Table of Contents

- 1. Salesforce (CRM) – Earnings Review

- 2. SOFI (SOFI) – CFO Interview with UBS

- 3. SentinelOne (S) — Earnings Review

- 4. PayPal (PYPL) – CFO Interview with UBS

In case you missed it — other recent content to read:

- Meta & Microsoft Earnings Reviews

- AMD, Alphabet and Visa Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Tesla & Service Now Earnings Reviews

- Netflix and Taiwan Semi Earnings Reviews

- Robinhood, Starbucks & Lemonade Earnings Reviews

- Palantir & Hims Earnings Reviews

- Duolingo, Celsius & Mercado Libre Earnings Reviews

- Airbnb, Datadog and The Trade Desk Earnings Reviews

- DraftKings & Coupang Earnings Reviews

- Shopify Earnings Review

- Nu & Disney Earnings Reviews

- CrowdStrike Earnings Review

- Zscaler Earnings Review

- Nvidia & Snowflake Earnings Reviews + Lemonade Investor Day

- SoFi Deep Dive

- Nu Deep Dive

- Zscaler Investment Case (shorter deep dive)

- Starbucks Investment Case

- Cava and Sweetgreen Deep Dives

- My updated holdings and return data as of today

1. Salesforce (CRM) – Earnings Review

a. Salesforce 101

Salesforce is one of the largest enterprise software firms on the planet. It provides a broad suite of products to help clients optimize customer interactions. The overarching niche is called Customer Resource Management (CRM). Salesforce offers a variety of cloud services to its customers. There’s a Sales Cloud, which perfects consumer touch-points. There’s a commerce and Marketing Cloud to build online storefronts and augment promotional activity. There’s a service cloud to handle customer issues and inquiries. There’s also a platform cloud, which includes Slack.

More recently, it debuted its Data Cloud. This is an aggregated analytics service to ingest, organize & glean insight from 1st and 3rd party data. It conjoins siloed context and “unlocks” previously disparate sources for client value creation. It’s similar to what Snowflake does (even though the two partner elsewhere), but more for managing customer relationships. MuleSoft and Tableau are both key pieces of this Data Cloud. MuleSoft integrates apps and data to enable management of these products within Salesforce. Tableau is a data visualization tool to create automated progress reports and suggestions to leverage findings. Next, it offers industry-specific clouds for sectors like healthcare. These are customized to meet specific regulatory and operational needs. All of these clouds and products make up the firm’s subscription & support revenue, which represents 94% of its total business. Professional services make up the rest.

Separately, Salesforce offers a product called Einstein One. This is a full set of AI tools, including outcome prediction, chatbots, image recognition, sentiment analytics and more. It’s considered a general-purpose AI platform infused into all Salesforce products. Most recently, through an OpenAI partnership, it debuted Einstein GPT. Einstein existed before the GenAI wave, but is now getting an upgrade thanks to it. Einstein GPT allows Salesforce clients to plug into language models (including OpenAI, Anthropic and Cohere) to make workflows more productive, intuitive, conversational and automated. It features a low-code toolset to reduce the barrier for non-experts to build applications; it also boasts expert-level tools to build more complex apps.

The newest Salesforce product is called Agentforce. This is (shockingly) another AI-powered platform. It’s the firm’s take on agentic AI apps. As a reminder, these are goal-oriented applications. They simply need to be told what to do, rather than how to accomplish that task. This makes them far more autonomous, malleable and powerful than legacy AI chatbots. Agentforce functions as a full-service, out-of-the-box suite turbocharge client GenAI adoption by making the embrace of this technology easier. It brings together all of Salesforce’s work in Data Cloud, Einstein AI and Customer360 (data unification across disparate sources) to create an end-to-end platform that actually drives value.

Benioff routinely rips on chatbots like Microsoft Copilot and how they offer empty promises and fall short of expected value. He sees Agentforce as an immediate ROI driver across a boatload of use cases. That’s important to note: The diversity of Salesforce’s cloud tools means more opportunity to drive vendor consolidation, interoperability and broader agent use cases without complexity. These agents do not replace humans, they simply assist them with things like drug discovery, deal pipeline building, customer service etc. And? Knowing Salesforce cannot possibly create every agent a customer could ever want, it offers model and agent builders to seamlessly customize algorithms for unique needs.

