Most of this week’s content was already sent. In case you missed it:

- Grab (GRAB) Earnings Review

- Nu (NU) Earnings Review

- Celsius (CELH) Earnings Review

- Mercado Libre (MELI) Earnings Review

- 2 Portfolio Updates — the first & the second

Other reviews sent this earnings season:

- Amazon, Cloudflare and Disney Earnings Reviews

- Datadog Earnings Review

- Airbnb Earnings Review

- Uber Earnings Review

- Shopify & Chipotle Earnings Reviews

- Alphabet & AMD Earnings Reviews

- PayPal Earnings Review

- Palantir Earnings Review

- Meta, Tesla & Starbucks Earnings Reviews + DeepSeek News & Implications

- Microsoft & Apple Earnings Reviews

- ServiceNow Earnings Review (section 2)

- Spotify Earnings Review (section 3)

- The Trade Desk Earnings Review

Next Week, coverage will include:

- PayPal Investor Day

- Hims Earnings Review

- Cava Earnings Review

- Lemonade Earnings Review

- Nvidia Earnings Review

- Salesforce Earnings Review

- Snowflake Earnings Review

- Duolingo Earnings Review

Table of Contents

1. Earnings Snapshots

a. Walmart (WMT)

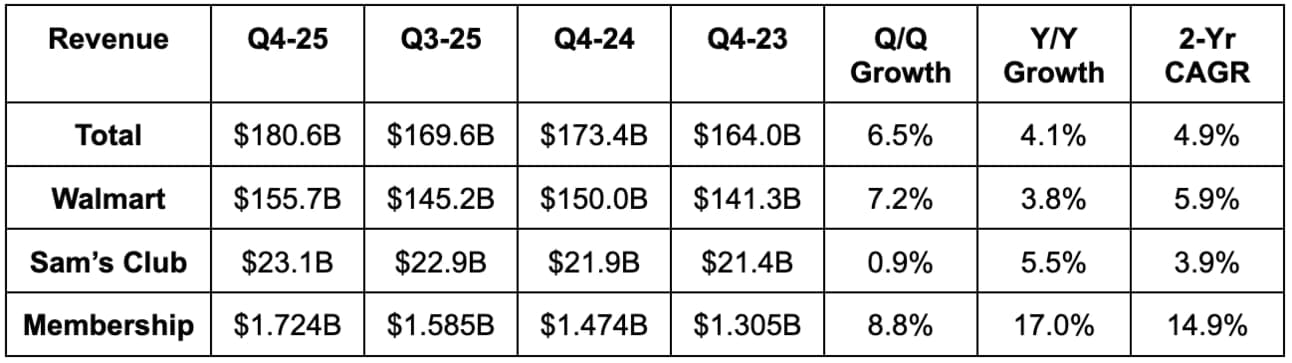

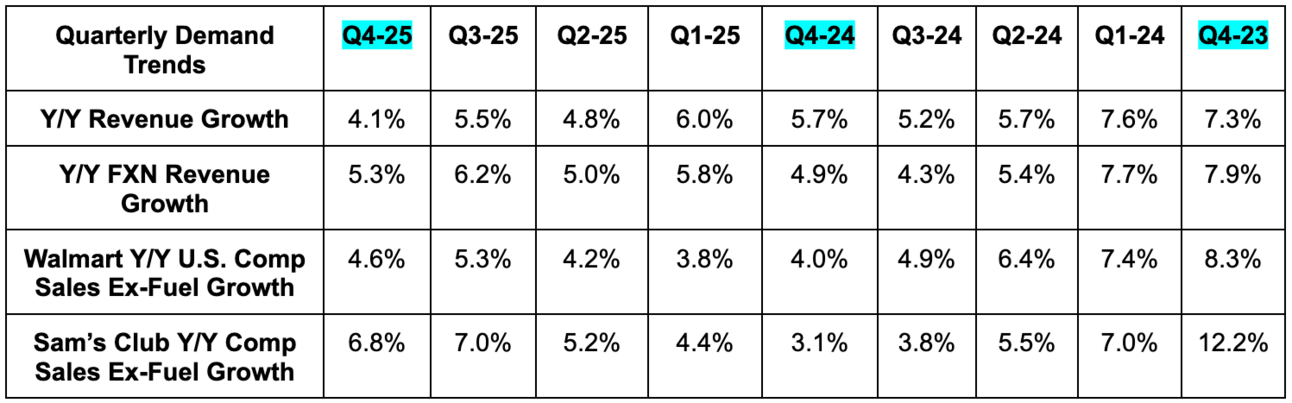

Demand:

- Beat revenue estimates by 0.9%.

