In case you missed it:

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews + DeepSeek News & Implications

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

- My Updated Holdings & Performance

Table of Contents

- 1. Earnings Snapshots — AppLovin & Reddit

- 2. Palo Alto (PANW) – Earnings Review

- 3. DraftKings (DKNG) – Earnings Review Part 2

- 4. Robinhood (HOOD) – Earnings Review

- 5. Headlines

- 6. Macro

1. Earnings Snapshots — AppLovin & Reddit

a. AppLovin (APP)

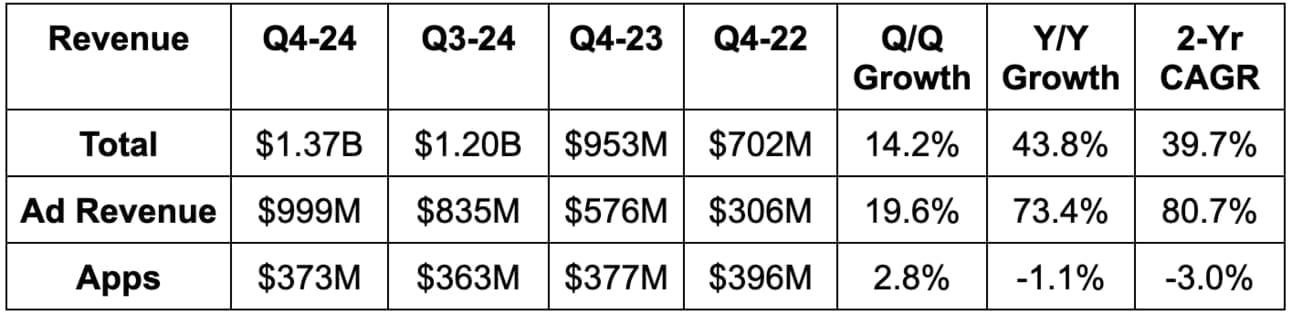

Results:

Applovin is in the business of assisting app owners and publishers in building and monetizing their audiences. It also connects ad buyers and publishers via advertising auctions mainly via mobile settings.

- Beat revenue estimates by 9% & beat guidance by 10%.

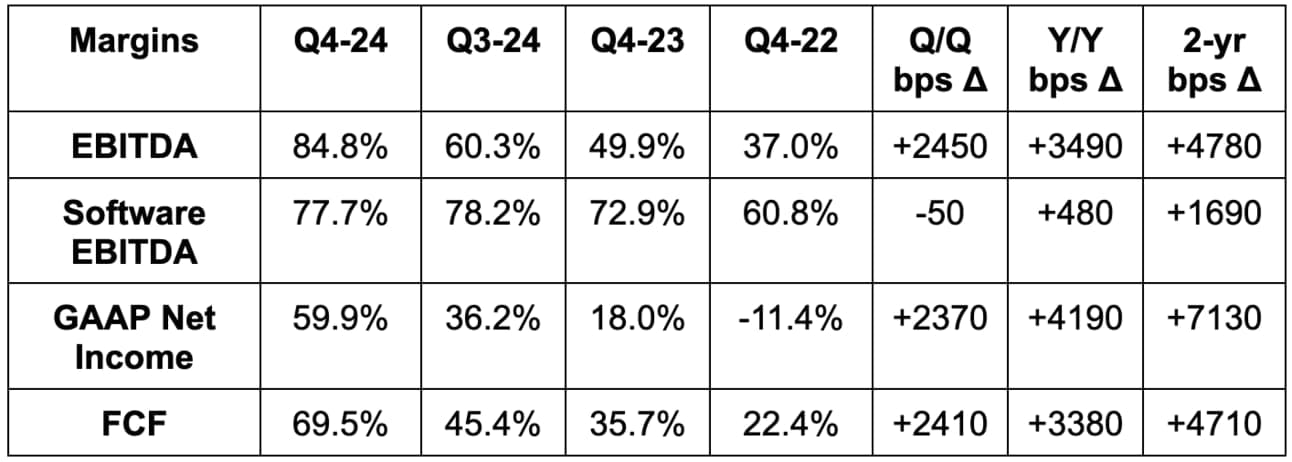

- Beat EBITDA estimates by 11% & beat guidance by 13%.

