Table of Contents

1. Disney (DIS) – Earnings Review

“This was a pivotal and successful year for Disney, and thanks to the significant progress we’ve made, we have emerged from a period of considerable challenges & disruption well positioned for growth and optimistic about our future.”

CEO Bob Iger

This was a very short earnings report with little new detail. The total call lasted 31 minutes (normally these last 60-70 minutes). Here are all of the highlights:

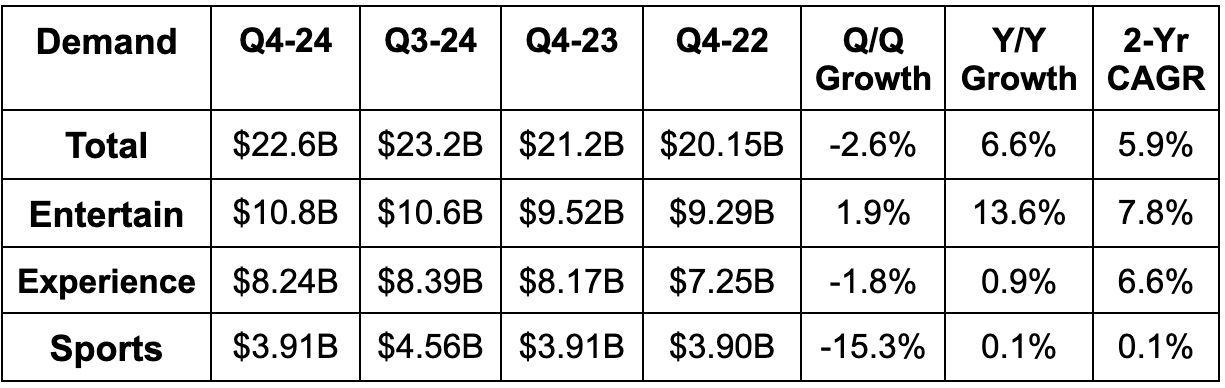

a. Demand

- Beat revenue estimates by 0.4%.

- Entertainment revenue beat by 1.6%.

- Sports revenue missed by 1%.

- Experiences revenue beat by 0.5%.

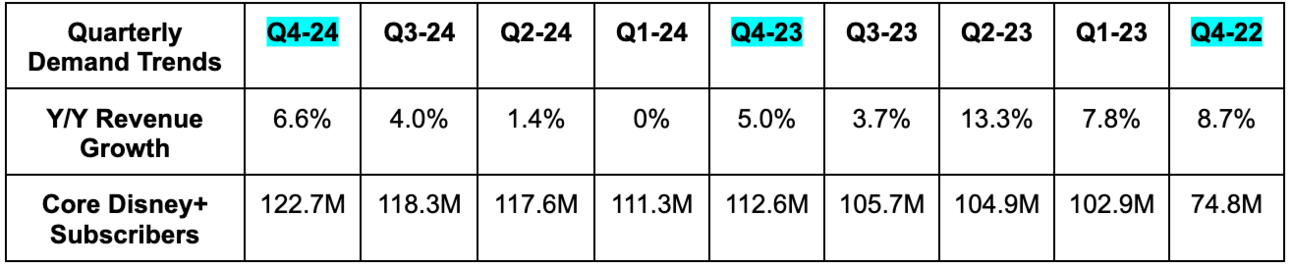

- Disney+ subscribers beat estimates by 2%. ESPN+ subscribers met estimates and Hulu subscribers slightly beat.

- Domestic Disney+ subscribers rose 2% Y/Y and international Disney+ subscribers rose 5% Y/Y. There weren’t any one-off sources of growth here from wholesale contracts or anything like that this quarter.

- Average revenue per user (ARPU) missed for all three streaming services, with the largest miss for ESPN+.

