In case you missed it from this week:

In case you missed it from this earnings season:

- Trade Desk Earnings Review

- DraftKings & Coupang Earnings Reviews

- Shopify & Mercado Libre Earnings Reviews

- Uber Earnings Review

- Apple & Duolingo Earnings Reviews

- AMD & Datadog Earnings Reviews

- Lemonade Earnings Review

- Palantir & Hims Earnings Reviews

- SoFi Earnings Review

- PayPal Earnings Review

- Meta, Robinhood & Starbucks Earnings Reviews

- Amazon & Microsoft Earnings Reviews

- Alphabet Earnings Review

- Tesla Earnings Review

- Chipotle Earnings Review

- ServiceNow Earnings Review

- Netflix & Taiwan Semi Earnings Reviews

- My current portfolio & performance vs. the S&P 500

Table of Contents

- 1. Sea Limited (SE) – Earnings Review

- 2. Cava (CAVA) – Earnings Review

- 3. SoFi (SOFI) – CEO Anthony Noto Interviews with …

- 4. Duolingo (DUOL) – CFO Matthew Skaruppa Intervie …

- 5. DraftKings (DKNG) – Co-Founder/CEO Jason Robins …

- 6. Mercado Libre (MELI) – Commerce President Ariel …

- 7. Uber (UBER) – GoGet 2025 Event & a CEO Intervie …

- 8. Meta (META) – Two Headlines

- 9. United Healthcare (UNH) – Thoughts

- 10. PayPal (PYPL) – Interesting Partnership

- 11. Starbucks (SBUX) – China

- 12. Headlines

- 13. Macro

1. Sea Limited (SE) – Earnings Review

Sea Limited is a Southeast Asian commerce giant, with a digital marketplace called “Shopee.” It complements this business with sizable financial service and entertainment offerings. The model is quite similar to Mercado Libre in Latin America.

a. Key Points

- Strong growth & cost discipline.

- Advertising is early and already turning into a large margin lever.

- “Best quarter for the entertainment segment since 2021” per the team.