- Beat $1.26 GAAP EPS estimates by $0.51.

- Beat FCF estimate by 24%.

Balance Sheet:

Guidance & Valuation:

- Revenue guidance beat estimates by 3.8%.

- EBITDA guidance beat estimates by 9%.

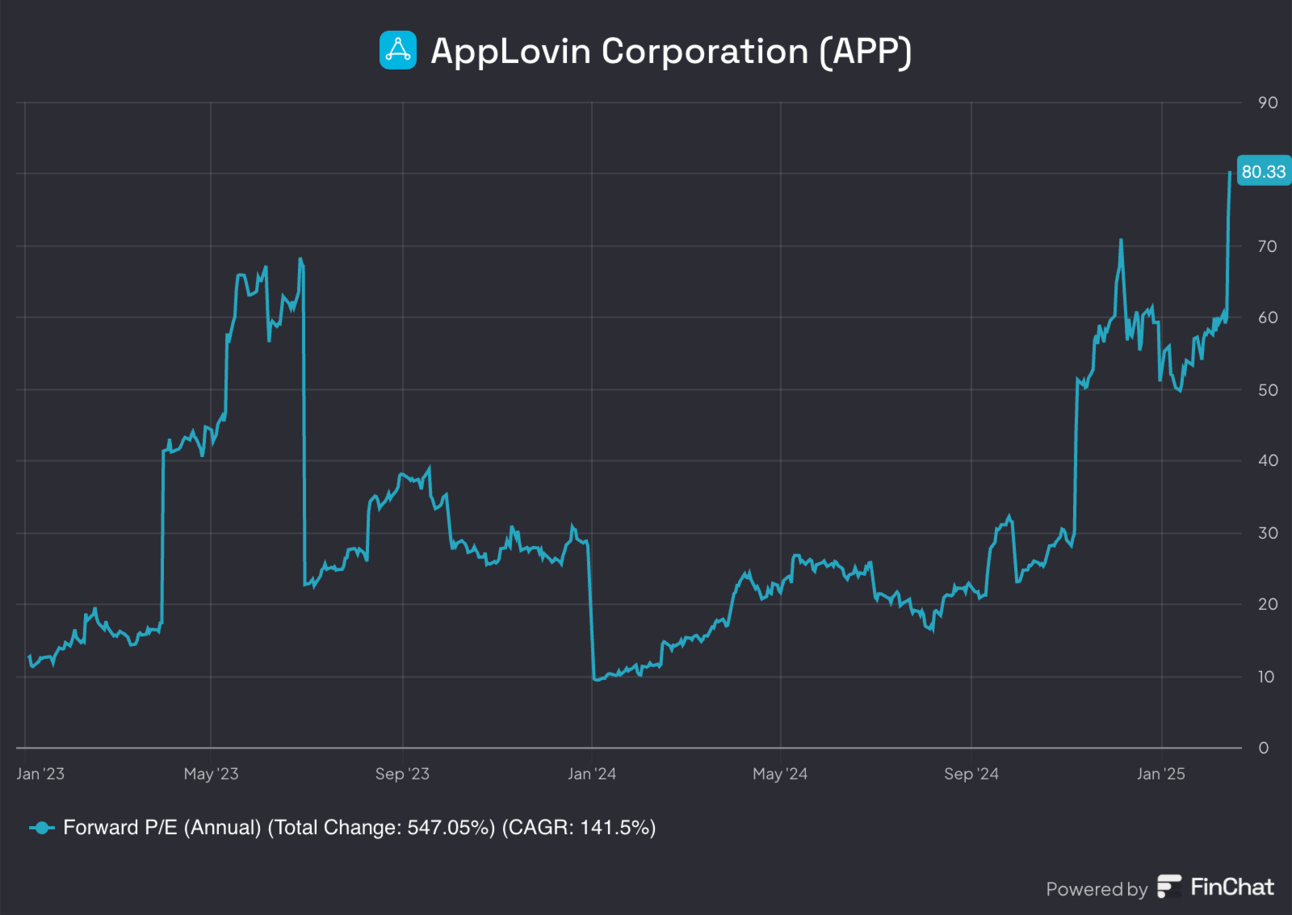

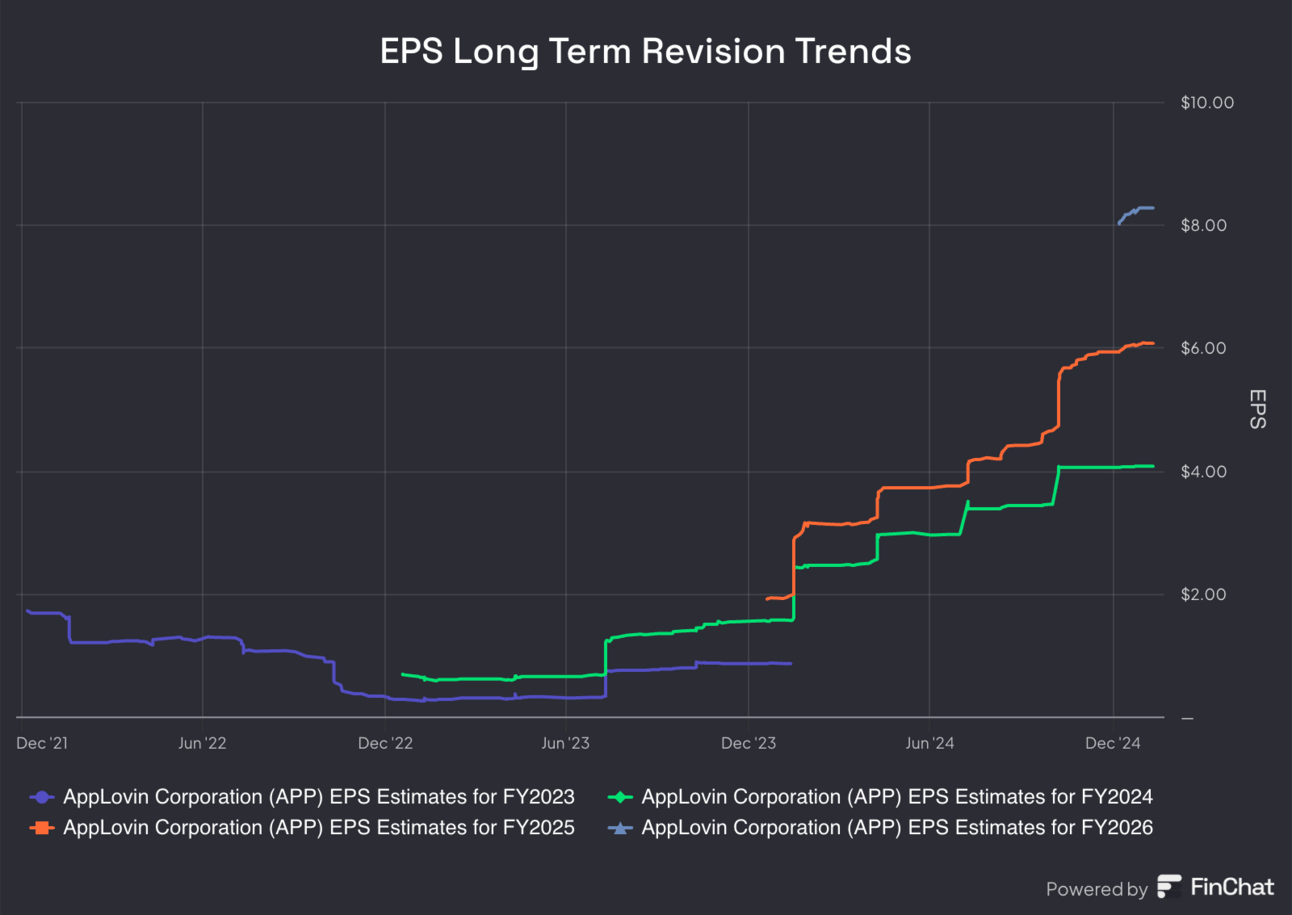

APP trades for 64× 2025 EPS (chart below is the forward EPS multiple for Q4-24 - Q3-25). Estimate revisions should bring that down closer to 60x. EPS is expected to grow by 40% this year and by 22% next year.

b. Reddit (RDDT)

Results:

- Beat revenue estimate by 5.5% & beat guidance by 8.8%.