That’s Salesforce in a nutshell. Now, the quarterly results.

b. Demand

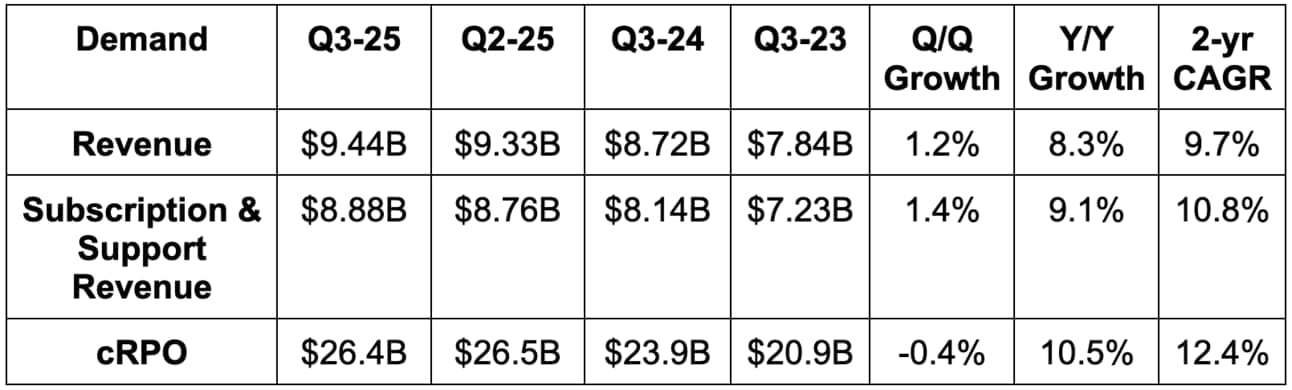

- Beat revenue estimates by 1% & beat guidance by 1.1%.

- Sales Cloud delivered 11% foreign exchange neutral (FXN) growth Y/Y vs. 10% last quarter and 10% last year.

- Service cloud delivered 10% FXN growth Y/Y vs. 11% last quarter and 11% last year.

- Slack delivered 8% FXN growth Y/Y vs. 17% last quarter and 18% last year. Slack won Rivian, Snap, Capital One and other big clients during the quarter. It was in a third of all seven-figure deals and enjoyed 50% Q/Q AI growth. Slack AI has now saved employees 1.1 million labor hours to date.

- Marketing & Commerce delivered 8% FXN growth Y/Y vs. 7% last quarter and 8% last year.

- MuleSoft delivered 1% Y/Y growth vs. 13% growth Y/Y last quarter and 26% Y/Y growth last year. Tough comp. MuleSoft secured 3M and Northwell Health as notable clients during the quarter.

- Tableau delivered 5% FXN growth Y/Y vs. 11% last quarter and 16% last year.

- Beat current remaining performance obligations (cRPO) estimates by 1.5% & beat guidance by 1.3%.

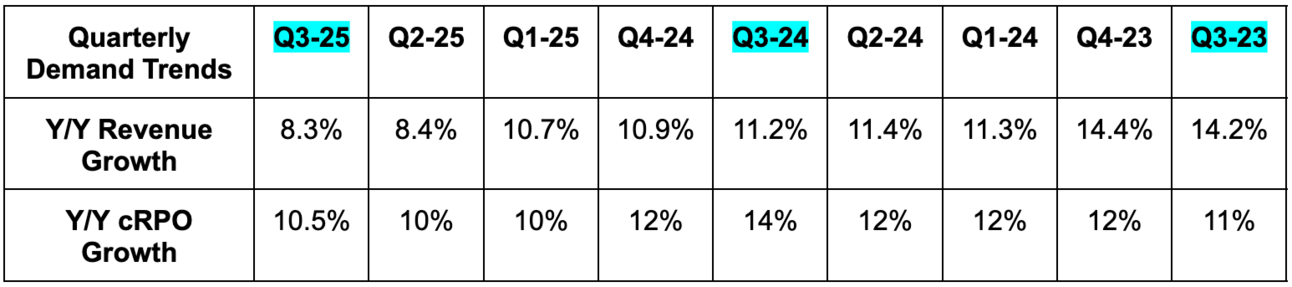

- 10.5% Y/Y cRPO growth compares to 10% last quarter and 14% last year.