d. Demand

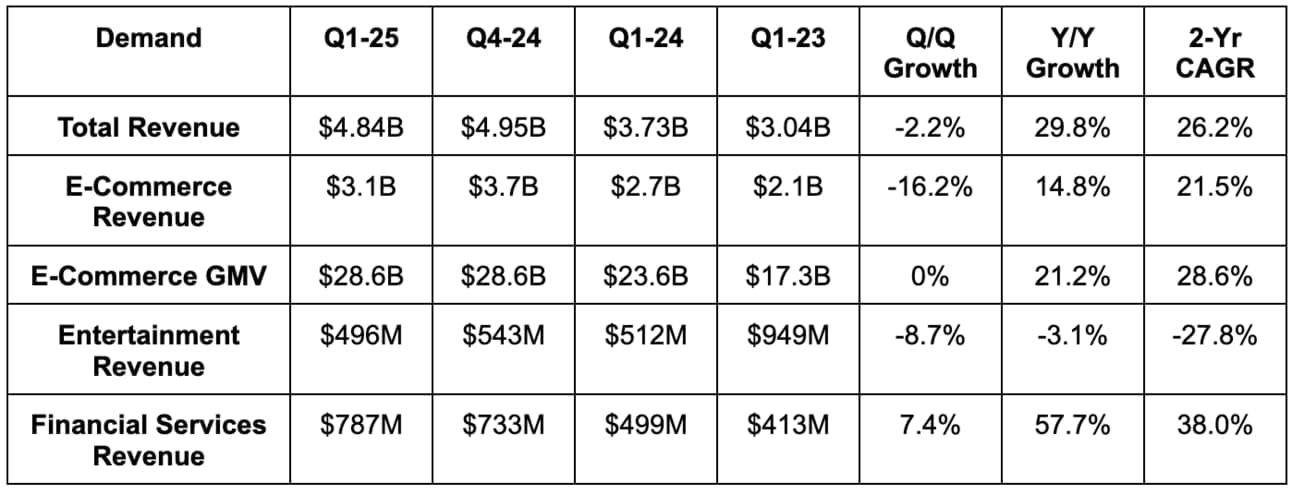

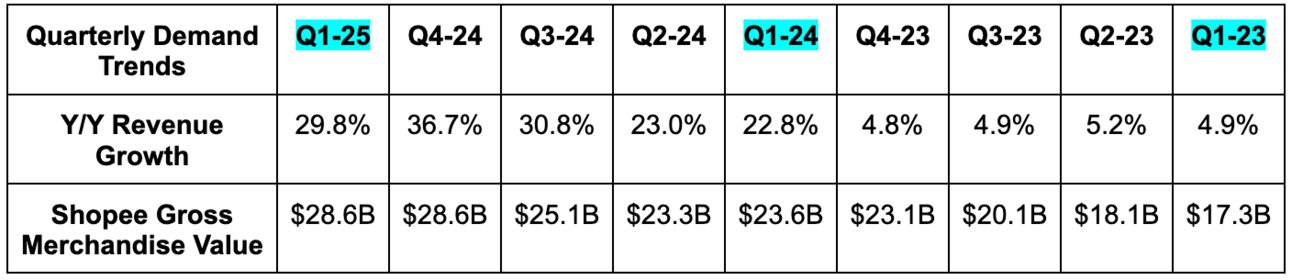

Sea Limited missed revenue estimates by 1.0%. Its 26.2% 2-year revenue compounded annual growth rate (CAGR) compares to 19.8% Q/Q & 17.1% 2 quarters ago.

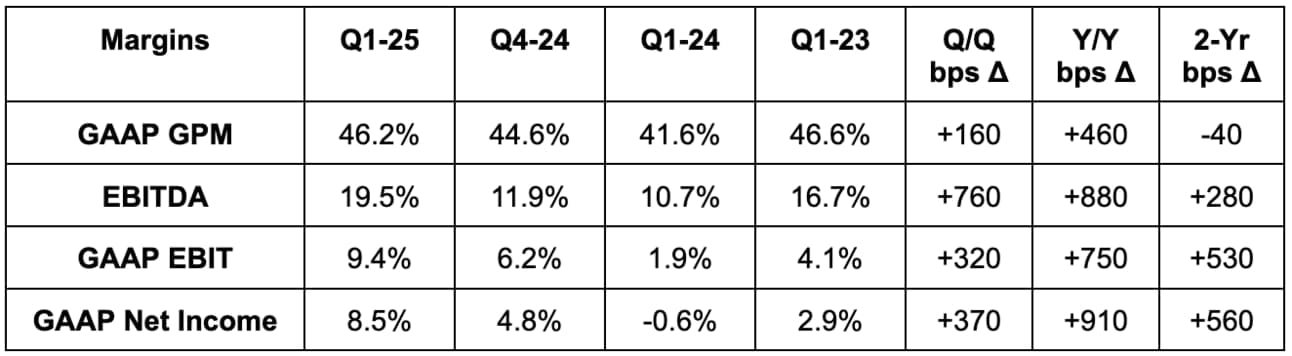

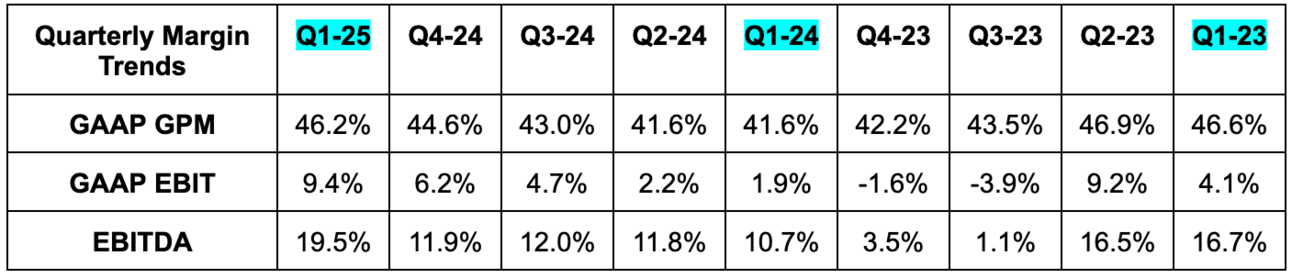

c. Profits & Margins

- Beat 44% GAAP GPM estimates by 220 bps.

- Beat EBITDA estimates by 30.7%.

- Commerce EBITDA margin was 8.5% vs. -0.9% Y/Y.

- Fintech EBITDA margin was 30.7% vs. 29.4% Y/Y.

- Beat $0.62 EPS estimates by $0.03.