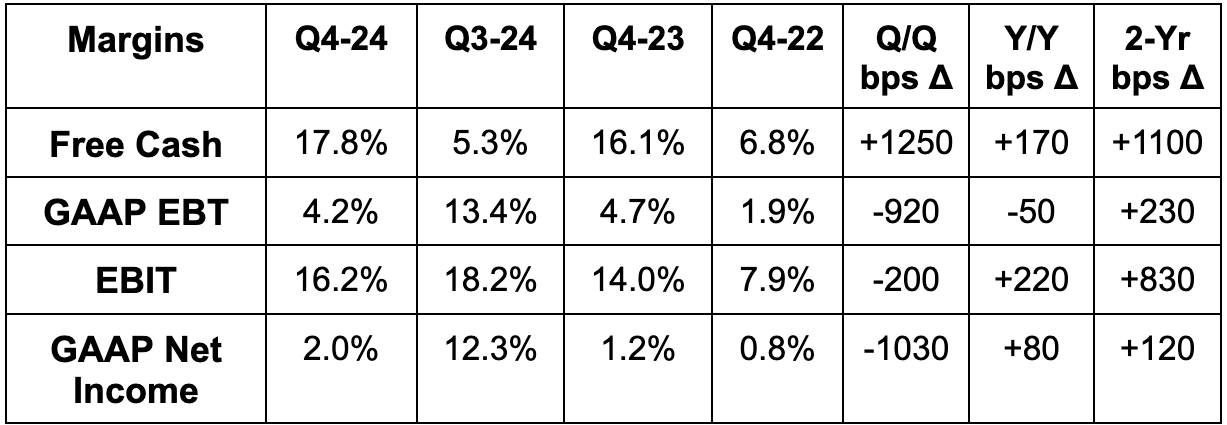

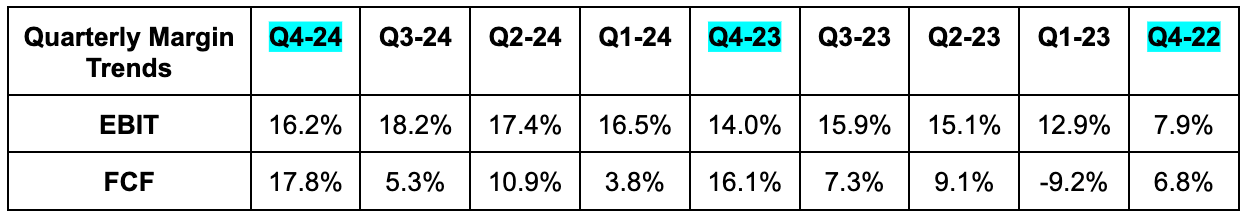

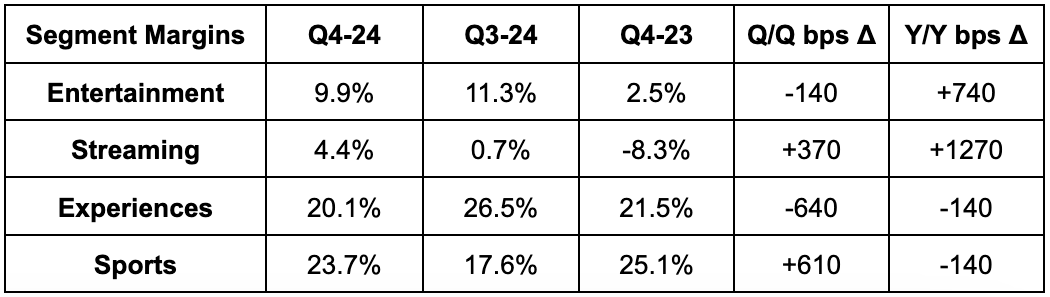

b. Profits & Margins

- Slightly beat EBIT estimates. EBIT rose 23% Y/Y.

- Entertainment EBIT missed by 8%.

- Experiences EBIT beat $130 million estimates by $122 million.

- Sports EBIT beat by 3%.

- Beat $1.11 EPS estimates by $0.03. EPS rose 39% Y/Y (easy comps).

- GAAP EPS rose from $0.14 to $0.25 Y/Y. Comps were easy, but this was still despite about $500 million in incremental impairment and restructuring charges compared to last year.

- Beat free cash flow (FCF) estimates by 17%. This represents a two-year record for quarterly FCF margin.

c. Balance Sheet

- $6B in cash & equivalents.

- $4.4B in investments.

- $1.1B in land.

- $39B in debt.

- Diluted share count fell 1% Y/Y.

d. Guidance & Valuation

- High single-digit 2025 EPS guidance beat 4% growth estimate.

- Entertainment EBIT is expected to rise by 10%+ in 2025. Core Disney+ subscribers to modestly fall Q/Q in Q1.

- Sports EBIT is expected to rise by 13% in 2025. Excluding India, EBIT will fall by 10% Y/Y here.

- Experiences EBIT to grow by 7% Y/Y. This will be back-half weighted, with hurricanes leading to negative Y/Y EBIT growth in Q1. It’s lapping expense increases at Disneyland, and seeing strong bookings activity for its expanding cruise fleet. Those are the sources of optimism here.

- Streaming growth in 2025 will be driven by a balance of pricing and subscriber, with a “tilt slightly towards pricing.”

- $15B 2025 operating cash flow (OCF) guidance beat $14.8B estimates, but its $7B FCF guide missed by 14%.

- 10%+ 2026-2027 EPS CAGR guidance beat 9% growth estimate. This was the highlight of the report.

- For 2026, it also expects 10%+ Y/Y OCF growth, 10%+ Entertainment EBIT growth, a 10% EBIT margin for non-live streaming, slow Y/Y sports EBIT growth and nearly 10% Y/Y Experiences EBIT growth.

- Park investment maturation and streaming margin expansion are the two drivers of this 2026-2027 profit optimism.

- Dividend growth will mirror EPS growth in 2025.

e. Call & Release

Entertainment:

In entertainment, linear revenue fell 6% Y/Y while EBIT fell 38% Y/Y. This remains in permanent decline. Fortunately, direct-to-consumer (DTC; streaming) revenue rose 15% Y/Y and is now more than 2x larger than the linear revenue base. EBIT for that segment also positively inflected to $253 million vs. -$400 million Y/Y. The 2027 streaming EBIT margin guide points to significantly more operating leverage left to enjoy. It had talked about this 10% margin goal for a long time, but this was the first time they gave us a schedule to get there.