- Agentforce is not yet a material part of cRPO. It launched with a week left in Q3.

c. Profits & Margins

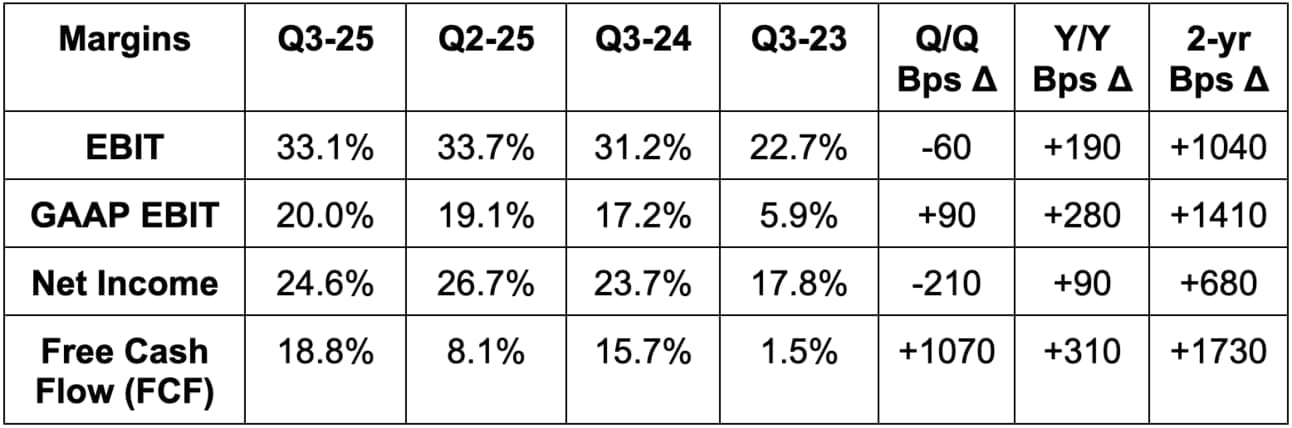

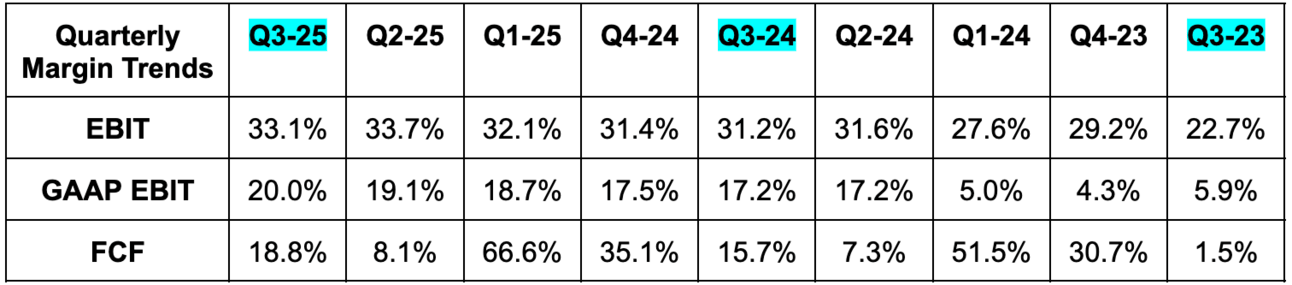

- GAAP gross margin was 77.7% vs. 75.3% Y/Y.

- Beat EBIT estimates by 3.4%. R&D rose 17% Y/Y; sales & marketing rose 13.5% Y/Y; G&A (smallest bucket) rose 34% Y/Y.

- Beat free cash flow (FCF) estimates by 5.3%.

- Beat $1.45 GAAP EPS estimates by $0.13 & beat guidance by $0.16. This includes a $0.17 mark-to-market headwind from equity investment valuations.

- Missed $2.45 EPS estimate by $0.04 & missed guidance by $0.02. This was related to $0.18 in mark-to-market reductions in its equity investment valuations. It’s common for companies to exclude this volatile line item from non-GAAP calculations, but CRM doesn't do that for whatever reason. It also rarely mentions equity valuation changes in investor materials, so I don’t think this challenge was baked into sell-side estimates. That fostered the miss.

d. Balance Sheet

- $12.8 billion in cash & equivalents.

- $4.84 billion in strategic investments.

- $8.43 billion in debt.

- Diluted share count fell by 1.7% Y/Y.

e. Guidance & Valuation

- Missed Q4 revenue estimates by 0.5%. Slightly raised annual guidance due to the Q3 beat.

- Reiterated annual subscription and support revenue guidance of 10% FXN.

- Missed Q4 $2.65 EPS estimates by $0.03. Slightly lowered annual guidance due to equity investment headwinds.