- GAAP operating cash flow (OCF) grew 62% Y/Y to $757M. Its OCF margin rose from 12.6% to 15.6% Y/Y.

d. Balance Sheet

- $8.4B in cash, equivalents and short-term investments.

- $172M in inventory vs. $143M Q/Q.

- $2.82B in long-term investments.

- $550M in borrowings.

- $1.33B in convertible senior notes.

e. Guidance & Valuation

The company “remains confident” in 20% Y/Y GMV growth in 2025 “with improving profitability.”

“Our strong start to the year gives us more confidence to achieve our full-year guidance.”

Founder/CEO Forrest Li

“We have not seen a material impact on our Shopee growth from the macro side… Our cross-border business has been a relatively small percentage of our entire businesses. So the cross-border trade impact from any aspect will not impact our overall business materially.”

Founder/CEO Forrest Li

SE trades for 27x forward EBITDA. EBITDA is expected to grow by 61% this year and by 31% next year.

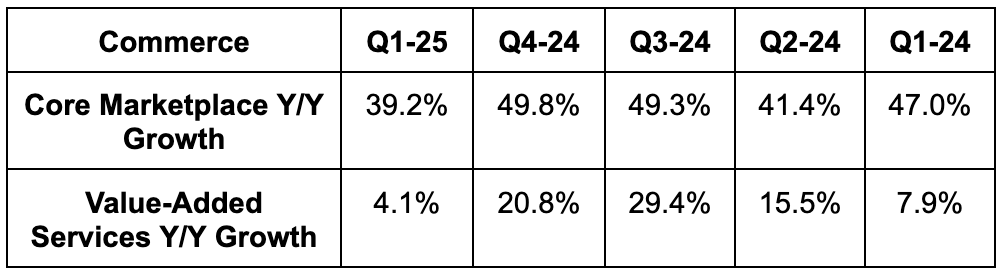

f. Segment Highlights

Advertising:

Ads continue to be a wonderful source of operating leverage for this business model. Like other marketplaces, this revenue is quite margin-accretive. SE has already built the brand awareness and traffic needed to turn on this monetization lever. Now it’s time to get paid. Ad revenue rose 50% Y/Y as marketplace sellers using an ad product rose 22% Y/Y and spend per average merchant rose 28% Y/Y. Going forward, it continues to round out the ad-tech suite. For example, its newer “GMV Max” tool makes it easier to more thoughtfully target relevant eyeballs and optimize for incremental GMV growth.

Shopee:

Just like other online marketplaces around the globe, success is the result of hard work on assortment and logistics service, as well as more tightly integrating entertainment and live-streaming with actionable commerce opportunities. This helped drive 20% of physical orders from content-driven sources like YouTube and 20.5% Y/Y gross order growth overall. That marks a modest acceleration compared to 20.1% Y/Y gross order growth last quarter. Content-driven business also continues to improve overall company marketing efficiency, boost advertising adoption and raise average basket size. It’s an important endeavor.

- Li told us that the YouTube partnership overall is “going very well,” with embedded links and orders ramping nicely.

Pricing competitiveness is also supporting successful expansion. That’s why logistics investments to localize fulfillment, bring goods closer to customers and find layers of automation wherever possible are so important. And it’s working. Per Qualtrics, SE was ranked first in “offering good prices” across both Asia and Brazil (newer expansion market). This is partially why it has seen zero impact on consumer buying behaviors amid recent geopolitical tensions.

In Brazil, improving economies of scale and service scores helped user growth outpace the market average. I’d expect that to be the case, given the relatively young business there, but still good to hear. When asked about the launch of TikTok Shop in that market, they said there was no change to the competitive environment. That’s likely because of how low overall e-commerce penetration is in the highly compelling country. The runway is massive and physical commerce displacement is by far the largest opportunity.

- Debuted Shopee AI assistant. This is its chatbot to automate some customer service interactions.

- They’re also hard at work on using GenAI to improve product search.

More on the Logistics Network Driving Shopee Success:

Cost efficiencies are paving the way for this attractive positioning, as cost per order fell 6% Y/Y in Asia and 21% Y/Y in Brazil. This happened while on-time delivery rates improved and Brazil delivery times overall fell by “2 to 3 days Y/Y. That’s how you take care of the customer, pass unique savings onto them and profitably supply lower-priced goods like everyday essentials. That, along with broader assortment generally speaking, is a powerful tailwind for driving more top-of-funnel buyer growth. And this quarter, that buyer growth was again above 15% Y/Y.