- U.S. revenue beat by 5.8%; International revenue beat by 4.9%.

- U.S. revenue +70% Y/Y; international revenue +76% Y/Y.

- Missed daily active user (DAU) estimate by 2%.

- Beat average revenue per user (ARPU) estimate by 8%.

- Beat EBITDA estimate by 20% & beat guidance by 30%.

- Beat $0.25 GAAP EPS estimates by $0.11.

Balance Sheet:

- $1.85B in cash & equivalents.

- No debt.

- Rapid dilution due to the IPO.

Guidance & Valuation:

- Revenue guidance beat by 2%.

- EBITDA guidance beat by 18%.

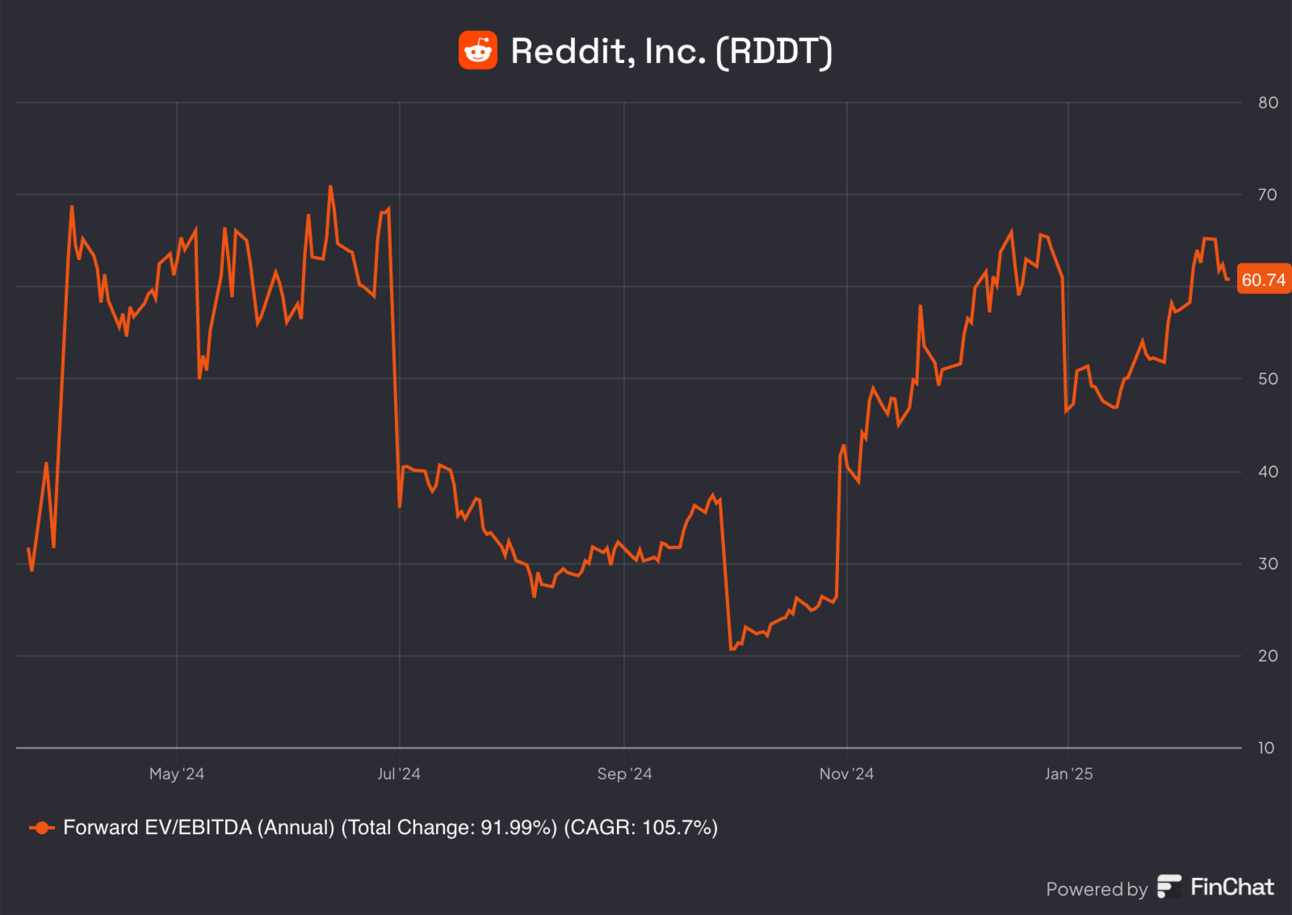

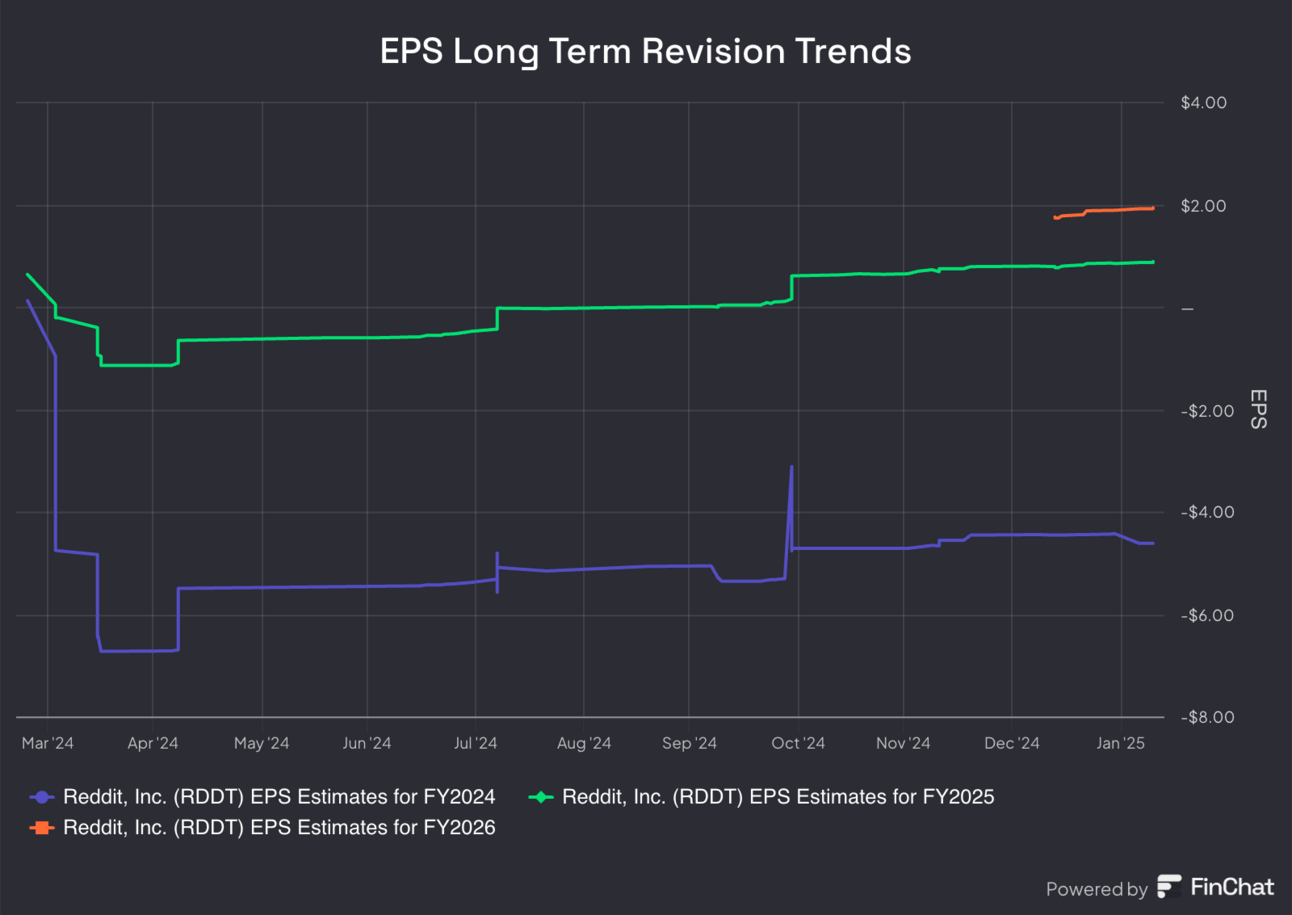

Reddit trades for 65× 2025 EPS. EPS is expected to grow by 22% this year and by 33% next year. It trades for 73× 2025 FCF. FCF is expected to double this year and then compound at a 35% clip for the following two years.

2. Palo Alto (PANW) – Earnings Review

a. Palo Alto 101

Palo Alto is a cybersecurity company competing across endpoint, cloud and network use cases. It’s aggressively bundling next-gen products into larger deals to differentiate vs. firewall-based competitors like Fortinet and beat next-gen disruptors. It calls this process “platformization,” which will again be a key piece of this review. There are 3 major pieces of their initiative:.

Cortex: Its endpoint security segment is called Cortex. Extended Security Information and Event Management (XSIAM) is the centerpiece for platformizing this section. XSIAM brings together Extended Security Orchestration, Automation and Response (XSOAR), Extended Detection and Response (XDR) and integrates Security Information Event Management (SIEM). XSOAR helps