- Beat 4.4% Walmart U.S. comparable (comp) store sales growth estimate with 4.6% growth.

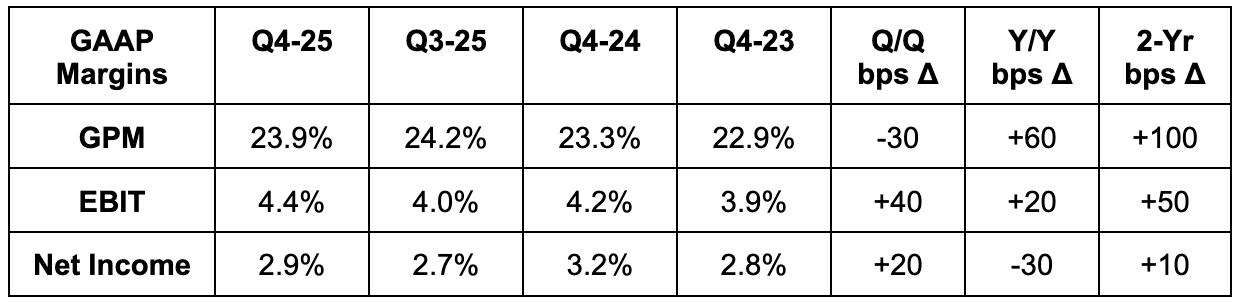

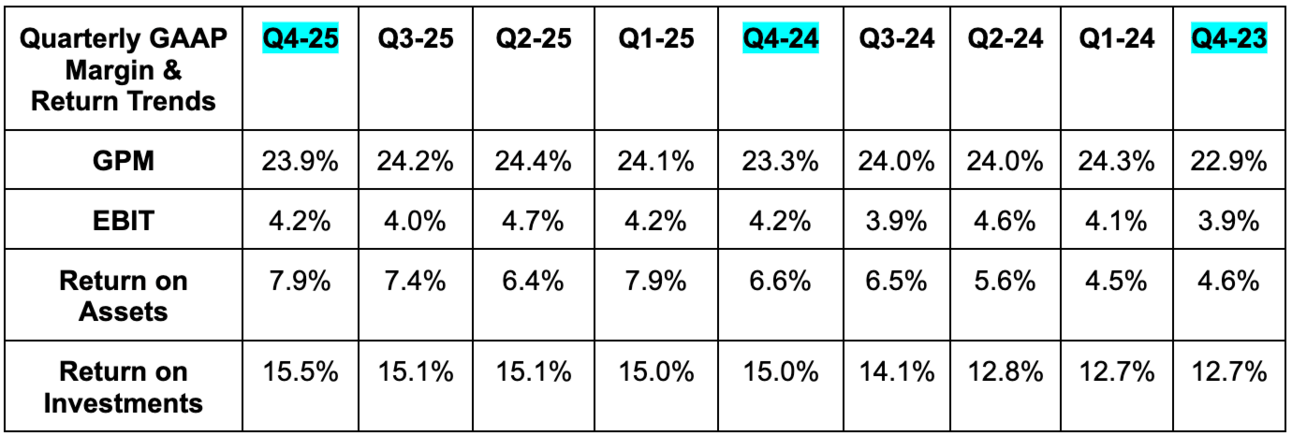

Profits, Margins & Returns:

- Met 23.9% gross profit margin (GPM) estimates.

- Beat EBIT estimates by 0.7%.

- Beat $0.65 EPS estimates by $0.01.

- Missed free cash flow (FCF) estimates by 18%.

Balance Sheet:

- $9.04B in cash & equivalents.

- Inventory rose 2.7% Y/Y to $56.4B.

- $5.7B in total short term debt & borrowings.

- $33.4B in long-term debt.

- Diluted share count fell by 0.3%Y/Y.

- 2024 dividends rose by 13% Y/Y.

Guidance & Valuation:

For Q1, Walmart guided to 3.5% FXN revenue growth. Analysts were looking for 4% overall growth. Considering FX is expected to remain a headwind, this is a miss. Its 2% FXN EBIT growth guide missed 12% growth estimates and its $0.58 adjusted EPS guide missed $0.65 estimates. Results include headwinds from leap year, a small revenue tailwind from VIZIO M&A and a profit headwind of 70 bps from VIZIO.

For the full year, 3.5% FXN revenue growth and an expected FX headwind missed 4.2% growth estimates. 4.5% FXN EBIT growth guidance missed 8% estimates and $2.55 adjusted EPS guidance missed $2.76 estimates.

Walmart trades for 36x forward EPS. EPS is expected to grow by 5% this year and then compound at a 12% clip over the next two years.