- Testing a few-hour delivery option in some Indonesian cities.

Loyalty Program:

Sea Limited is testing a Shopee paid membership program in Indonesia. It comes with free shipping and deeper discounts. Adoption so far was called “encouraging;” it had 1 million subscribers as of Q1’s end. As hoped for, member buyer frequency and spend levels are 3x and 4x higher than non-members.

Financial Services – rebranded from SeaMoney to “Monee” this quarter:

Sea Limited thinks “Monee” is more synergistic with “Shopee” and that the name change will drive more cross-selling awareness. That should build on already strong momentum, including 50%+ Y/Y revenue and EBITDA growth for the year.

Vitally, considering that growth was powered by 77% Y/Y loan growth, “asset quality was stable” during the quarter. Specifically, non-performing loan (NPL) rate across small merchant and consumer loans was stable Q/Q at 1.1%. Really good to see as their credit book rapidly grows despite adding 4 million new borrowers during the quarter. They’re “confident in maintaining resilient Monee growth across cycles and also confident in loan growth guidance for the year.

- 10% of this loan book is actually “Off-Shoppe,” meaning originated by another party.

- The ShopeePay app crossed 30M total downloads in March. This is a wonderful driver of commerce cross-selling and a key piece of the ecosystem.

- Pay Later marketing campaigns in Thailand and Malaysia "effectively drove new user acquisition & increased penetration on Shopee.” Thailand’s loan book crossed $1B during the quarter.

- Higher credit limits in Indonesia and Malaysia are increasing its traction with affluent individuals.

- Strong loan growth in Brazil continues to geographically diversify its credit book.

“We are moving beyond payments and credit to every aspect of people’s lives relating to money, such as banking, investment and insurance.”

Founder/CEO Forrest Li

Li on Approach to Funding the Credit Business:

“Instead of using our cash in the short-term, even though it may make more economic sense, we would rather build up a more sustainable and healthy source of funding. We would rather collaborate with 3rd-party financial institutions and explore different sources of funding.”

Founder/ CEO Forrest Li

Entertainment:

The entertainment business continued its post-pandemic recovery in what leadership calls “its best quarter since 2021.” This was again driven by success for the video game Free Fire and an interesting collaboration with a Japanese show called “Naruto.” This combination generated 300M impressions and led to DAUs in Q1 finally re-approaching the peak pandemic rate. It also drove 51% Y/Y bookings growth, 11% active user growth and 32% active pay growth for the quarter, while bookings per user rose 36% Y/Y to $1.17.

- In Taiwan, its Arena of Valor video game drove considerable social media buzz.

- The Delta Force Mobile game was released across APAC and Latin America last month and “has seen good traction with 10M+ downloads.” It will launch a new game called Free City starting this month.

g. Take

Great quarter. Another convincing Q1 Y/Y growth acceleration and more explosive operating leverage is not a combination that should be overlooked. SE is showing that its growth is not solely a byproduct of how much it spent on marketing. Its user base is seemingly a lot stickier than that, and I can’t help but think that’s a direct effect of their strong logistics service improvements, obsessive focus on marketplace health, and increasingly powerful cross-selling engine. I think ads, rising product breadth and a continued focus on efficient growth all mean the margin ceiling is not close to being reached.

This business looks a lot like Coupang in Korea, Mercado Libre in LatAm and the non-AWS Amazon business across the globe. I say that in an extremely complimentary way and think bulls should be uniformly pleased with these results.

2. Cava (CAVA) – Earnings Review

Cava is a quick-service restaurant chain that sells Mediterranean food, with a focus on strong value, quality ingredients and a warm, in-store ambiance.

My Cava Deep Dive can be found here.

a. Key Points

- Resilient quarter.

- The loyalty program is working well.

- In-store efficiency initiatives are ramping smoothly.

- Not seeing any consumer impact from all of the trade drama.