- Missed Q4 $1.66 GAAP EPS estimates by $0.09. Raised annual guidance via Q3 beat.

- Slightly raised annual GAAP EBIT margin guidance from 19.7% to 19.8%.

- Slightly raised annual EBIT margin guidance from 32.8% to 32.9%.

- Raised annual operating cash flow (OCF) growth guidance from 24% Y/Y to 25% Y/Y. Raised annual FCF growth guidance from 26% Y/Y to 27% Y/Y.

- Reiterated that stock comp will be 8.4% of this year’s revenue, with CapEx set to be slightly below 2% of revenue.

Salesforce EPS is expected to grow by 23% this year, 11% next year and 14% the following year.

f. Call & Release

Agentforce Opportunity & Progress:

Benioff spent the entirety of his prepared remarks speaking about Agentforce. And to understand why, I think it’s important to start with the market size. The company is calling this “digital labor,” which is really just another way of saying deployed agentic AI. So how big is this opportunity? Can this move the financial needle for Salesforce, considering its already massive revenue base. To leadership, the answer is a resounding yes. In Benioff’s typically-charismatic way, here’s how he spoke about the total addressable market (TAM) here:

“We've created a new market that is so much bigger and more exciting than the data management market that it's hard to get our head completely around. This is the market for digital labor. Right out of the gate, Salesforce has become the largest supplier of digital labor.”

Co-Founder/CEO Marc Benioff

If you think about it, the enormity of this market makes sense. The opportunity includes essentially every single tedious manual enterprise task that can be automated, as Agentforce is broad and malleable. Furthermore, it can potentially become the operating system for next-gen hardware, as those robotics will be powered by GenAI models and algorithms.

While I don’t like to be dramatic in my writing, this type of innovation can have a profound impact on human productivity and prosperity in the coming decades. It’s no secret that birth rates are tanking all over the globe. Population growth has always been among the single most powerful drivers of potential GDP growth. By offloading mundane work to next-gen algorithms, we can de-correlate that increasingly precarious relationship and grow beyond population bottlenecks. Whoever enables that de-correlation will likely be financially rewarded. As a relevant aside, this can also have a sizable impact on CRM’s financials by unlocking more complex use cases and so bolstering its own traffic and revenue.

“These agents are not tools. They are becoming collaborators. They're working 24/7 to analyze data, make decisions, take action… and free up humans to focus on building strategic initiatives and relationships.”

Co-Founder/CEO Marc Benioff

Agentforce Go-To-Market:

Agentforce commercially debuted during the last week of Q3, yet has already closed 200 deals with firms like FedEx, Ace Hardware, IBM and others. To Benioff, the level of pipeline growth (which now includes “thousands” of potential contracts) is something they’ve “never seen anything like.” He’s always charismatic, but this quarter it was especially noticeable. Salesforce started with the implementation of 10,000 agents at its Dreamforce event, and has since embarked on a “world tour” program to spread the word. The company also leaned into account executive hiring to bolster go-to-market and support this product’s launch. It will hire 1,400 total salespeople during the 4th quarter and will use Agentforce’s “Sales Coaching Agent” to make these hires as strong as possible. On December 17th, Salesforce will conduct another launch event for “Agentforce 2.0” to build on the utility of the initial offering.

Salesforce is leaning heavily on global system integrators (GSIs) like Accenture to help augment its selling capacity. Notably, Accenture is also using this new platform internally to improve deal quality and deal bidding coverage by 75%. That matters a lot. These GSIs are trusted partners for other clients to purchase software. It’s one thing for Accenture to say “we think this works well.” It’s more powerful to tell customers “look how well this is working for us.” Partners like Accenture delivered 9 of its 10 largest Agentforce deals during the quarter. AWS was credited for 3 of its 10 largest overall deals.

Agentforce Edge & Competition:

There are a few pieces of Agentforce differentiation in the eyes of leadership. First is the broad, unified product platform. All products… from Slack to Sales Cloud to Tableau… have been rewritten and recoded to operate as a single, cohesive platform. These are not stitched-together point solutions despite mainly being assembled via M&A. That’s partially why its largest deals now include more than 5 cloud products on average. A larger sum of compelling products simply means more potential agent use cases and more room for value creation. It also means a lot more data to train all of these agents on a company’s own hyper-relevant insight. For context, Einstein sees 2 trillion transactions per week. All of this added signal lowers model hallucination rates and unlocks more complex autonomous workflows.