automate and guide best practices for incident response while ranking severity of threats. It relies on SIEM for its scaled, complete data ingestion to instruct optimal workflows. SIEM is a key piece of XDR, as XDR infuses non-endpoint data sources into breach protection to extend coverage beyond strictly that endpoint. Adding more data without sacrificing cost and latency performance is where SIEM shines.

Strata: The network security suite is called Strata. This is where Palo Alto is supplanting legacy firewall vendors by offering (what it views as) superior, software-enabled firewalls alongside a suite of network security software. It deploys software-defined wide area networks (SD-WANs) within firewall environments. SD-WANs serve as virtual network securers using a software-based approach to protection. Palo Alto protects networks using a “zero trust” architecture. Zero trust means a bad actor cannot penetrate the most vulnerable part of a digital ecosystem and move freely within it thereafter. Zero trust ensures consistent and complex validation of these permissions at every level. It ends the game of “everyone within a firewall environment getting perpetual, unconditional access” and greatly limits the potential damage of network breaches.

PANW provides “next-gen firewalls” (hardware-based & software-based) with tools like contextual app inspection (more malleable access rules), intrusion prevention, URL filtering, data loss prevention (DLP) and more. Secure Access Service Edge (SASE) is the overarching software product that ties its network platformization approach together. It is built