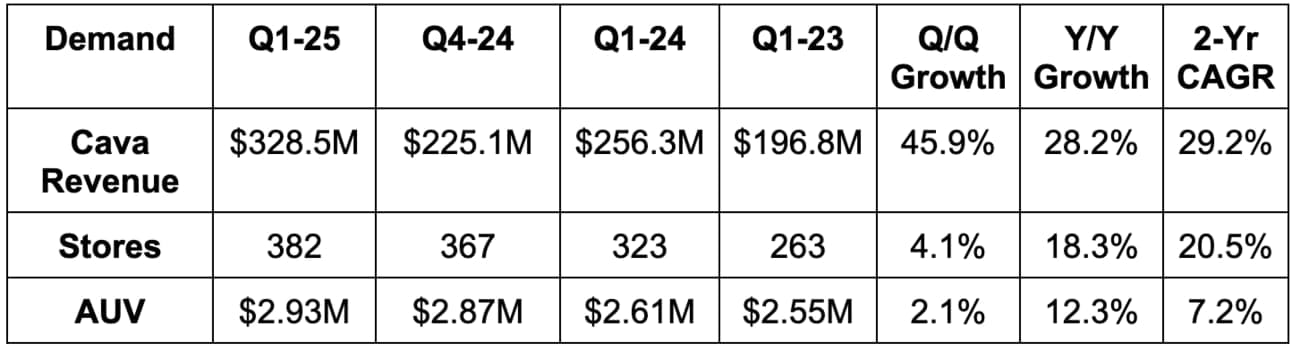

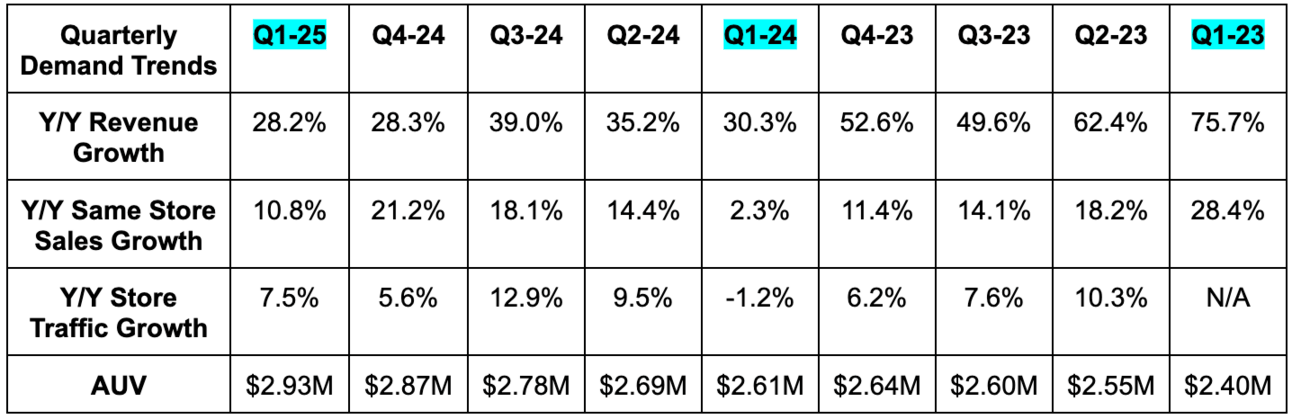

b. Demand

- Beat revenue estimates by 0.3%. Cava surpassed $1B in trailing 12-month revenue this quarter.

- Its 29.2% 2-year revenue compounded annual growth rate (CAGR) compares to 39.9% Q/Q & 44.2% 2 quarters ago.

- Beat 10.4% Y/Y same-store sales growth estimates with 10.8% Y/Y growth.

- Beat location estimates by 0.4%.

