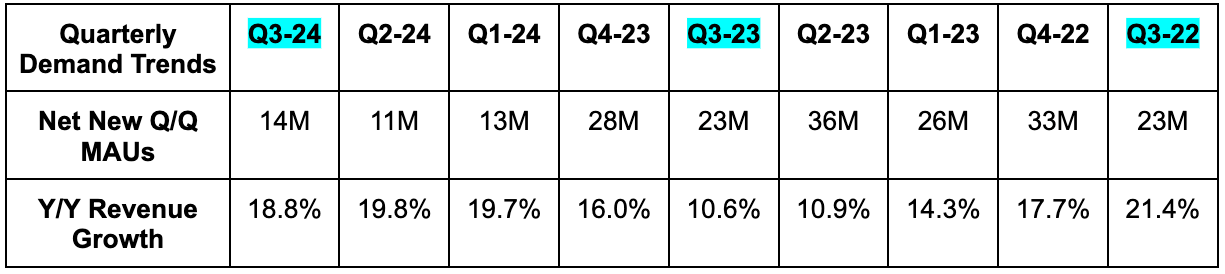

a. Demand

- Missed revenue estimates by 1% & slightly missed revenue guidance.

- Foreign exchange headwinds were stronger than expected. If they were exactly as expected, revenue would have beaten estimates by about 0.6%.

- On a foreign exchange neutral (FXN) basis, revenue rose by 21% Y/Y vs. 14% last quarter; premium revenue rose by 24% Y/Y vs. 14% last quarter; ad-supported revenue rose by 7% Y/Y vs. 15% last quarter.

- Beat 13 million net new monthly active user (MAU) guidance by 1 million. Beat 5 million net new premium subscriber guidance by 1 million.

- Slightly beat monthly active user (MAU) guidance & premium user guidance.

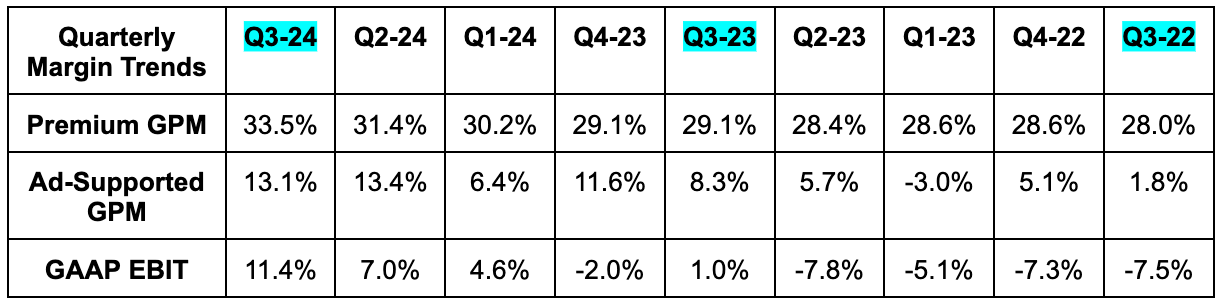

Premium revenue growth was powered by 12% subscriber growth and 9% ARPU growth. Price hikes helped a bit. Advertising revenue growth was driven by impression growth. The pricing environment remained weak across music and podcasting. It’s a “volatile environment for brand-related marketing spend.”

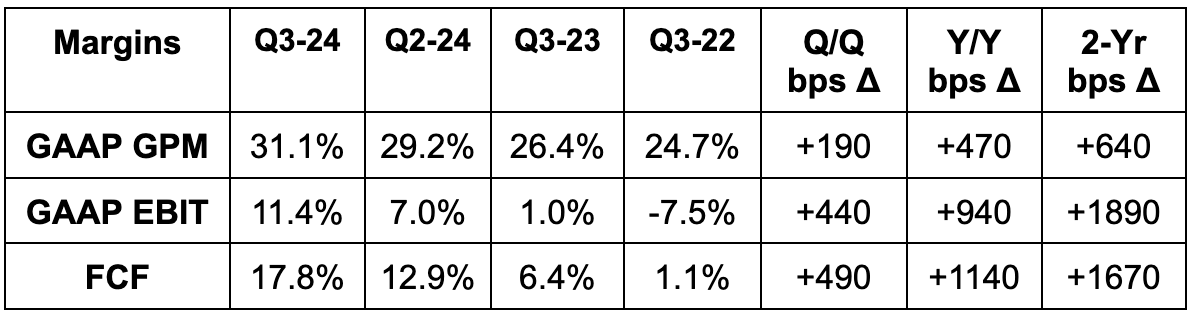

b. Profits & Margins

- Beat 30.2% GPM estimates & beat same guidance by 90 bps each.

- Beat EBIT estimates by 18% & beat guidance by 12%.

- Beat free cash flow (FCF) estimates by 38%.

- Missed $1.77 GAAP EPS estimates by $0.23. This was related to higher payroll tax-related social charges from more stock comp as the stock price rose.

- Had social charges been as expected, it would have earned $1.74. Had FX headwinds and social charges been as expected, it would have comfortably beat estimates.

- This is why both GAAP EBIT & FCF beat while this was a miss. Not concerning.

c. Balance Sheet

- €6.1B in cash & equivalents.

- €1.34B in notes.

- Diluted shares +4.7% Y/Y; basic shares +3.4% Y/Y.

d. Guidance & Valuation

- Missed Q4 revenue estimates by 3.8%. Had FX headwinds been as expected (€80M in incremental headwinds), it would have missed by 1.8%.

- Beat Q4 EBIT estimates by 11.6%.

- Beat 30.6% Q4 GPM estimates by 120 bps.

- Guided to 665 million MAUs or 25 million quarterly adds.

- Guided to 260 million premium subscribers or 8 million quarterly adds.

Spotify remains on track or ahead of schedule for all targets offered at its 2022 investor day. It’s already at the low end of its margin target range.

Spotify trades for 52x forward earnings. EPS is expected to compound at a 39% clip through 2025 and 2026. It hasn’t been profitable for long enough to use anything but gross profit in the chart below.

e. Call & Letter Highlights

MAUs:

MAU growth was the only disappointing part of Spotify’s last quarter. This quarter, trends recovered as expected. It capitalized on product enhancements and “reversing” previously unpopular product decisions. It also enjoyed improving marketing efficiency to justify incremental spend.

Y/Y MAU Growth

Q3-24

Q2-24

Q1-24

Q4-23

Q3-23

Latin America