on the aforementioned zero trust foundation. SASE integrates tools that help prevent unauthorized access to data, abuse of networks (like phishing attacks to overwhelm networks with traffic) and broad visibility into health and performance of a network. It includes Software-Defined Wide Area Network (SD-WAN) for traffic routing, a Secure Web Gateway (SWG) and a Cloud Access Security Broker (CASB) to decide who gets access to which apps.

Cortex Cloud: The cloud security suite is now called Cortex Cloud. Like XSIAM and SASE are the platformization pillars in endpoint and network, in cloud it’s the Cloud Native Application Protection Platform (CNAPP). CNAPP includes Cloud Security Posture Management (CSPM), which organizes access compliance, provides cloud ecosystem visibility, and proactively blocks misconfigurations. Beyond that, Cloud Workload Protection Platform (CWPP) is its cloud workload protection tool. Most recently, Palo Alto debuted (CDEM) to “evaluate internet exposure risks and discover unknown internet-exposed cloud assets.” Finally, it added cloud detection and response (CDR) and integrated its newer DSPM product (from purchasing Dig Security) into the CNAPP suite.

While these three product groups are technically separate, they routinely pull context, service and data from each other to uplift overall value creation.

b. Key Points

- Decent quarter and guidance.

- Its ongoing platform push continues to go well.

- Integrated more Cortex products into Prisma and renamed it Cortex Cloud.

- Confident in sustaining FCF margin for next few years amid shift away from upfront payments.