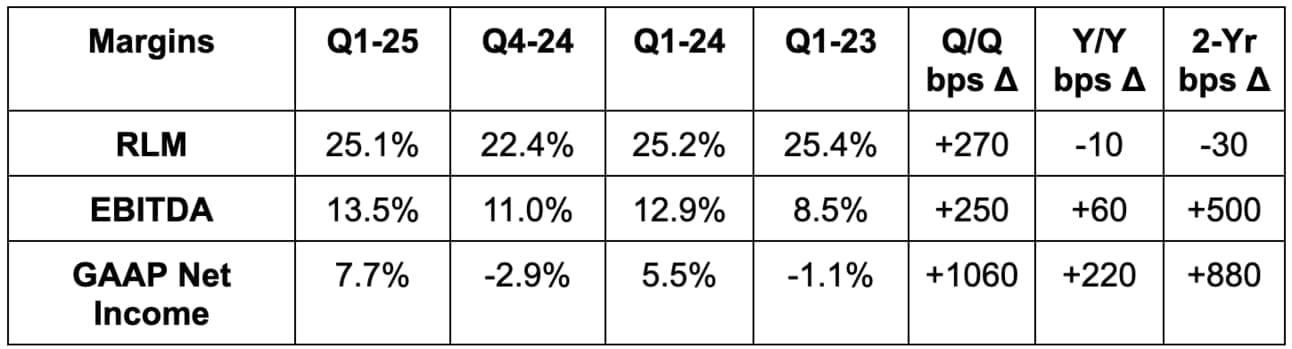

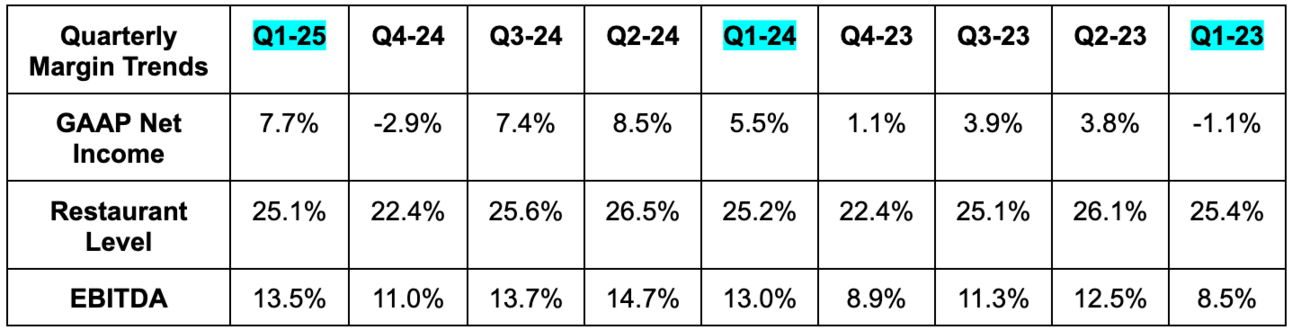

c. Profits & Margins

- Beat 25.0% restaurant-level margin (RLM).

- Beat EBITDA estimate by 2.2%.

- Beat GAAP EBIT estimate by 4.7%.

- Beat $0.13 GAAP EPS estimate by $0.09 – or by $0.04 excluding tax benefits.

Food, beverage and packaging was 29.3% of revenue vs. 28.2% Y/Y. This was, as expected, again driven by last year’s steak launch. Cava continues to expect comps to normalize in June and for the overall 2025 impact to be about 100 bps.

Labor and related costs were 25.7% of revenue vs. 26.0% Y/Y thanks to modest revenue outperformance. Leverage was partially offset by 3% wage inflation. Occupancy & related costs were 7.4% of sales vs. 8.0% Y/Y – again thanks to fixed cost leverage stemming from strong revenue generation. Overall, general and administrative expenses ex-stock comp were 10.5% of revenue vs. 11.1% Y/Y. All of this enabled 35% Y/Y EBITDA growth.

d. Balance Sheet

- $370M in cash & equivalents. They shifted $80M from cash to equivalents this quarter via the creation of a fixed income portfolio to maximize net interest income.

- No debt.

- Cava has an untapped $75M credit revolver.

- Share count rose by 0.4% Y/Y. They expect stock comp to be $21M for the year, representing less than 2% of total revenue.

e. Annual Guidance & Valuation

- Reiterated 7% same-store sales guidance, which missed 7.9% estimates.

- They expect 3-year same-store sales growth to be in the high-30% range for the rest of the year. It was 41% this quarter. The team is generally prudent with modeling forward expectations, so this could easily stay at 41% for the rest of the year.

- This includes just a 1.7% price hike implemented this year. The rest of the growth will come from traffic.

- Reiterated restaurant margin guidance, which slightly missed estimates.

- This includes expectations of no additional price hikes for the rest of the year.

- Reiterated location guidance, which slightly beat estimates.

- Raised EBITDA guidance by 1.3%, which missed estimates by 2.4%.

“Our guidance reflects both the evolving macroeconomic landscape and the strength we're seeing in our business. Our consumer remains resilient and we believe that momentum is appropriately captured in our outlook.”

CFO Tricia Tolivar

Cava trades for 72x forward EBITDA. EBITDA is expected to grow by 27% in each of the next two years.