Inside Out 2 and the new Deadpool movie both broke box office records and generated more than $300 million in incremental EBIT for Disney this quarter. They helped drive subscriber interest and powered 39% Y/Y growth in content sales, licensing and other. The success directly shows you how powerful of a weapon box office hits can be. They help Disney+... They help give it more intellectual property (IP) to leverage at its parks… They drive consumer packaged goods (CPG) revenue. So helpful. It was vital for this company to turn around the flailing, cash-burning film division. Disney has done exactly that. They slashed a great deal of their film pipeline, focused exclusively on story-telling over cultural influence… and it’s working.

Separately, the password sharing crackdown has begun. It’s starting in Latin America, and will roll out to its other 130 countries in the coming quarters. This was a powerful subscriber growth lever for Netflix to pull. Netflix has more loyal subscribers and lower churn, so the benefit to Disney will be smaller. It still should be a material tailwind.

“A successful Disney movie today drives more value than it ever has in the past with our increased number of consumer touch points extending the reach and impact of our world-class storytelling from streaming to Parks and Resorts, cruise ships, consumer products and games. This multiplier effect means that the system economics of our movie business has never been stronger.”

CEO Bob Iger

Lastly, Disney will likely accelerate content spend in certain international markets where it thinks its IP resonates and the competitive landscape is most compelling. These won’t be “enormous” investments, but will be larger than they’ve been in 2022 and 2023. This was likely a source of next year’s FCF guidance miss, especially considering OCF was ahead.

- Lion King and Moana sequels are coming soon. New Captain America, Lilo and Stitch, Fantastic Four, Zootopia and Avatar films are coming in 2025.

- The entertainment part of its streaming business enjoyed 14% Y/Y advertising growth. This was driven by ad load, as the pricing environment remains weak due to all of the Amazon Prime supply becoming available.

- Hulu’s subscription offering with live TV enjoyed 5% Y/Y subscriber growth. The offering without live TV delivered 1% Y/Y subscriber growth.

- Disney+ core average revenue per user (ARPU) was roughly flat domestically and hurt by mix shift to cheaper ad-supported plans. Internationally, price hikes led to 3% Y/Y ARPU growth.

Sports:

Revenue across the globe was flat, while EBIT fell 5% Y/Y in North America and 18% Y/Y abroad. Modest ESPN+ subscription declines as well as more college football rights were the two sources. Notably, ESPN+ subscribers returned to positive (3% Q/Q) sequential growth.

While ESPN+ is a decent asset, the content library is still quite underwhelming. Hulu’s live TV division does offer a great menu of live sporting events, but ESPN is still in the process of moving all of its content to streaming. The first step will be an ESPN/Disney+/Hulu bundle coming next month. Next year, ESPN will launch a standalone streaming service. That’s when we should expect its streaming business to realize its full potential while linear decay continues. The launch will infuse live stats, fully integrated betting, AI-enabled personalization and several other new fan experiences to deepen connections. If you’re a Yankees or a Dodgers fan (or a Tigers fan… go Tigers), you will be able to craft your own New York or Los Angeles-inspired ESPN experience. Love Real Madrid? They’ll have you covered.

One more note on the sports transition. I think this is going to be a strong driver of ad impression pricing. Why? Let’s go back to what Disney’s advertising partner (The Trade Desk) said this month about sports. Interest ebbs and flows by the minute. If my Michigan Wolverines somehow manage to complete a pass further than 10 yards down the field, that will excite (and shock) me. That incremental excitement will keep me more engaged, which will mean ad impressions becoming more valuable in real-time. Programmatic bidding within streaming environments can fully account for this. Pre-purchased linear impressions cannot.

- Domestic ESPN advertising revenue rose 7% Y/Y.

Experiences:

Domestic parks & experiences EBIT did modestly grow by 3% Y/Y thanks to more guest spending. The domestic consumer weakness that it called out last quarter is improving. Disney Cruise Line launches, more technology spending and input cost inflation offset this growth. Internationally, lower traffic led to a 32% Y/Y decline in EBIT. The Paris Olympic Games were the largest contributor here.

- Disney will launch its 6th cruise ship next week, with 7 more planned in future years.

f. Take

The quarter was fine. The streaming business was the standout, and its Experiences division seems to be turning a corner as macro brightens. Disney has fixed its content engine and resolved its pressing micro-level issues (everywhere besides Lucas Films). Now? Its issues are macro-based. That’s encouraging. It means Disney’s results can actually improve when macro gets easier for expensive vacations. That wouldn’t be the case if it were still releasing box office flop after flop.

The multi-year guidance is quite encouraging, with forward-looking bookings actually offering a degree of visibility and certainty for those forecasts. I continue to see this as a mispriced, high-quality business.