And this leads us to its second point of differentiation – the Data Cloud. More product means more data… The Data Cloud means it can effectively use all of this data to train agentic algorithms more thoroughly. The combination of CRM’s suite of enterprise software, models from partners like Hugging Face and the Data Cloud means a customer has everything they need in one place. For College Possible (non-profit), this meant the company could onboard Agentforce for its existing Salesforce products and use all needed data “with the flip of a switch.”

- Data Cloud was in 8 of its 10 largest deals. IBM bought Data Cloud this quarter.

- Data Cloud was in 1/3 of its 7 figure deals.

- Its purchase of Zoomin equips it with quality assets to more effectively handle unstructured data. This is highly important for GenAI.

In terms of how this offering compares to others like Microsoft Copilot, Benioff continued to be highly critical of that tech giant’s offering:

“We've heard about Copilot. We've seen the demo. In many ways, it's just repackaged ChatGPT… While these legacy chatbots have handled basic tasks like password resets and other basic things, Agentforce is really unlocking an entirely new level of digital intelligence and operational efficiency.”

Co-Founder/CEO Marc Benioff

Agentforce Use Cases:

Salesforce is readily using Agentforce internally to offer proof of concept for other customers and to make its own operations more efficient. Agentforce is now powering help.salesforce.com and is already on pace to field 2 million support cases per year. It sees this potentially handling 50% of all case volume in the future. The product is also being used for sales engagements and lead generation, as well as other back-of-office automation. All of these efficiency gains will mean a “rebalance” in human resources into areas that will still be relevant and needed – such as sales. This will also likely mean lower employee growth needs, as revenue and profit are less strongly tied to headcount.

“This should save millions of hours and dollars to reinvest into our strategic growth initiatives.”

Co-Founder/CEO Marc Benioff

Customer case studies:

- Vivint is using this to improve customer service ratings and to lower service rep churn. It’s also now using this for contractor scheduling and “proactive issue resolution.”

- Indeed is using this to automate application handling.

- Wiley is using Agentforce to accelerate case resolution by 40%.

- SharkNinja is using it to automate and personalize customer support within the Commerce Cloud.

Most of these case studies to date are still related to customer service automation, but I’m sure Agentforce 2.0 will attempt to go much deeper.

g. Take

Good quarter. All of the misses are related to equity investment valuation swings, which are pure noise to me. The rest of the numbers were quite good and commentary surrounding Agentforce was undeniably exciting. This is one of the highest quality enterprise software companies on the planet, with these results representing more of the same wonderfully stable top-and-bottom-line compounding.

2. SOFI (SOFI) – CFO Interview with UBS

Loan Origination Trends:

Origination momentum was called strong across all three lending buckets by CFO Chris Lapointe. And notably, he also called capital market loan demand “stronger than it has been in years.” That’s related to rate cuts leading to macro confidence, better liquidity, more favorable credit spreads and lower hurdle rates for capital market buyers. This strength is so important. It helps to effectively de-couple SoFi’s loan origination growth from its balance sheet growth. It allows them to rapidly expand the loan business without jeopardizing capital ratio cushions.

And while this has been a fantastic outlet for balance sheet management, it continues to get even more promising. Its lantern marketplace keeps enjoying rapid growth. This is where it sends rejected borrowers (~75% of applicants) to find other loan partners to originate. SoFi collects high-margin, low-risk fees and can cater to more loan demand without stashing unwanted credit. It also gets valuable data from these borrowers to cross-sell them other products like SoFi Money, debit and Invest. Eventually, many of these customers will turn into prime candidates for SoFi’s credit branch. This ensures they stay close to these people and serve them in other ways (before that credit up-leveling unfolds).

More recently, it has spoken about originating credit within its own app and demographic for capital market partners. This has rapidly become a central part of its overarching loan platform. The development means it can say yes to as many qualified borrowers that enter its site as possible. And it can do so in a way that offloads credit risk and merely generates high-margin financial service revenue. Just like with Lantern, this gives it yet another tool to help more customers.

This is how you ensure your loan top-of-funnel is as strong as possible… It’s how you maximize member growth… It’s how you delight more customers… It's how you maintain rapid growth… all without placing undue stress on a balance sheet. The loan platform expansion is the single most positive development for SoFi amid a sea of other positives that have played out in recent months. I repeat: This responsibly uncaps the growth potential for its largest segment. More revenue… more customer data… not more risk.